VPACX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.04 |

0.60 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.262 |

0.104 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.837 |

0.043 |

-19.485 |

0.0000 |

|log-return| |

-95.176 |

2.941 |

-32.358 |

0.0000 |

I(right-tail) |

0.153 |

0.059 |

2.610 |

0.0091 |

|log-return|*I(right-tail) |

-7.173 |

4.190 |

-1.712 |

0.0870 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.707 |

0.678 |

0.922 |

0.847 |

VWEHX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.01 |

-0.01 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.01 |

0.01 |

0.02 |

0.52 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.036 |

0.052 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.539 |

0.073 |

-21.190 |

0.0000 |

|log-return| |

-293.353 |

14.628 |

-20.055 |

0.0000 |

I(right-tail) |

0.281 |

0.092 |

3.069 |

0.0022 |

|log-return|*I(right-tail) |

60.219 |

17.342 |

3.472 |

0.0005 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.851 |

0.949 |

0.706 |

0.847 |

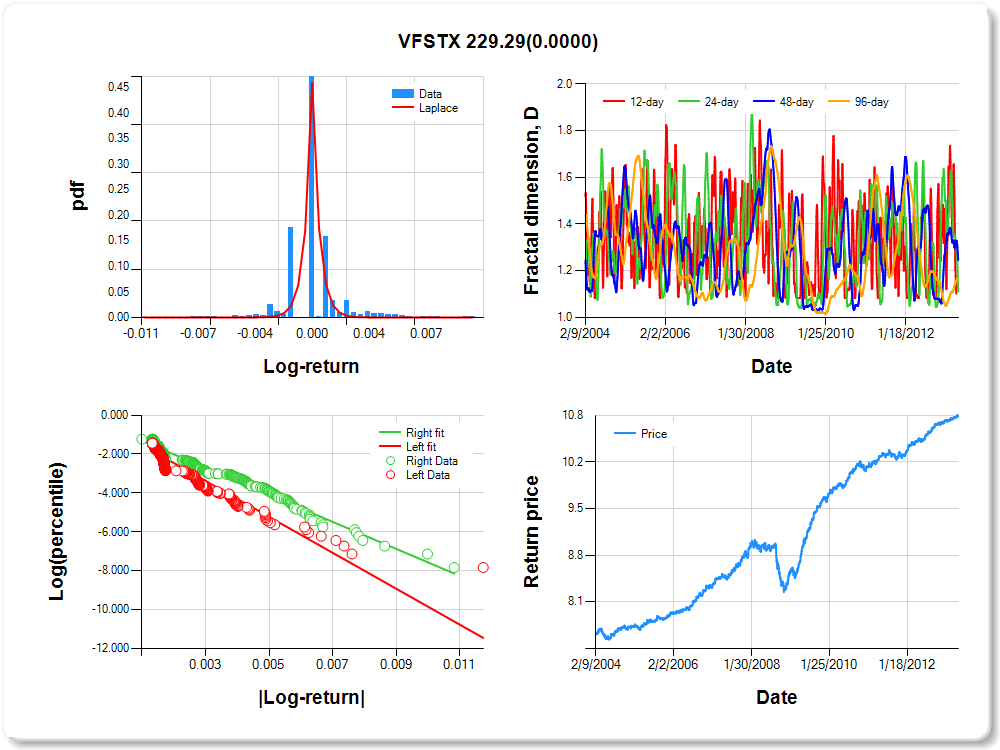

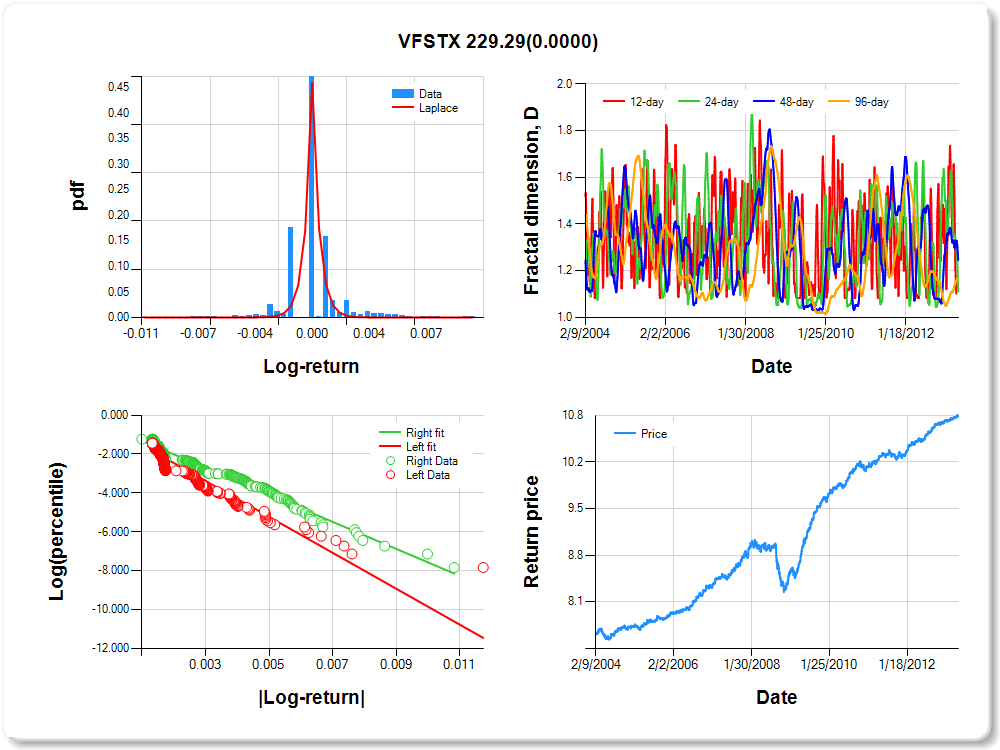

VFSTX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| 0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.01 |

0.01 |

0.76 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.104 |

0.069 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.977 |

0.076 |

-12.830 |

0.0000 |

|log-return| |

-925.221 |

40.807 |

-22.673 |

0.0000 |

I(right-tail) |

0.079 |

0.099 |

0.804 |

0.4215 |

|log-return|*I(right-tail) |

229.292 |

48.763 |

4.702 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| NaN |

0.889 |

0.754 |

0.834 |

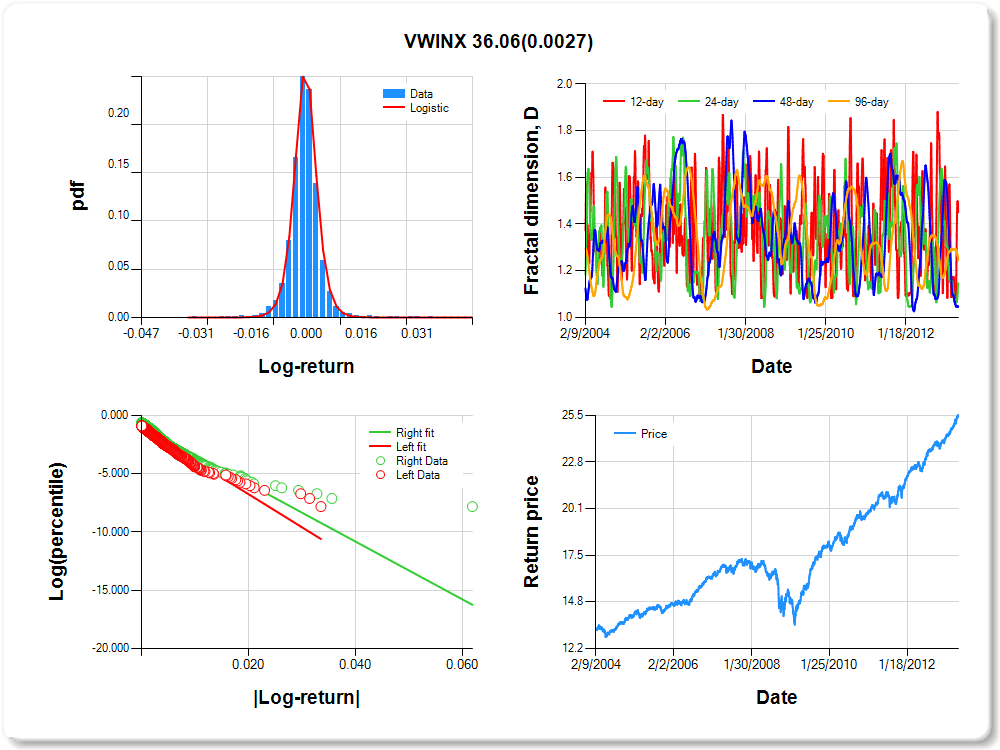

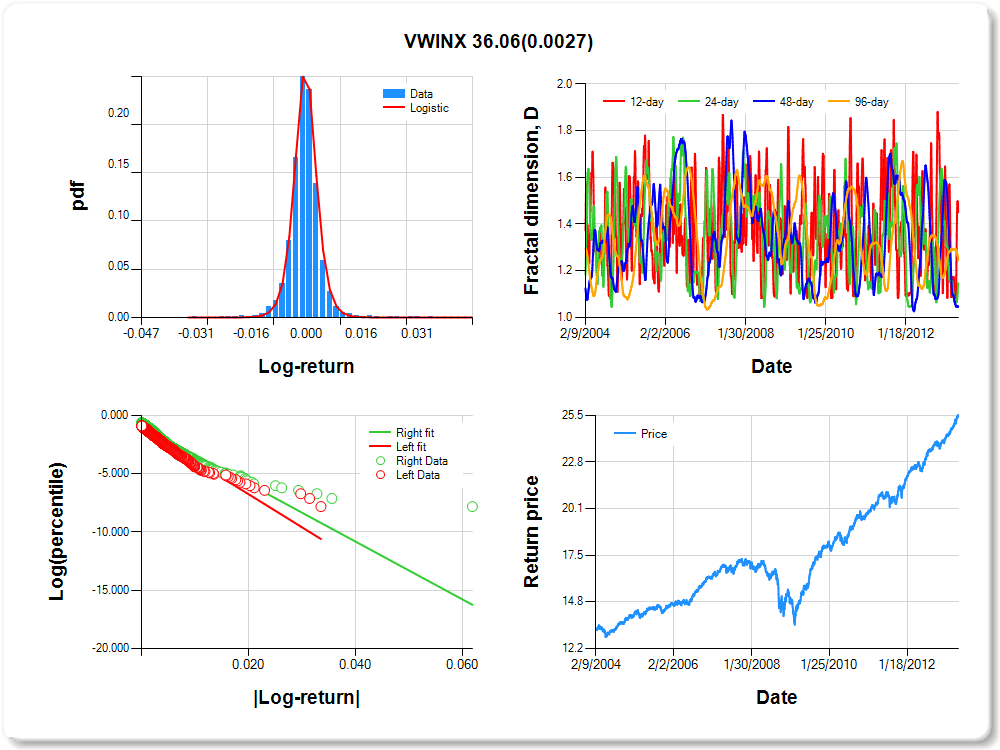

VWINX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.02 |

-0.01 |

-0.01 |

0.00 |

0.00 |

0.00 |

0.00 |

0.01 |

0.01 |

0.02 |

0.68 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.488 |

0.070 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.989 |

0.044 |

-22.553 |

0.0000 |

|log-return| |

-283.896 |

9.354 |

-30.351 |

0.0000 |

I(right-tail) |

0.160 |

0.058 |

2.789 |

0.0053 |

|log-return|*I(right-tail) |

36.059 |

11.987 |

3.008 |

0.0027 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.550 |

0.853 |

0.954 |

0.754 |

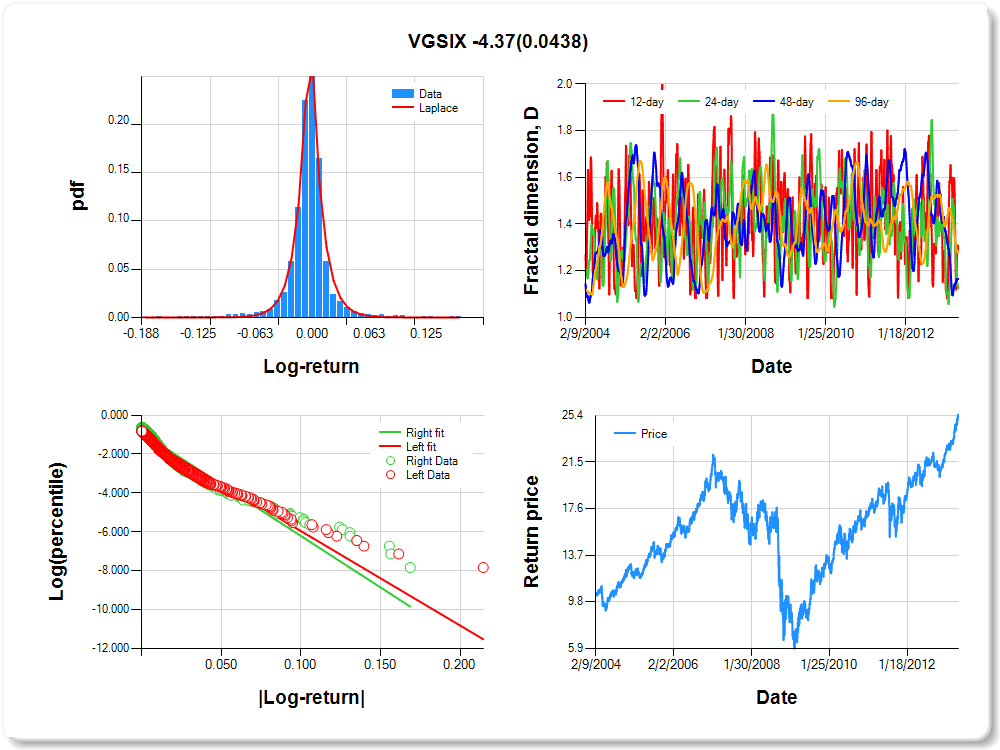

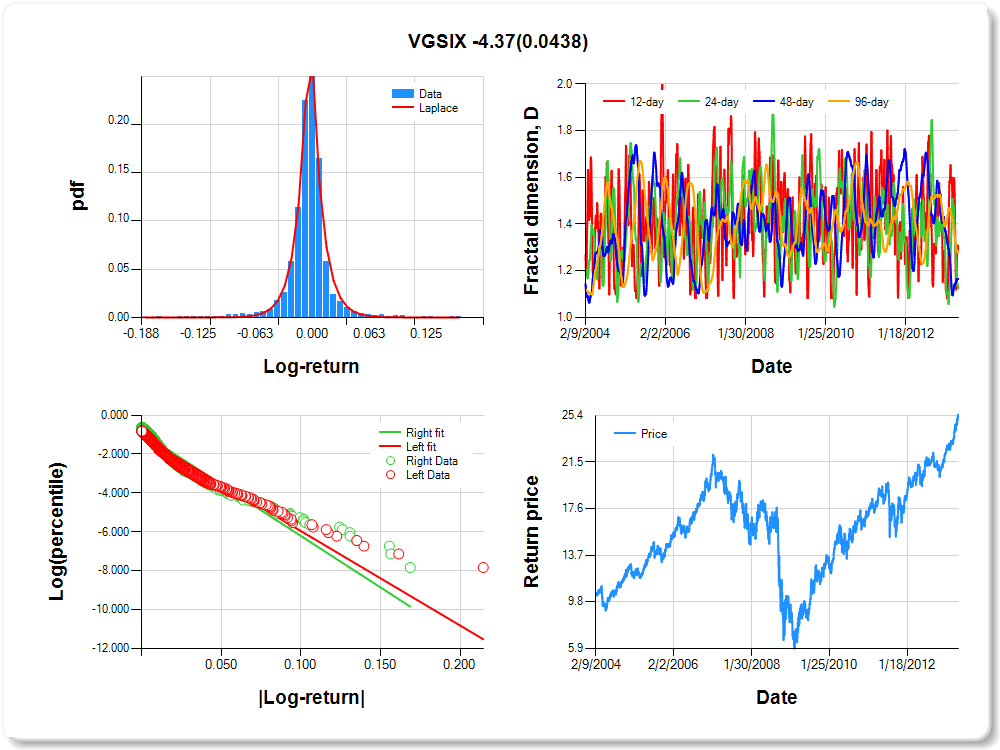

VGSIX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.09 |

-0.08 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.08 |

0.10 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.214 |

0.107 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.087 |

0.038 |

-28.838 |

0.0000 |

|log-return| |

-48.563 |

1.530 |

-31.745 |

0.0000 |

I(right-tail) |

0.187 |

0.051 |

3.665 |

0.0003 |

|log-return|*I(right-tail) |

-4.368 |

2.166 |

-2.017 |

0.0438 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.710 |

0.876 |

0.836 |

0.724 |

NAESX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.05 |

0.06 |

0.73 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.280 |

0.180 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.880 |

0.041 |

-21.356 |

0.0000 |

|log-return| |

-78.007 |

2.389 |

-32.647 |

0.0000 |

I(right-tail) |

0.243 |

0.056 |

4.308 |

0.0000 |

|log-return|*I(right-tail) |

-14.118 |

3.499 |

-4.035 |

0.0001 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.475 |

0.283 |

0.625 |

0.704 |

VWELX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.03 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.00 |

0.00 |

0.01 |

0.02 |

0.03 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.056 |

0.125 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.031 |

0.041 |

-25.138 |

0.0000 |

|log-return| |

-146.636 |

4.704 |

-31.176 |

0.0000 |

I(right-tail) |

0.316 |

0.055 |

5.749 |

0.0000 |

|log-return|*I(right-tail) |

-25.473 |

6.748 |

-3.775 |

0.0002 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.432 |

0.688 |

0.893 |

0.690 |

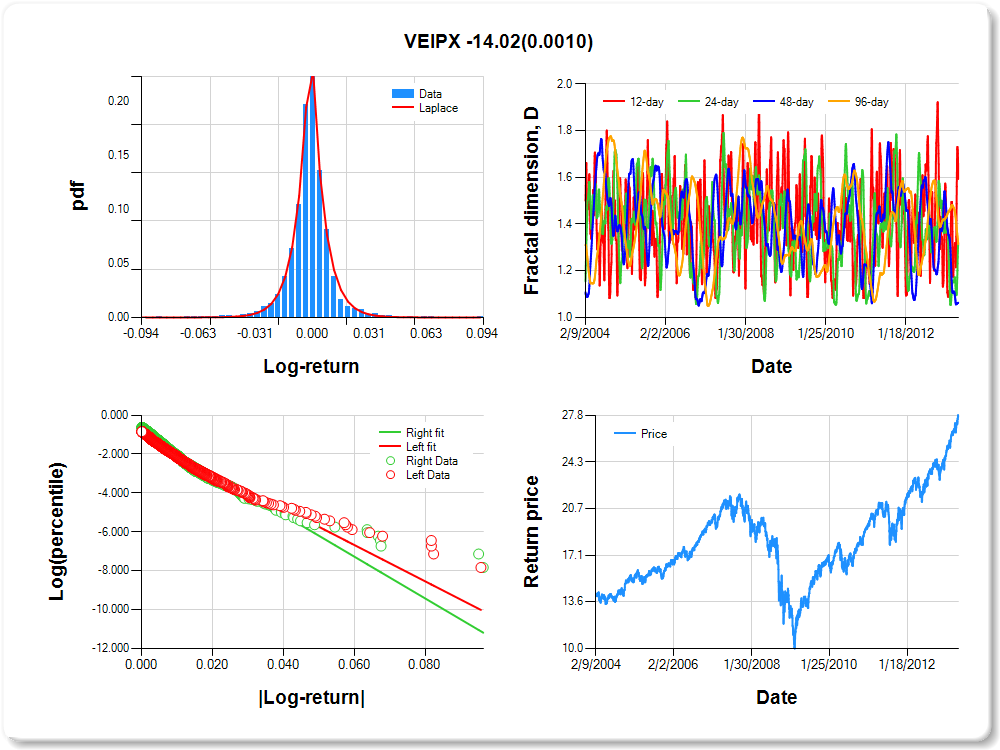

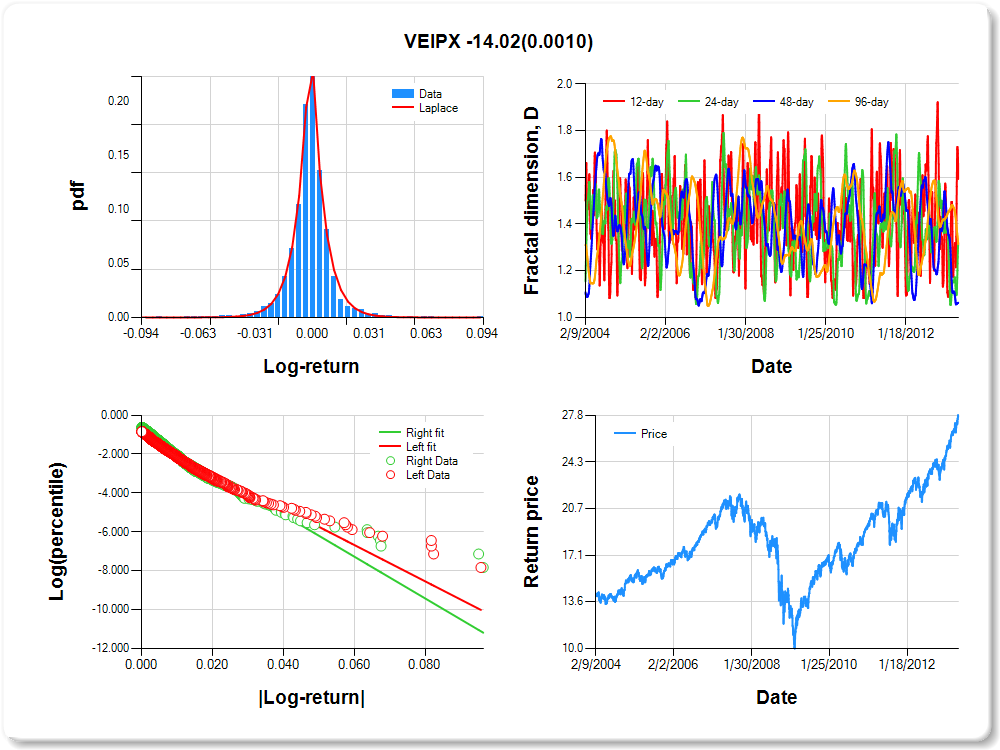

VEIPX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.04 |

0.04 |

-0.11 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.010 |

0.125 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.035 |

0.040 |

-26.084 |

0.0000 |

|log-return| |

-93.458 |

2.957 |

-31.601 |

0.0000 |

I(right-tail) |

0.247 |

0.054 |

4.587 |

0.0000 |

|log-return|*I(right-tail) |

-14.020 |

4.264 |

-3.288 |

0.0010 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.407 |

0.681 |

0.937 |

0.686 |

VTI

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.29 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.152 |

0.123 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.992 |

0.040 |

-24.887 |

0.0000 |

|log-return| |

-90.768 |

2.826 |

-32.117 |

0.0000 |

I(right-tail) |

0.244 |

0.053 |

4.559 |

0.0000 |

|log-return|*I(right-tail) |

-14.894 |

4.090 |

-3.641 |

0.0003 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.431 |

0.500 |

0.829 |

0.686 |

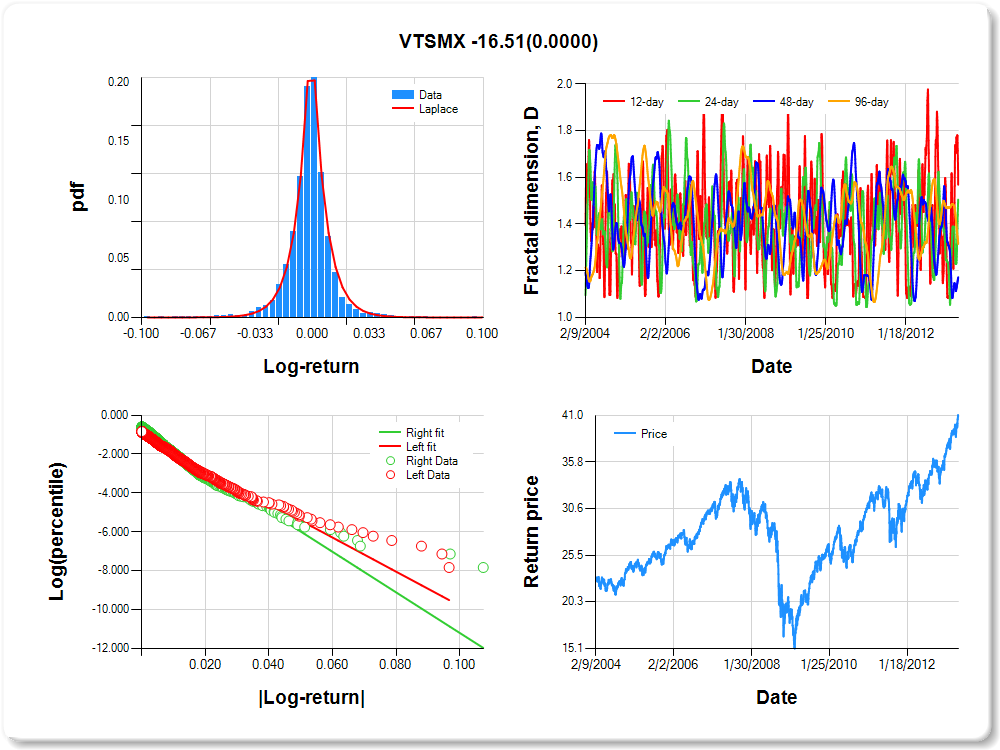

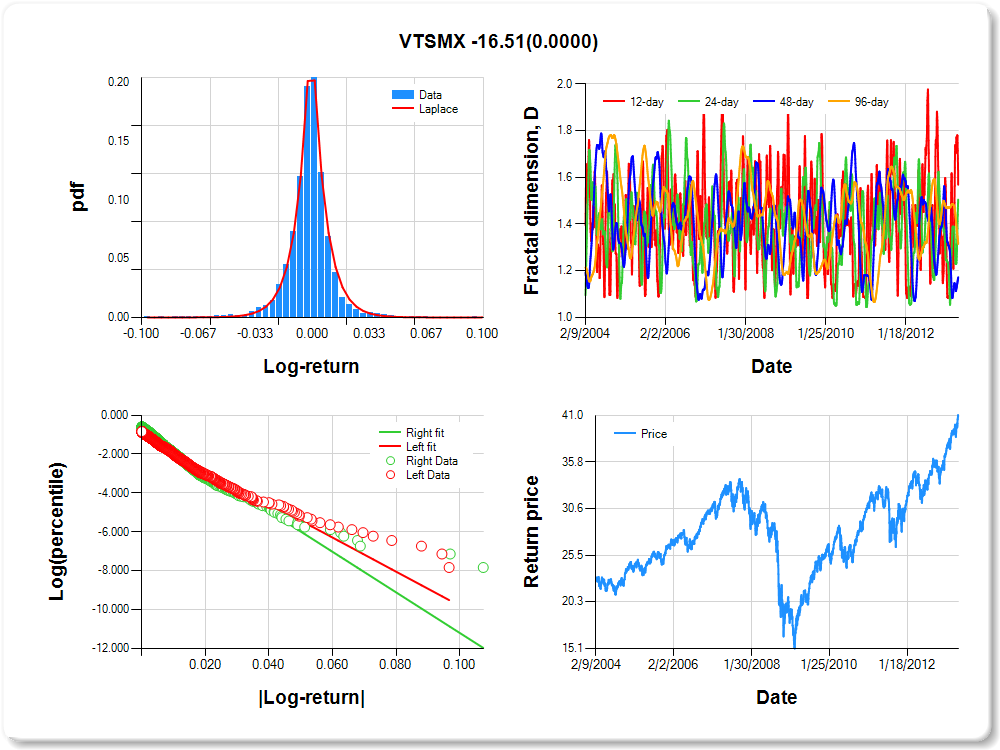

VTSMX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.70 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.068 |

0.133 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.008 |

0.040 |

-25.213 |

0.0000 |

|log-return| |

-87.724 |

2.753 |

-31.862 |

0.0000 |

I(right-tail) |

0.262 |

0.054 |

4.862 |

0.0000 |

|log-return|*I(right-tail) |

-16.515 |

4.015 |

-4.113 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.431 |

0.495 |

0.828 |

0.685 |

VDIGX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.03 |

0.04 |

0.80 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.075 |

0.126 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.021 |

0.041 |

-24.988 |

0.0000 |

|log-return| |

-105.968 |

3.384 |

-31.315 |

0.0000 |

I(right-tail) |

0.264 |

0.056 |

4.736 |

0.0000 |

|log-return|*I(right-tail) |

-15.840 |

4.900 |

-3.233 |

0.0012 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.454 |

0.760 |

0.927 |

0.683 |

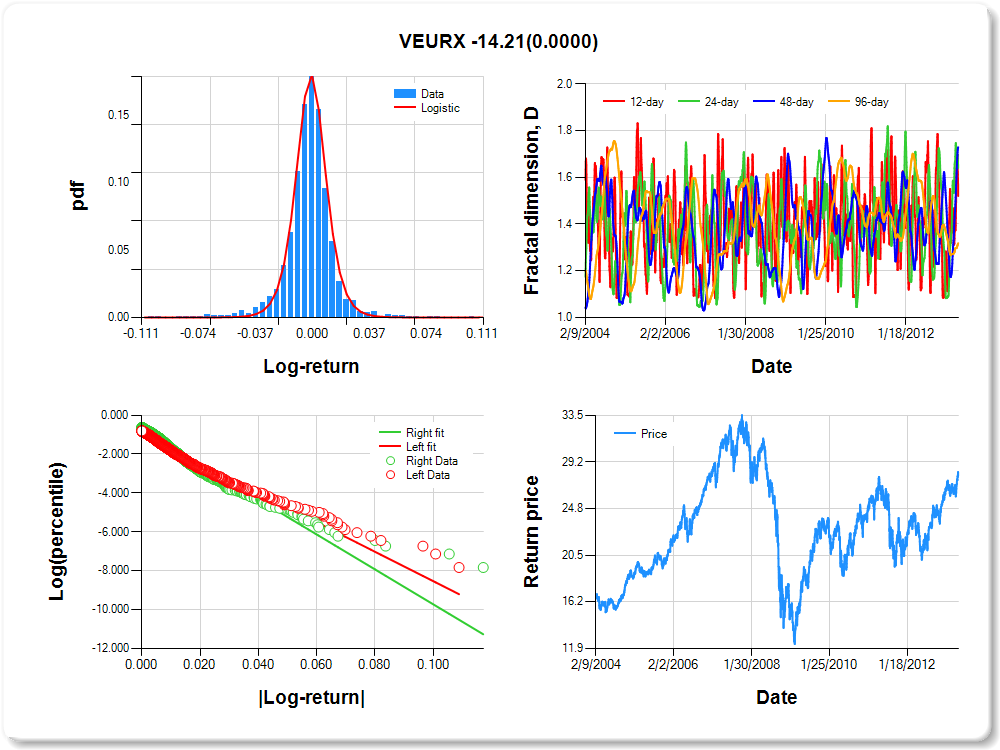

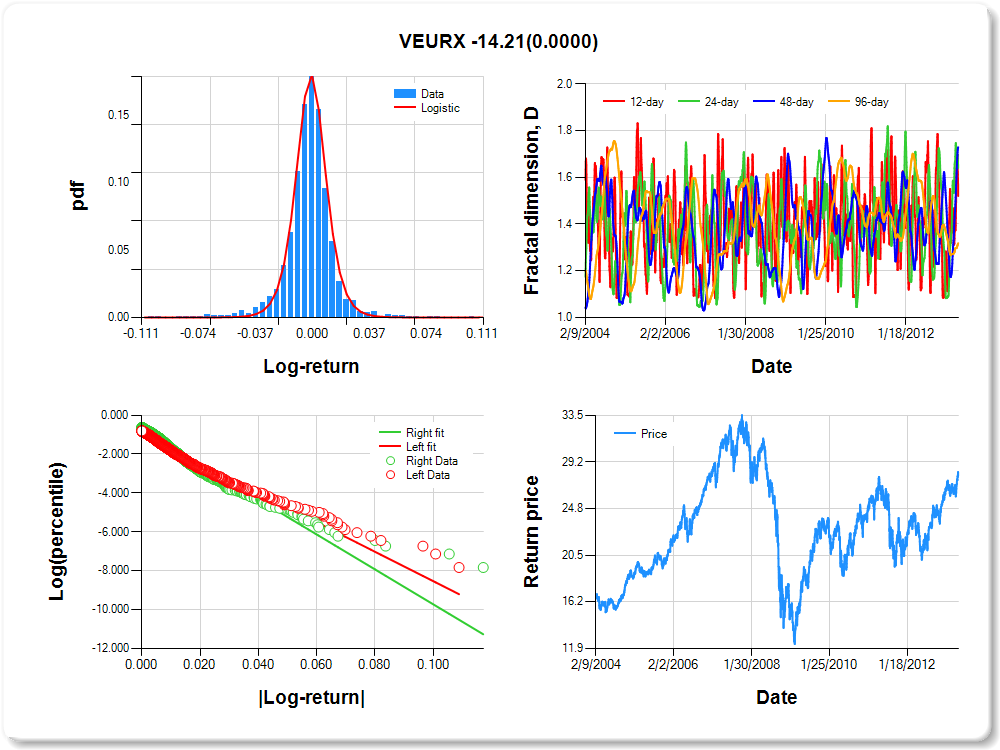

VEURX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.06 |

2.02 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.043 |

0.095 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.951 |

0.040 |

-23.933 |

0.0000 |

|log-return| |

-75.659 |

2.323 |

-32.574 |

0.0000 |

I(right-tail) |

0.233 |

0.055 |

4.243 |

0.0000 |

|log-return|*I(right-tail) |

-14.205 |

3.451 |

-4.116 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.480 |

0.359 |

0.271 |

0.682 |

VWNFX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.04 |

0.04 |

0.51 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.067 |

0.131 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.035 |

0.040 |

-25.954 |

0.0000 |

|log-return| |

-89.616 |

2.835 |

-31.613 |

0.0000 |

I(right-tail) |

0.269 |

0.054 |

5.005 |

0.0000 |

|log-return|*I(right-tail) |

-17.352 |

4.138 |

-4.193 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.471 |

0.554 |

0.816 |

0.682 |

VGHCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.03 |

-0.01 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.01 |

0.02 |

0.03 |

0.65 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.249 |

0.084 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.961 |

0.040 |

-23.844 |

0.0000 |

|log-return| |

-126.745 |

3.959 |

-32.017 |

0.0000 |

I(right-tail) |

0.266 |

0.055 |

4.878 |

0.0000 |

|log-return|*I(right-tail) |

-18.210 |

5.694 |

-3.198 |

0.0014 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.559 |

0.862 |

0.959 |

0.649 |

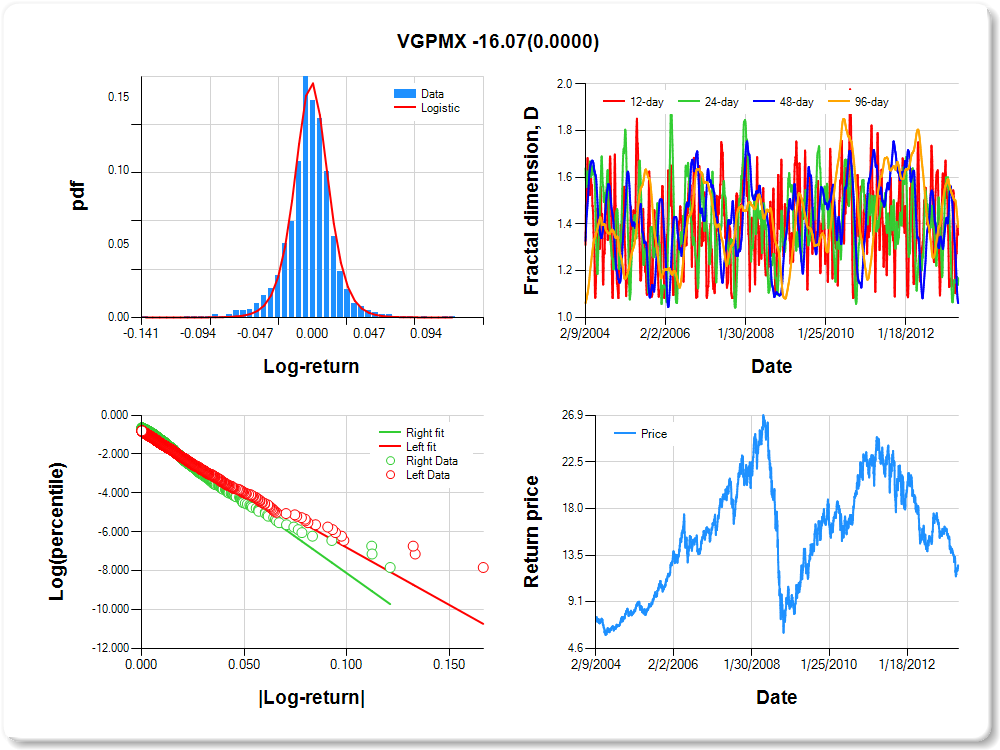

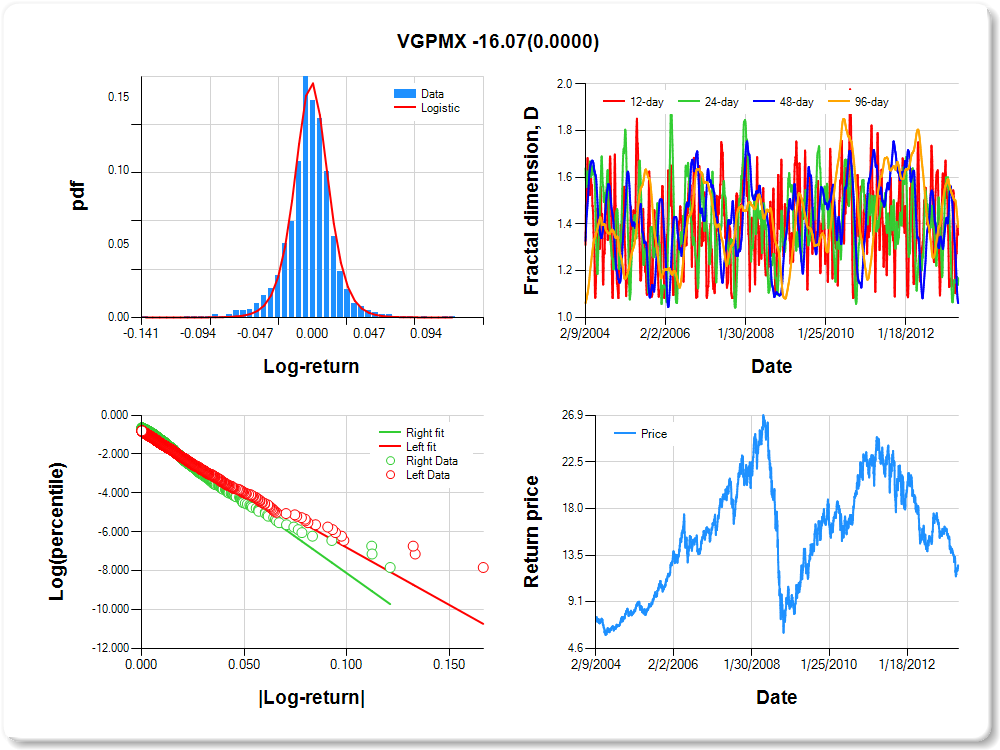

VGPMX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

1.03 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.293 |

0.107 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.894 |

0.041 |

-21.973 |

0.0000 |

|log-return| |

-58.960 |

1.802 |

-32.724 |

0.0000 |

I(right-tail) |

0.294 |

0.057 |

5.113 |

0.0000 |

|log-return|*I(right-tail) |

-16.071 |

2.783 |

-5.774 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.645 |

0.832 |

0.939 |

0.613 |

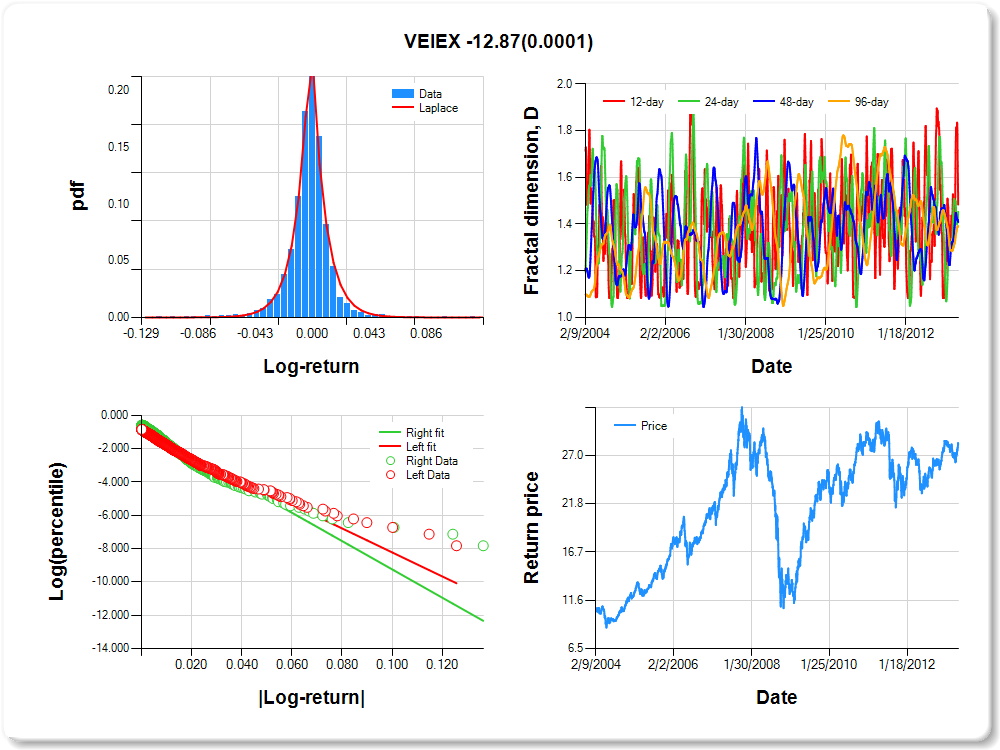

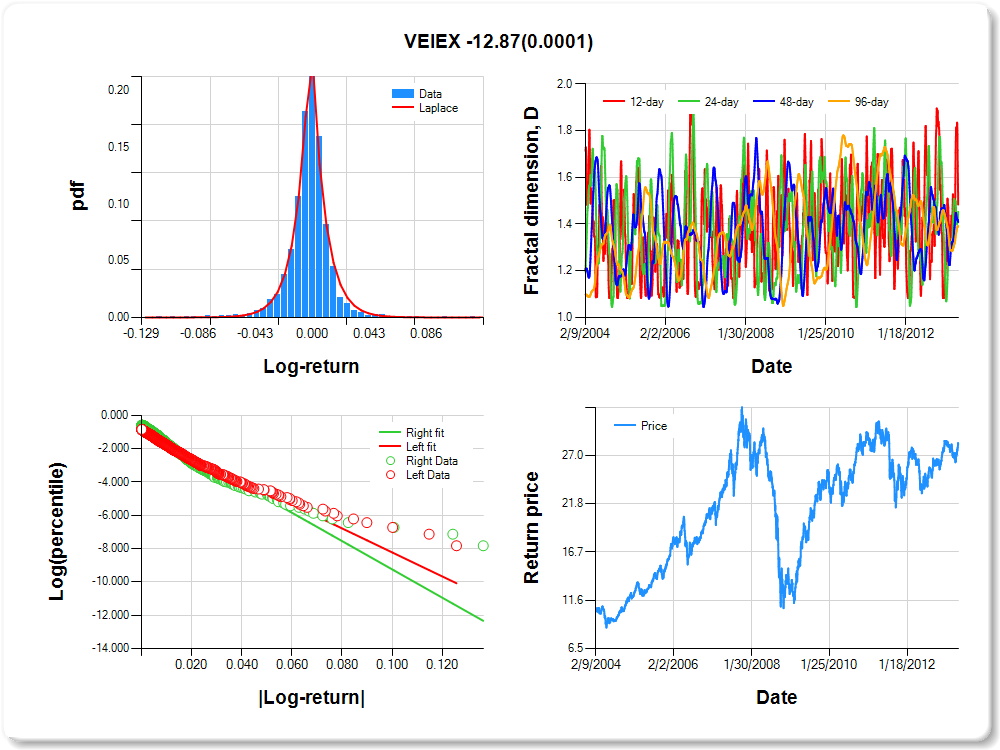

VEIEX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.05 |

0.06 |

0.33 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.052 |

0.133 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.009 |

0.040 |

-24.940 |

0.0000 |

|log-return| |

-71.993 |

2.269 |

-31.724 |

0.0000 |

I(right-tail) |

0.273 |

0.054 |

5.031 |

0.0000 |

|log-return|*I(right-tail) |

-12.869 |

3.299 |

-3.901 |

0.0001 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.516 |

0.547 |

0.591 |

0.609 |

VFLTX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.01 |

-0.01 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.01 |

0.01 |

0.21 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.166 |

0.092 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.187 |

0.057 |

-21.006 |

0.0000 |

|log-return| |

-479.130 |

18.905 |

-25.344 |

0.0000 |

I(right-tail) |

0.182 |

0.075 |

2.433 |

0.0151 |

|log-return|*I(right-tail) |

82.799 |

23.383 |

3.541 |

0.0004 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.769 |

0.715 |

0.325 |

0.505 |

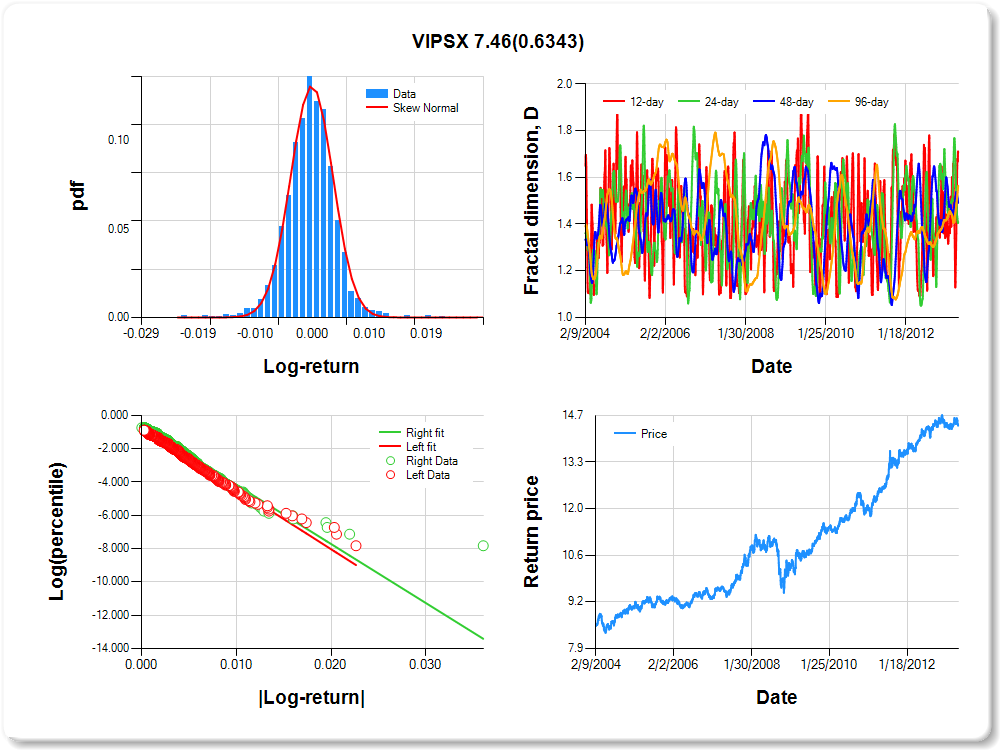

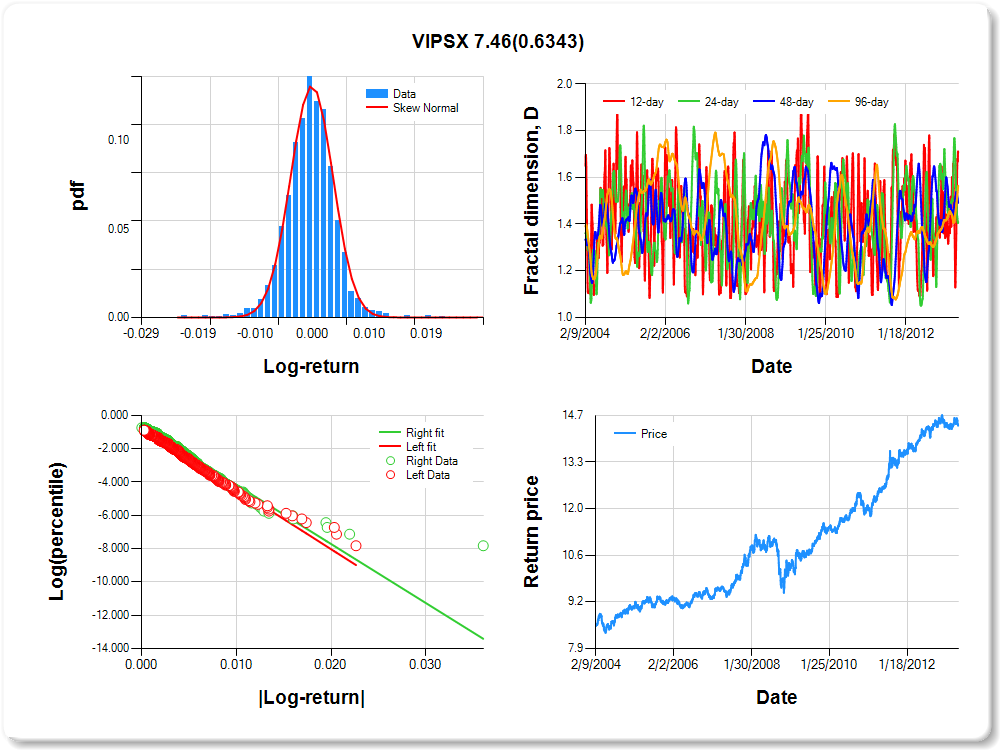

VIPSX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.01 |

-0.01 |

-0.01 |

0.00 |

0.00 |

0.00 |

0.00 |

0.01 |

0.01 |

0.01 |

0.32 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Skew Normal |

-0.283 |

0.223 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.667 |

0.050 |

-13.291 |

0.0000 |

|log-return| |

-361.460 |

11.529 |

-31.353 |

0.0000 |

I(right-tail) |

0.161 |

0.069 |

2.335 |

0.0197 |

|log-return|*I(right-tail) |

7.462 |

15.684 |

0.476 |

0.6343 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.293 |

0.591 |

0.508 |

0.435 |