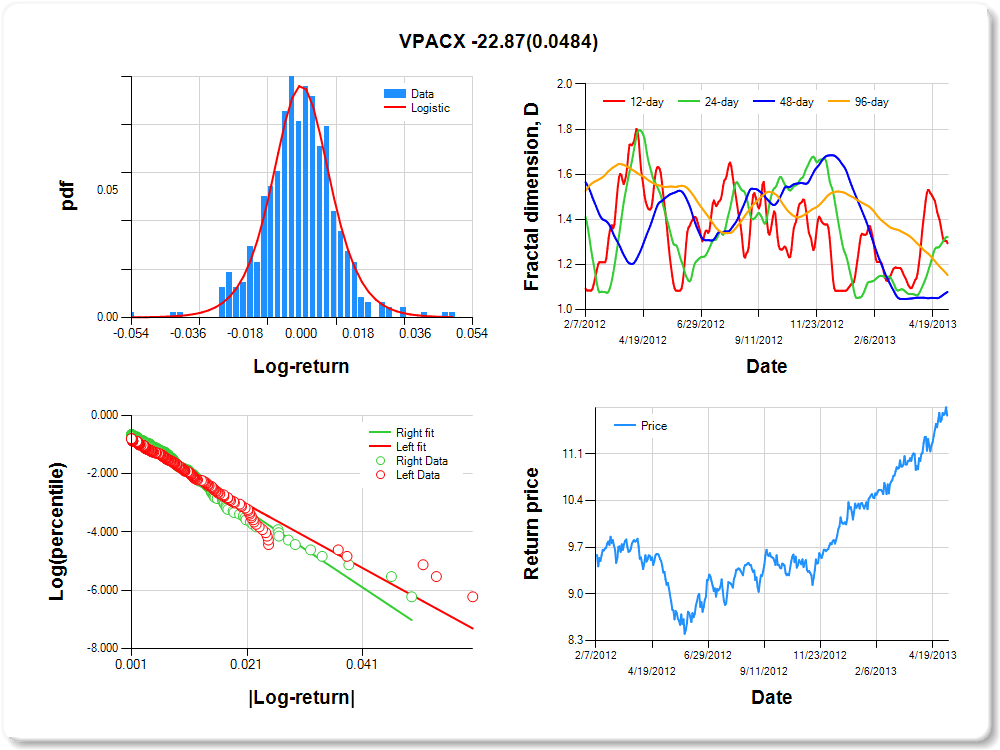

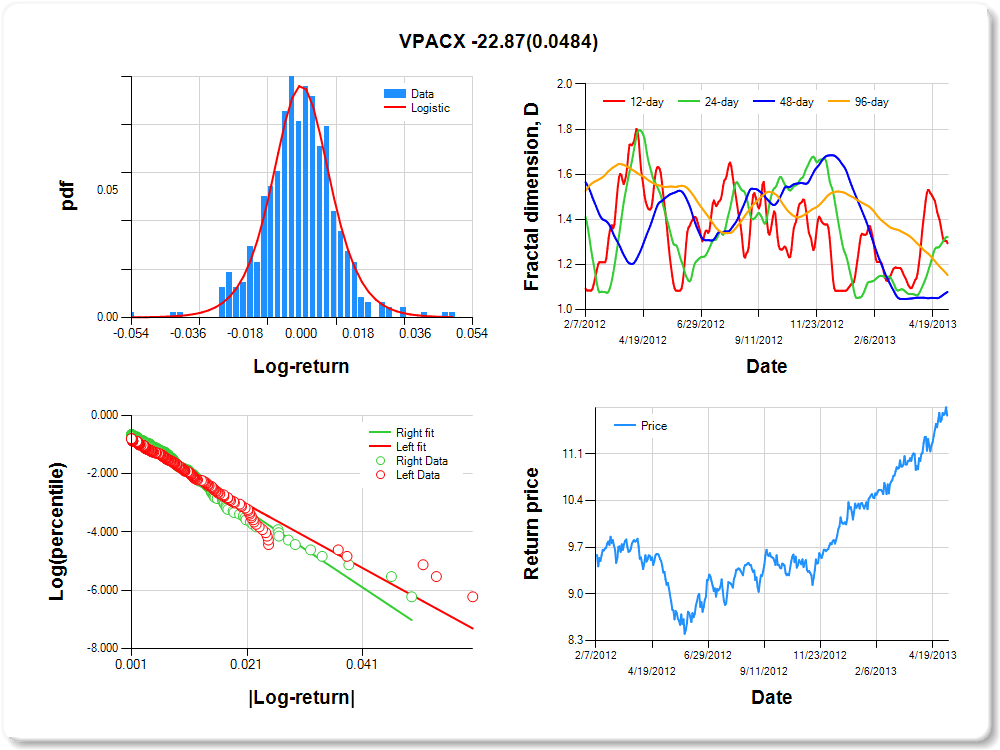

VPACX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.03 |

0.03 |

2.99 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.192 |

0.188 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.789 |

0.097 |

-8.095 |

0.0000 |

|log-return| |

-108.985 |

7.756 |

-14.052 |

0.0000 |

I(right-tail) |

0.268 |

0.137 |

1.964 |

0.0501 |

|log-return|*I(right-tail) |

-22.871 |

11.559 |

-1.979 |

0.0484 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.707 |

0.678 |

0.922 |

0.847 |

VWEHX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.01 |

-0.01 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.01 |

0.01 |

0.01 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.102 |

0.074 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.569 |

0.151 |

-10.412 |

0.0000 |

|log-return| |

-333.719 |

38.857 |

-8.588 |

0.0000 |

I(right-tail) |

0.407 |

0.185 |

2.206 |

0.0282 |

|log-return|*I(right-tail) |

92.643 |

43.900 |

2.110 |

0.0357 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.851 |

0.949 |

0.706 |

0.847 |

VFSTX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| 0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.01 |

0.01 |

3.03 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.994 |

0.044 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.093 |

0.379 |

-0.245 |

0.8064 |

|log-return| |

-2431.321 |

341.828 |

-7.113 |

0.0000 |

I(right-tail) |

-1.336 |

0.403 |

-3.313 |

0.0011 |

|log-return|*I(right-tail) |

1861.257 |

347.196 |

5.361 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| NaN |

0.889 |

0.754 |

0.834 |

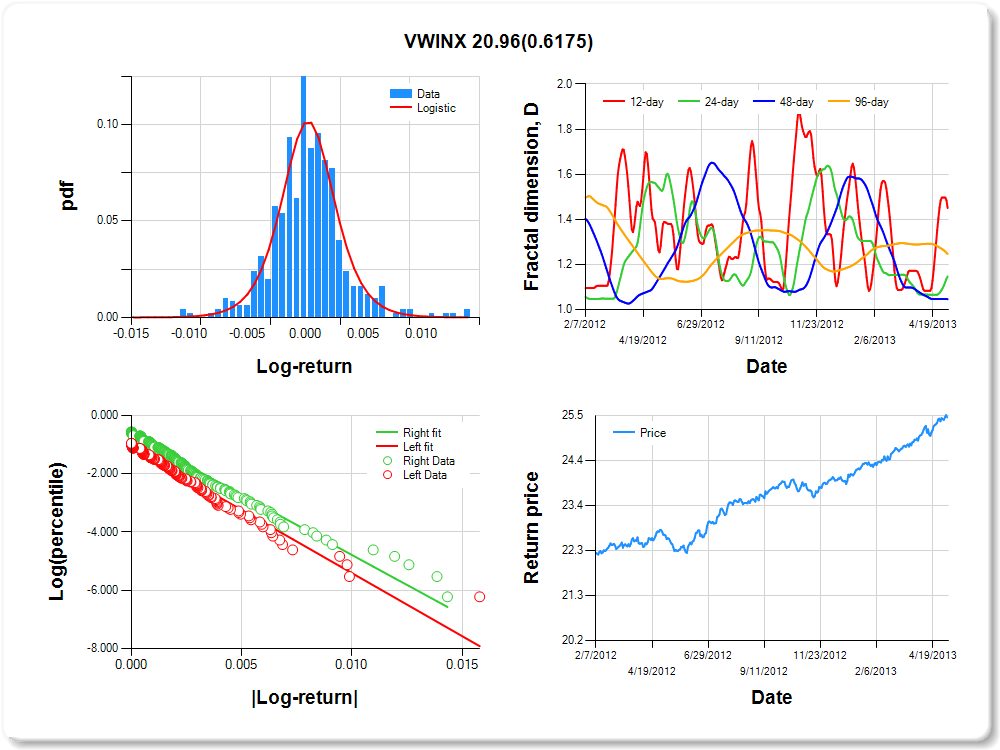

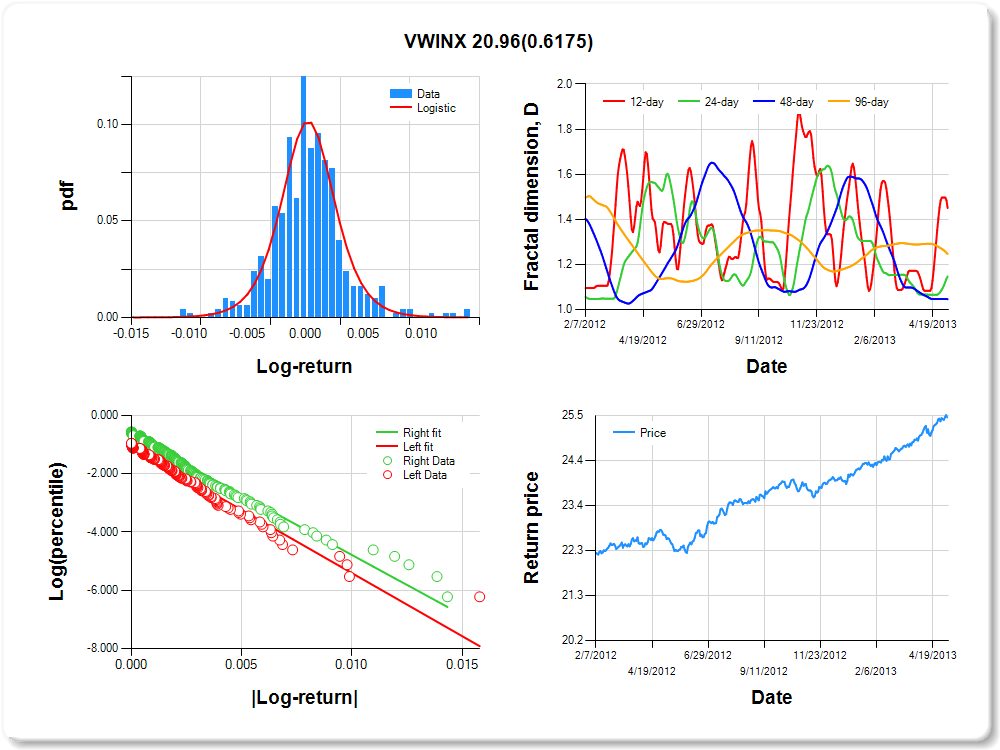

VWINX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.01 |

-0.01 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.01 |

0.01 |

0.01 |

2.20 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.140 |

0.169 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.914 |

0.107 |

-8.538 |

0.0000 |

|log-return| |

-433.015 |

33.243 |

-13.026 |

0.0000 |

I(right-tail) |

0.404 |

0.139 |

2.914 |

0.0037 |

|log-return|*I(right-tail) |

20.962 |

41.952 |

0.500 |

0.6175 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.550 |

0.853 |

0.954 |

0.754 |

VGSIX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.05 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.043 |

0.103 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.009 |

0.091 |

-11.040 |

0.0000 |

|log-return| |

-79.900 |

5.852 |

-13.654 |

0.0000 |

I(right-tail) |

0.289 |

0.122 |

2.372 |

0.0181 |

|log-return|*I(right-tail) |

-12.333 |

8.341 |

-1.479 |

0.1399 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.710 |

0.876 |

0.836 |

0.724 |

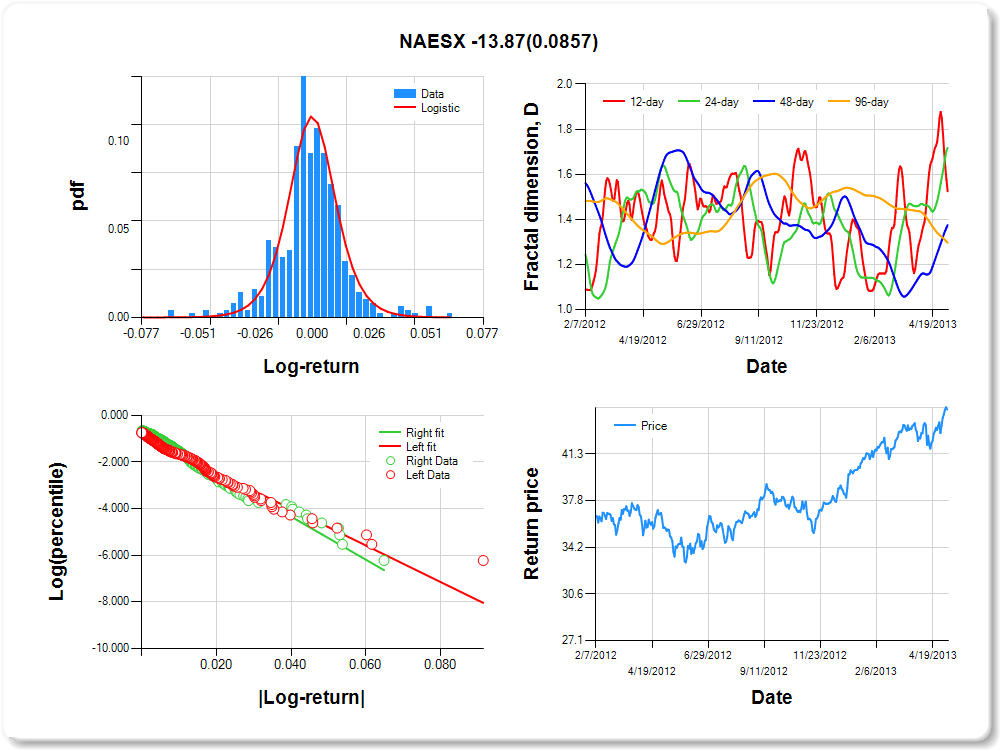

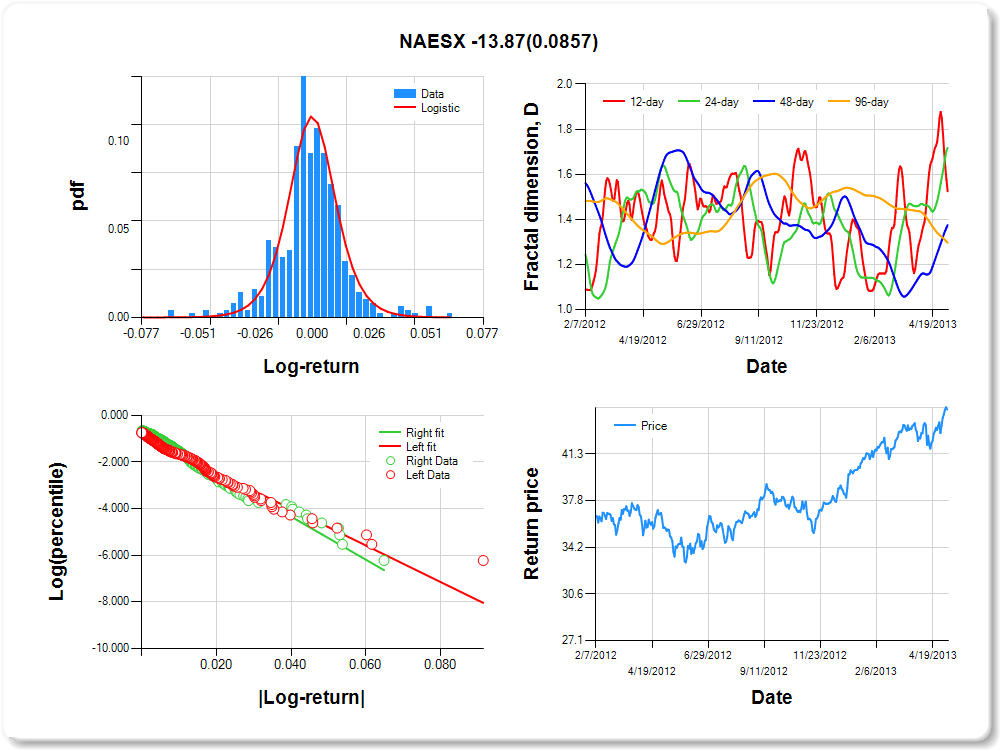

NAESX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.04 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.05 |

0.05 |

3.07 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.320 |

0.150 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.870 |

0.087 |

-9.958 |

0.0000 |

|log-return| |

-78.269 |

5.352 |

-14.625 |

0.0000 |

I(right-tail) |

0.227 |

0.126 |

1.803 |

0.0720 |

|log-return|*I(right-tail) |

-13.868 |

8.053 |

-1.722 |

0.0857 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.475 |

0.283 |

0.625 |

0.704 |

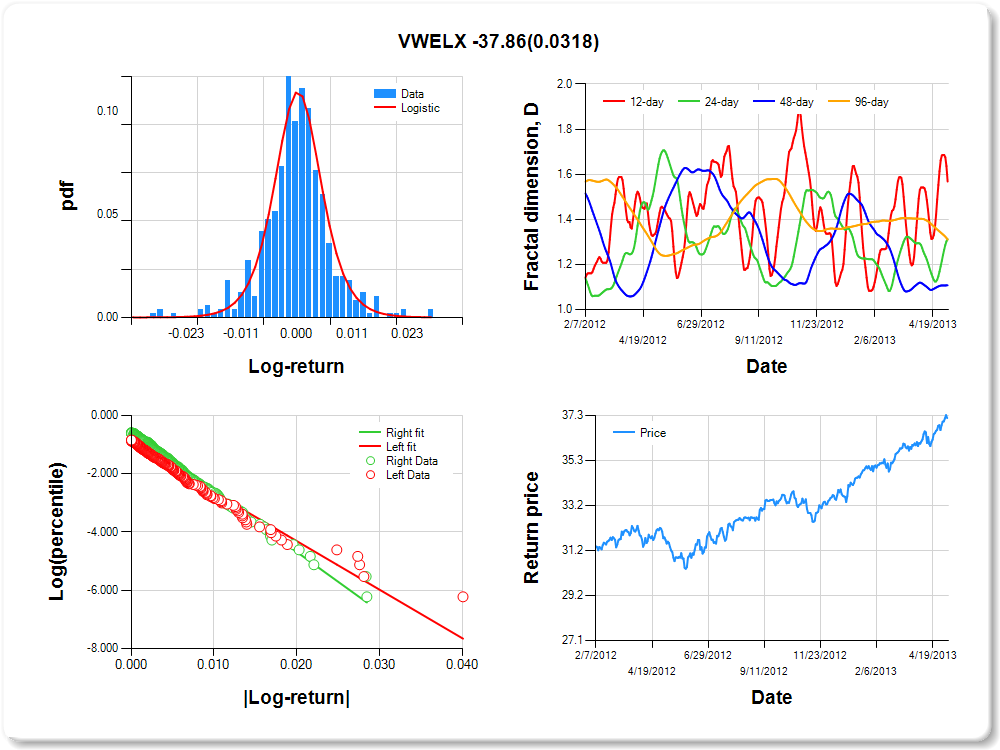

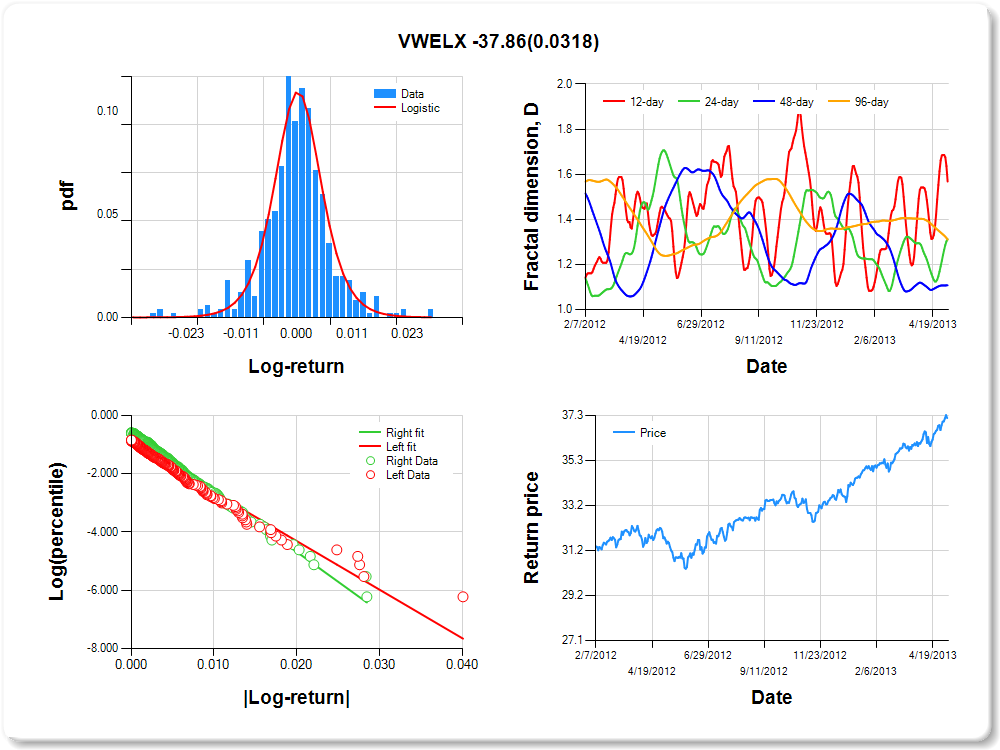

VWELX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.03 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.00 |

0.00 |

0.01 |

0.02 |

0.02 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.331 |

0.157 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.943 |

0.094 |

-10.059 |

0.0000 |

|log-return| |

-166.499 |

12.045 |

-13.823 |

0.0000 |

I(right-tail) |

0.395 |

0.129 |

3.064 |

0.0023 |

|log-return|*I(right-tail) |

-37.856 |

17.579 |

-2.154 |

0.0318 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.432 |

0.688 |

0.893 |

0.690 |

VEIPX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.03 |

0.03 |

1.83 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.327 |

0.164 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.899 |

0.091 |

-9.827 |

0.0000 |

|log-return| |

-120.067 |

8.467 |

-14.181 |

0.0000 |

I(right-tail) |

0.358 |

0.129 |

2.773 |

0.0058 |

|log-return|*I(right-tail) |

-23.557 |

12.437 |

-1.894 |

0.0588 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.407 |

0.681 |

0.937 |

0.686 |

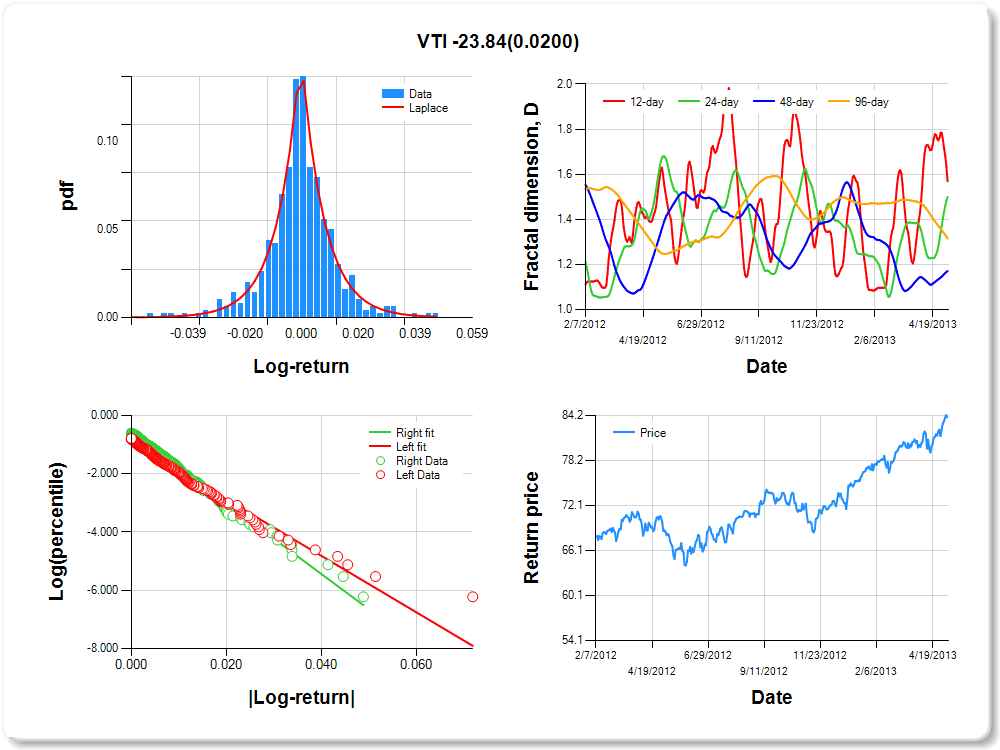

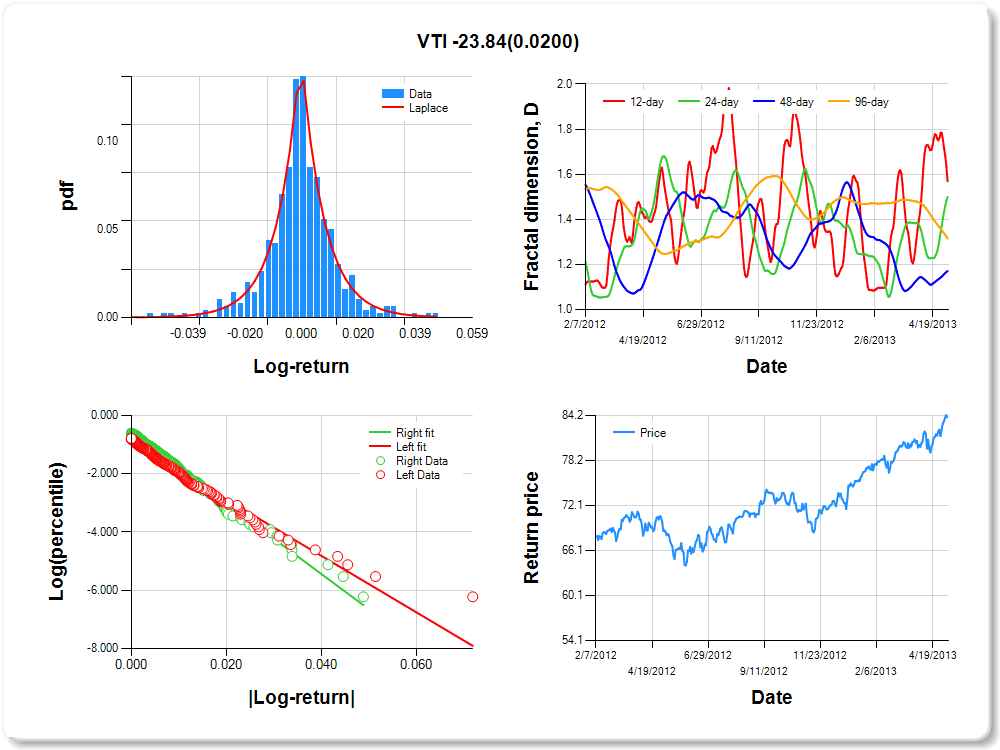

VTI

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.03 |

0.03 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.349 |

0.227 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.935 |

0.089 |

-10.502 |

0.0000 |

|log-return| |

-96.993 |

6.809 |

-14.244 |

0.0000 |

I(right-tail) |

0.333 |

0.125 |

2.671 |

0.0078 |

|log-return|*I(right-tail) |

-23.839 |

10.216 |

-2.334 |

0.0200 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.431 |

0.500 |

0.829 |

0.686 |

VTSMX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.04 |

0.04 |

3.53 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.350 |

0.227 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.945 |

0.090 |

-10.525 |

0.0000 |

|log-return| |

-95.649 |

6.769 |

-14.131 |

0.0000 |

I(right-tail) |

0.316 |

0.126 |

2.520 |

0.0121 |

|log-return|*I(right-tail) |

-21.804 |

10.095 |

-2.160 |

0.0313 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.431 |

0.495 |

0.828 |

0.685 |

VDIGX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.01 |

0.03 |

0.03 |

2.28 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.253 |

0.159 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.900 |

0.090 |

-9.969 |

0.0000 |

|log-return| |

-125.692 |

8.811 |

-14.265 |

0.0000 |

I(right-tail) |

0.358 |

0.130 |

2.762 |

0.0060 |

|log-return|*I(right-tail) |

-25.981 |

13.133 |

-1.978 |

0.0484 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.454 |

0.760 |

0.927 |

0.683 |

VEURX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

2.03 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.289 |

0.206 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.793 |

0.095 |

-8.337 |

0.0000 |

|log-return| |

-76.359 |

5.301 |

-14.404 |

0.0000 |

I(right-tail) |

0.245 |

0.131 |

1.870 |

0.0620 |

|log-return|*I(right-tail) |

-19.302 |

8.054 |

-2.397 |

0.0169 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.480 |

0.359 |

0.271 |

0.682 |

VWNFX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.03 |

0.03 |

3.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.401 |

0.244 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.938 |

0.094 |

-9.970 |

0.0000 |

|log-return| |

-100.227 |

7.259 |

-13.808 |

0.0000 |

I(right-tail) |

0.356 |

0.128 |

2.786 |

0.0055 |

|log-return|*I(right-tail) |

-25.773 |

10.707 |

-2.407 |

0.0164 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.471 |

0.554 |

0.816 |

0.682 |

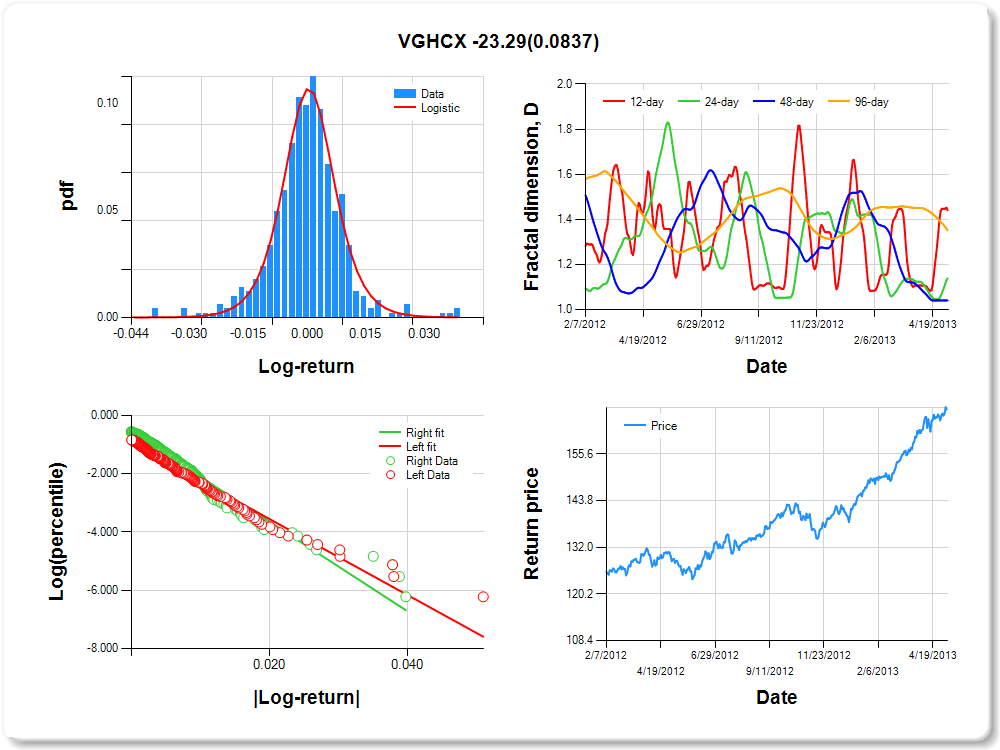

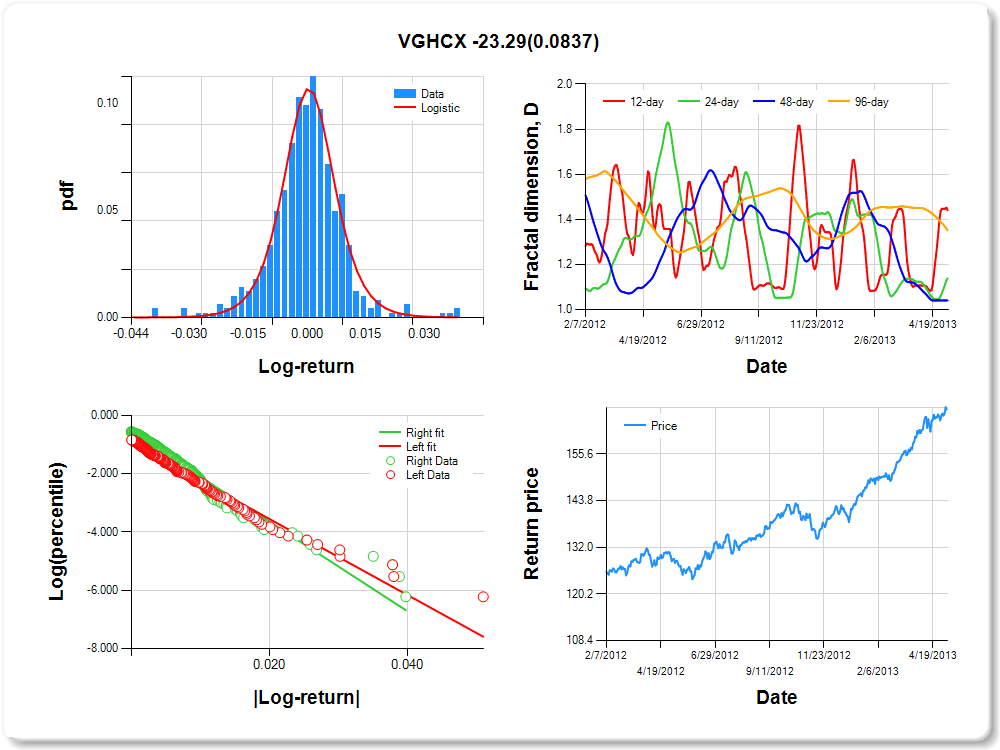

VGHCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.03 |

-0.01 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.01 |

0.03 |

0.04 |

2.01 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.261 |

0.160 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.942 |

0.093 |

-10.095 |

0.0000 |

|log-return| |

-130.468 |

9.396 |

-13.886 |

0.0000 |

I(right-tail) |

0.374 |

0.126 |

2.959 |

0.0032 |

|log-return|*I(right-tail) |

-23.289 |

13.439 |

-1.733 |

0.0837 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.559 |

0.862 |

0.959 |

0.649 |

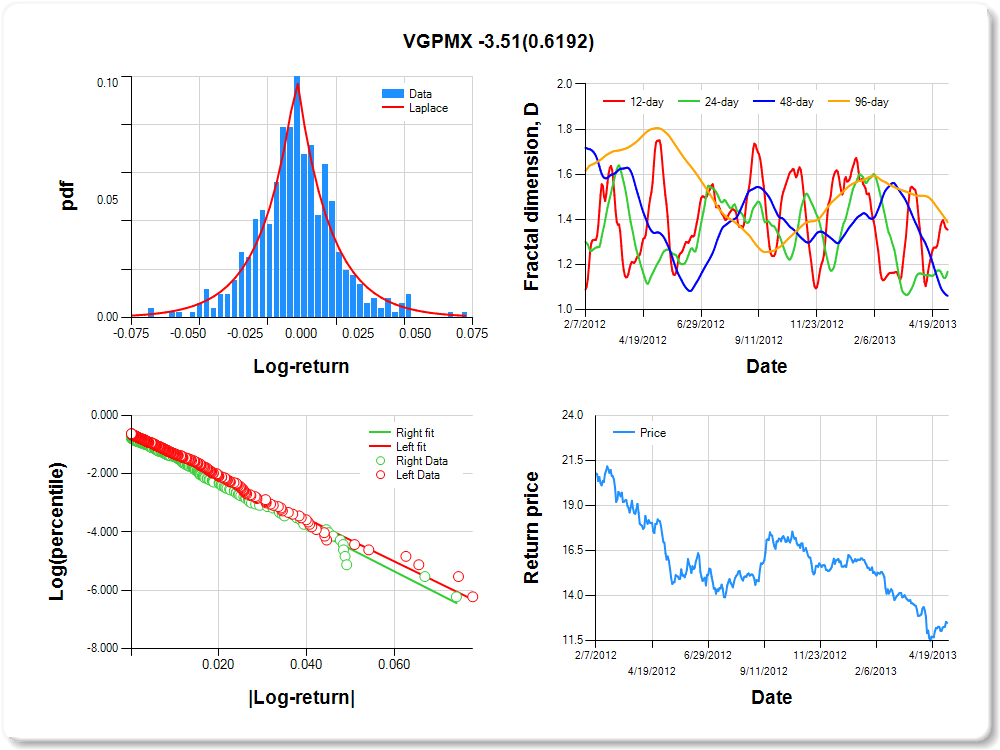

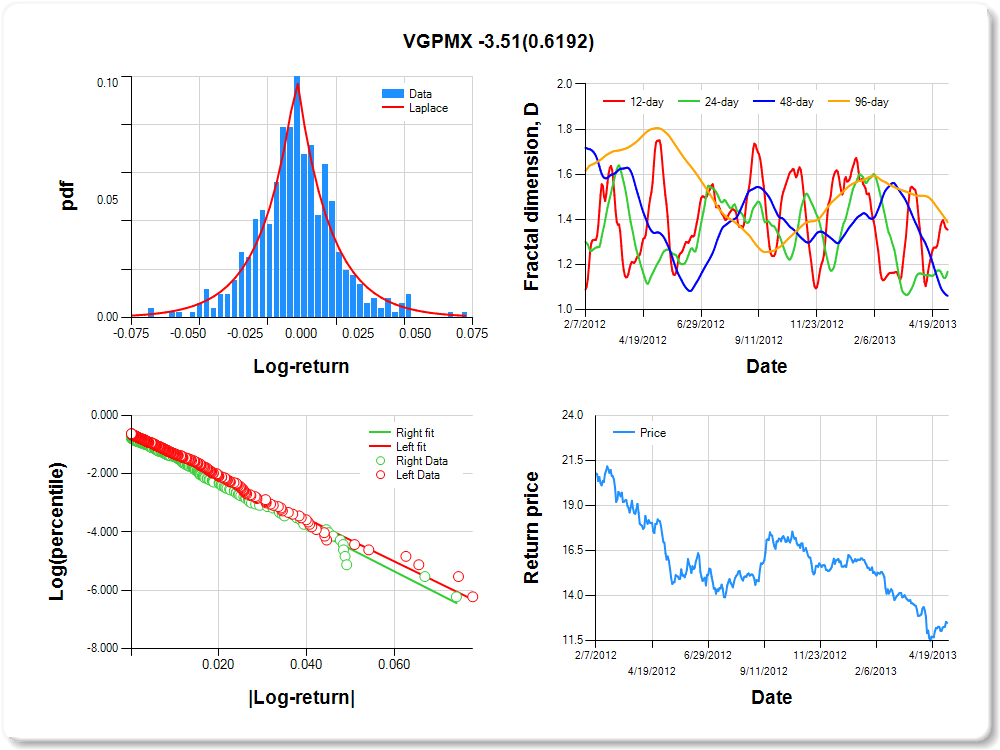

VGPMX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.05 |

0.79 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.022 |

0.333 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.594 |

0.090 |

-6.629 |

0.0000 |

|log-return| |

-73.190 |

4.667 |

-15.683 |

0.0000 |

I(right-tail) |

-0.129 |

0.133 |

-0.972 |

0.3317 |

|log-return|*I(right-tail) |

-3.514 |

7.066 |

-0.497 |

0.6192 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.645 |

0.832 |

0.939 |

0.613 |

VEIEX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.04 |

2.32 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.502 |

0.172 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.819 |

0.091 |

-9.045 |

0.0000 |

|log-return| |

-90.727 |

6.235 |

-14.551 |

0.0000 |

I(right-tail) |

0.192 |

0.128 |

1.500 |

0.1341 |

|log-return|*I(right-tail) |

-21.541 |

9.566 |

-2.252 |

0.0248 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.516 |

0.547 |

0.591 |

0.609 |

VFLTX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| 0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.01 |

0.01 |

0.01 |

2.08 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Cauchy |

-0.511 |

0.047 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.980 |

0.187 |

-5.234 |

0.0000 |

|log-return| |

-979.898 |

103.474 |

-9.470 |

0.0000 |

I(right-tail) |

0.078 |

0.217 |

0.357 |

0.7216 |

|log-return|*I(right-tail) |

496.078 |

110.255 |

4.499 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.769 |

0.715 |

0.325 |

0.505 |

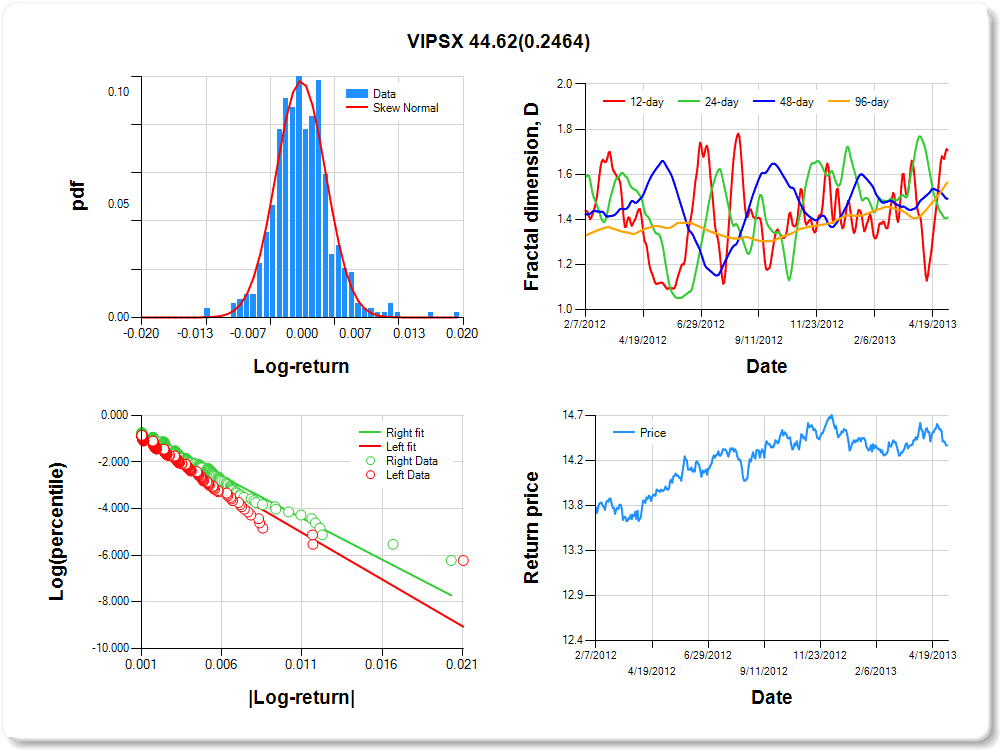

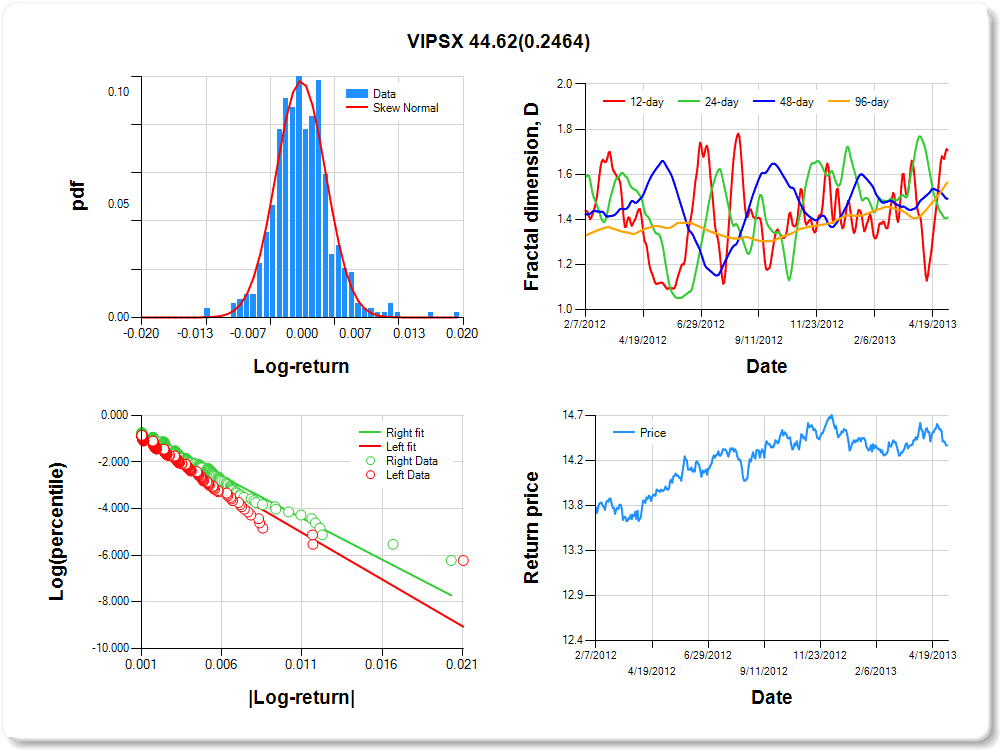

VIPSX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.01 |

-0.01 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.01 |

0.01 |

0.01 |

0.26 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Skew Normal |

0.127 |

0.273 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.765 |

0.105 |

-7.266 |

0.0000 |

|log-return| |

-400.176 |

29.693 |

-13.477 |

0.0000 |

I(right-tail) |

0.151 |

0.146 |

1.038 |

0.3000 |

|log-return|*I(right-tail) |

44.618 |

38.445 |

1.161 |

0.2464 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.293 |

0.591 |

0.508 |

0.435 |