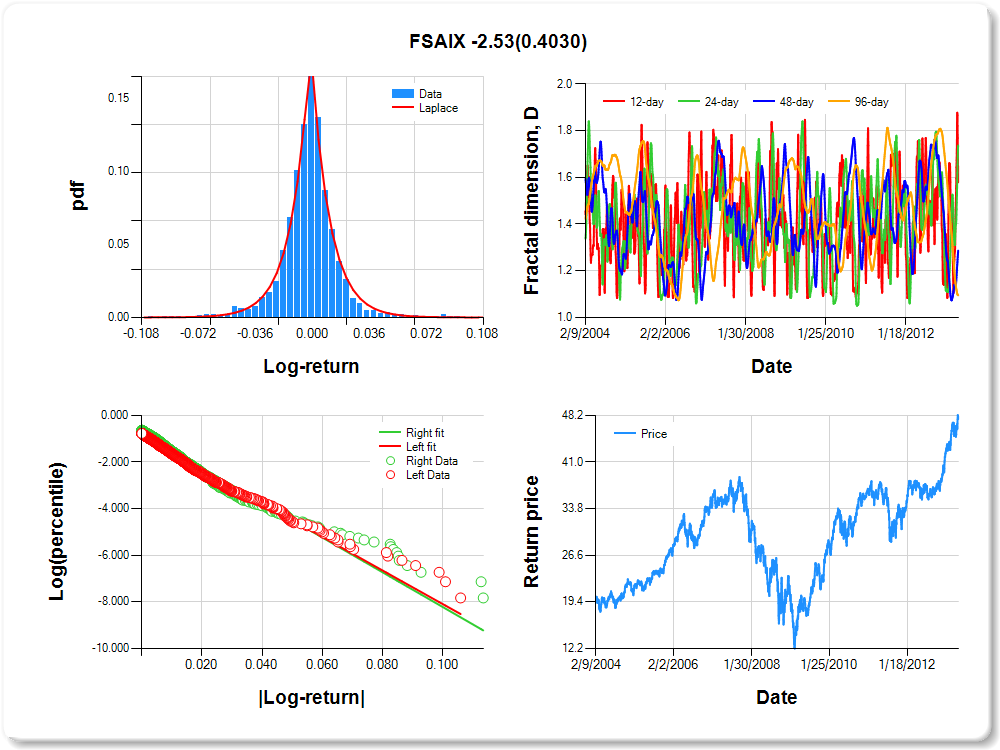

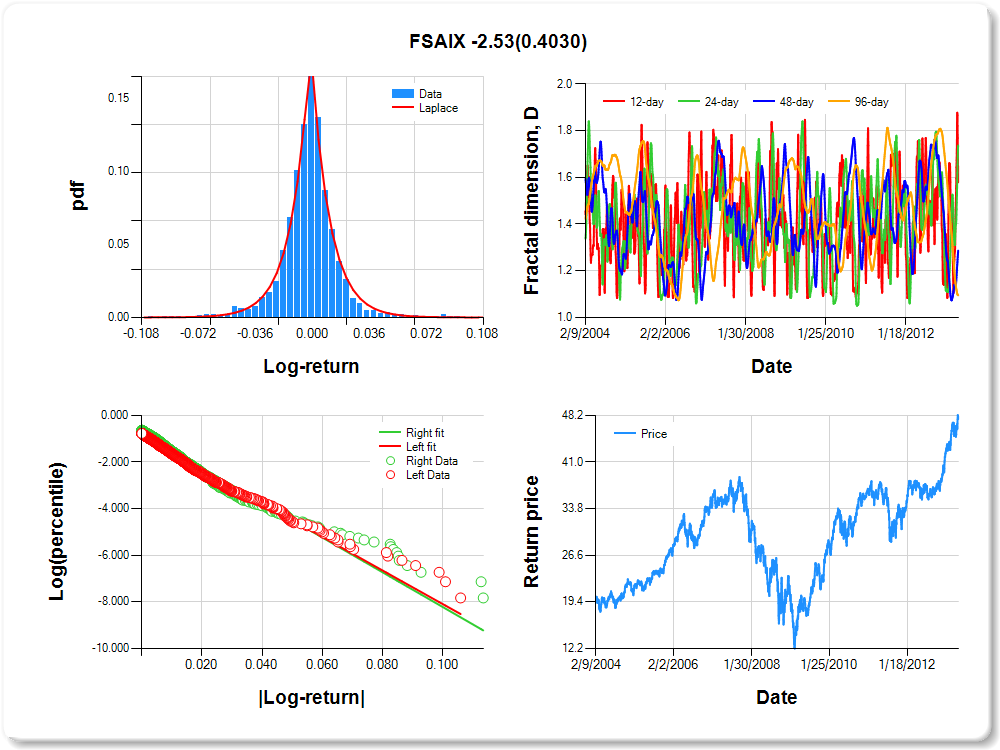

FSAIX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.07 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.044 |

0.183 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.884 |

0.040 |

-22.148 |

0.0000 |

|log-return| |

-71.945 |

2.165 |

-33.225 |

0.0000 |

I(right-tail) |

0.126 |

0.055 |

2.319 |

0.0205 |

|log-return|*I(right-tail) |

-2.530 |

3.025 |

-0.836 |

0.4030 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.421 |

0.263 |

0.714 |

0.905 |

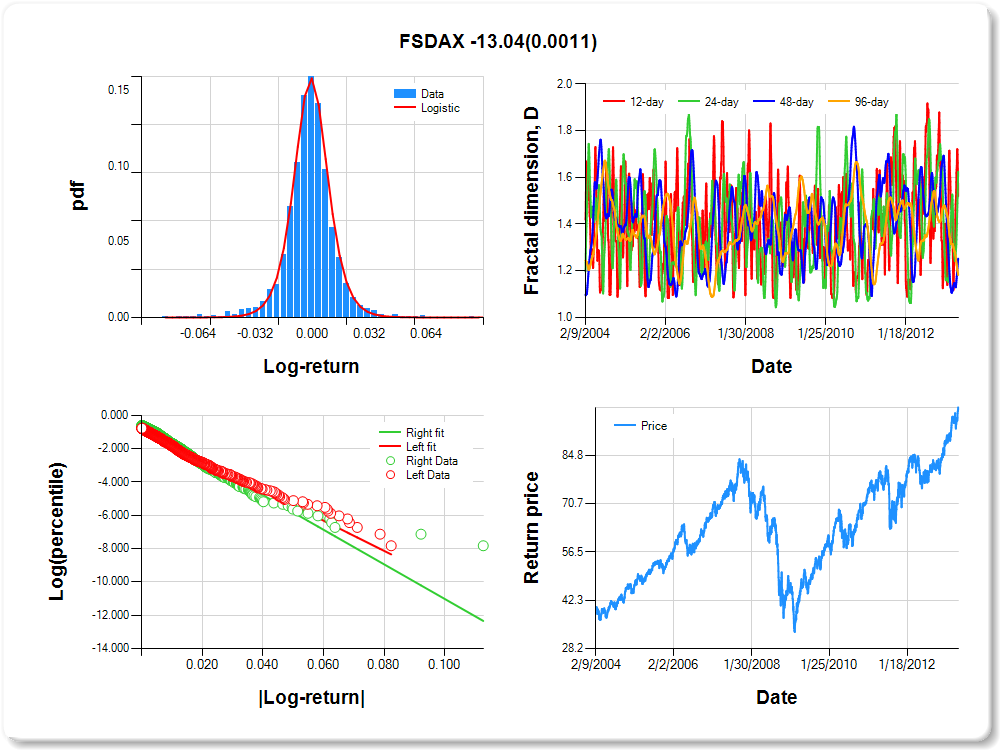

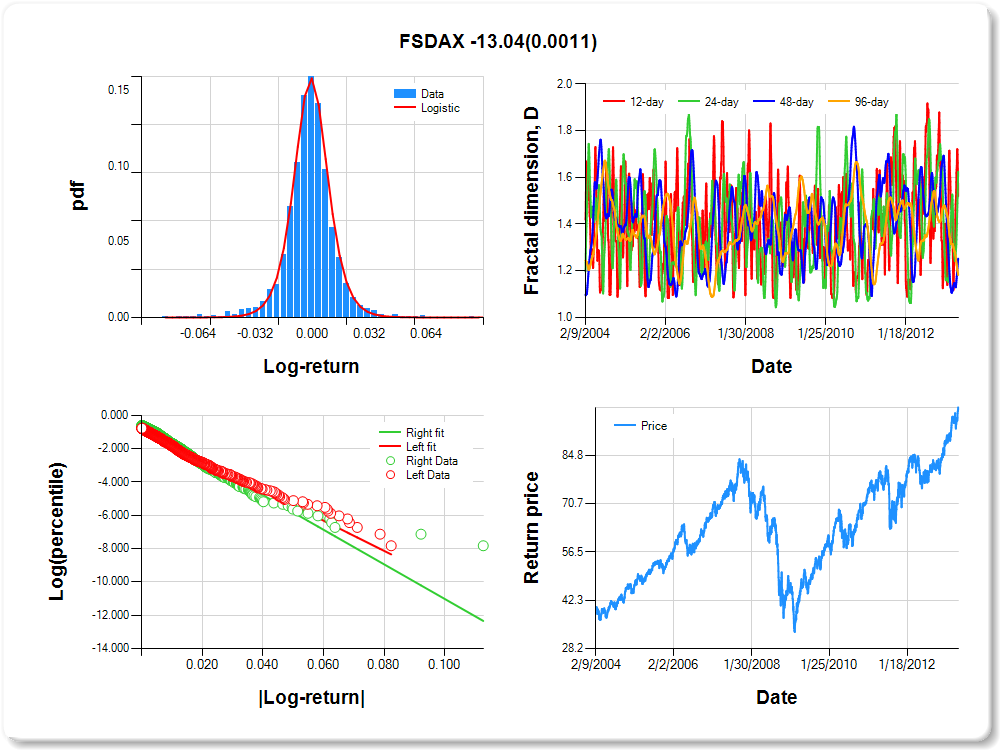

FSDAX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.04 |

0.20 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.247 |

0.109 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.874 |

0.040 |

-21.816 |

0.0000 |

|log-return| |

-90.753 |

2.729 |

-33.251 |

0.0000 |

I(right-tail) |

0.234 |

0.056 |

4.205 |

0.0000 |

|log-return|*I(right-tail) |

-13.035 |

3.992 |

-3.265 |

0.0011 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.480 |

0.375 |

0.748 |

0.818 |

FSAVX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.07 |

1.23 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.084 |

0.174 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.904 |

0.039 |

-23.026 |

0.0000 |

|log-return| |

-63.070 |

1.897 |

-33.252 |

0.0000 |

I(right-tail) |

0.155 |

0.054 |

2.869 |

0.0042 |

|log-return|*I(right-tail) |

-7.380 |

2.748 |

-2.686 |

0.0073 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.467 |

0.306 |

0.557 |

0.815 |

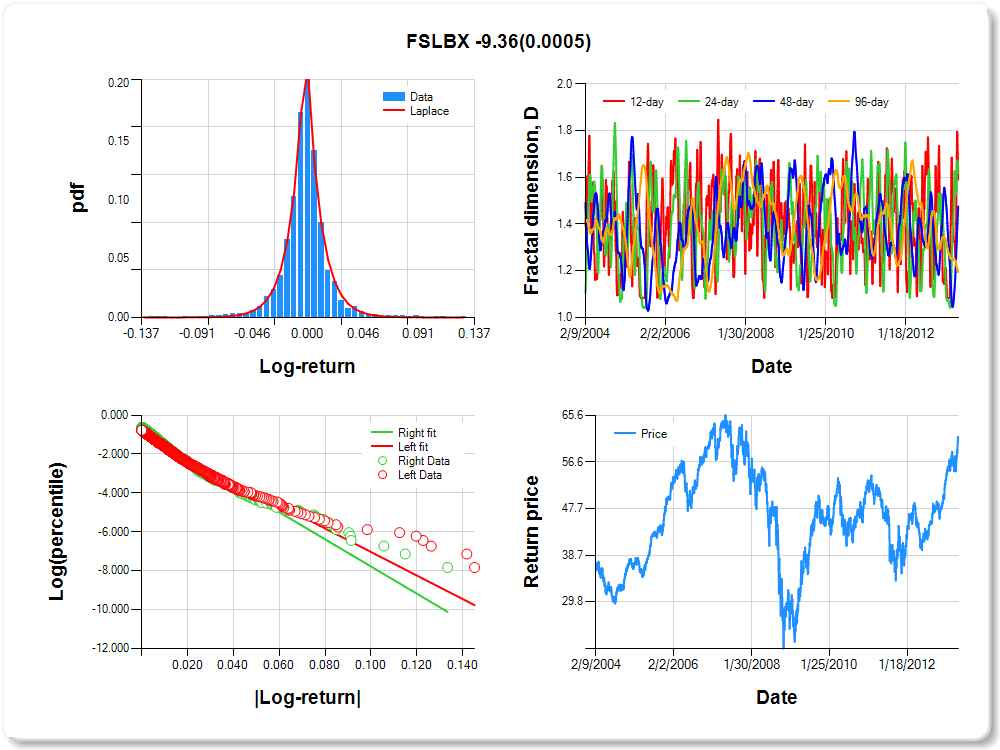

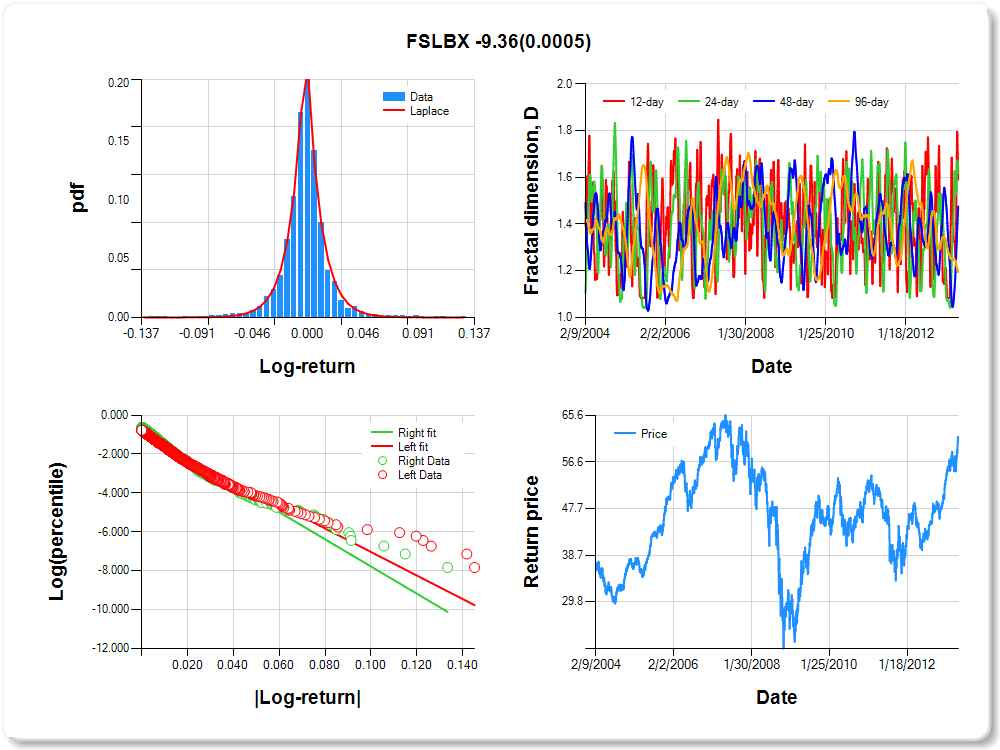

FSLBX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.08 |

0.87 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.082 |

0.141 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.977 |

0.038 |

-25.675 |

0.0000 |

|log-return| |

-60.479 |

1.846 |

-32.770 |

0.0000 |

I(right-tail) |

0.192 |

0.052 |

3.653 |

0.0003 |

|log-return|*I(right-tail) |

-9.359 |

2.698 |

-3.468 |

0.0005 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.409 |

0.378 |

0.525 |

0.806 |

FSRFX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.05 |

0.27 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.018 |

0.145 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.795 |

0.041 |

-19.324 |

0.0000 |

|log-return| |

-83.748 |

2.492 |

-33.606 |

0.0000 |

I(right-tail) |

0.187 |

0.057 |

3.273 |

0.0011 |

|log-return|*I(right-tail) |

-8.758 |

3.583 |

-2.444 |

0.0146 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.470 |

0.259 |

0.734 |

0.800 |

FSHOX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.07 |

0.95 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.161 |

0.107 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.833 |

0.040 |

-21.034 |

0.0000 |

|log-return| |

-70.547 |

2.087 |

-33.809 |

0.0000 |

I(right-tail) |

0.112 |

0.055 |

2.040 |

0.0414 |

|log-return|*I(right-tail) |

-2.722 |

2.946 |

-0.924 |

0.3556 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.459 |

0.361 |

0.425 |

0.796 |

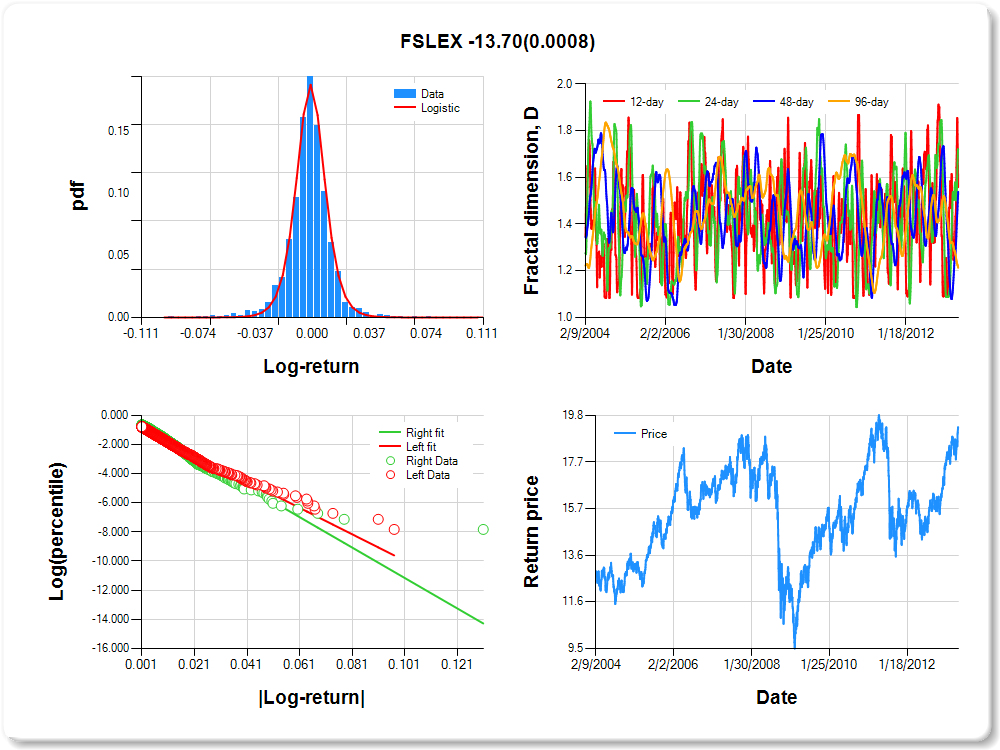

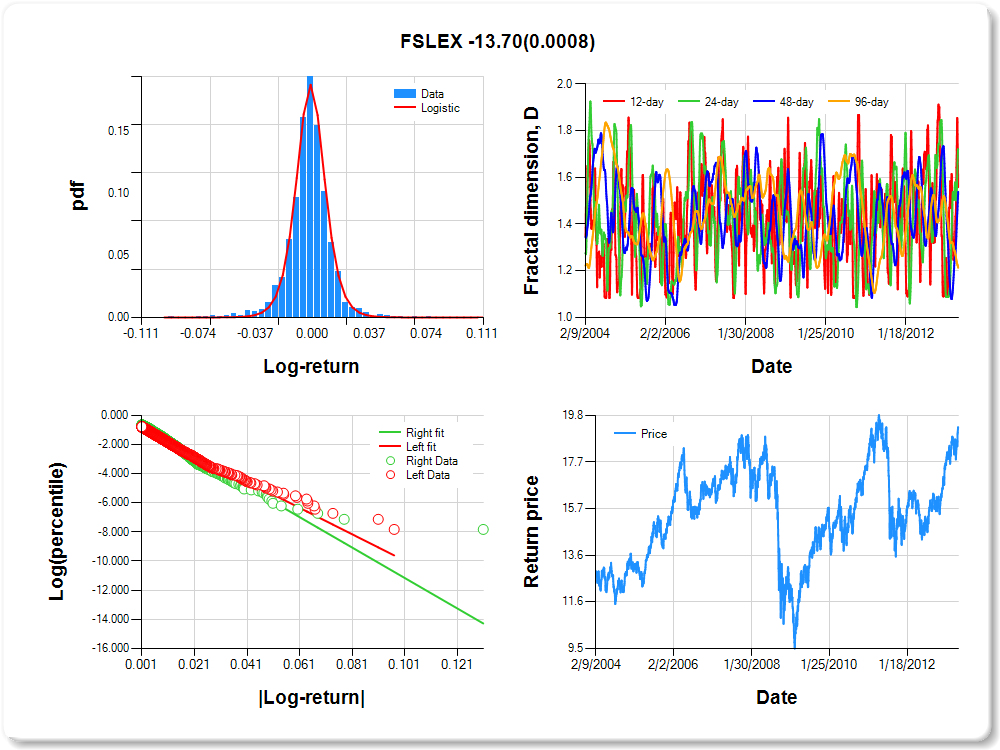

FSLEX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

1.06 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.241 |

0.091 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.862 |

0.041 |

-21.263 |

0.0000 |

|log-return| |

-90.793 |

2.744 |

-33.089 |

0.0000 |

I(right-tail) |

0.191 |

0.057 |

3.354 |

0.0008 |

|log-return|*I(right-tail) |

-13.699 |

4.076 |

-3.361 |

0.0008 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.442 |

0.280 |

0.461 |

0.787 |

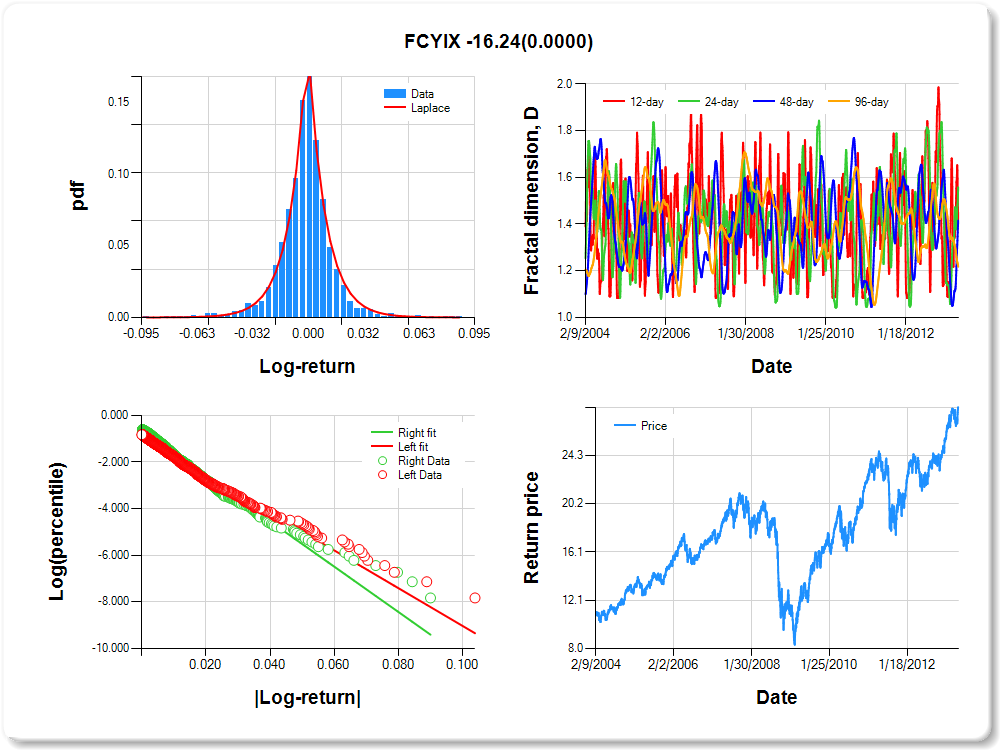

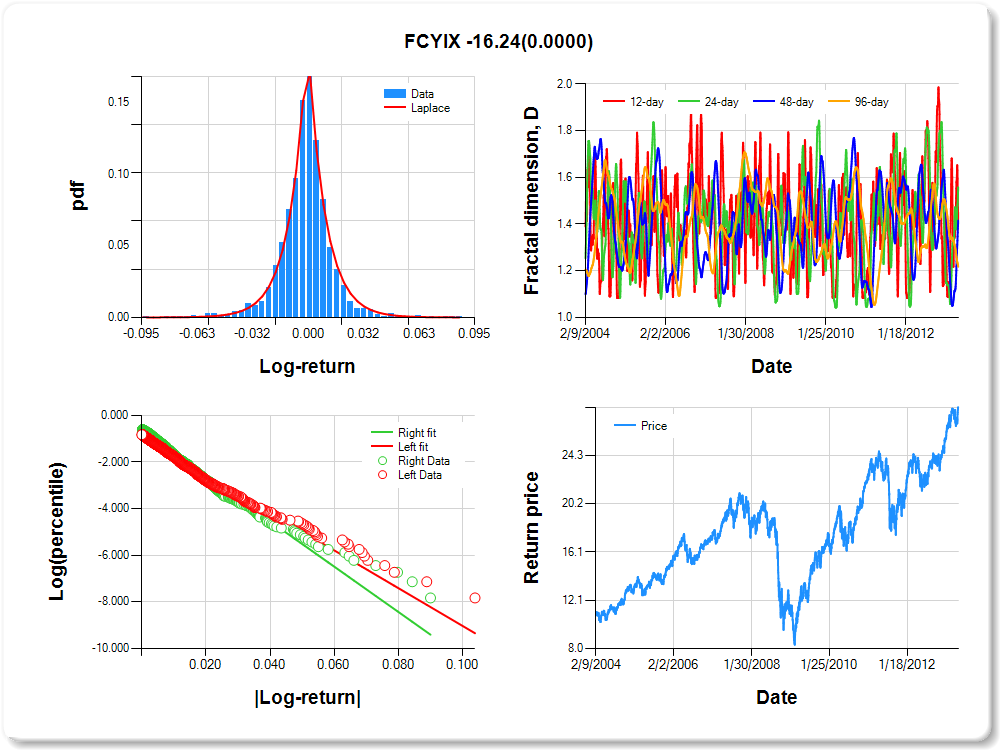

FCYIX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.05 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

1.10 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.148 |

0.176 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.925 |

0.041 |

-22.415 |

0.0000 |

|log-return| |

-80.874 |

2.504 |

-32.293 |

0.0000 |

I(right-tail) |

0.281 |

0.056 |

4.981 |

0.0000 |

|log-return|*I(right-tail) |

-16.237 |

3.685 |

-4.406 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.580 |

0.442 |

0.585 |

0.783 |

FSAGX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.08 |

1.06 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.212 |

0.097 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.769 |

0.040 |

-19.182 |

0.0000 |

|log-return| |

-59.354 |

1.751 |

-33.895 |

0.0000 |

I(right-tail) |

0.075 |

0.057 |

1.315 |

0.1886 |

|log-return|*I(right-tail) |

-2.102 |

2.511 |

-0.837 |

0.4026 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.668 |

0.753 |

0.882 |

0.768 |

FIDSX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.08 |

0.28 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.188 |

0.116 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.018 |

0.037 |

-27.764 |

0.0000 |

|log-return| |

-58.262 |

1.771 |

-32.904 |

0.0000 |

I(right-tail) |

0.112 |

0.051 |

2.203 |

0.0277 |

|log-return|*I(right-tail) |

-6.491 |

2.573 |

-2.523 |

0.0117 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.441 |

0.356 |

0.382 |

0.723 |

FBMPX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.30 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.141 |

0.130 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.946 |

0.039 |

-24.112 |

0.0000 |

|log-return| |

-82.396 |

2.518 |

-32.719 |

0.0000 |

I(right-tail) |

0.177 |

0.054 |

3.293 |

0.0010 |

|log-return|*I(right-tail) |

-7.566 |

3.603 |

-2.100 |

0.0358 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.429 |

0.791 |

0.869 |

0.700 |

FWRLX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.05 |

0.06 |

0.05 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.083 |

0.097 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.922 |

0.043 |

-21.590 |

0.0000 |

|log-return| |

-78.886 |

2.495 |

-31.616 |

0.0000 |

I(right-tail) |

0.211 |

0.058 |

3.636 |

0.0003 |

|log-return|*I(right-tail) |

-9.051 |

3.563 |

-2.540 |

0.0111 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.488 |

0.615 |

0.646 |

0.700 |

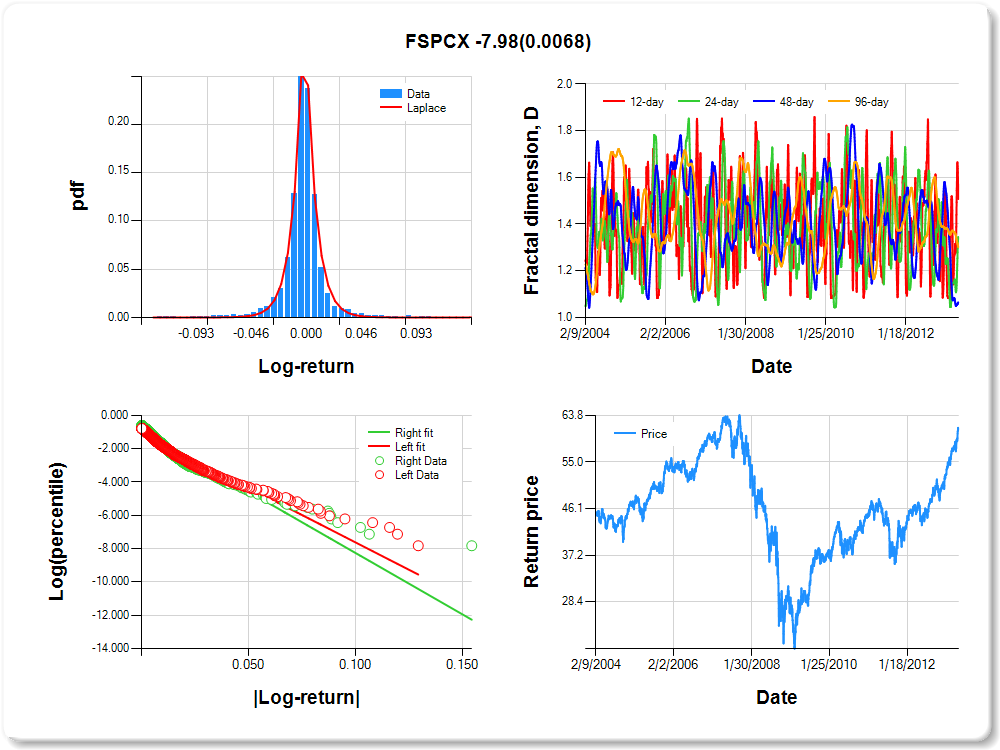

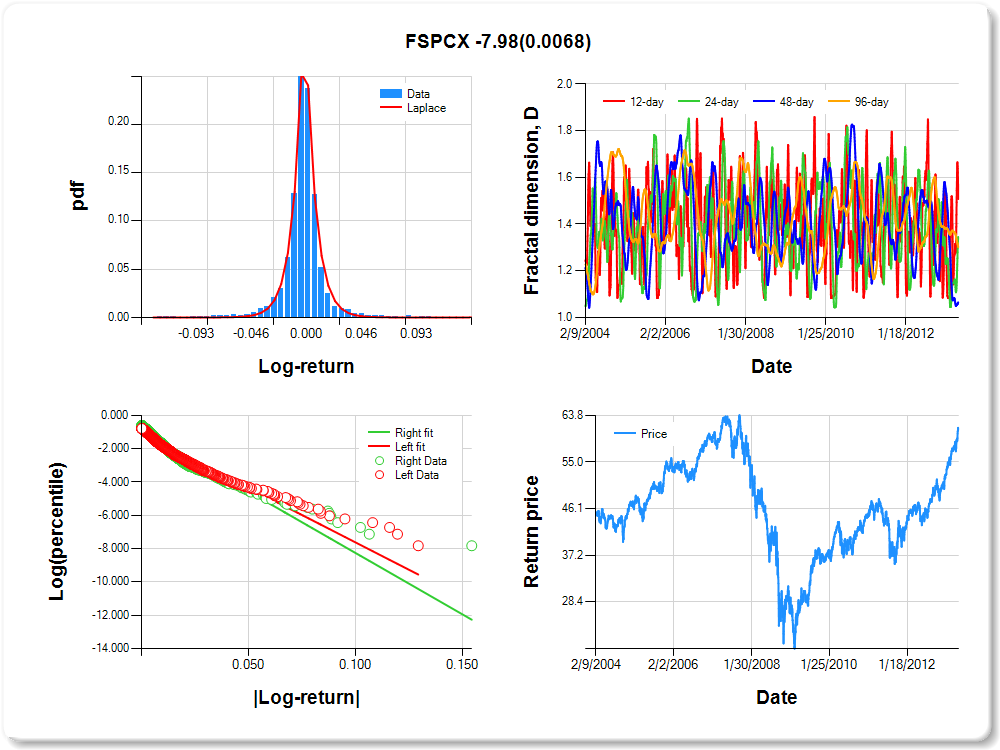

FSPCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.05 |

0.07 |

1.61 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.140 |

0.103 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.058 |

0.037 |

-28.232 |

0.0000 |

|log-return| |

-65.697 |

2.038 |

-32.232 |

0.0000 |

I(right-tail) |

0.164 |

0.051 |

3.234 |

0.0012 |

|log-return|*I(right-tail) |

-7.977 |

2.942 |

-2.711 |

0.0068 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.493 |

0.655 |

0.935 |

0.699 |

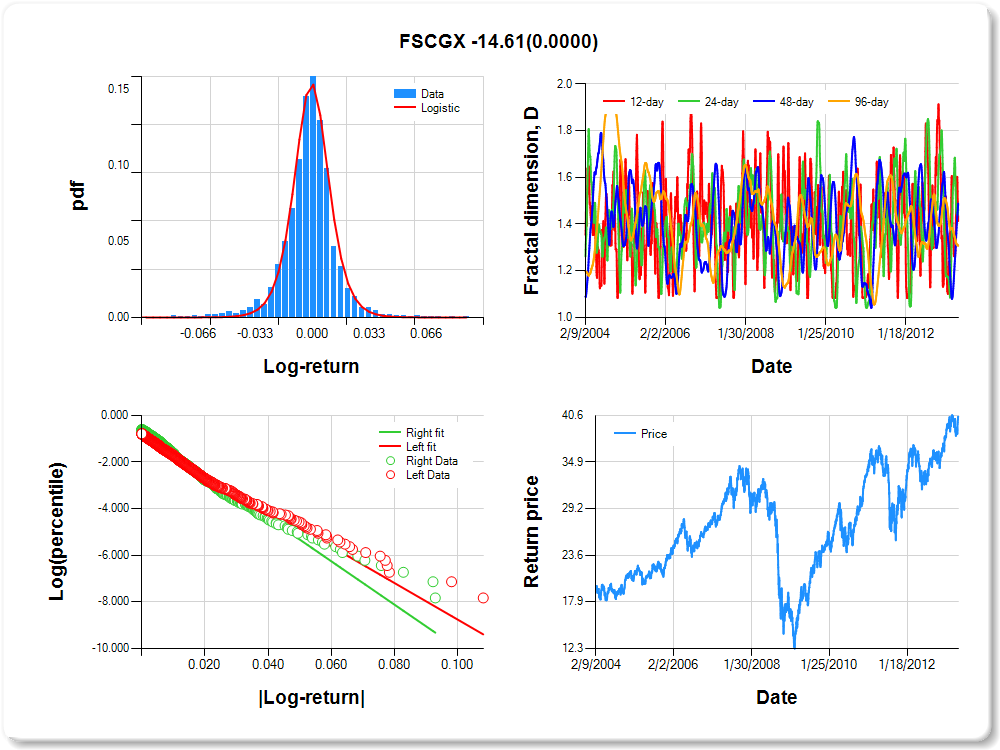

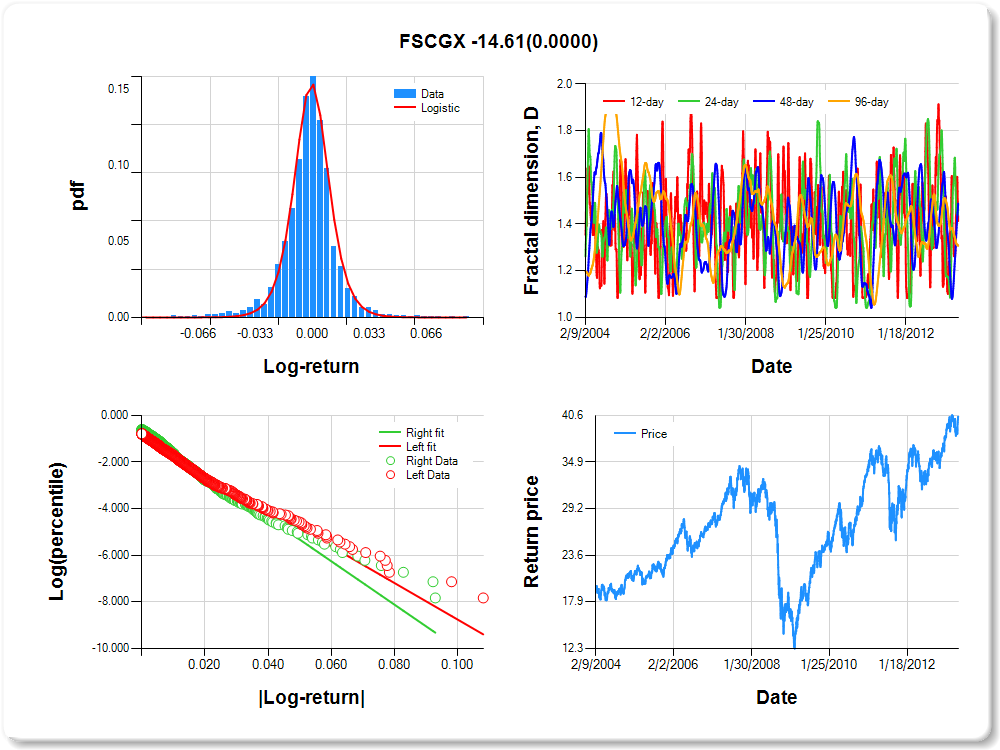

FSCGX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.06 |

0.85 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.154 |

0.111 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.907 |

0.040 |

-22.669 |

0.0000 |

|log-return| |

-78.418 |

2.381 |

-32.935 |

0.0000 |

I(right-tail) |

0.245 |

0.055 |

4.440 |

0.0000 |

|log-return|*I(right-tail) |

-14.611 |

3.519 |

-4.152 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.587 |

0.536 |

0.512 |

0.693 |

FSCHX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

1.07 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.059 |

0.147 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.968 |

0.040 |

-24.477 |

0.0000 |

|log-return| |

-70.719 |

2.184 |

-32.378 |

0.0000 |

I(right-tail) |

0.315 |

0.055 |

5.753 |

0.0000 |

|log-return|*I(right-tail) |

-17.251 |

3.282 |

-5.256 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.477 |

0.493 |

0.246 |

0.689 |

FDFAX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.03 |

-0.03 |

-0.01 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.01 |

0.02 |

0.03 |

1.10 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.260 |

0.083 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.967 |

0.041 |

-23.795 |

0.0000 |

|log-return| |

-133.403 |

4.189 |

-31.843 |

0.0000 |

I(right-tail) |

0.261 |

0.055 |

4.767 |

0.0000 |

|log-return|*I(right-tail) |

-12.893 |

5.907 |

-2.183 |

0.0291 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.788 |

0.919 |

0.958 |

0.686 |

FDLSX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.40 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.047 |

0.199 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.841 |

0.041 |

-20.585 |

0.0000 |

|log-return| |

-95.043 |

2.853 |

-33.308 |

0.0000 |

I(right-tail) |

0.205 |

0.056 |

3.643 |

0.0003 |

|log-return|*I(right-tail) |

-10.209 |

4.081 |

-2.501 |

0.0124 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.419 |

0.657 |

0.817 |

0.680 |

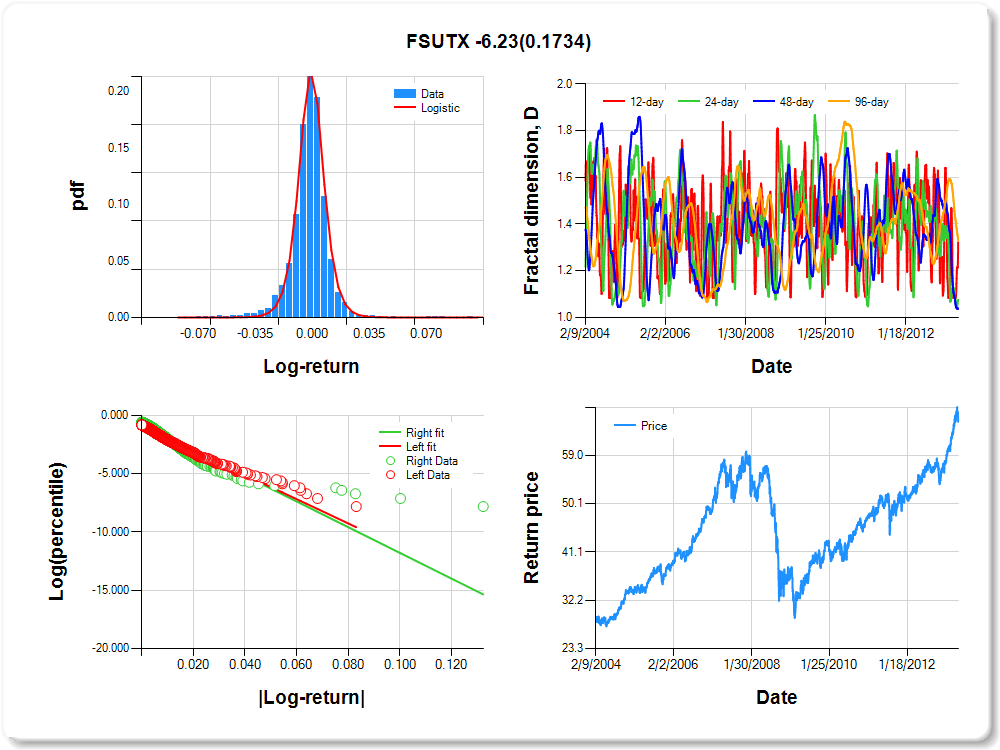

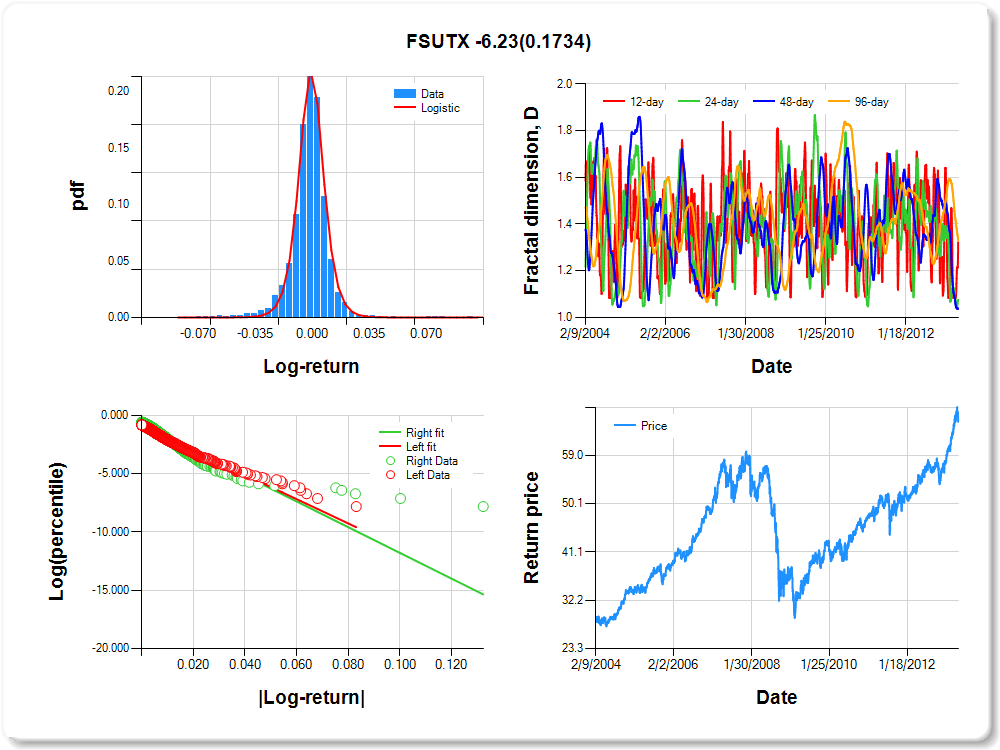

FSUTX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.03 |

0.04 |

1.19 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.370 |

0.078 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.942 |

0.041 |

-23.059 |

0.0000 |

|log-return| |

-104.008 |

3.226 |

-32.244 |

0.0000 |

I(right-tail) |

0.178 |

0.055 |

3.257 |

0.0011 |

|log-return|*I(right-tail) |

-6.230 |

4.574 |

-1.362 |

0.1734 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.678 |

0.924 |

0.962 |

0.671 |

FSCPX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.50 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.130 |

0.147 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.900 |

0.040 |

-22.409 |

0.0000 |

|log-return| |

-89.417 |

2.717 |

-32.906 |

0.0000 |

I(right-tail) |

0.160 |

0.055 |

2.887 |

0.0039 |

|log-return|*I(right-tail) |

-8.275 |

3.898 |

-2.123 |

0.0339 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.447 |

0.704 |

0.792 |

0.662 |

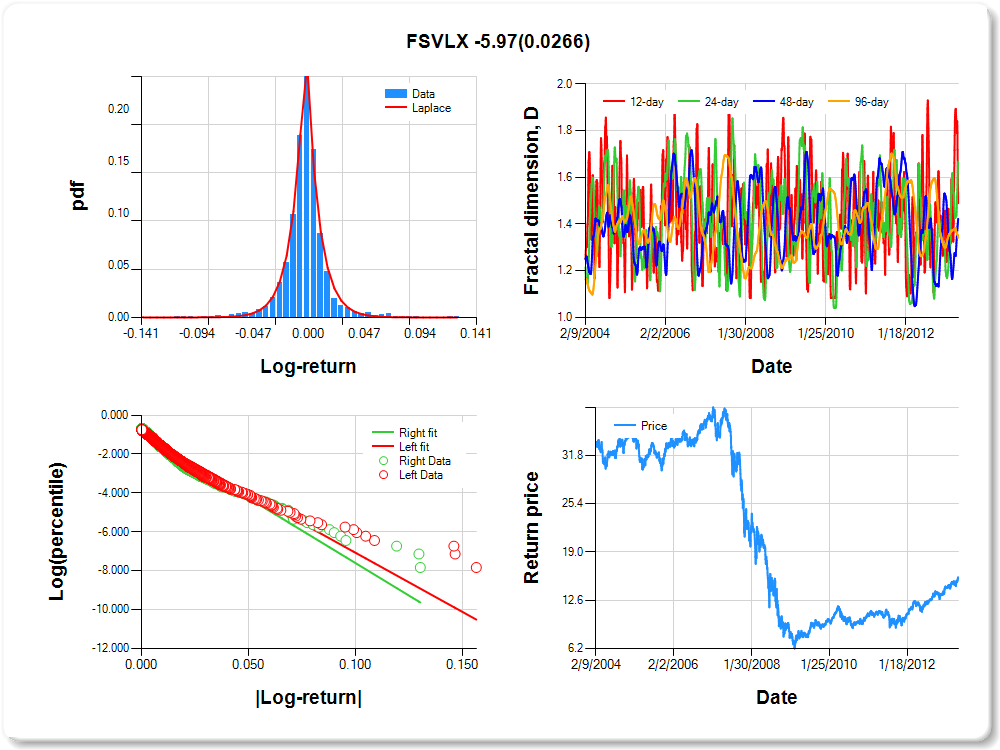

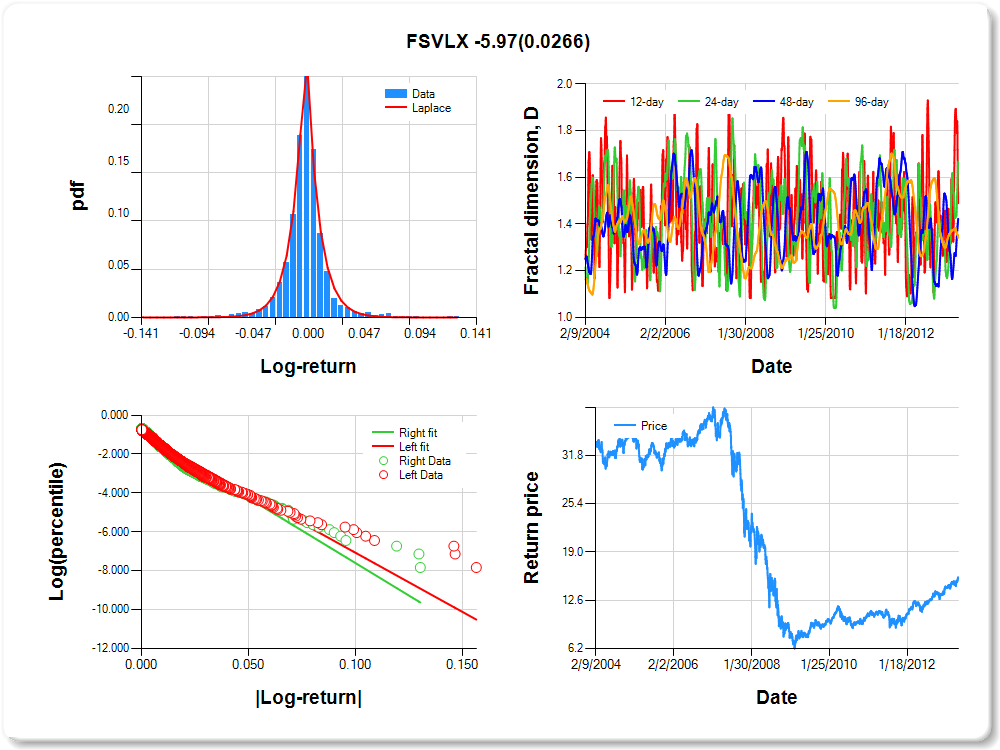

FSVLX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.07 |

0.73 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.158 |

0.126 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.978 |

0.037 |

-26.334 |

0.0000 |

|log-return| |

-60.849 |

1.844 |

-32.991 |

0.0000 |

I(right-tail) |

0.066 |

0.052 |

1.279 |

0.2009 |

|log-return|*I(right-tail) |

-5.965 |

2.689 |

-2.219 |

0.0266 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.510 |

0.332 |

0.577 |

0.659 |

FBSOX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.13 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.086 |

0.153 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.895 |

0.041 |

-21.652 |

0.0000 |

|log-return| |

-91.790 |

2.831 |

-32.422 |

0.0000 |

I(right-tail) |

0.197 |

0.056 |

3.498 |

0.0005 |

|log-return|*I(right-tail) |

-7.069 |

3.987 |

-1.773 |

0.0763 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.629 |

0.492 |

0.637 |

0.655 |

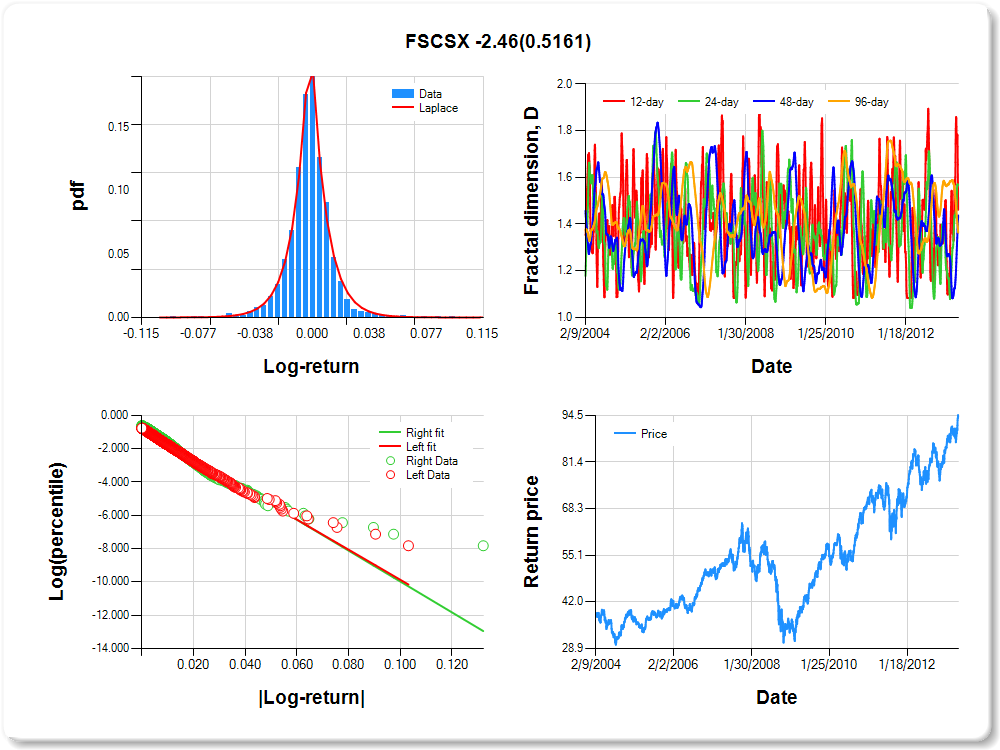

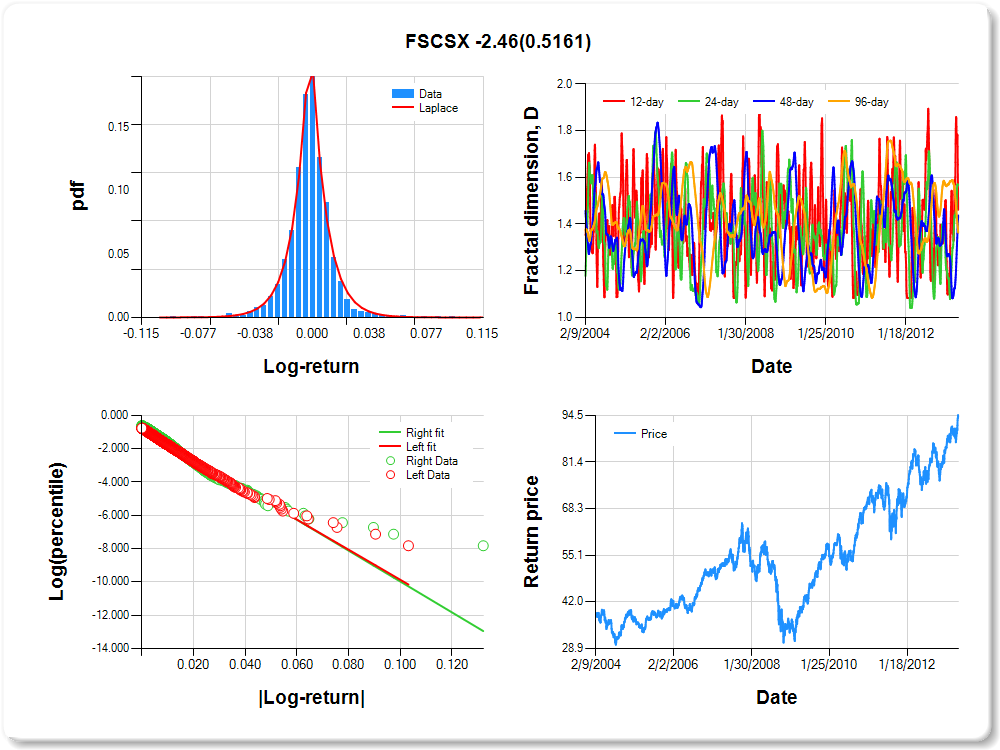

FSCSX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.50 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.199 |

0.148 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.844 |

0.041 |

-20.801 |

0.0000 |

|log-return| |

-90.237 |

2.712 |

-33.270 |

0.0000 |

I(right-tail) |

0.142 |

0.056 |

2.548 |

0.0109 |

|log-return|*I(right-tail) |

-2.456 |

3.781 |

-0.650 |

0.5161 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.539 |

0.432 |

0.563 |

0.637 |

FDCPX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

1.85 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.010 |

0.128 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.714 |

0.043 |

-16.577 |

0.0000 |

|log-return| |

-88.795 |

2.649 |

-33.524 |

0.0000 |

I(right-tail) |

0.146 |

0.059 |

2.476 |

0.0134 |

|log-return|*I(right-tail) |

-6.721 |

3.752 |

-1.791 |

0.0733 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.608 |

0.501 |

0.557 |

0.629 |

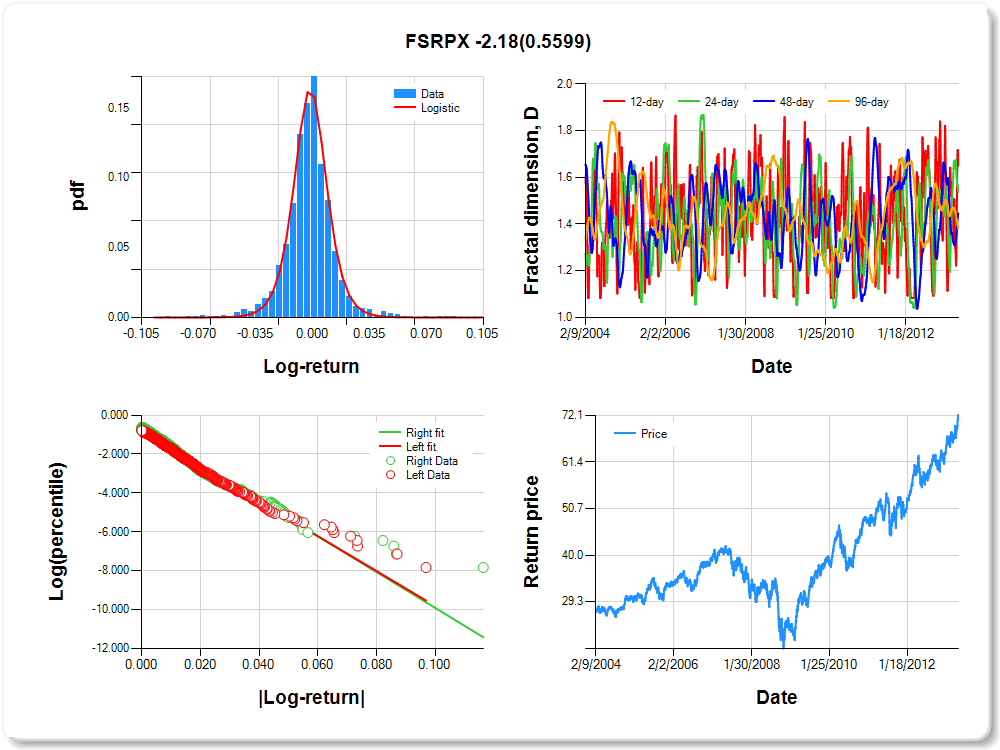

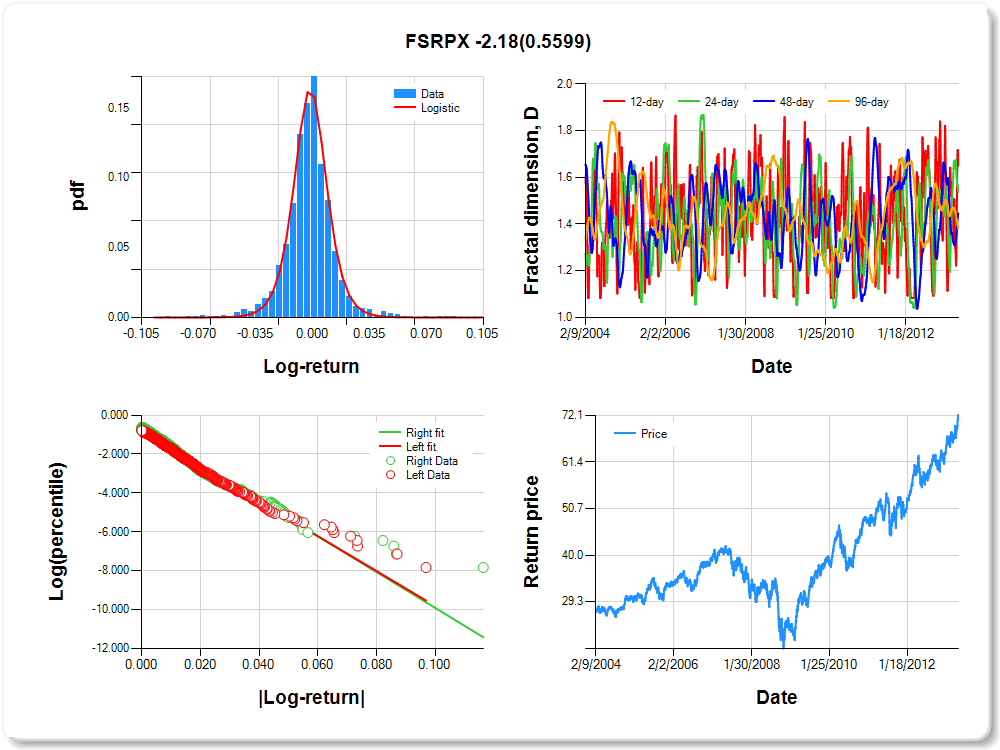

FSRPX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.05 |

0.05 |

-0.22 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.144 |

0.104 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.819 |

0.042 |

-19.694 |

0.0000 |

|log-return| |

-89.815 |

2.713 |

-33.111 |

0.0000 |

I(right-tail) |

0.121 |

0.056 |

2.165 |

0.0305 |

|log-return|*I(right-tail) |

-2.182 |

3.743 |

-0.583 |

0.5599 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.349 |

0.463 |

0.553 |

0.620 |

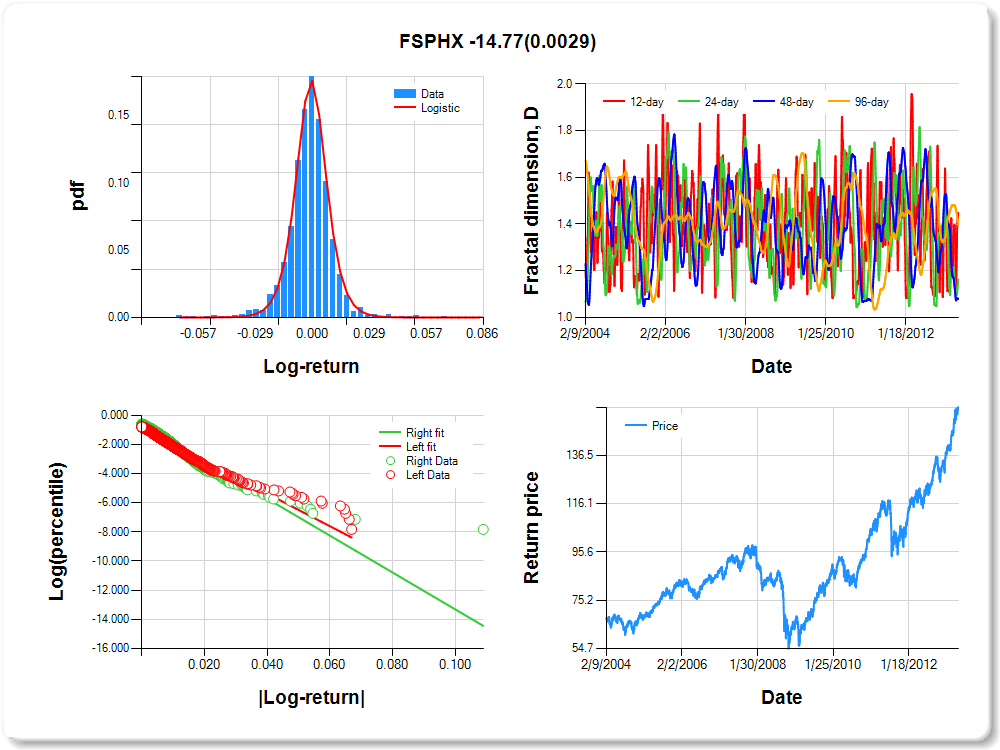

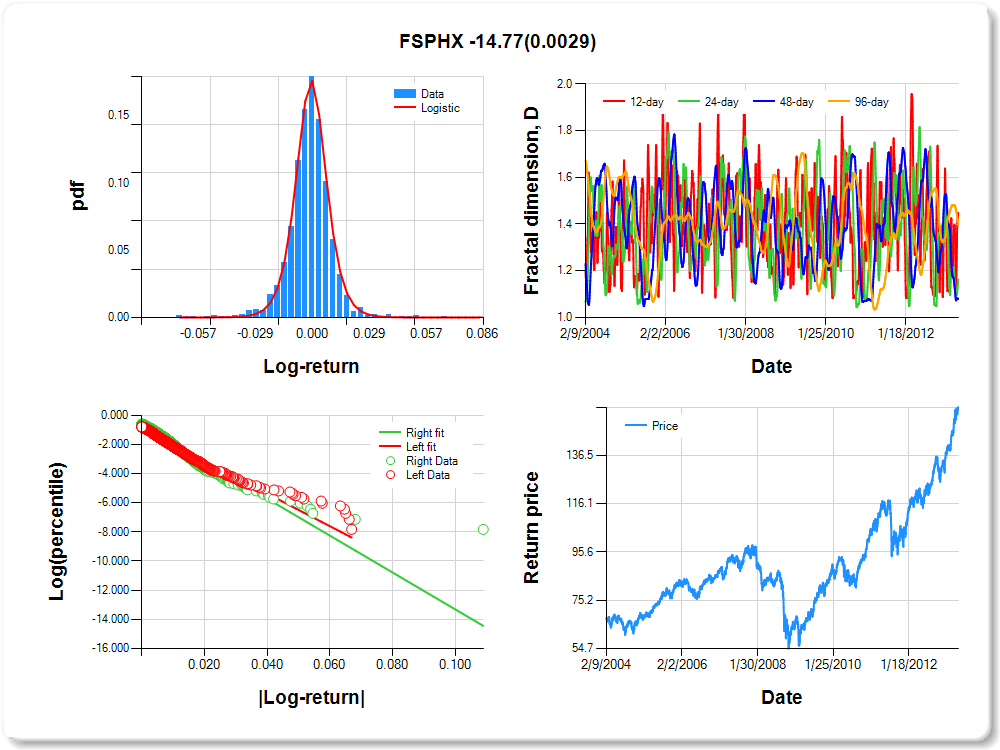

FSPHX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.03 |

0.04 |

0.35 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.387 |

0.097 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.899 |

0.041 |

-22.209 |

0.0000 |

|log-return| |

-111.801 |

3.429 |

-32.601 |

0.0000 |

I(right-tail) |

0.240 |

0.056 |

4.312 |

0.0000 |

|log-return|*I(right-tail) |

-14.770 |

4.958 |

-2.979 |

0.0029 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.552 |

0.837 |

0.919 |

0.606 |

FSRBX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.08 |

0.10 |

1.45 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.131 |

0.098 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.040 |

0.036 |

-29.292 |

0.0000 |

|log-return| |

-51.179 |

1.558 |

-32.843 |

0.0000 |

I(right-tail) |

0.014 |

0.050 |

0.285 |

0.7755 |

|log-return|*I(right-tail) |

0.493 |

2.178 |

0.226 |

0.8210 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.533 |

0.425 |

0.545 |

0.605 |

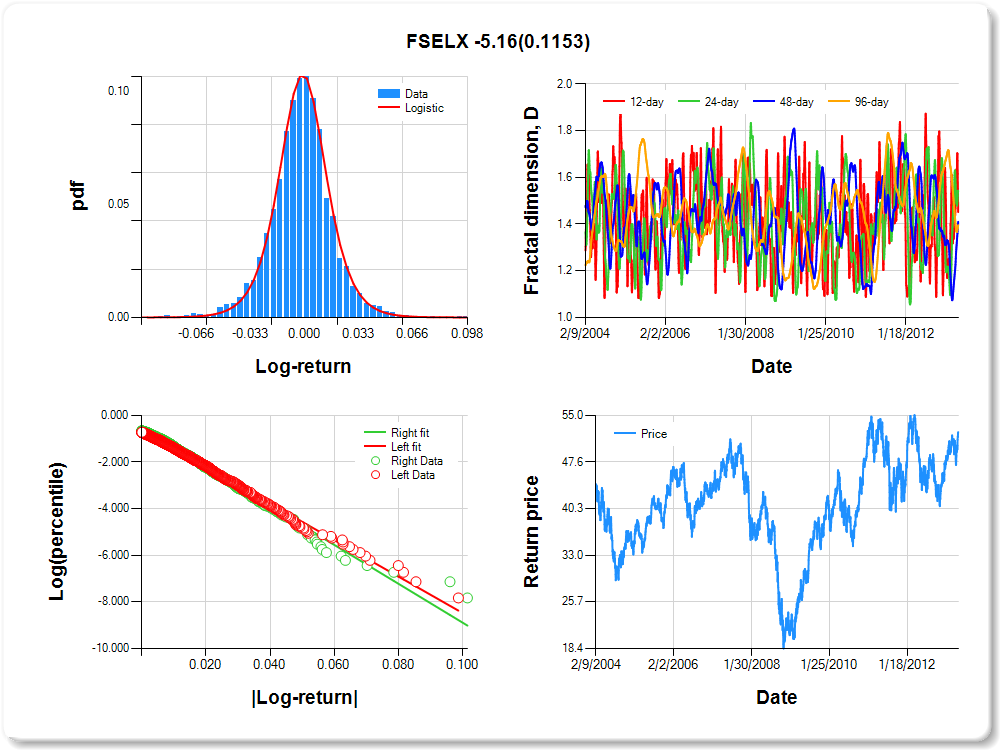

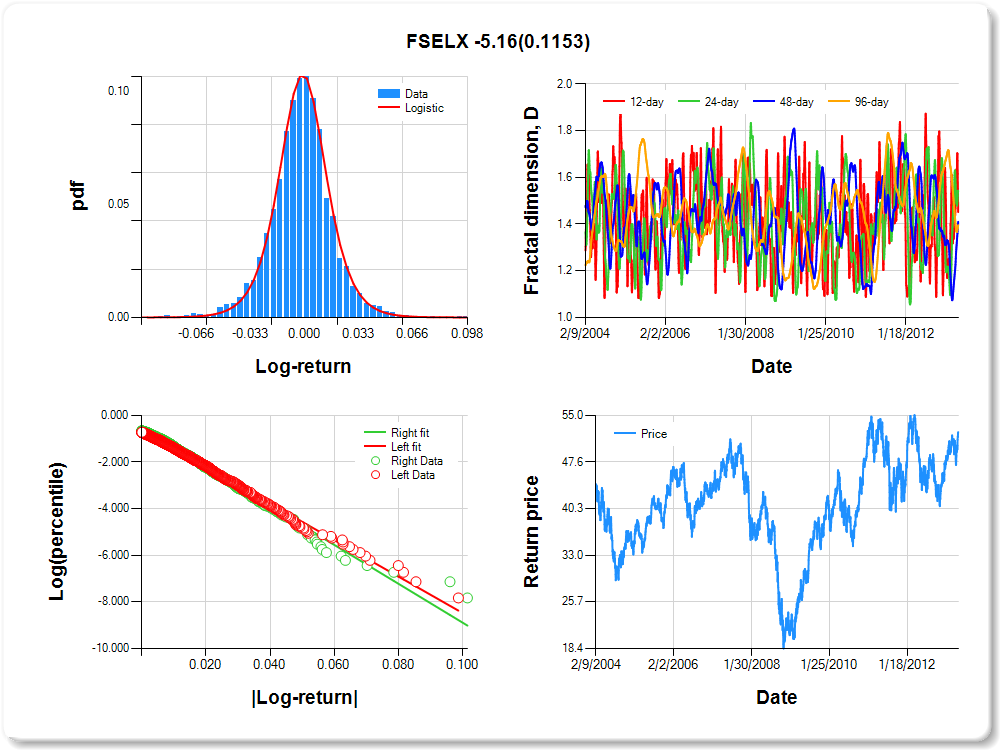

FSELX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.05 |

0.39 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.009 |

0.159 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.649 |

0.042 |

-15.274 |

0.0000 |

|log-return| |

-78.122 |

2.274 |

-34.355 |

0.0000 |

I(right-tail) |

0.105 |

0.060 |

1.742 |

0.0816 |

|log-return|*I(right-tail) |

-5.163 |

3.278 |

-1.575 |

0.1153 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.549 |

0.460 |

0.590 |

0.604 |

FSMEX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.03 |

0.04 |

0.17 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.263 |

0.099 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.896 |

0.041 |

-21.763 |

0.0000 |

|log-return| |

-110.840 |

3.421 |

-32.400 |

0.0000 |

I(right-tail) |

0.233 |

0.057 |

4.091 |

0.0000 |

|log-return|*I(right-tail) |

-14.377 |

4.970 |

-2.893 |

0.0039 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.688 |

0.343 |

0.664 |

0.603 |

FPHAX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.03 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.03 |

0.04 |

0.74 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.645 |

0.074 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.842 |

0.044 |

-19.268 |

0.0000 |

|log-return| |

-120.440 |

3.765 |

-31.986 |

0.0000 |

I(right-tail) |

0.017 |

0.059 |

0.295 |

0.7684 |

|log-return|*I(right-tail) |

14.883 |

5.007 |

2.973 |

0.0030 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.645 |

0.943 |

0.934 |

0.603 |

FSDCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.05 |

0.84 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.013 |

0.226 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.721 |

0.044 |

-16.468 |

0.0000 |

|log-return| |

-80.860 |

2.438 |

-33.164 |

0.0000 |

I(right-tail) |

0.154 |

0.060 |

2.590 |

0.0097 |

|log-return|*I(right-tail) |

-9.022 |

3.492 |

-2.584 |

0.0098 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.640 |

0.574 |

0.552 |

0.595 |

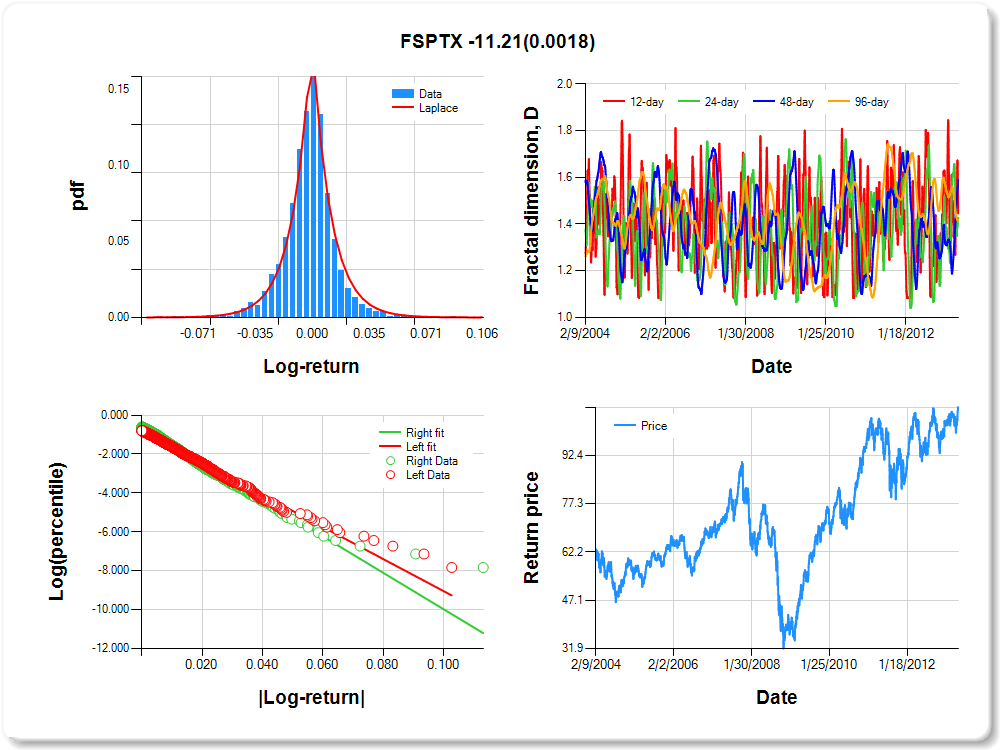

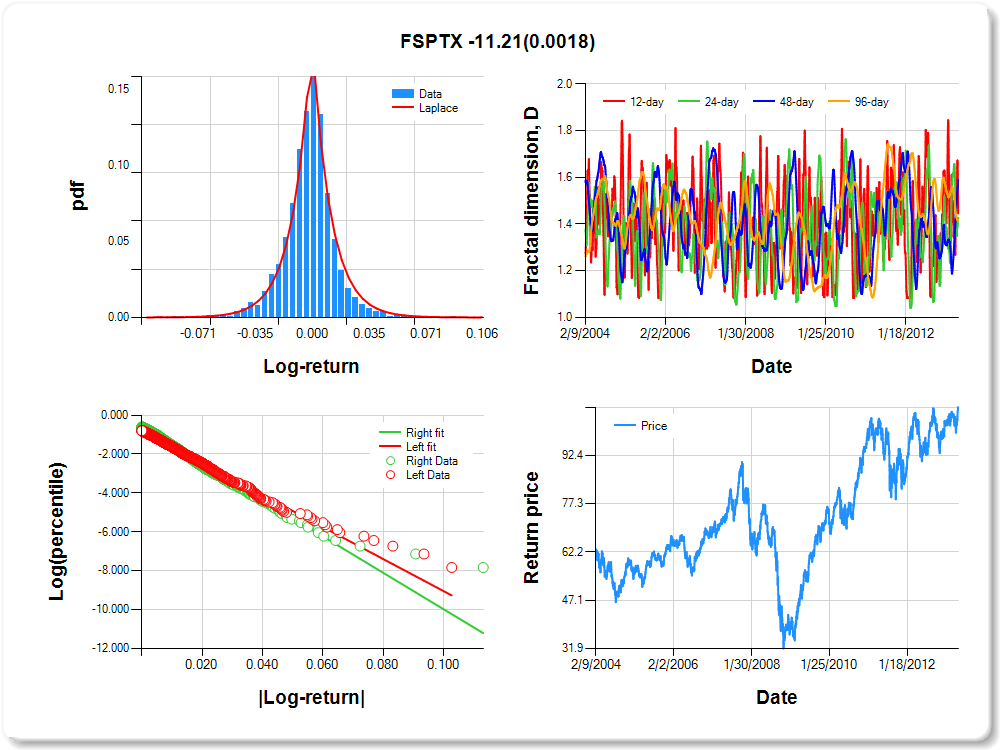

FSPTX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.62 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.056 |

0.185 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.797 |

0.042 |

-18.859 |

0.0000 |

|log-return| |

-82.414 |

2.490 |

-33.097 |

0.0000 |

I(right-tail) |

0.191 |

0.057 |

3.336 |

0.0009 |

|log-return|*I(right-tail) |

-11.206 |

3.586 |

-3.125 |

0.0018 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.554 |

0.573 |

0.410 |

0.586 |

FSDPX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

1.62 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.080 |

0.098 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.951 |

0.040 |

-23.967 |

0.0000 |

|log-return| |

-67.106 |

2.059 |

-32.598 |

0.0000 |

I(right-tail) |

0.333 |

0.055 |

6.016 |

0.0000 |

|log-return|*I(right-tail) |

-18.792 |

3.148 |

-5.970 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.444 |

0.467 |

0.300 |

0.580 |

FBIOX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.03 |

0.04 |

0.78 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.022 |

0.114 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.752 |

0.041 |

-18.221 |

0.0000 |

|log-return| |

-93.139 |

2.762 |

-33.724 |

0.0000 |

I(right-tail) |

0.234 |

0.059 |

3.961 |

0.0001 |

|log-return|*I(right-tail) |

-13.311 |

4.091 |

-3.254 |

0.0012 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.641 |

0.875 |

0.926 |

0.569 |

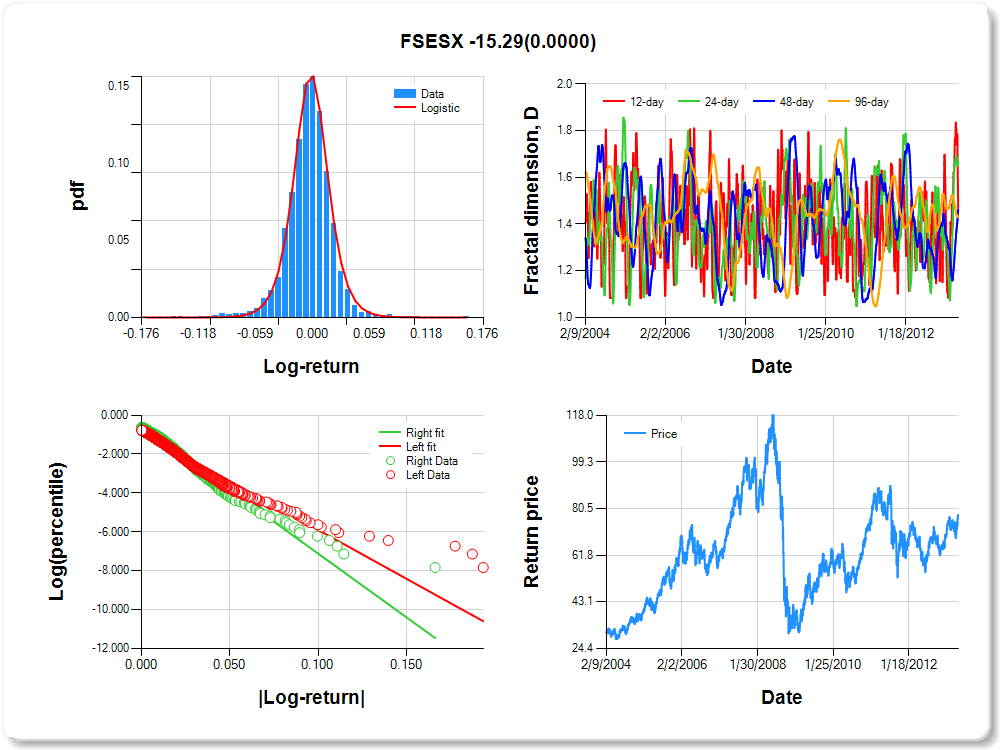

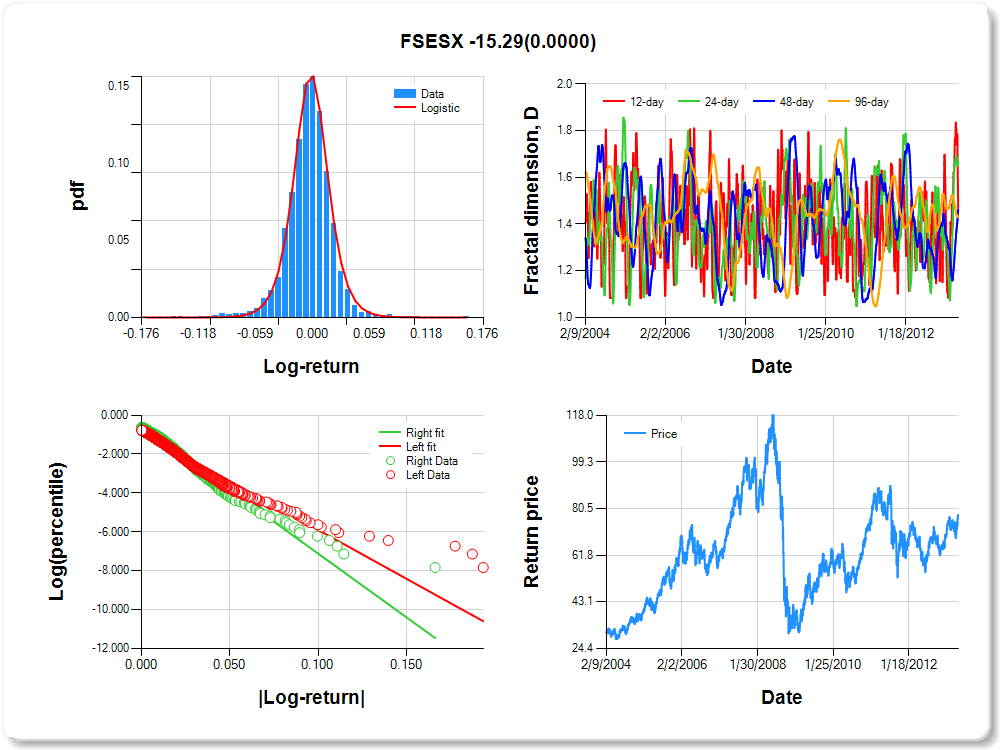

FSESX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.09 |

-0.07 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.08 |

0.61 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.148 |

0.108 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.882 |

0.040 |

-22.090 |

0.0000 |

|log-return| |

-50.145 |

1.531 |

-32.755 |

0.0000 |

I(right-tail) |

0.312 |

0.057 |

5.505 |

0.0000 |

|log-return|*I(right-tail) |

-15.289 |

2.386 |

-6.407 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.532 |

0.341 |

0.537 |

0.566 |

FSNGX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.09 |

-0.07 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.08 |

0.58 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.050 |

0.079 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.971 |

0.038 |

-25.782 |

0.0000 |

|log-return| |

-49.448 |

1.519 |

-32.551 |

0.0000 |

I(right-tail) |

0.264 |

0.054 |

4.886 |

0.0000 |

|log-return|*I(right-tail) |

-13.140 |

2.364 |

-5.557 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.585 |

0.348 |

0.306 |

0.551 |

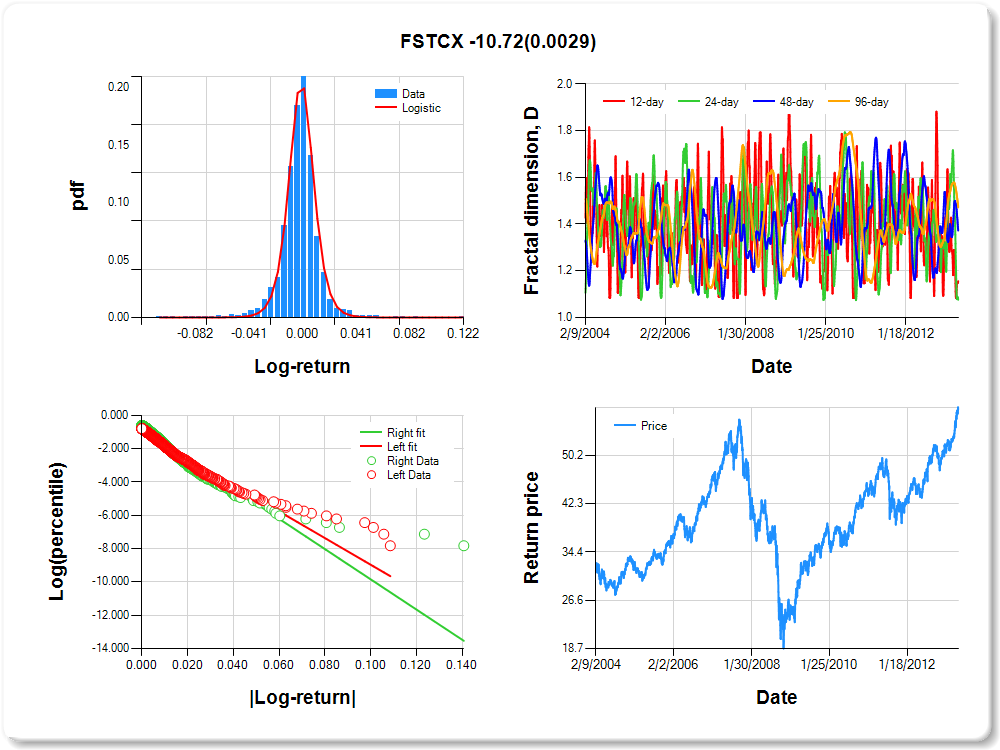

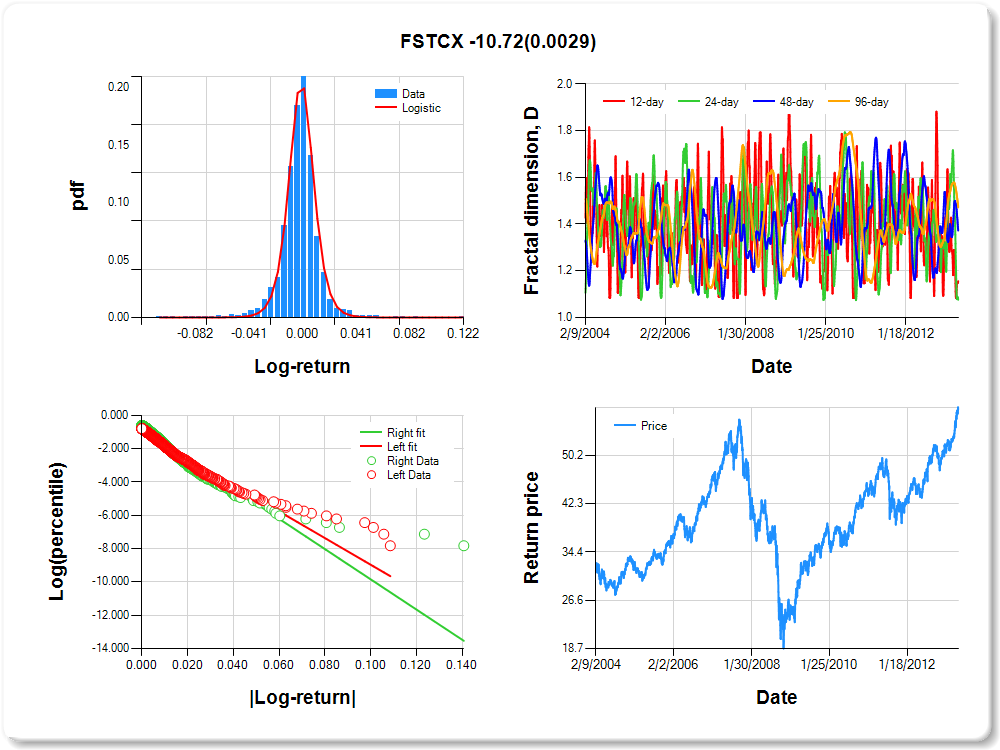

FSTCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

1.21 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.202 |

0.083 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.960 |

0.040 |

-24.240 |

0.0000 |

|log-return| |

-80.010 |

2.480 |

-32.258 |

0.0000 |

I(right-tail) |

0.198 |

0.054 |

3.691 |

0.0002 |

|log-return|*I(right-tail) |

-10.719 |

3.591 |

-2.985 |

0.0029 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.845 |

0.924 |

0.628 |

0.528 |

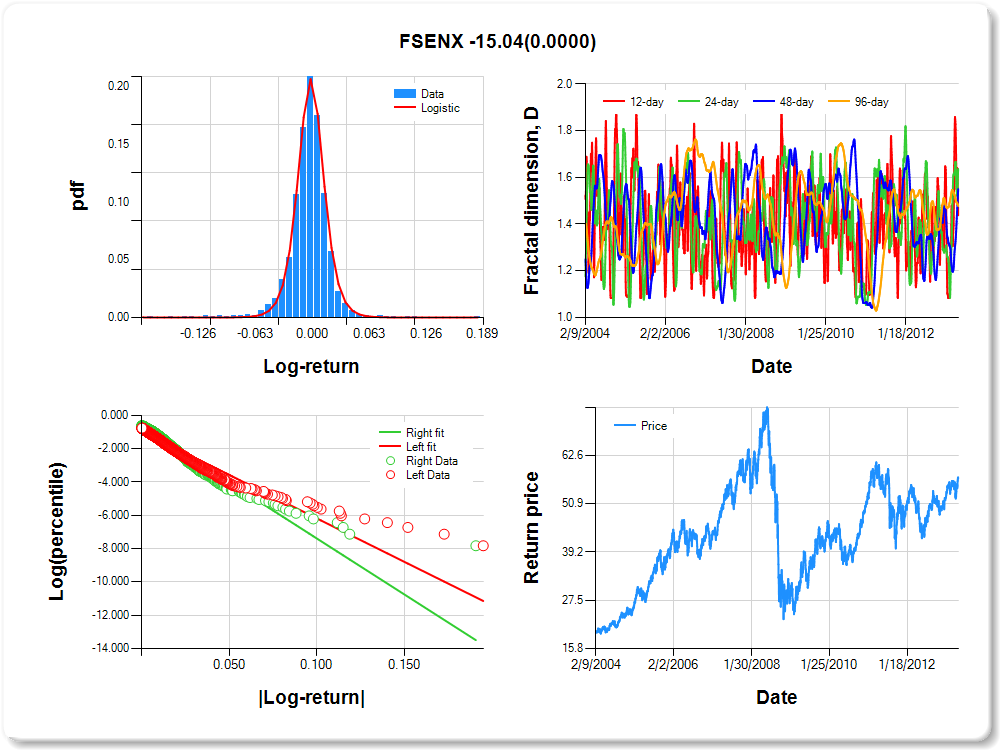

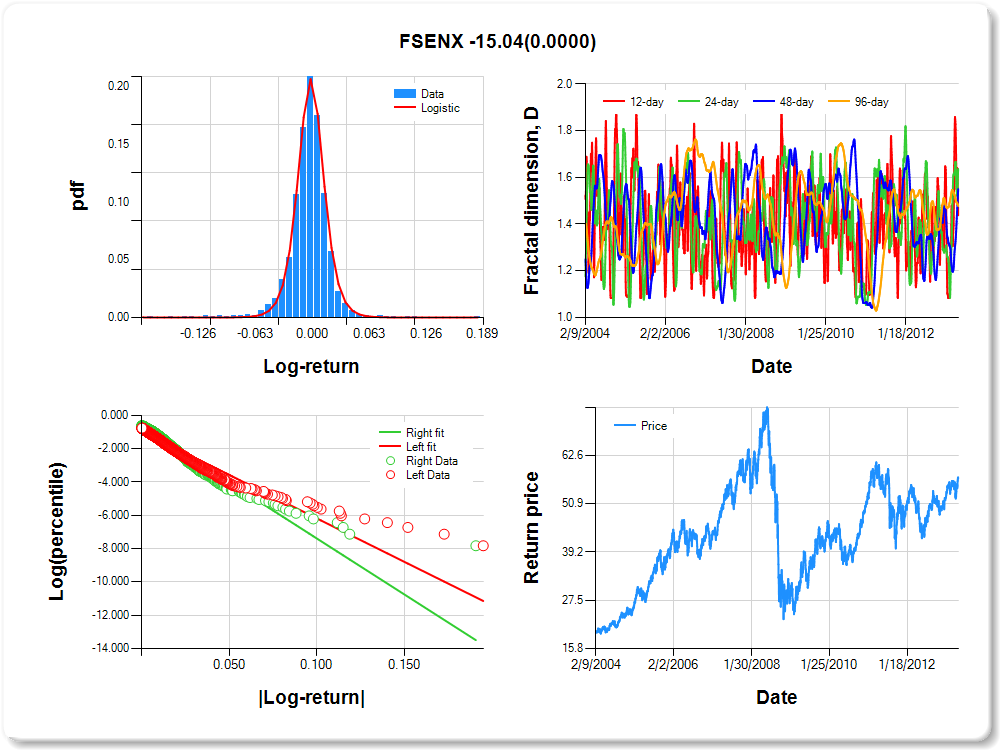

FSENX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.09 |

-0.07 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.08 |

1.31 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.036 |

0.083 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.977 |

0.038 |

-25.563 |

0.0000 |

|log-return| |

-52.121 |

1.607 |

-32.442 |

0.0000 |

I(right-tail) |

0.300 |

0.054 |

5.528 |

0.0000 |

|log-return|*I(right-tail) |

-15.041 |

2.502 |

-6.011 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.562 |

0.363 |

0.450 |

0.522 |

FSHCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.03 |

0.05 |

0.82 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.344 |

0.094 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.945 |

0.040 |

-23.568 |

0.0000 |

|log-return| |

-86.099 |

2.679 |

-32.140 |

0.0000 |

I(right-tail) |

0.321 |

0.056 |

5.730 |

0.0000 |

|log-return|*I(right-tail) |

-20.374 |

4.030 |

-5.055 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.586 |

0.440 |

0.644 |

0.512 |

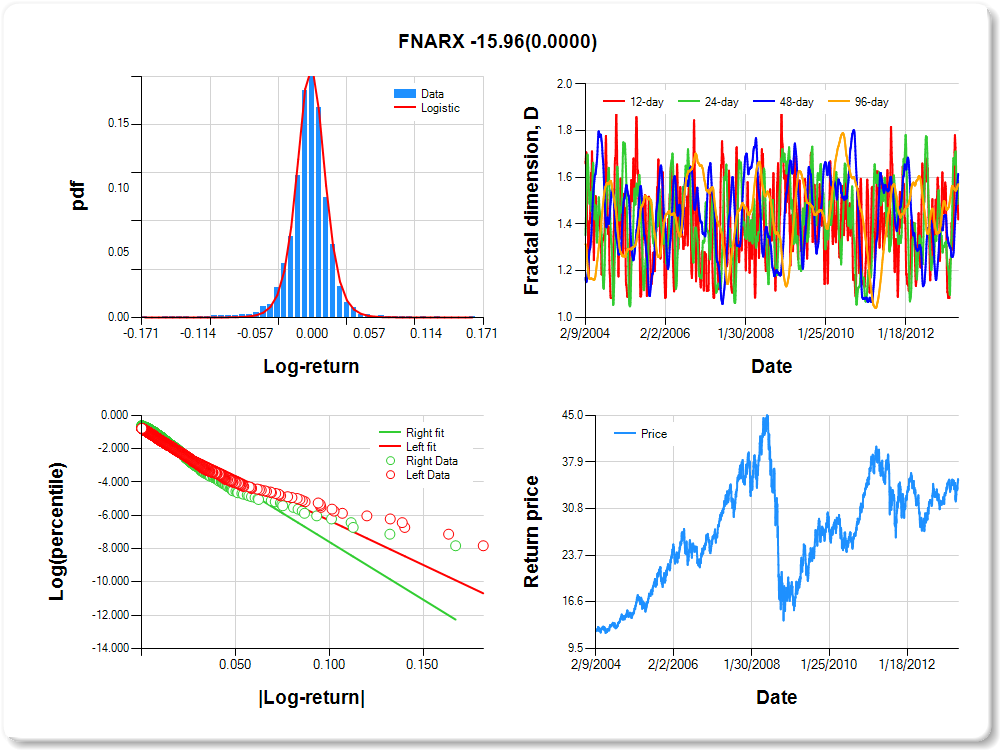

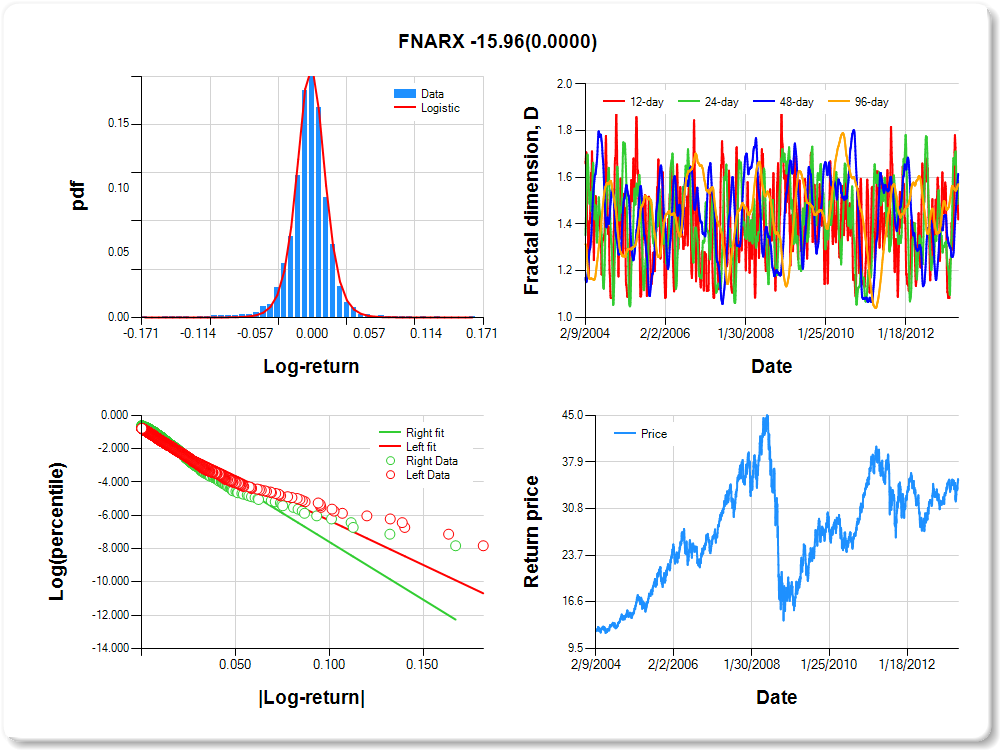

FNARX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.09 |

-0.07 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.07 |

0.60 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.091 |

0.088 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.979 |

0.039 |

-25.258 |

0.0000 |

|log-return| |

-53.270 |

1.650 |

-32.290 |

0.0000 |

I(right-tail) |

0.314 |

0.055 |

5.724 |

0.0000 |

|log-return|*I(right-tail) |

-15.958 |

2.574 |

-6.201 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.580 |

0.414 |

0.384 |

0.429 |