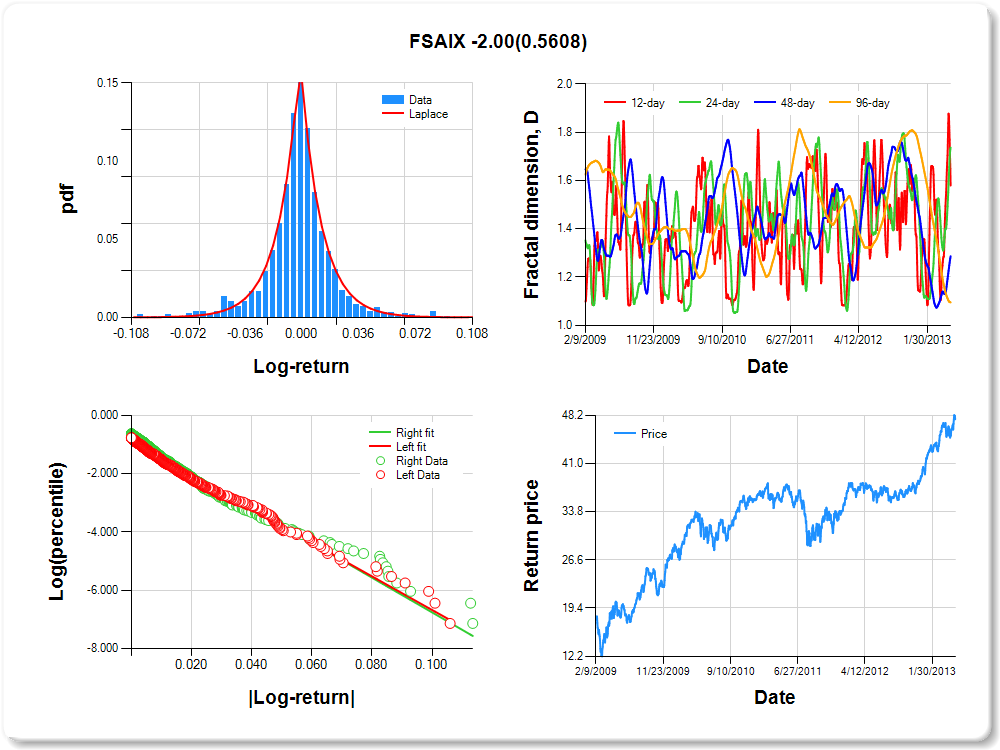

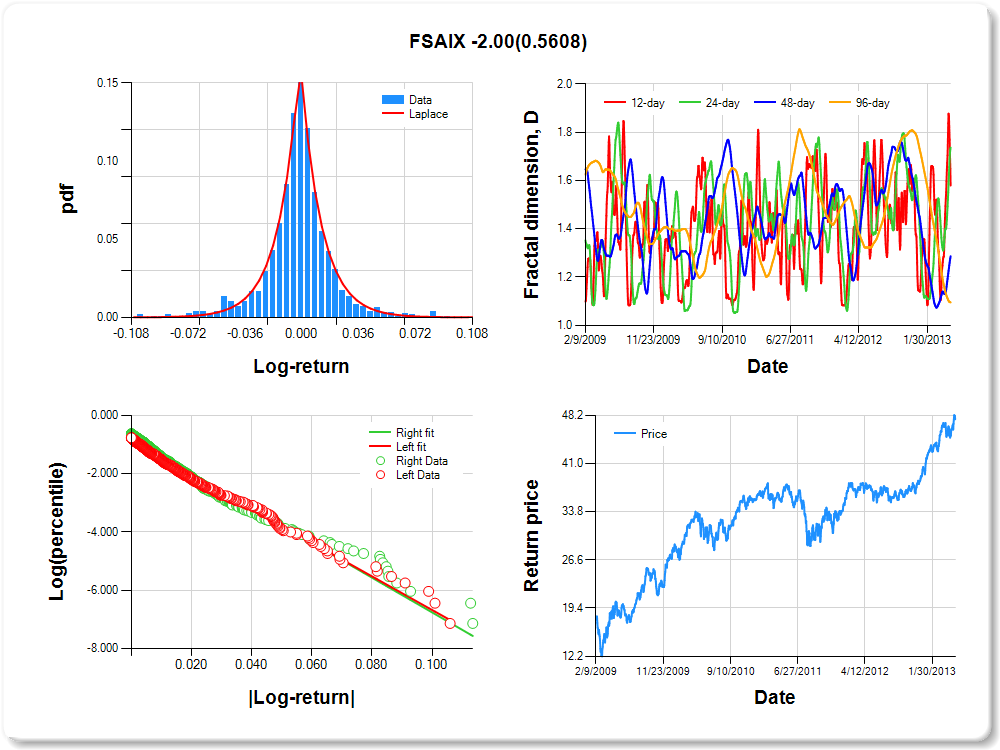

FSAIX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.06 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.07 |

0.09 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.045 |

0.206 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.897 |

0.056 |

-16.108 |

0.0000 |

|log-return| |

-57.719 |

2.460 |

-23.459 |

0.0000 |

I(right-tail) |

0.117 |

0.076 |

1.539 |

0.1242 |

|log-return|*I(right-tail) |

-1.996 |

3.431 |

-0.582 |

0.5608 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.421 |

0.263 |

0.714 |

0.905 |

FSDAX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.04 |

0.06 |

0.59 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.249 |

0.210 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.841 |

0.057 |

-14.728 |

0.0000 |

|log-return| |

-73.418 |

3.121 |

-23.526 |

0.0000 |

I(right-tail) |

0.167 |

0.079 |

2.124 |

0.0339 |

|log-return|*I(right-tail) |

-9.945 |

4.558 |

-2.182 |

0.0293 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.480 |

0.375 |

0.748 |

0.818 |

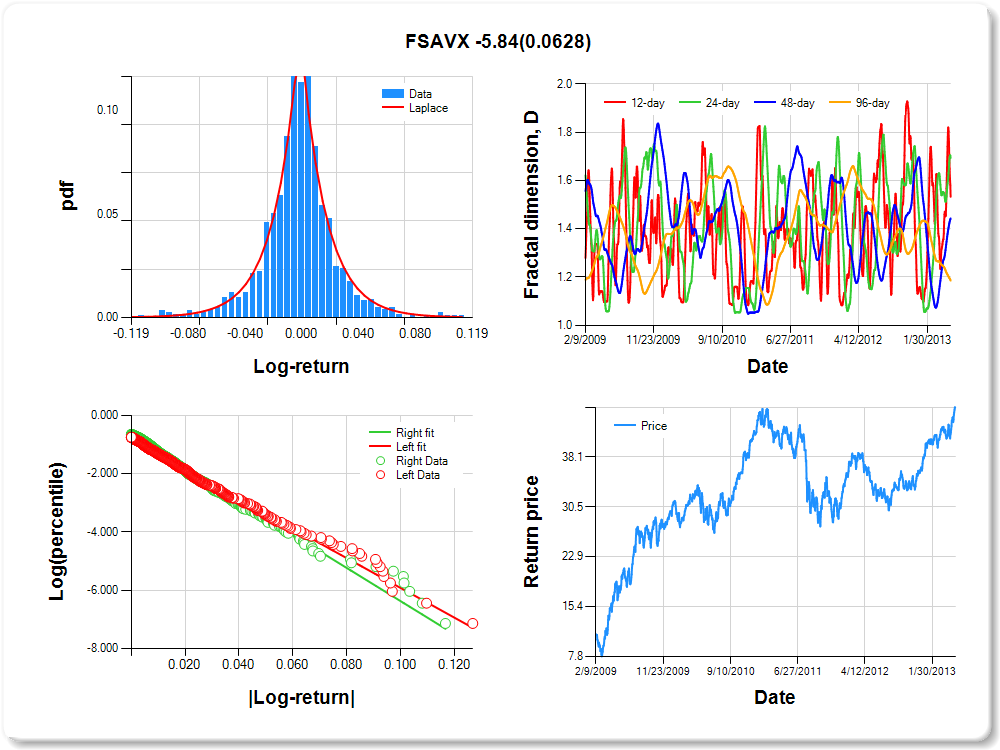

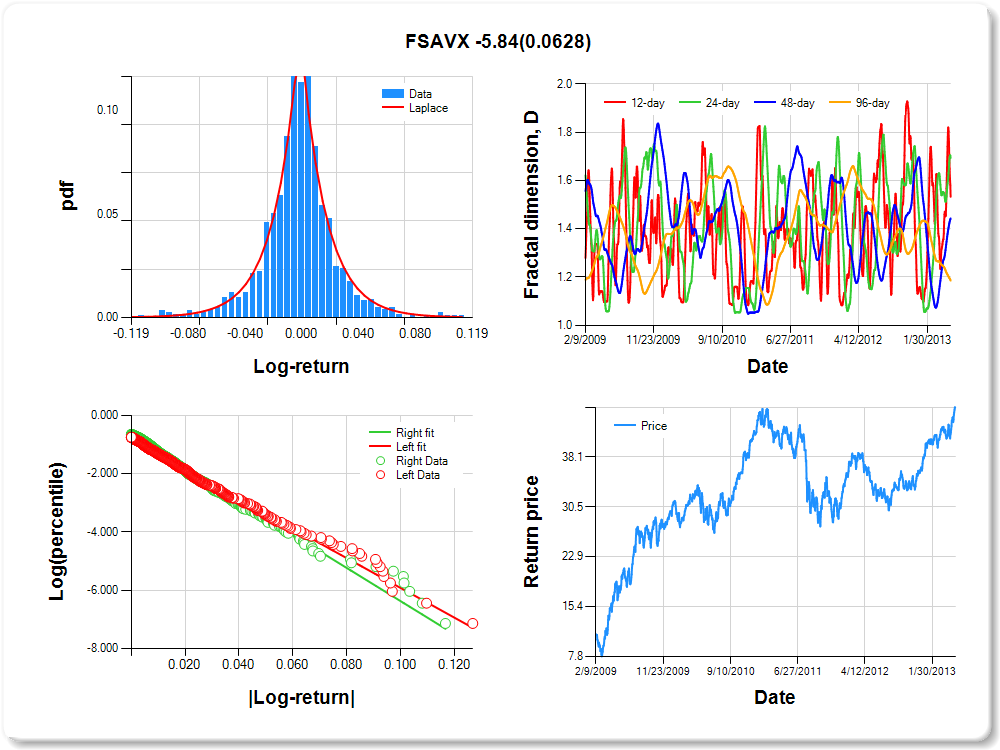

FSAVX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.09 |

-0.08 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.07 |

0.10 |

1.48 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.085 |

0.246 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.808 |

0.057 |

-14.162 |

0.0000 |

|log-return| |

-51.052 |

2.151 |

-23.738 |

0.0000 |

I(right-tail) |

0.133 |

0.079 |

1.669 |

0.0954 |

|log-return|*I(right-tail) |

-5.840 |

3.136 |

-1.863 |

0.0628 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.467 |

0.306 |

0.557 |

0.815 |

FSLBX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.11 |

-0.07 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.08 |

0.09 |

0.67 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.085 |

0.171 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.945 |

0.054 |

-17.547 |

0.0000 |

|log-return| |

-48.050 |

2.056 |

-23.375 |

0.0000 |

I(right-tail) |

0.158 |

0.075 |

2.118 |

0.0344 |

|log-return|*I(right-tail) |

-7.883 |

3.042 |

-2.591 |

0.0097 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.409 |

0.378 |

0.525 |

0.806 |

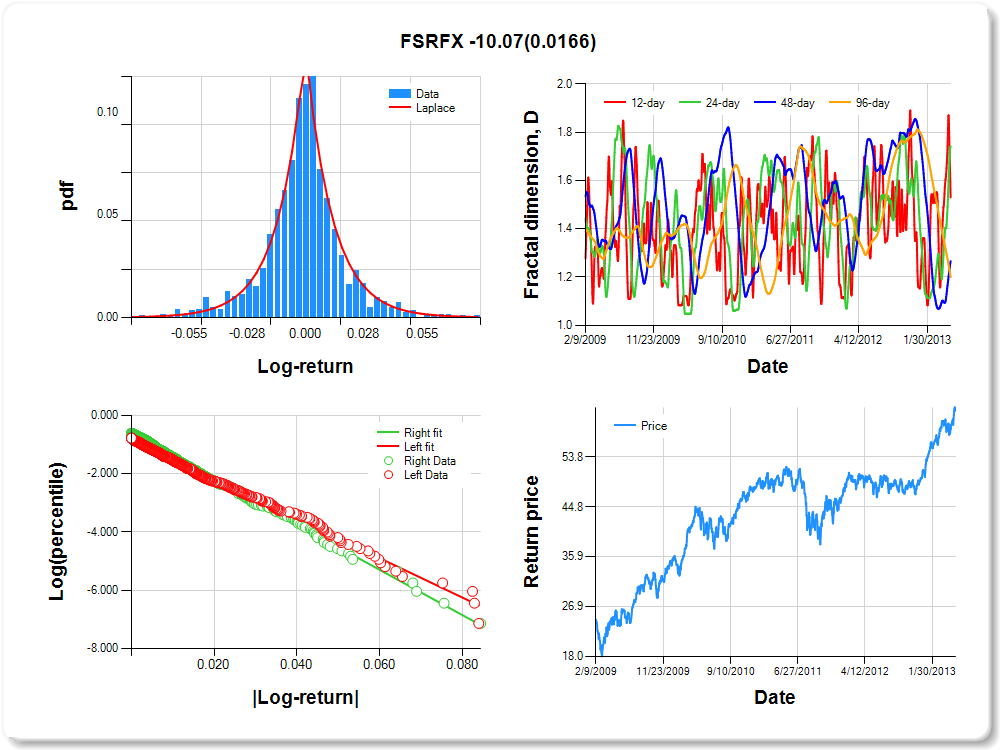

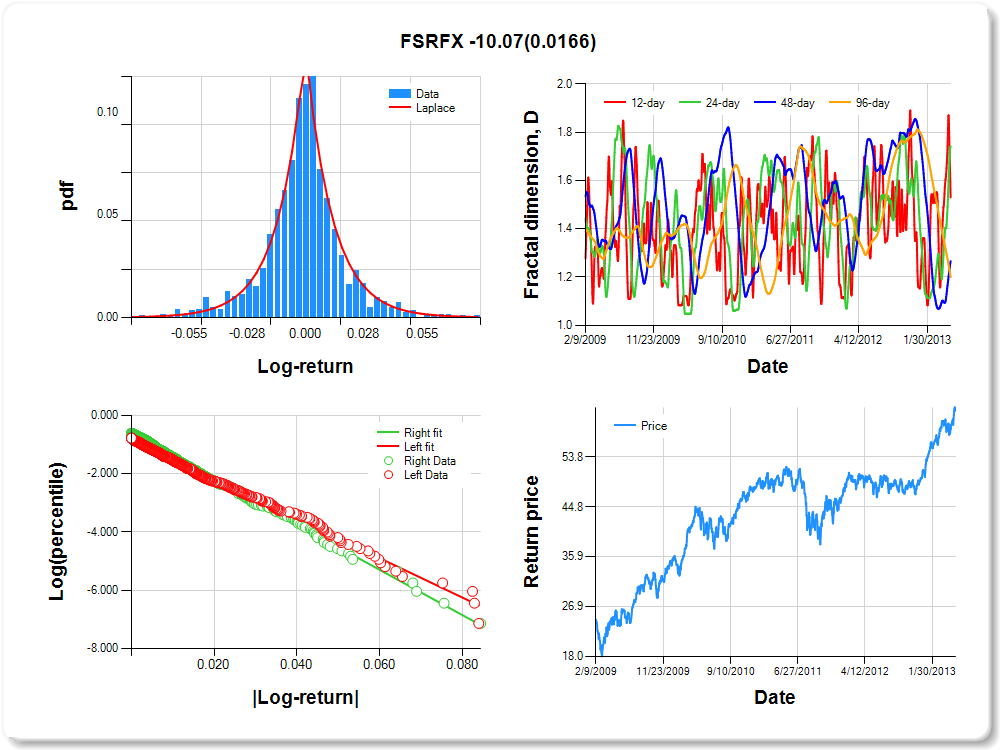

FSRFX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

0.55 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.023 |

0.260 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.835 |

0.058 |

-14.401 |

0.0000 |

|log-return| |

-67.573 |

2.889 |

-23.389 |

0.0000 |

I(right-tail) |

0.206 |

0.080 |

2.592 |

0.0097 |

|log-return|*I(right-tail) |

-10.069 |

4.197 |

-2.399 |

0.0166 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.470 |

0.259 |

0.734 |

0.800 |

FSHOX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.07 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.06 |

0.07 |

1.02 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.146 |

0.198 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.847 |

0.056 |

-15.254 |

0.0000 |

|log-return| |

-57.022 |

2.396 |

-23.796 |

0.0000 |

I(right-tail) |

0.126 |

0.077 |

1.626 |

0.1043 |

|log-return|*I(right-tail) |

-4.222 |

3.439 |

-1.228 |

0.2197 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.459 |

0.361 |

0.425 |

0.796 |

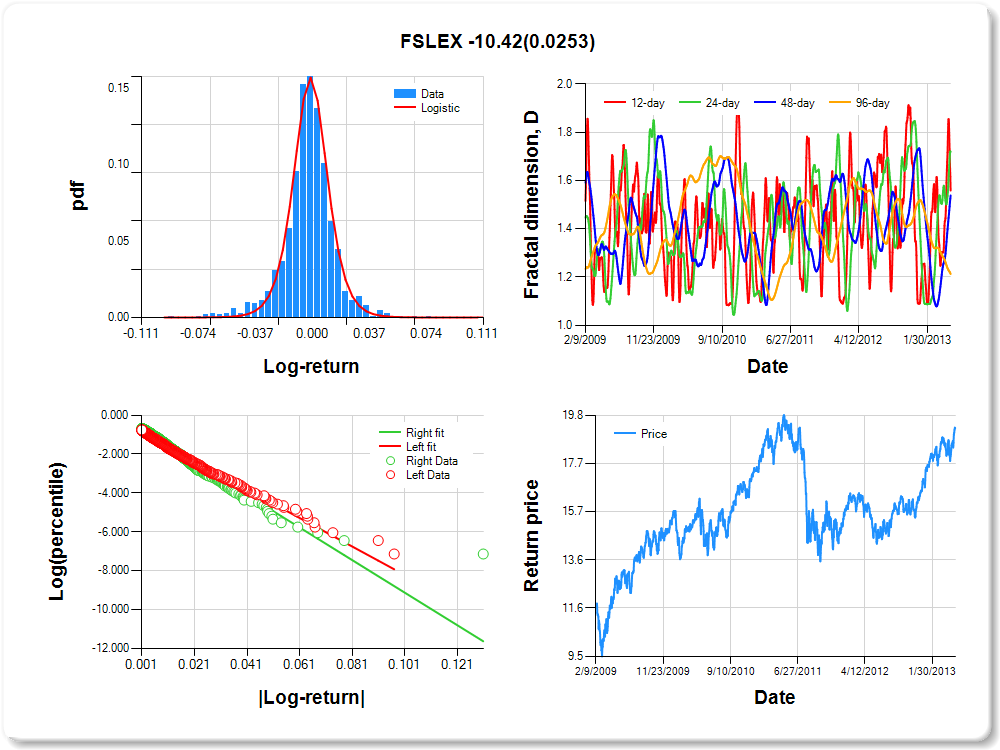

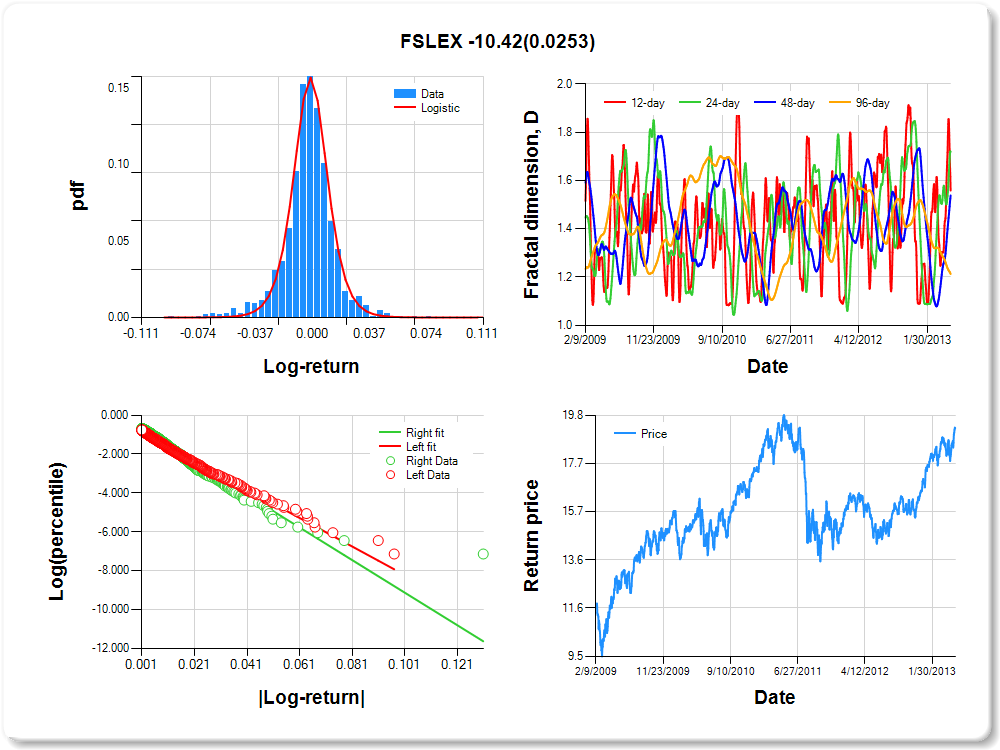

FSLEX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.05 |

0.05 |

1.10 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.241 |

0.109 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.845 |

0.056 |

-15.052 |

0.0000 |

|log-return| |

-73.444 |

3.102 |

-23.679 |

0.0000 |

I(right-tail) |

0.140 |

0.079 |

1.755 |

0.0795 |

|log-return|*I(right-tail) |

-10.423 |

4.655 |

-2.239 |

0.0253 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.442 |

0.280 |

0.461 |

0.787 |

FCYIX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.07 |

2.16 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.151 |

0.219 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.878 |

0.058 |

-15.144 |

0.0000 |

|log-return| |

-65.152 |

2.819 |

-23.113 |

0.0000 |

I(right-tail) |

0.236 |

0.080 |

2.960 |

0.0031 |

|log-return|*I(right-tail) |

-13.452 |

4.196 |

-3.206 |

0.0014 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.580 |

0.442 |

0.585 |

0.783 |

FSAGX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.10 |

-0.07 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.08 |

0.10 |

1.63 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.216 |

0.108 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.767 |

0.055 |

-13.892 |

0.0000 |

|log-return| |

-49.635 |

2.058 |

-24.116 |

0.0000 |

I(right-tail) |

-0.025 |

0.078 |

-0.325 |

0.7451 |

|log-return|*I(right-tail) |

0.180 |

2.929 |

0.061 |

0.9511 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.668 |

0.753 |

0.882 |

0.768 |

FIDSX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.10 |

-0.08 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.08 |

0.10 |

0.40 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.192 |

0.167 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.924 |

0.054 |

-17.079 |

0.0000 |

|log-return| |

-46.583 |

1.986 |

-23.458 |

0.0000 |

I(right-tail) |

0.108 |

0.075 |

1.448 |

0.1480 |

|log-return|*I(right-tail) |

-6.160 |

2.909 |

-2.117 |

0.0344 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.441 |

0.356 |

0.382 |

0.723 |

FBMPX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

0.45 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.137 |

0.158 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.940 |

0.056 |

-16.908 |

0.0000 |

|log-return| |

-65.469 |

2.830 |

-23.132 |

0.0000 |

I(right-tail) |

0.180 |

0.076 |

2.372 |

0.0178 |

|log-return|*I(right-tail) |

-6.100 |

4.041 |

-1.510 |

0.1313 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.429 |

0.791 |

0.869 |

0.700 |

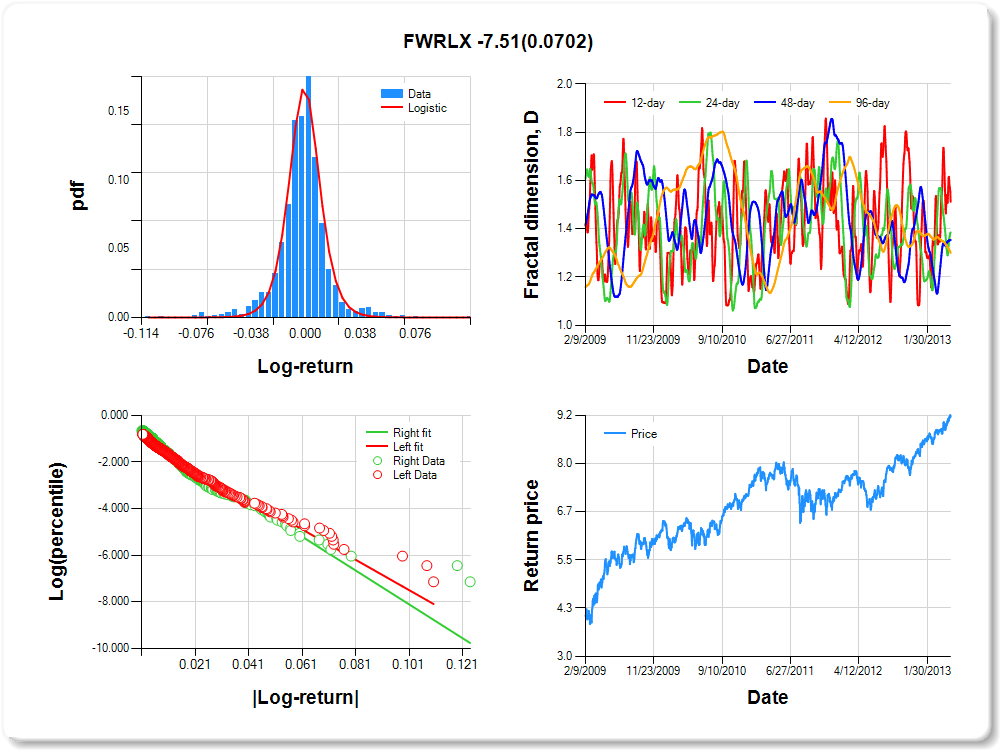

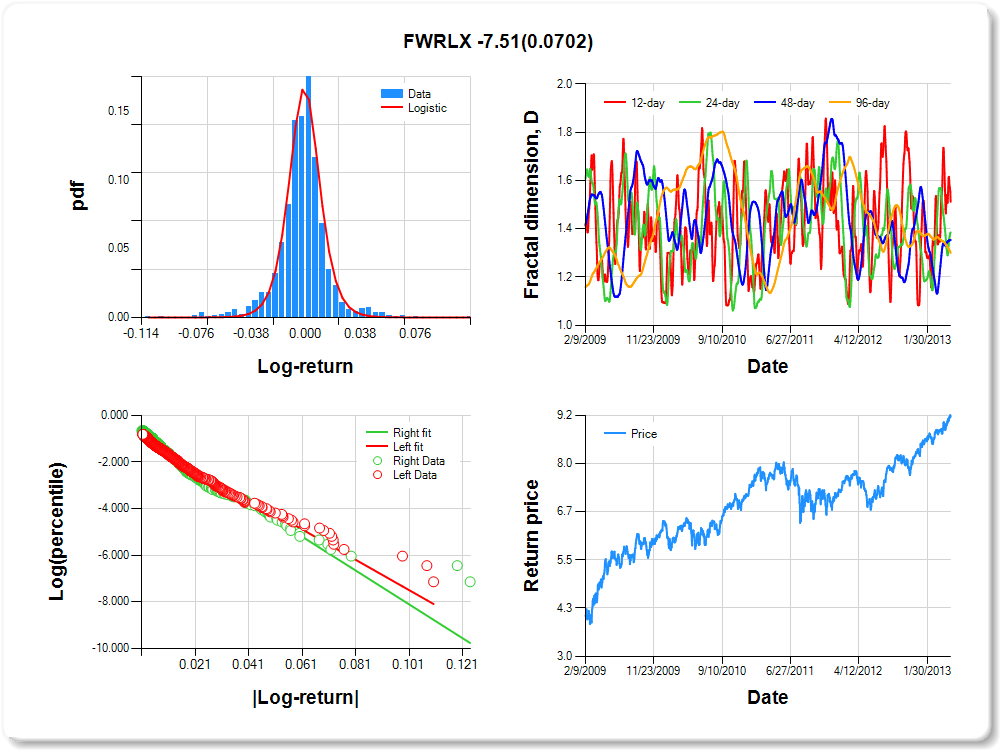

FWRLX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

0.09 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.083 |

0.103 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.947 |

0.057 |

-16.623 |

0.0000 |

|log-return| |

-65.024 |

2.864 |

-22.705 |

0.0000 |

I(right-tail) |

0.147 |

0.078 |

1.891 |

0.0589 |

|log-return|*I(right-tail) |

-7.512 |

4.145 |

-1.812 |

0.0702 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.488 |

0.615 |

0.646 |

0.700 |

FSPCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.07 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.07 |

0.09 |

2.21 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.133 |

0.139 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.994 |

0.054 |

-18.266 |

0.0000 |

|log-return| |

-52.332 |

2.278 |

-22.972 |

0.0000 |

I(right-tail) |

0.152 |

0.074 |

2.070 |

0.0386 |

|log-return|*I(right-tail) |

-6.393 |

3.284 |

-1.946 |

0.0518 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.493 |

0.655 |

0.935 |

0.699 |

FSCGX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.07 |

1.15 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.153 |

0.218 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.867 |

0.057 |

-15.185 |

0.0000 |

|log-return| |

-62.986 |

2.696 |

-23.364 |

0.0000 |

I(right-tail) |

0.193 |

0.079 |

2.458 |

0.0141 |

|log-return|*I(right-tail) |

-11.596 |

3.999 |

-2.900 |

0.0038 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.587 |

0.536 |

0.512 |

0.693 |

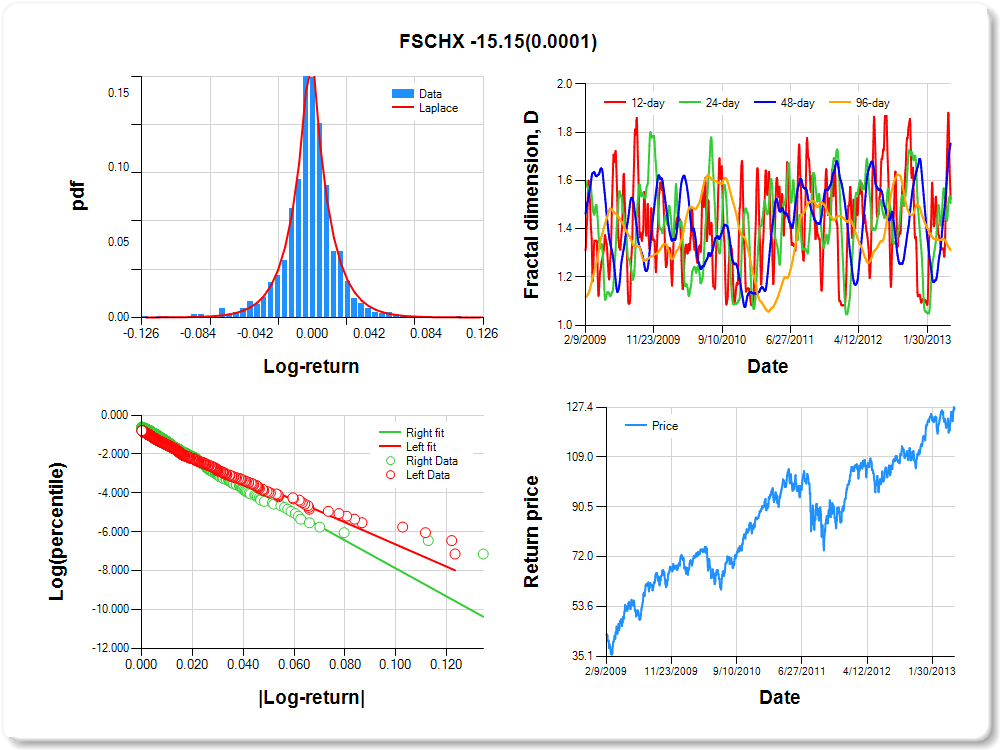

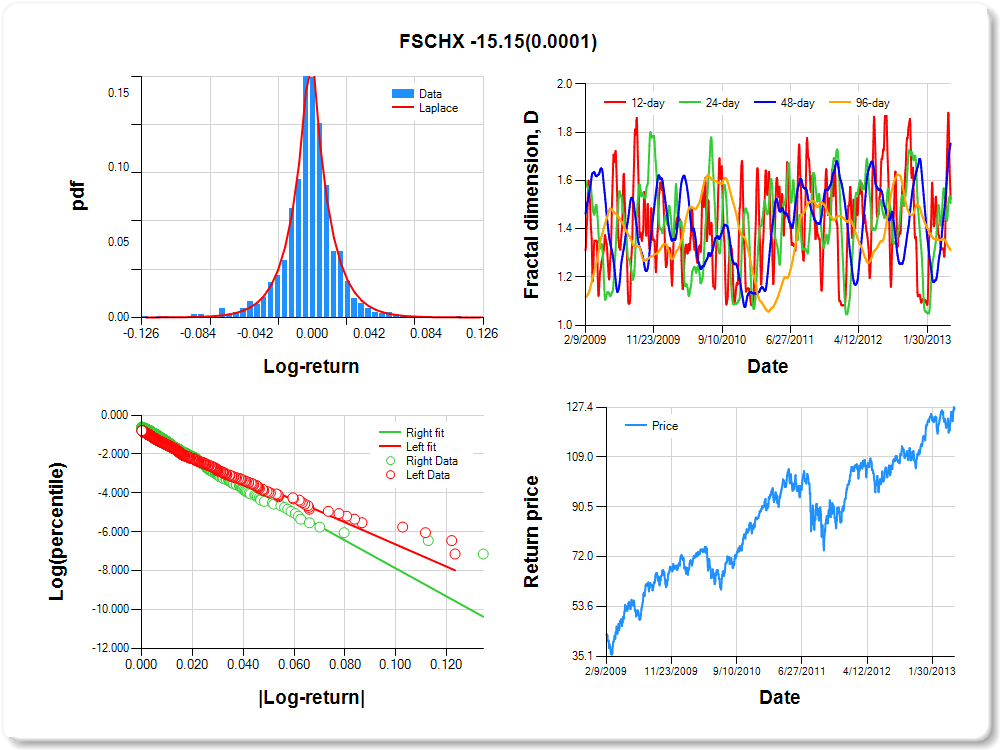

FSCHX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

1.41 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.058 |

0.176 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.948 |

0.055 |

-17.082 |

0.0000 |

|log-return| |

-56.938 |

2.469 |

-23.057 |

0.0000 |

I(right-tail) |

0.285 |

0.077 |

3.701 |

0.0002 |

|log-return|*I(right-tail) |

-15.148 |

3.780 |

-4.008 |

0.0001 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.477 |

0.493 |

0.246 |

0.689 |

FDFAX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.03 |

0.04 |

1.54 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.258 |

0.156 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.960 |

0.057 |

-16.791 |

0.0000 |

|log-return| |

-106.521 |

4.712 |

-22.607 |

0.0000 |

I(right-tail) |

0.214 |

0.076 |

2.794 |

0.0053 |

|log-return|*I(right-tail) |

-9.383 |

6.640 |

-1.413 |

0.1579 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.788 |

0.919 |

0.958 |

0.686 |

FDLSX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

0.67 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.042 |

0.239 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.835 |

0.057 |

-14.572 |

0.0000 |

|log-return| |

-76.767 |

3.258 |

-23.559 |

0.0000 |

I(right-tail) |

0.201 |

0.079 |

2.525 |

0.0117 |

|log-return|*I(right-tail) |

-9.117 |

4.704 |

-1.938 |

0.0528 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.419 |

0.657 |

0.817 |

0.680 |

FSUTX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

2.34 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.372 |

0.086 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.929 |

0.057 |

-16.424 |

0.0000 |

|log-return| |

-86.802 |

3.781 |

-22.956 |

0.0000 |

I(right-tail) |

0.055 |

0.075 |

0.737 |

0.4616 |

|log-return|*I(right-tail) |

1.179 |

5.255 |

0.224 |

0.8225 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.678 |

0.924 |

0.962 |

0.671 |

FSCPX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.05 |

1.17 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.129 |

0.185 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.880 |

0.057 |

-15.455 |

0.0000 |

|log-return| |

-71.873 |

3.087 |

-23.286 |

0.0000 |

I(right-tail) |

0.175 |

0.079 |

2.234 |

0.0257 |

|log-return|*I(right-tail) |

-7.738 |

4.448 |

-1.739 |

0.0822 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.447 |

0.704 |

0.792 |

0.662 |

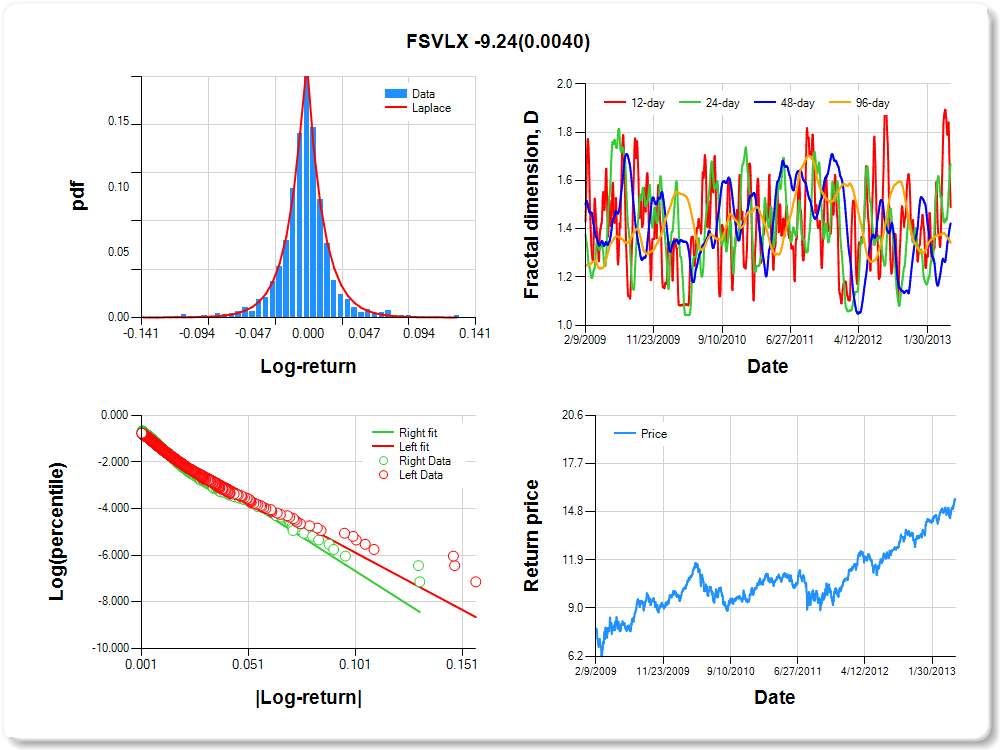

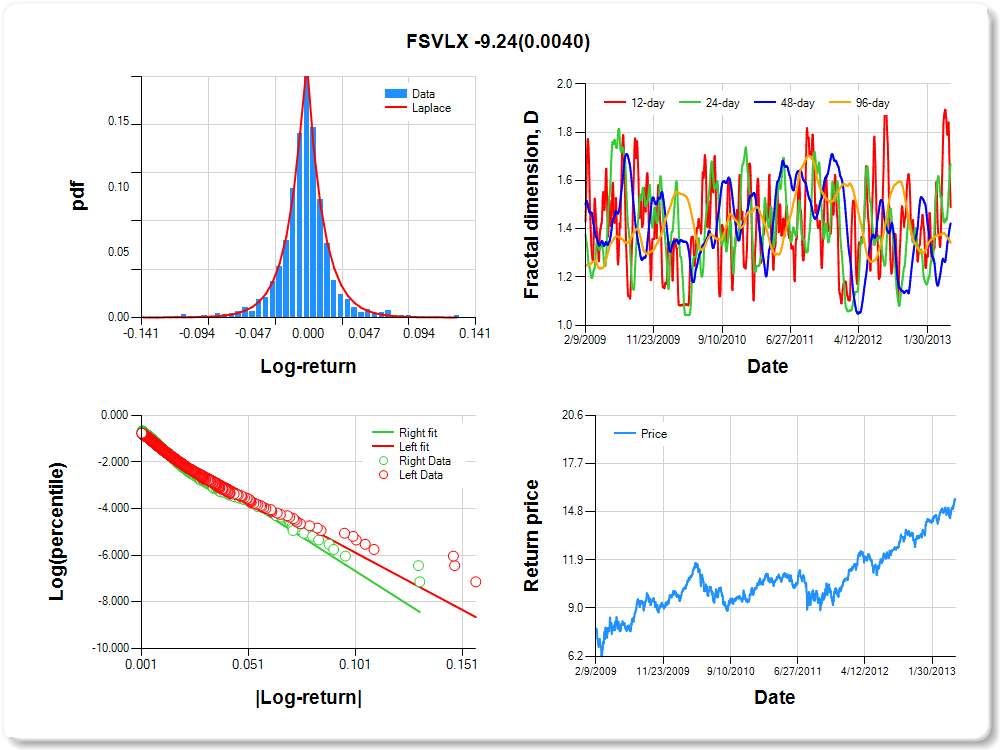

FSVLX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.10 |

-0.07 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.07 |

0.08 |

1.07 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.164 |

0.167 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.966 |

0.054 |

-17.876 |

0.0000 |

|log-return| |

-49.069 |

2.131 |

-23.026 |

0.0000 |

I(right-tail) |

0.138 |

0.075 |

1.833 |

0.0671 |

|log-return|*I(right-tail) |

-9.239 |

3.208 |

-2.880 |

0.0040 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.510 |

0.332 |

0.577 |

0.659 |

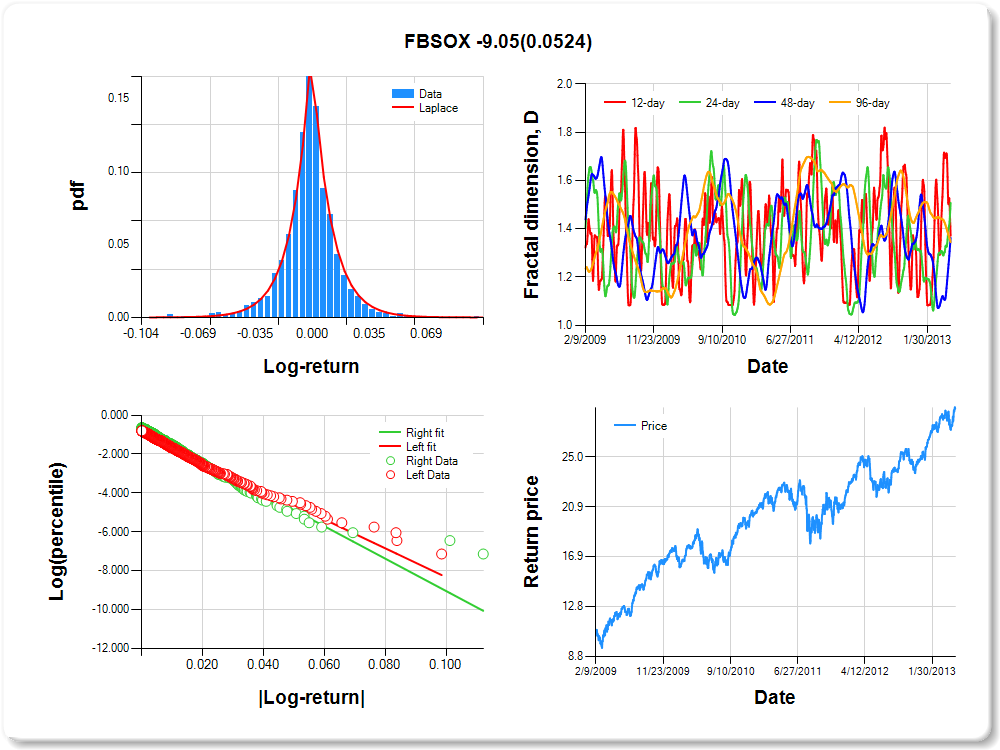

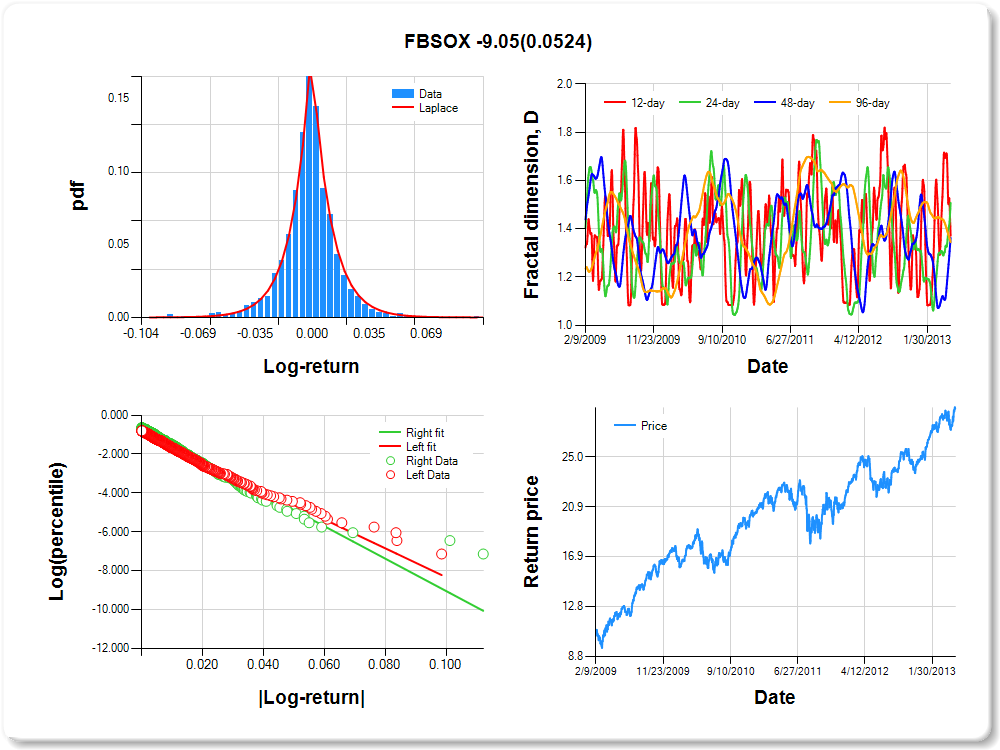

FBSOX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

0.25 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.087 |

0.185 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.881 |

0.058 |

-15.234 |

0.0000 |

|log-return| |

-74.241 |

3.221 |

-23.052 |

0.0000 |

I(right-tail) |

0.194 |

0.080 |

2.442 |

0.0148 |

|log-return|*I(right-tail) |

-9.045 |

4.658 |

-1.942 |

0.0524 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.629 |

0.492 |

0.637 |

0.655 |

FSCSX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

1.21 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.194 |

0.167 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.882 |

0.057 |

-15.522 |

0.0000 |

|log-return| |

-74.132 |

3.189 |

-23.247 |

0.0000 |

I(right-tail) |

0.135 |

0.077 |

1.756 |

0.0793 |

|log-return|*I(right-tail) |

-1.739 |

4.421 |

-0.393 |

0.6942 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.539 |

0.432 |

0.563 |

0.637 |

FDCPX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

2.10 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.011 |

0.135 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.755 |

0.059 |

-12.897 |

0.0000 |

|log-return| |

-77.423 |

3.259 |

-23.755 |

0.0000 |

I(right-tail) |

0.122 |

0.081 |

1.505 |

0.1325 |

|log-return|*I(right-tail) |

-4.760 |

4.636 |

-1.027 |

0.3048 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.608 |

0.501 |

0.557 |

0.629 |

FSRPX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

0.46 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.130 |

0.199 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.826 |

0.059 |

-13.897 |

0.0000 |

|log-return| |

-74.376 |

3.221 |

-23.092 |

0.0000 |

I(right-tail) |

0.132 |

0.079 |

1.672 |

0.0947 |

|log-return|*I(right-tail) |

-2.086 |

4.417 |

-0.472 |

0.6369 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.349 |

0.463 |

0.553 |

0.620 |

FSPHX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.42 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.375 |

0.113 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.943 |

0.057 |

-16.534 |

0.0000 |

|log-return| |

-88.763 |

3.900 |

-22.762 |

0.0000 |

I(right-tail) |

0.278 |

0.078 |

3.574 |

0.0004 |

|log-return|*I(right-tail) |

-14.459 |

5.680 |

-2.546 |

0.0110 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.552 |

0.837 |

0.919 |

0.606 |

FSRBX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.11 |

-0.08 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.10 |

0.14 |

2.39 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.129 |

0.153 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.931 |

0.052 |

-17.896 |

0.0000 |

|log-return| |

-40.860 |

1.725 |

-23.683 |

0.0000 |

I(right-tail) |

0.000 |

0.073 |

-0.001 |

0.9989 |

|log-return|*I(right-tail) |

0.147 |

2.432 |

0.061 |

0.9518 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.533 |

0.425 |

0.545 |

0.605 |

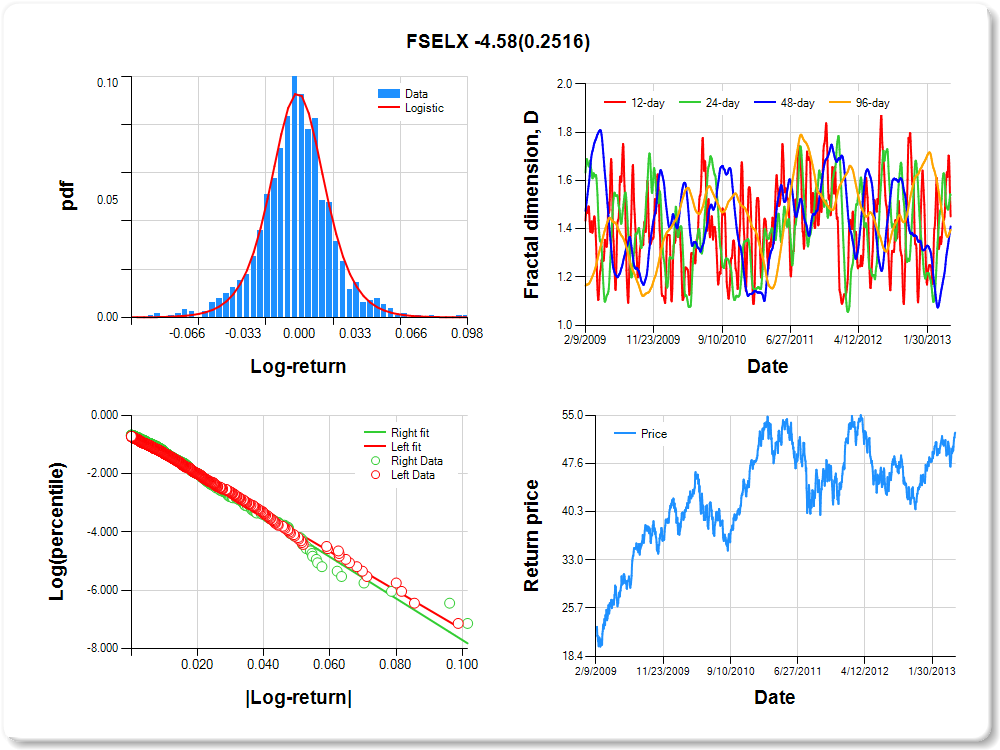

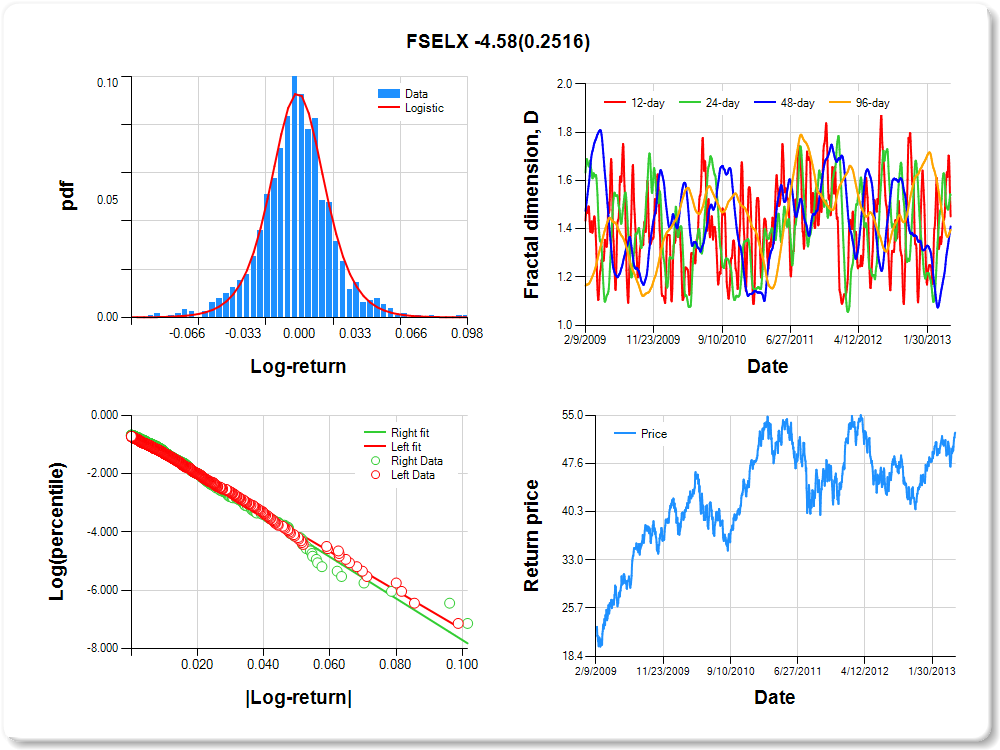

FSELX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

1.04 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.008 |

0.179 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.670 |

0.059 |

-11.307 |

0.0000 |

|log-return| |

-66.658 |

2.759 |

-24.161 |

0.0000 |

I(right-tail) |

0.095 |

0.084 |

1.131 |

0.2585 |

|log-return|*I(right-tail) |

-4.583 |

3.996 |

-1.147 |

0.2516 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.549 |

0.460 |

0.590 |

0.604 |

FSMEX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.29 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.251 |

0.116 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.900 |

0.058 |

-15.486 |

0.0000 |

|log-return| |

-88.298 |

3.863 |

-22.857 |

0.0000 |

I(right-tail) |

0.225 |

0.079 |

2.840 |

0.0046 |

|log-return|*I(right-tail) |

-13.716 |

5.644 |

-2.430 |

0.0152 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.688 |

0.343 |

0.664 |

0.603 |

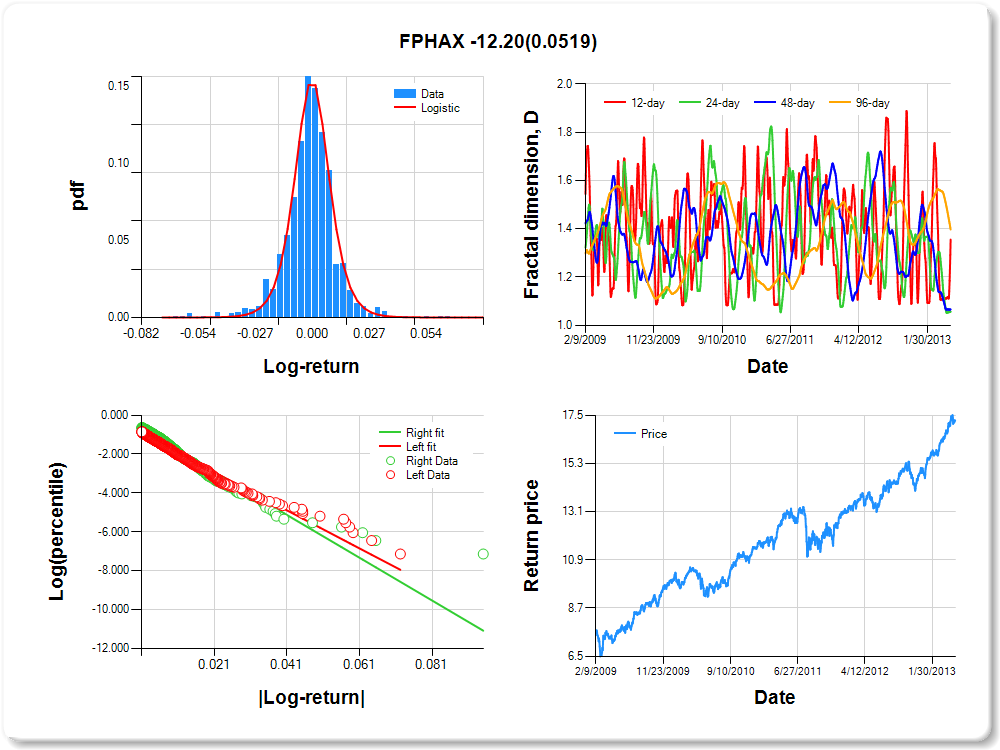

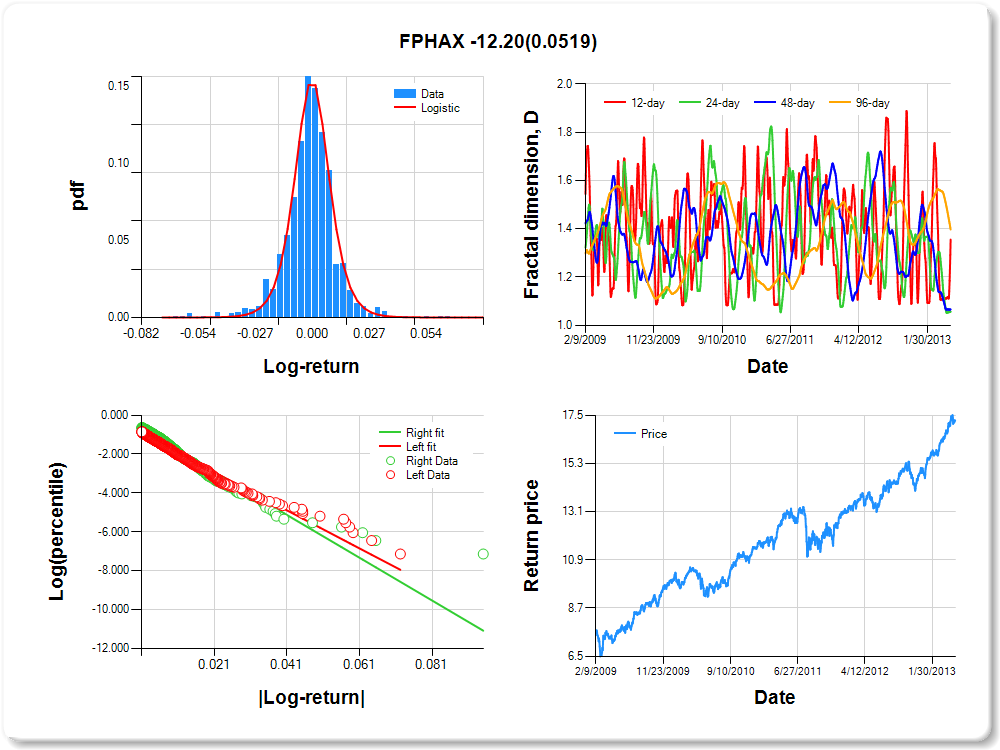

FPHAX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.03 |

0.04 |

1.27 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.206 |

0.111 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.925 |

0.060 |

-15.504 |

0.0000 |

|log-return| |

-97.829 |

4.372 |

-22.376 |

0.0000 |

I(right-tail) |

0.258 |

0.082 |

3.168 |

0.0016 |

|log-return|*I(right-tail) |

-12.199 |

6.269 |

-1.946 |

0.0519 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.645 |

0.943 |

0.934 |

0.603 |

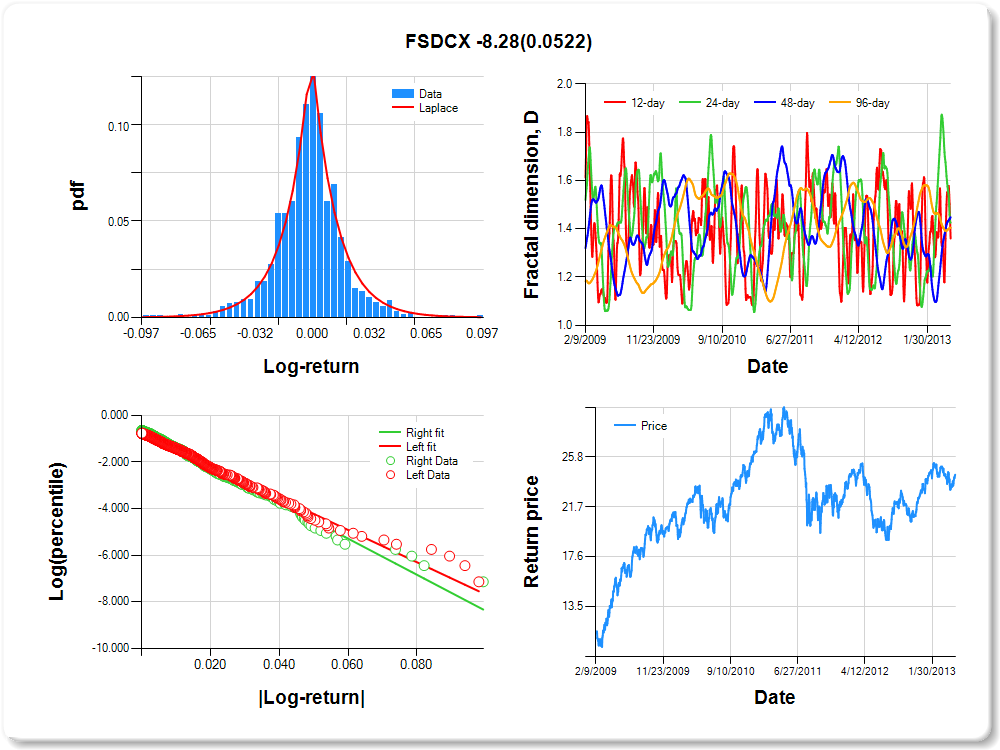

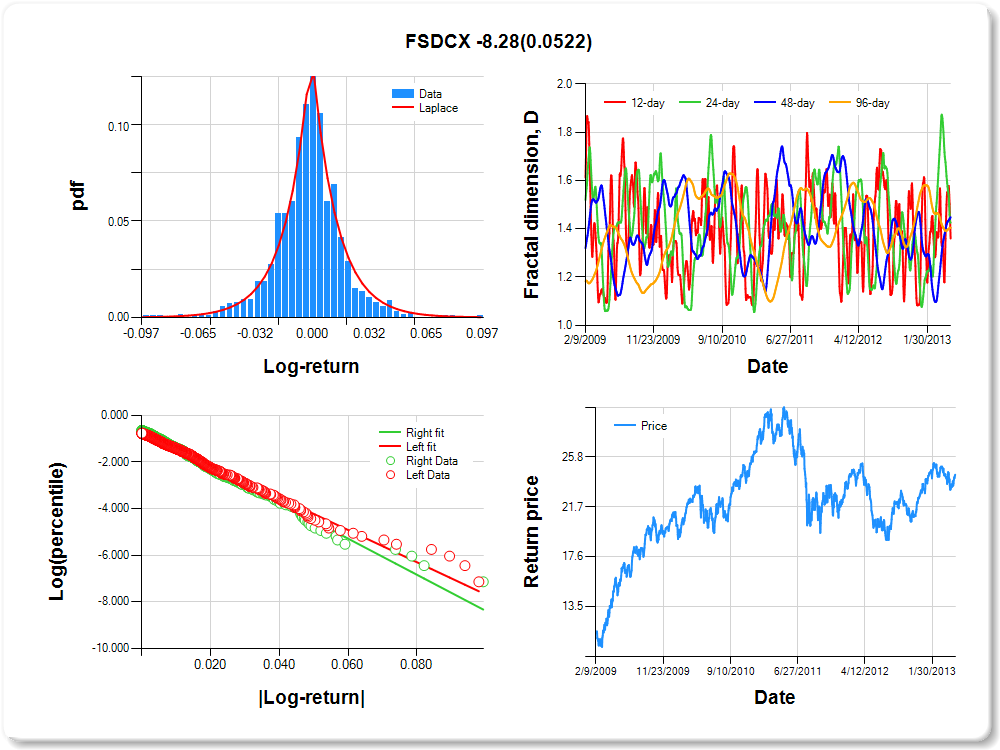

FSDCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

1.13 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.011 |

0.243 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.755 |

0.060 |

-12.679 |

0.0000 |

|log-return| |

-69.044 |

2.933 |

-23.537 |

0.0000 |

I(right-tail) |

0.129 |

0.082 |

1.569 |

0.1170 |

|log-return|*I(right-tail) |

-8.277 |

4.260 |

-1.943 |

0.0522 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.640 |

0.574 |

0.552 |

0.595 |

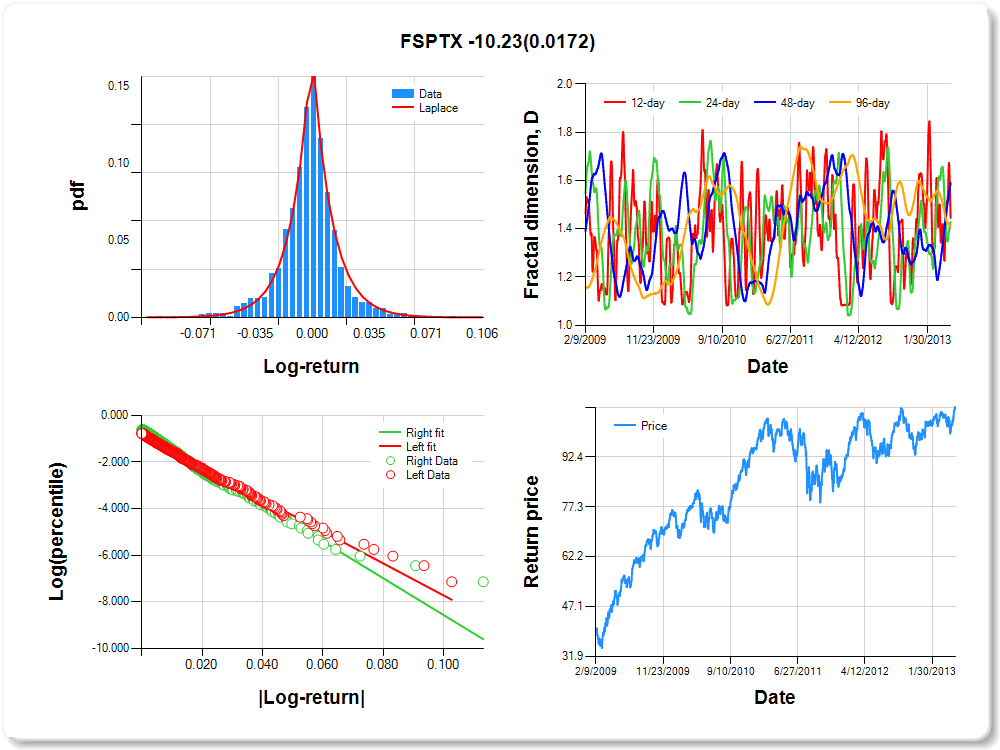

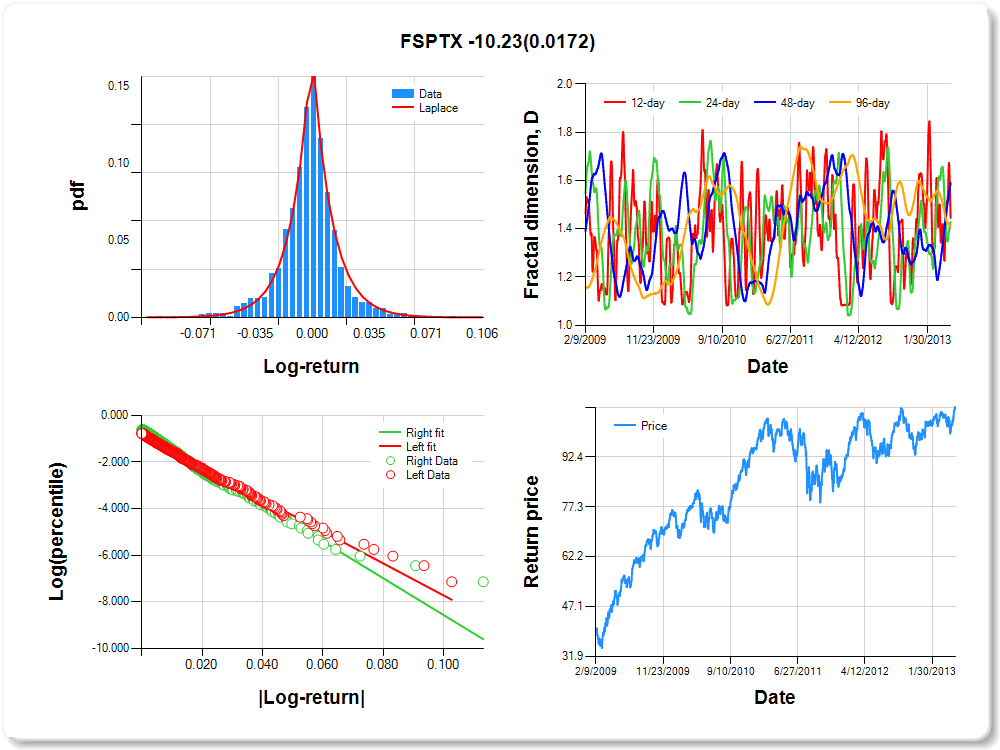

FSPTX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

0.78 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.056 |

0.194 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.853 |

0.057 |

-14.862 |

0.0000 |

|log-return| |

-68.646 |

2.936 |

-23.377 |

0.0000 |

I(right-tail) |

0.184 |

0.079 |

2.333 |

0.0198 |

|log-return|*I(right-tail) |

-10.233 |

4.290 |

-2.385 |

0.0172 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.554 |

0.573 |

0.410 |

0.586 |

FSDPX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.07 |

2.17 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.072 |

0.187 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.920 |

0.056 |

-16.487 |

0.0000 |

|log-return| |

-54.679 |

2.357 |

-23.201 |

0.0000 |

I(right-tail) |

0.264 |

0.078 |

3.402 |

0.0007 |

|log-return|*I(right-tail) |

-14.948 |

3.625 |

-4.123 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.444 |

0.467 |

0.300 |

0.580 |

FBIOX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

1.28 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.177 |

0.130 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.801 |

0.057 |

-13.980 |

0.0000 |

|log-return| |

-83.303 |

3.510 |

-23.733 |

0.0000 |

I(right-tail) |

0.241 |

0.082 |

2.941 |

0.0033 |

|log-return|*I(right-tail) |

-10.605 |

5.180 |

-2.047 |

0.0408 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.641 |

0.875 |

0.926 |

0.569 |

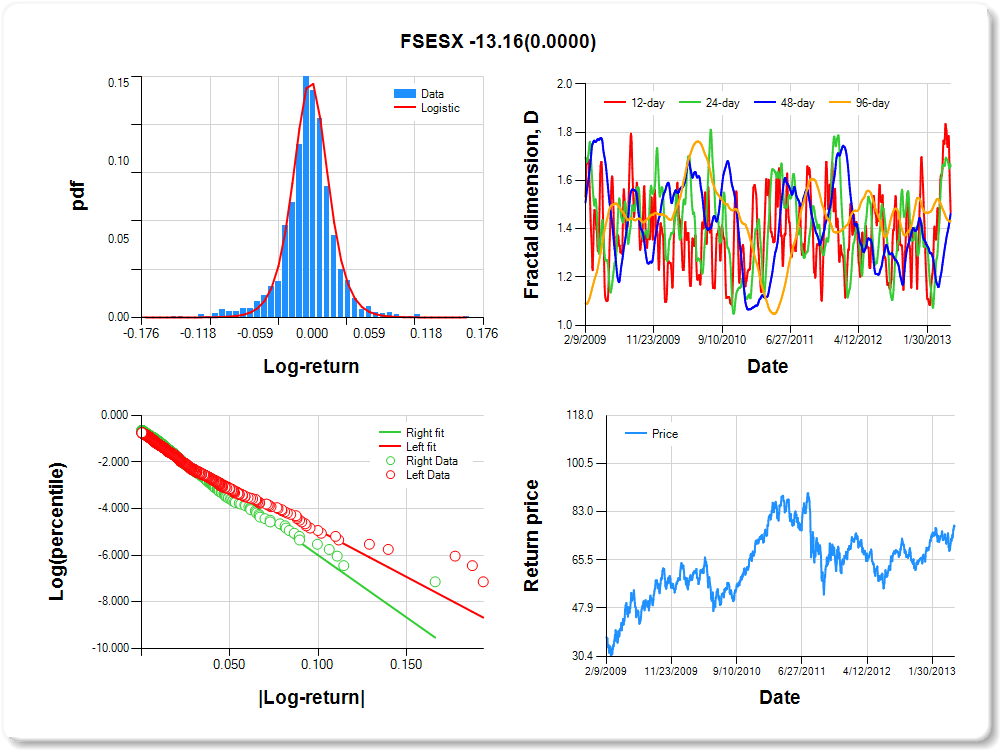

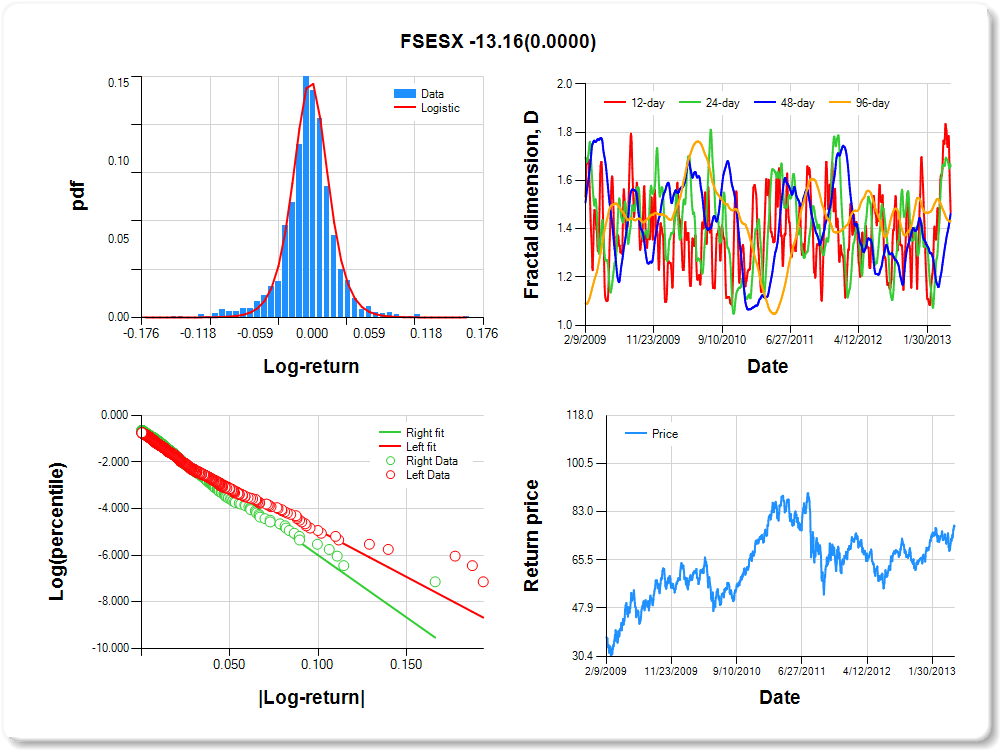

FSESX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.11 |

-0.09 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.08 |

0.09 |

0.70 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.144 |

0.113 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.921 |

0.054 |

-17.009 |

0.0000 |

|log-return| |

-40.014 |

1.715 |

-23.326 |

0.0000 |

I(right-tail) |

0.243 |

0.077 |

3.145 |

0.0017 |

|log-return|*I(right-tail) |

-13.162 |

2.738 |

-4.807 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.532 |

0.341 |

0.537 |

0.566 |

FSNGX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.12 |

-0.09 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.08 |

0.10 |

0.81 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.045 |

0.130 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.003 |

0.051 |

-19.656 |

0.0000 |

|log-return| |

-38.977 |

1.675 |

-23.277 |

0.0000 |

I(right-tail) |

0.153 |

0.073 |

2.097 |

0.0362 |

|log-return|*I(right-tail) |

-9.621 |

2.622 |

-3.669 |

0.0003 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.585 |

0.348 |

0.306 |

0.551 |

FSTCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.05 |

0.06 |

1.31 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.196 |

0.137 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.031 |

0.055 |

-18.640 |

0.0000 |

|log-return| |

-63.426 |

2.832 |

-22.394 |

0.0000 |

I(right-tail) |

0.192 |

0.074 |

2.611 |

0.0091 |

|log-return|*I(right-tail) |

-9.198 |

4.096 |

-2.246 |

0.0249 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.845 |

0.924 |

0.628 |

0.528 |

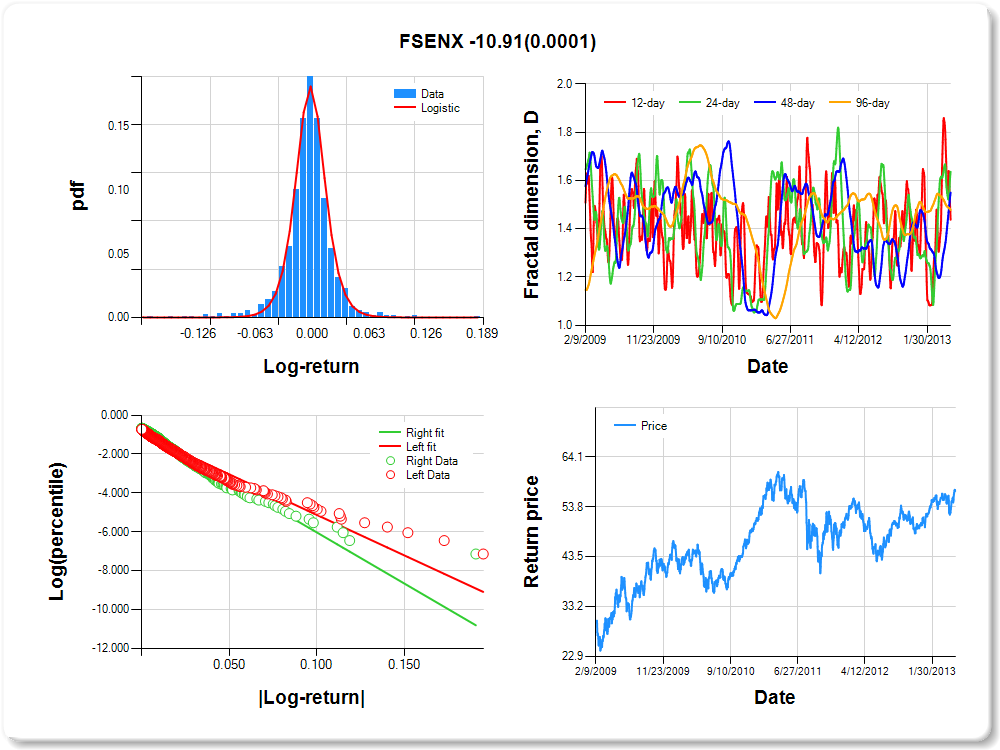

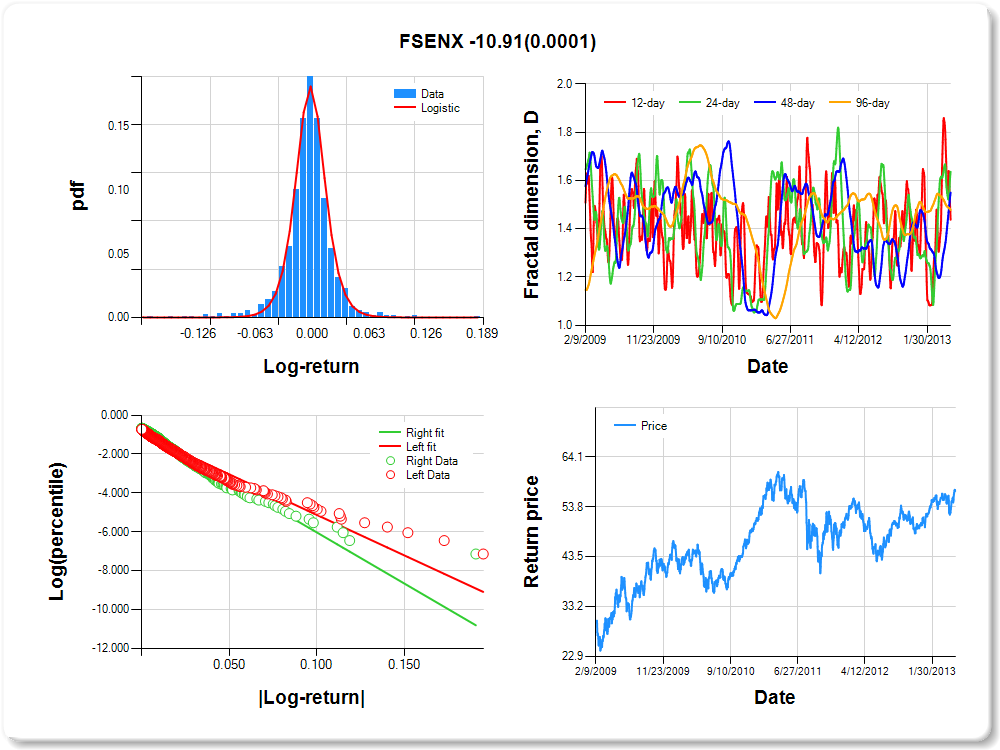

FSENX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.11 |

-0.09 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.08 |

0.09 |

1.53 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.032 |

0.094 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.955 |

0.052 |

-18.407 |

0.0000 |

|log-return| |

-41.693 |

1.771 |

-23.537 |

0.0000 |

I(right-tail) |

0.190 |

0.075 |

2.535 |

0.0114 |

|log-return|*I(right-tail) |

-10.906 |

2.794 |

-3.903 |

0.0001 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.562 |

0.363 |

0.450 |

0.522 |

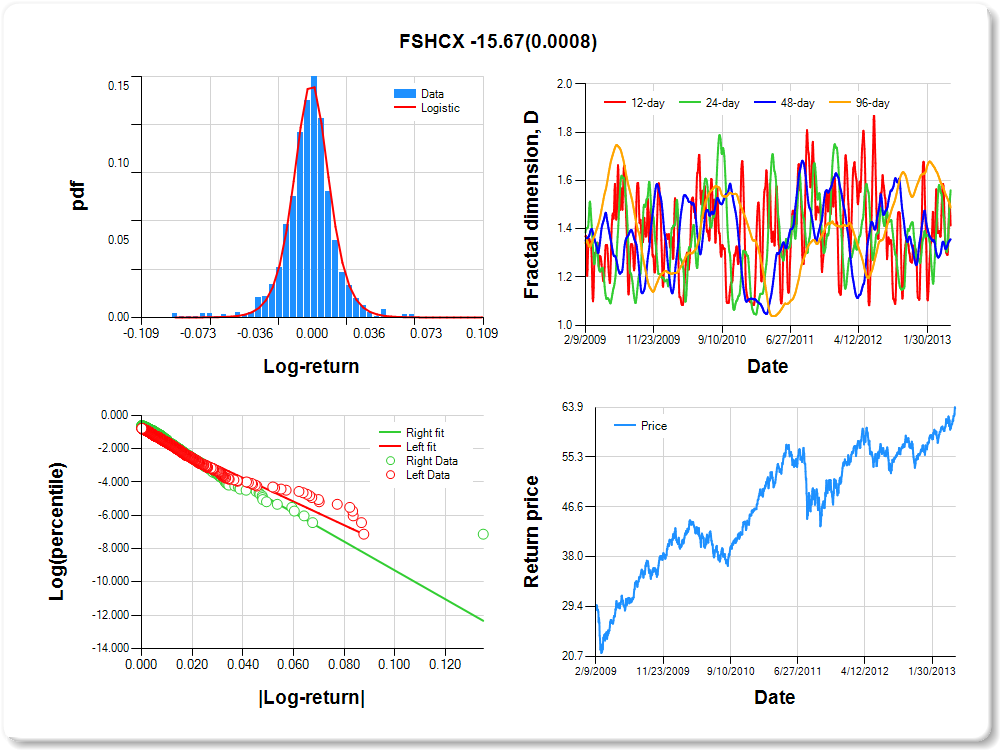

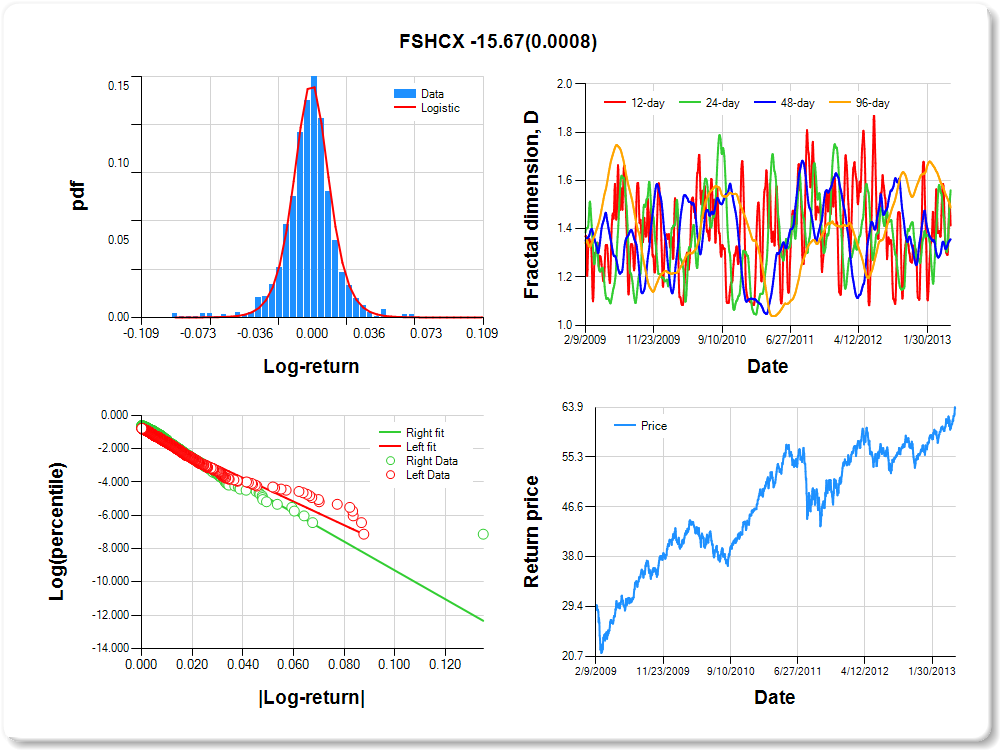

FSHCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

1.54 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.340 |

0.113 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.923 |

0.056 |

-16.400 |

0.0000 |

|log-return| |

-70.803 |

3.096 |

-22.867 |

0.0000 |

I(right-tail) |

0.268 |

0.079 |

3.410 |

0.0007 |

|log-return|*I(right-tail) |

-15.666 |

4.674 |

-3.352 |

0.0008 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.586 |

0.440 |

0.644 |

0.512 |

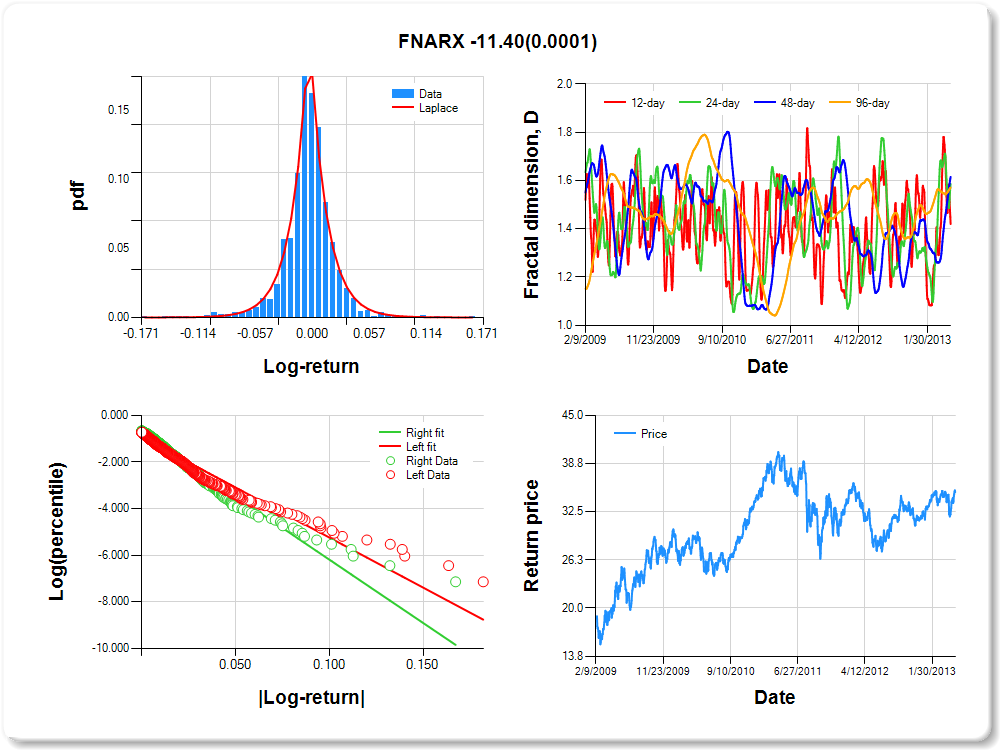

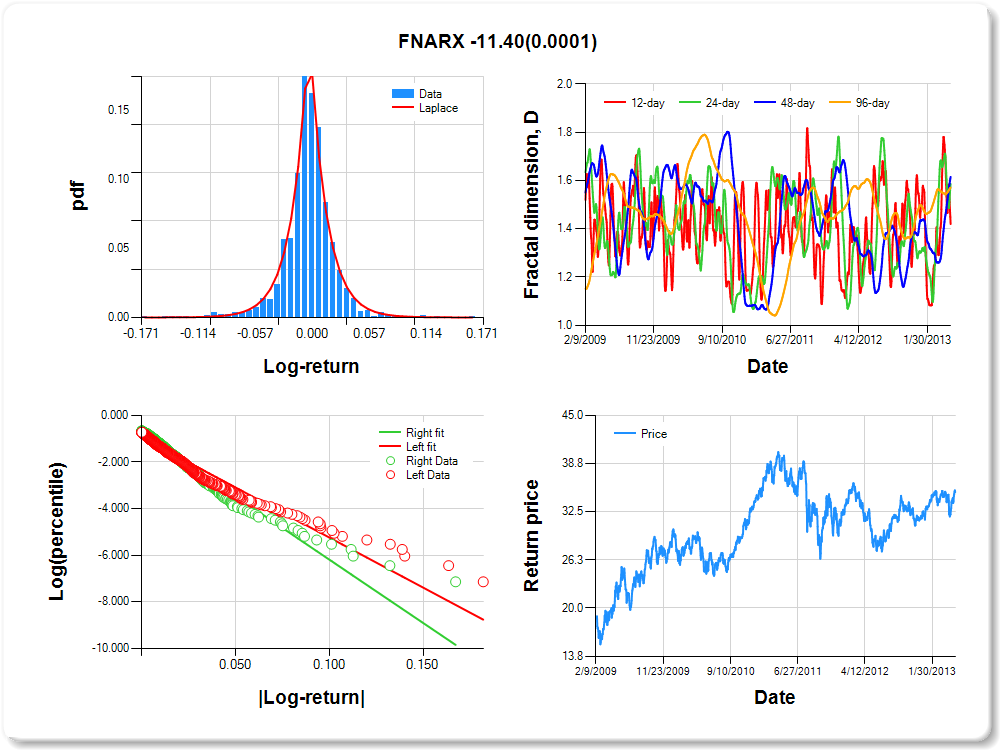

FNARX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.11 |

-0.09 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.07 |

0.09 |

0.91 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.074 |

0.164 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.945 |

0.052 |

-18.045 |

0.0000 |

|log-return| |

-42.877 |

1.823 |

-23.520 |

0.0000 |

I(right-tail) |

0.196 |

0.076 |

2.584 |

0.0099 |

|log-return|*I(right-tail) |

-11.396 |

2.881 |

-3.955 |

0.0001 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.580 |

0.414 |

0.384 |

0.429 |