XLI

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.98 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.003 |

0.159 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.896 |

0.041 |

-22.081 |

0.0000 |

|log-return| |

-88.810 |

2.701 |

-32.875 |

0.0000 |

I(right-tail) |

0.220 |

0.055 |

3.967 |

0.0001 |

|log-return|*I(right-tail) |

-12.887 |

3.921 |

-3.286 |

0.0010 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.537 |

0.345 |

0.561 |

0.773 |

XLF

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.10 |

-0.07 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.08 |

0.10 |

0.74 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.157 |

0.114 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.050 |

0.036 |

-28.981 |

0.0000 |

|log-return| |

-50.898 |

1.559 |

-32.639 |

0.0000 |

I(right-tail) |

0.055 |

0.050 |

1.101 |

0.2708 |

|log-return|*I(right-tail) |

-1.537 |

2.211 |

-0.695 |

0.4870 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.439 |

0.358 |

0.734 |

0.745 |

XLY

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.38 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.258 |

0.151 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.901 |

0.039 |

-22.944 |

0.0000 |

|log-return| |

-86.963 |

2.626 |

-33.111 |

0.0000 |

I(right-tail) |

0.195 |

0.055 |

3.555 |

0.0004 |

|log-return|*I(right-tail) |

-11.250 |

3.821 |

-2.944 |

0.0033 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.458 |

0.696 |

0.803 |

0.720 |

XLP

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.03 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.01 |

0.02 |

0.03 |

0.46 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.030 |

0.108 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.864 |

0.043 |

-20.090 |

0.0000 |

|log-return| |

-150.337 |

4.694 |

-32.027 |

0.0000 |

I(right-tail) |

0.302 |

0.059 |

5.143 |

0.0000 |

|log-return|*I(right-tail) |

-22.835 |

6.740 |

-3.388 |

0.0007 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.683 |

0.946 |

0.972 |

0.681 |

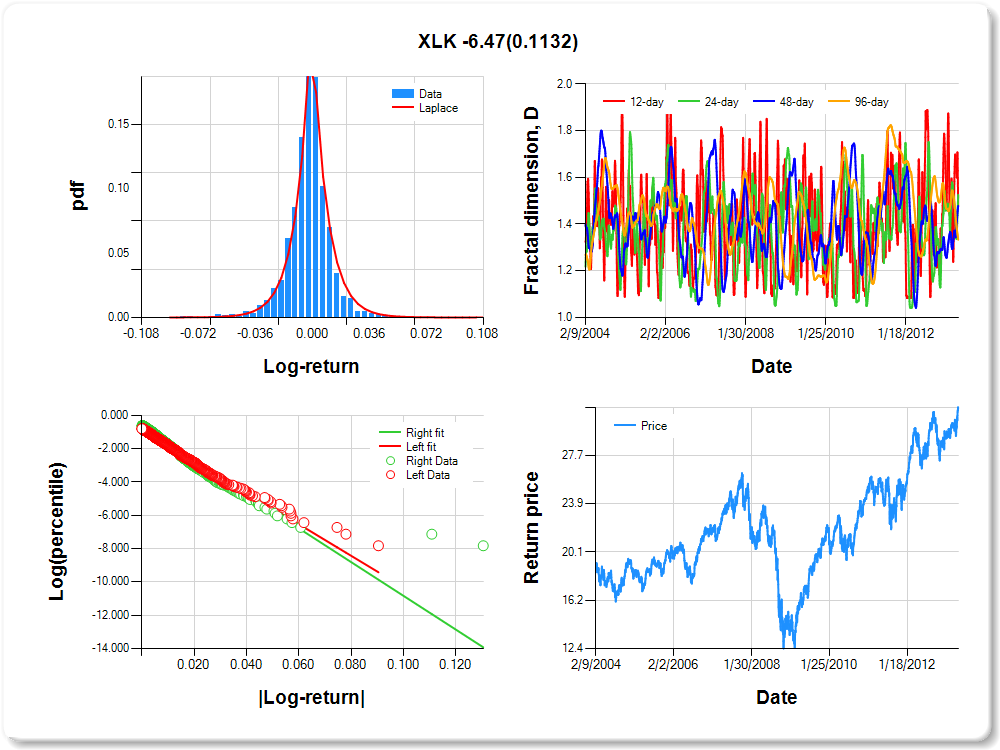

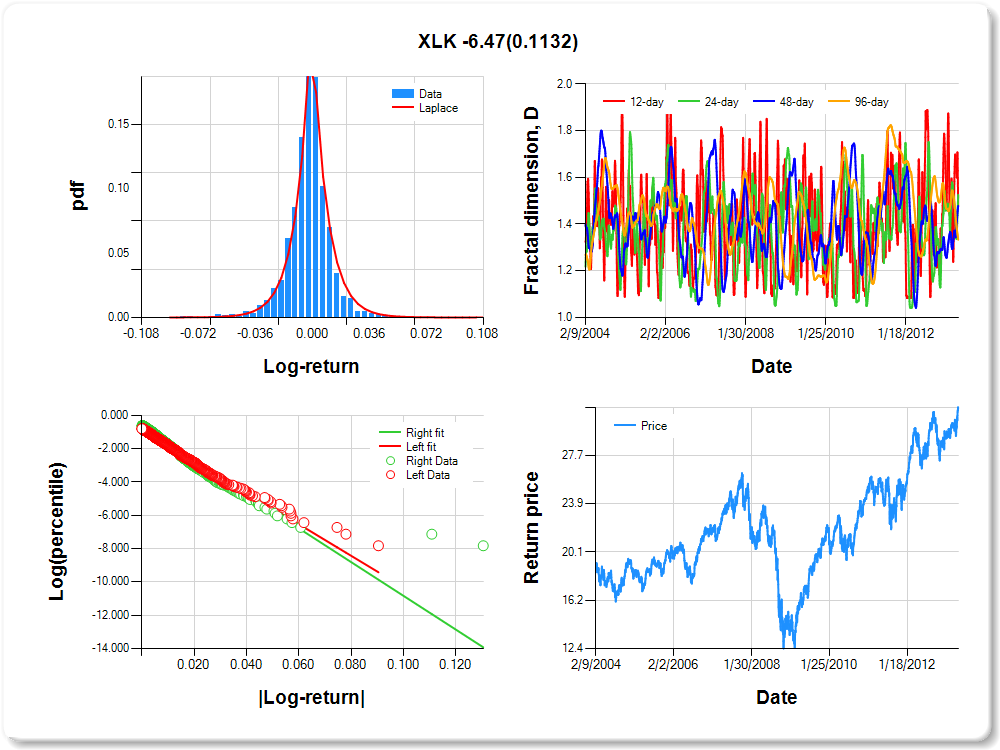

XLK

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.04 |

1.09 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.284 |

0.146 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.837 |

0.042 |

-19.975 |

0.0000 |

|log-return| |

-94.790 |

2.885 |

-32.858 |

0.0000 |

I(right-tail) |

0.140 |

0.057 |

2.478 |

0.0133 |

|log-return|*I(right-tail) |

-6.472 |

4.084 |

-1.585 |

0.1132 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.523 |

0.474 |

0.522 |

0.667 |

XLV

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.01 |

0.03 |

0.03 |

0.20 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.075 |

0.074 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.901 |

0.040 |

-22.450 |

0.0000 |

|log-return| |

-118.006 |

3.633 |

-32.484 |

0.0000 |

I(right-tail) |

0.206 |

0.056 |

3.679 |

0.0002 |

|log-return|*I(right-tail) |

-14.852 |

5.308 |

-2.798 |

0.0052 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.441 |

0.855 |

0.943 |

0.647 |

XLU

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.03 |

0.03 |

0.72 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.313 |

0.093 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.884 |

0.041 |

-21.475 |

0.0000 |

|log-return| |

-111.562 |

3.418 |

-32.642 |

0.0000 |

I(right-tail) |

0.135 |

0.056 |

2.427 |

0.0153 |

|log-return|*I(right-tail) |

-1.384 |

4.782 |

-0.289 |

0.7723 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.748 |

0.946 |

0.974 |

0.593 |

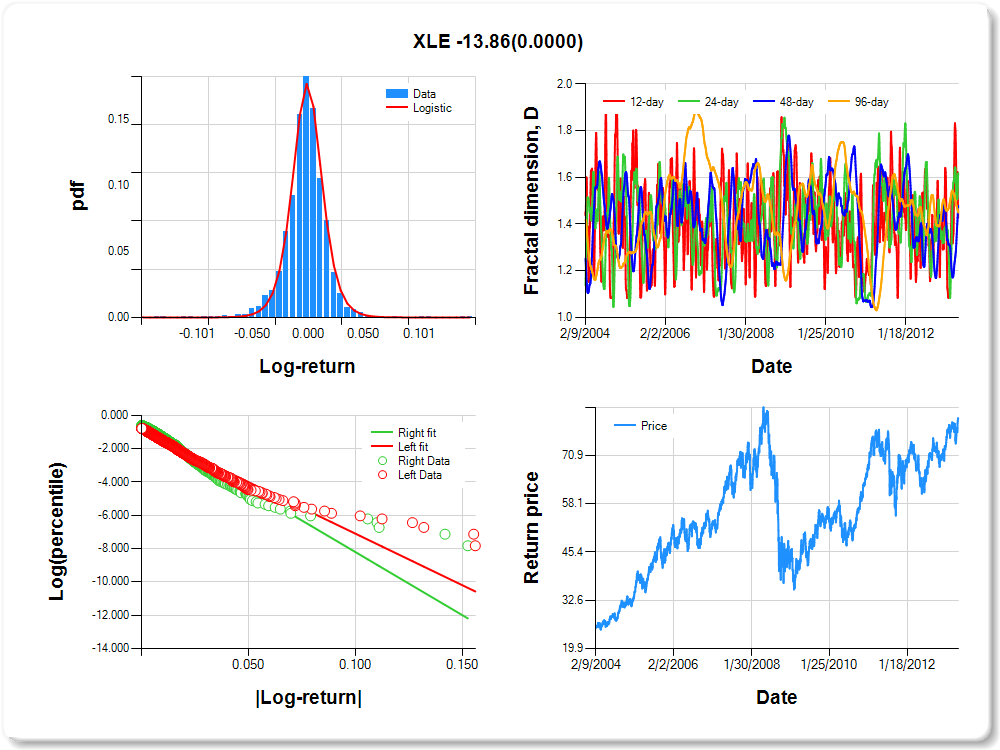

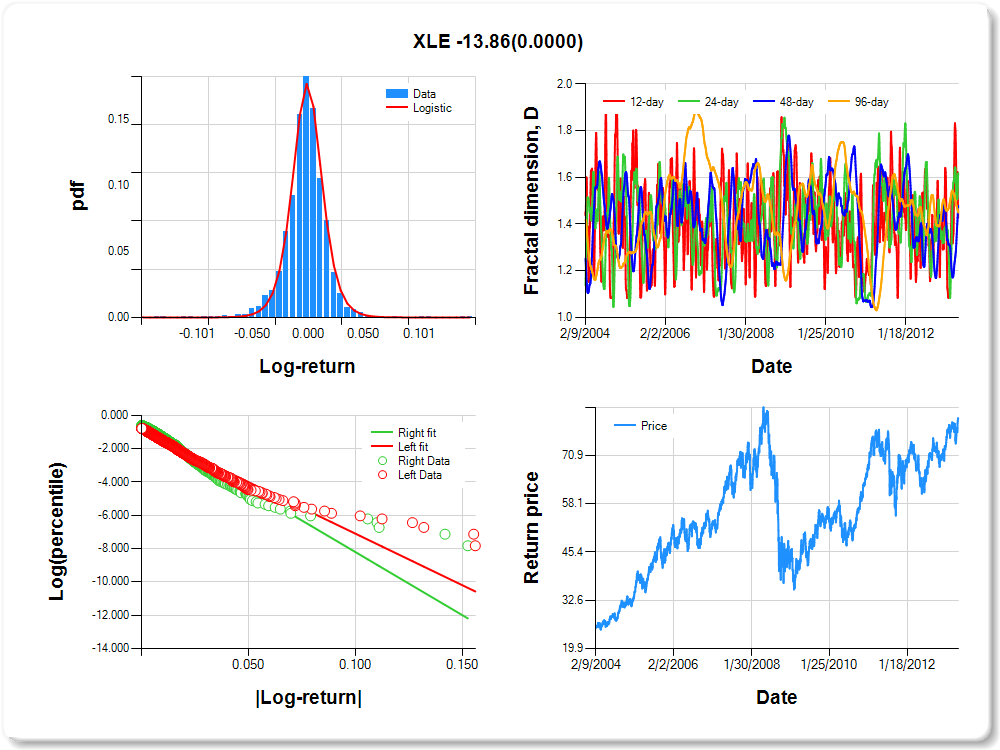

XLE

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

0.70 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.040 |

0.097 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.926 |

0.040 |

-23.267 |

0.0000 |

|log-return| |

-61.825 |

1.906 |

-32.440 |

0.0000 |

I(right-tail) |

0.282 |

0.056 |

5.075 |

0.0000 |

|log-return|*I(right-tail) |

-13.857 |

2.877 |

-4.817 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.573 |

0.382 |

0.522 |

0.550 |

XLB

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.029 |

0.095 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.855 |

0.041 |

-20.742 |

0.0000 |

|log-return| |

-75.855 |

2.303 |

-32.944 |

0.0000 |

I(right-tail) |

0.232 |

0.057 |

4.084 |

0.0000 |

|log-return|*I(right-tail) |

-13.080 |

3.404 |

-3.843 |

0.0001 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.513 |

0.439 |

0.229 |

0.499 |