TRV

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.09 |

-0.07 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.11 |

-0.01 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.098 |

0.108 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.038 |

0.053 |

-19.737 |

0.0000 |

|log-return| |

-49.916 |

2.222 |

-22.462 |

0.0000 |

I(right-tail) |

0.083 |

0.071 |

1.158 |

0.2472 |

|log-return|*I(right-tail) |

1.515 |

3.023 |

0.501 |

0.6162 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.029 |

0.719 |

0.958 |

0.775 |

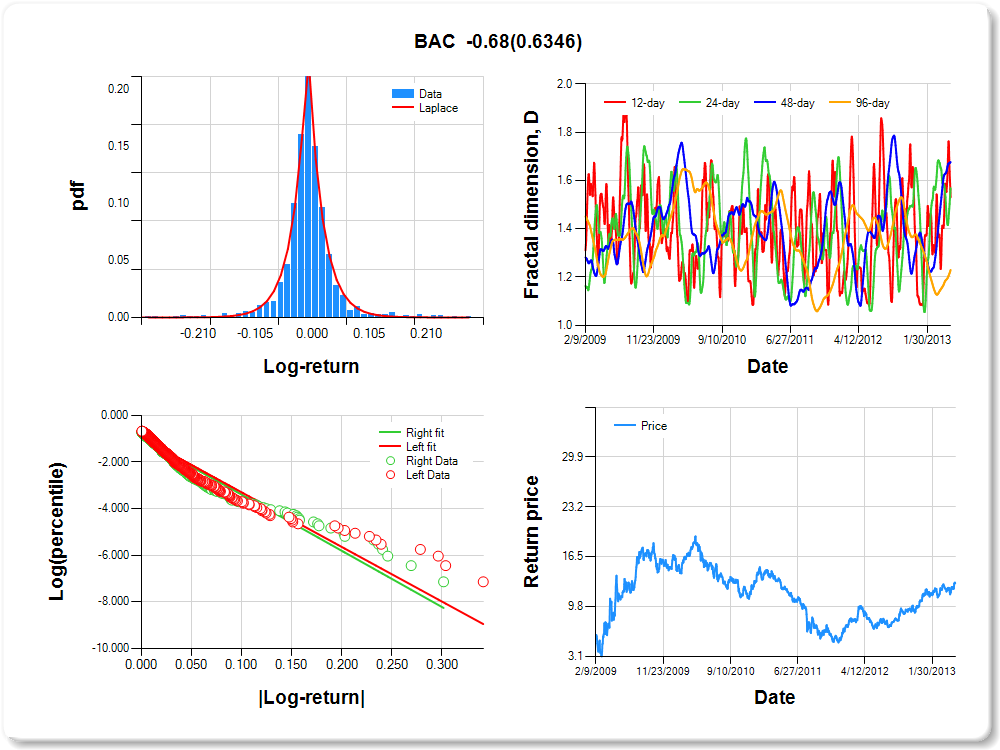

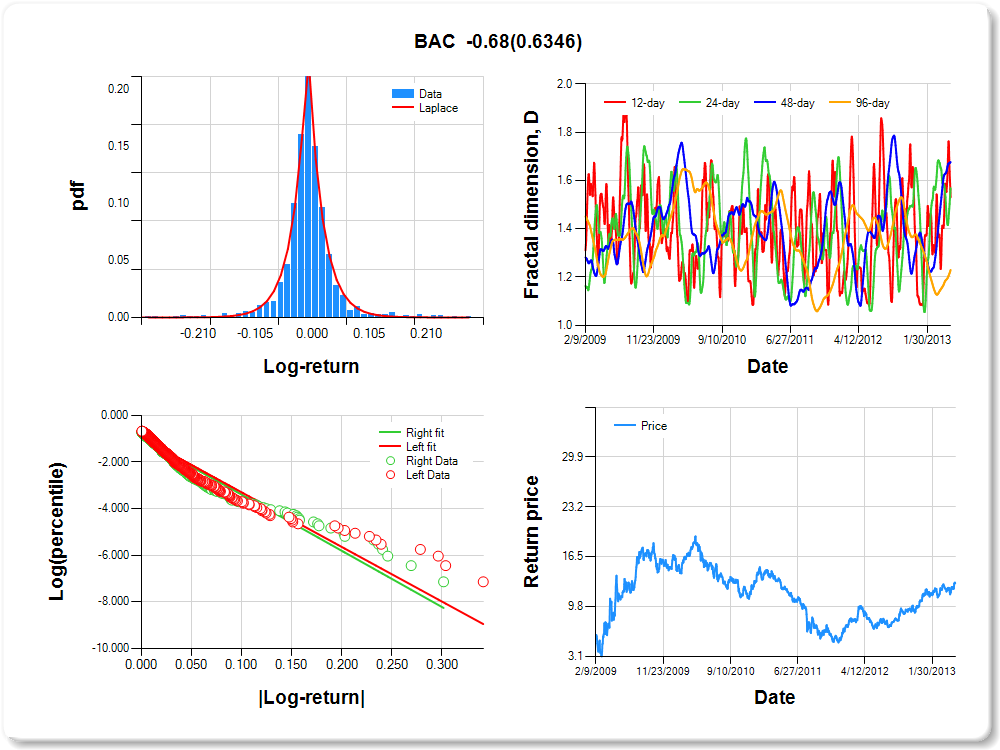

BAC

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.21 |

-0.14 |

-0.07 |

-0.04 |

-0.02 |

0.00 |

0.02 |

0.06 |

0.17 |

0.23 |

0.85 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.094 |

0.144 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.967 |

0.050 |

-19.372 |

0.0000 |

|log-return| |

-23.377 |

0.993 |

-23.541 |

0.0000 |

I(right-tail) |

-0.029 |

0.071 |

-0.401 |

0.6883 |

|log-return|*I(right-tail) |

-0.682 |

1.435 |

-0.475 |

0.6346 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.469 |

0.432 |

0.323 |

0.770 |

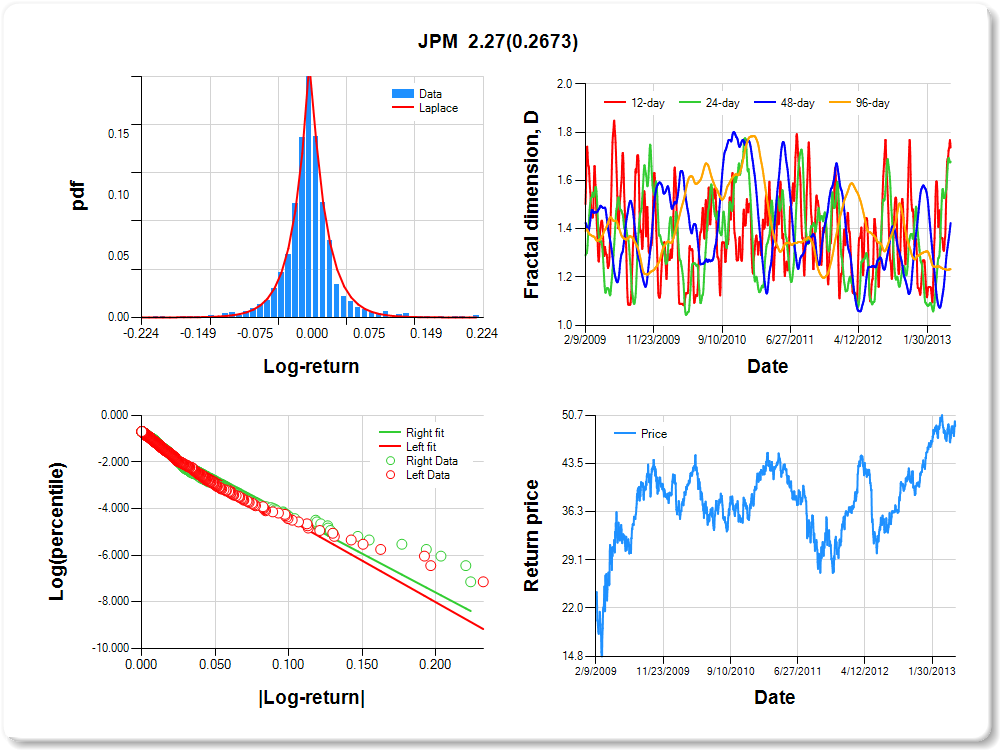

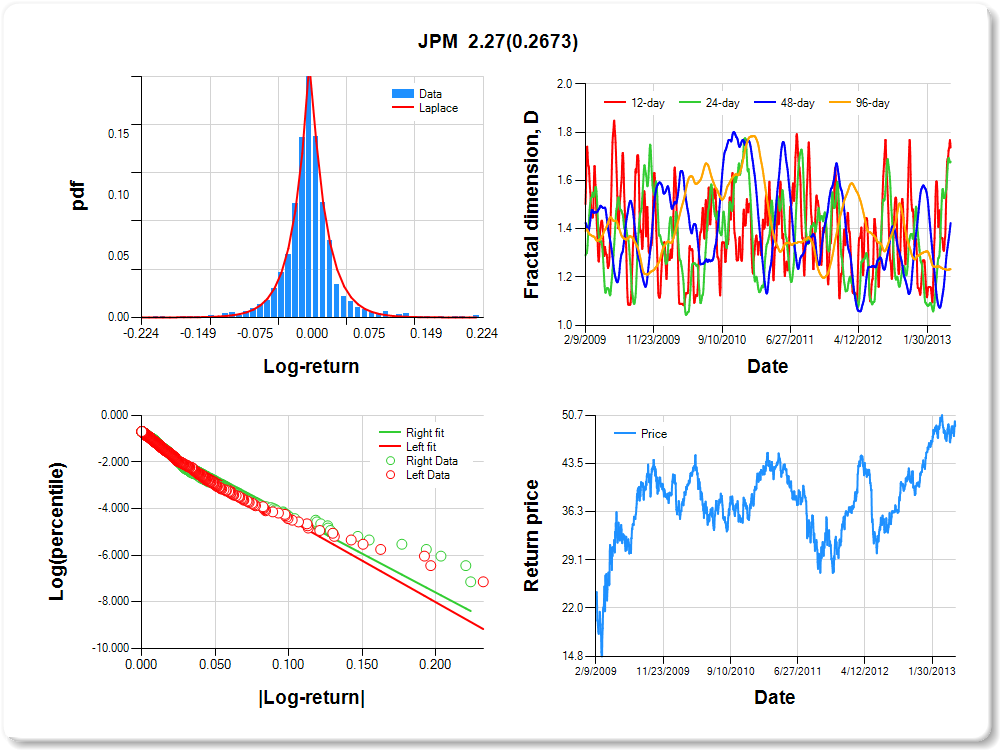

JPM

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.13 |

-0.10 |

-0.05 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.05 |

0.13 |

0.16 |

0.37 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.040 |

0.158 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.896 |

0.052 |

-17.238 |

0.0000 |

|log-return| |

-35.569 |

1.484 |

-23.964 |

0.0000 |

I(right-tail) |

-0.039 |

0.073 |

-0.540 |

0.5894 |

|log-return|*I(right-tail) |

2.269 |

2.045 |

1.110 |

0.2673 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.263 |

0.321 |

0.576 |

0.767 |

JNJ

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.03 |

0.04 |

1.13 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.300 |

0.133 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.912 |

0.054 |

-16.902 |

0.0000 |

|log-return| |

-110.238 |

4.695 |

-23.478 |

0.0000 |

I(right-tail) |

0.031 |

0.075 |

0.418 |

0.6761 |

|log-return|*I(right-tail) |

10.605 |

6.355 |

1.669 |

0.0954 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.847 |

0.903 |

0.967 |

0.764 |

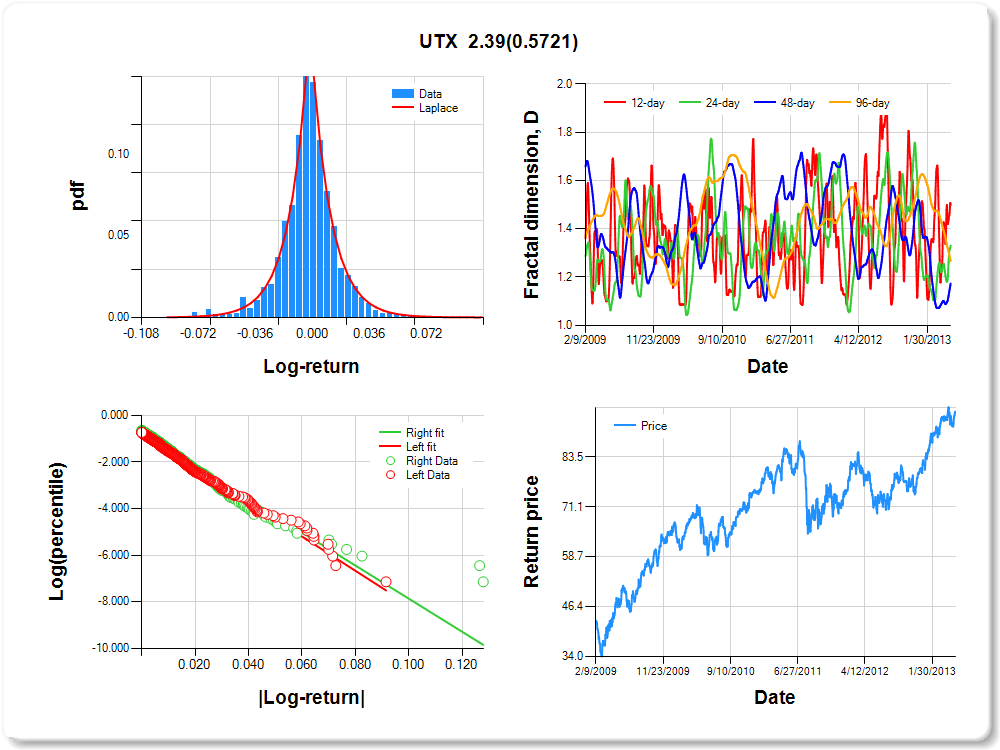

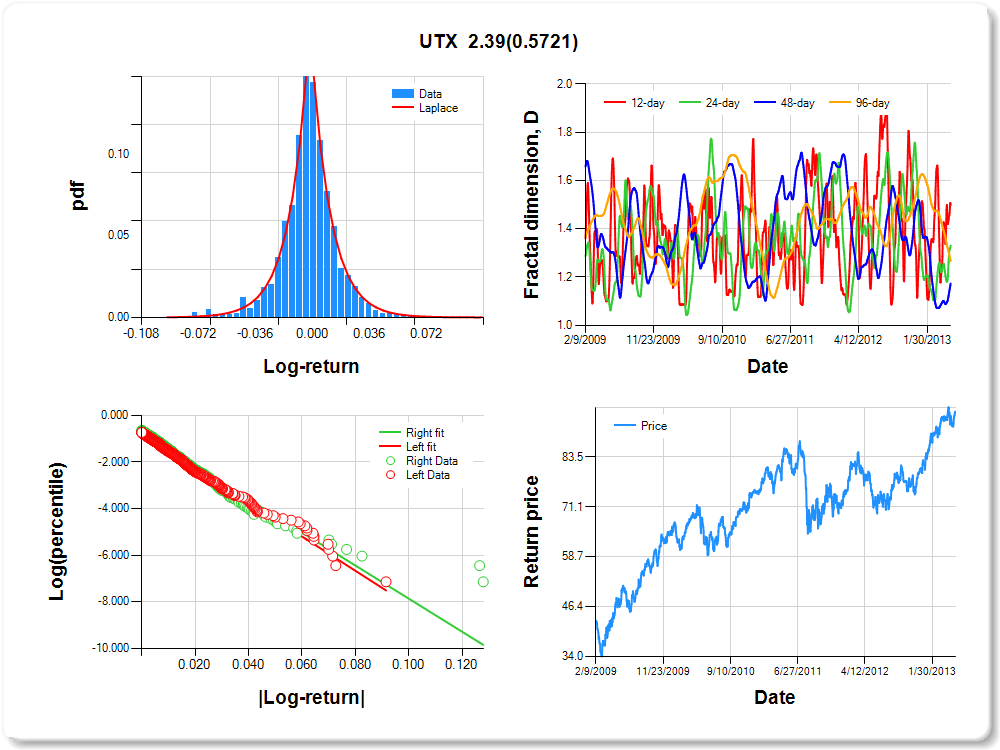

UTX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.07 |

0.06 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.275 |

0.193 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.794 |

0.057 |

-14.049 |

0.0000 |

|log-return| |

-73.320 |

3.064 |

-23.927 |

0.0000 |

I(right-tail) |

0.032 |

0.078 |

0.408 |

0.6830 |

|log-return|*I(right-tail) |

2.389 |

4.228 |

0.565 |

0.5721 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.501 |

0.669 |

0.827 |

0.733 |

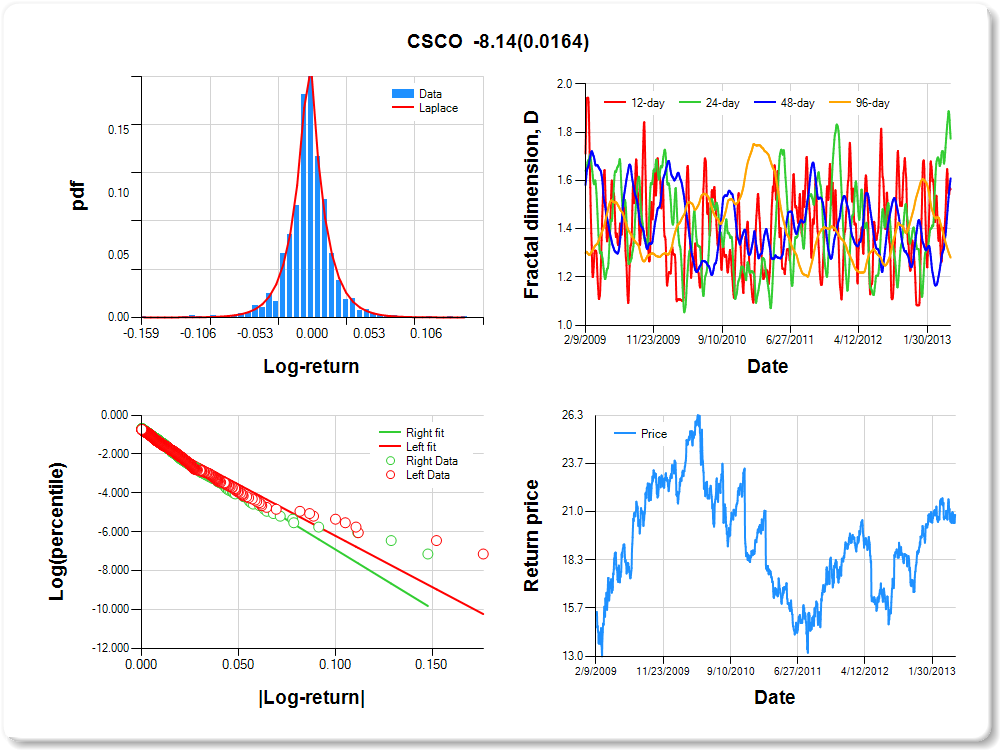

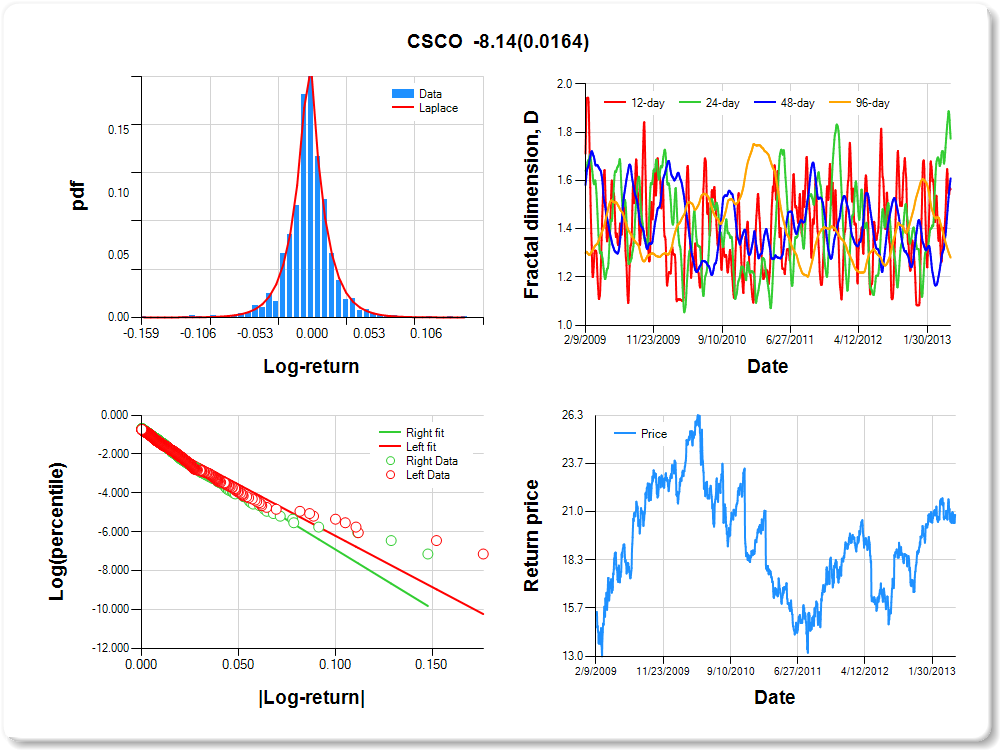

CSCO

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.10 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.07 |

1.87 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.150 |

0.149 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.916 |

0.053 |

-17.133 |

0.0000 |

|log-return| |

-52.669 |

2.263 |

-23.273 |

0.0000 |

I(right-tail) |

0.115 |

0.076 |

1.507 |

0.1321 |

|log-return|*I(right-tail) |

-8.144 |

3.387 |

-2.404 |

0.0164 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.435 |

0.226 |

0.391 |

0.719 |

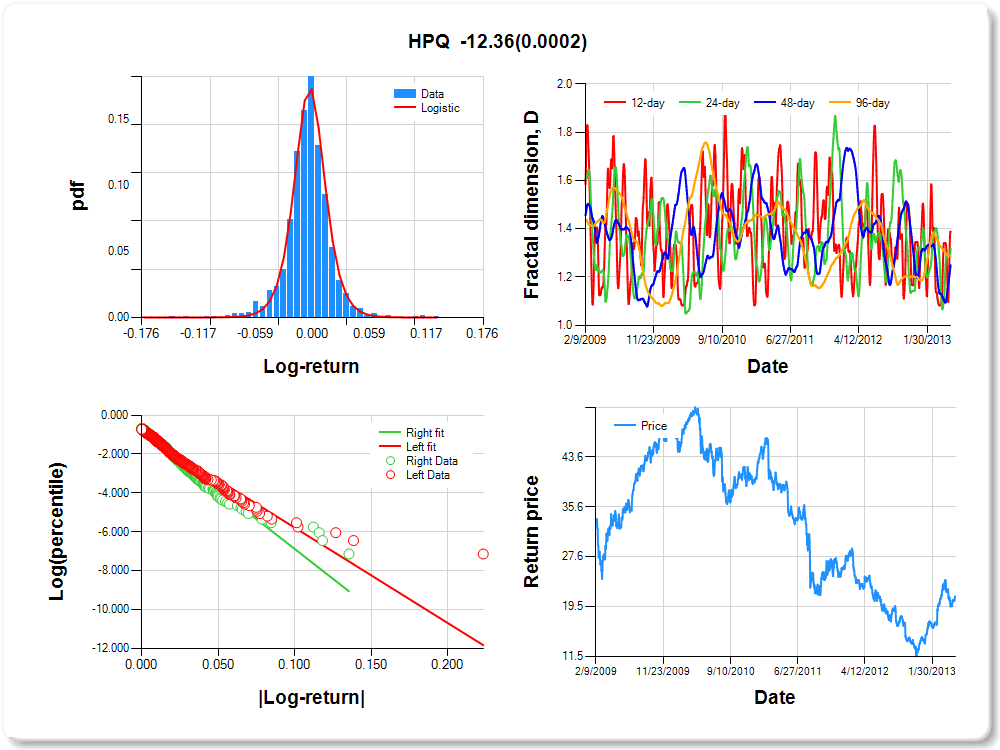

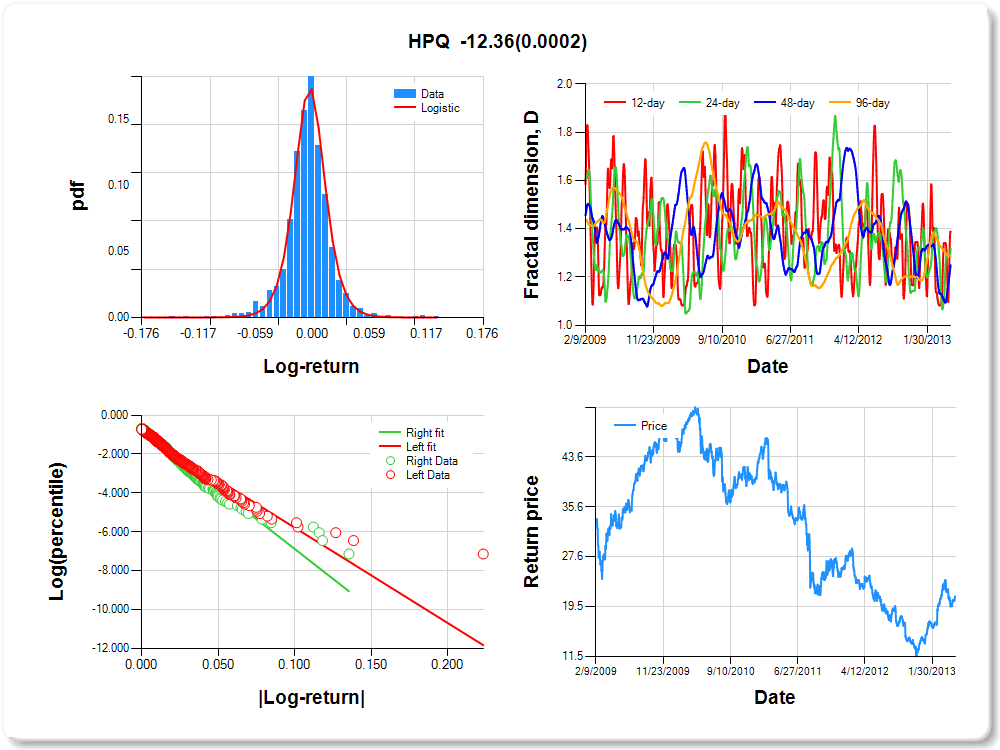

HPQ

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.07 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.08 |

0.91 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.426 |

0.098 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.878 |

0.054 |

-16.232 |

0.0000 |

|log-return| |

-49.042 |

2.099 |

-23.363 |

0.0000 |

I(right-tail) |

0.143 |

0.078 |

1.848 |

0.0648 |

|log-return|*I(right-tail) |

-12.365 |

3.290 |

-3.758 |

0.0002 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.612 |

0.681 |

0.750 |

0.713 |

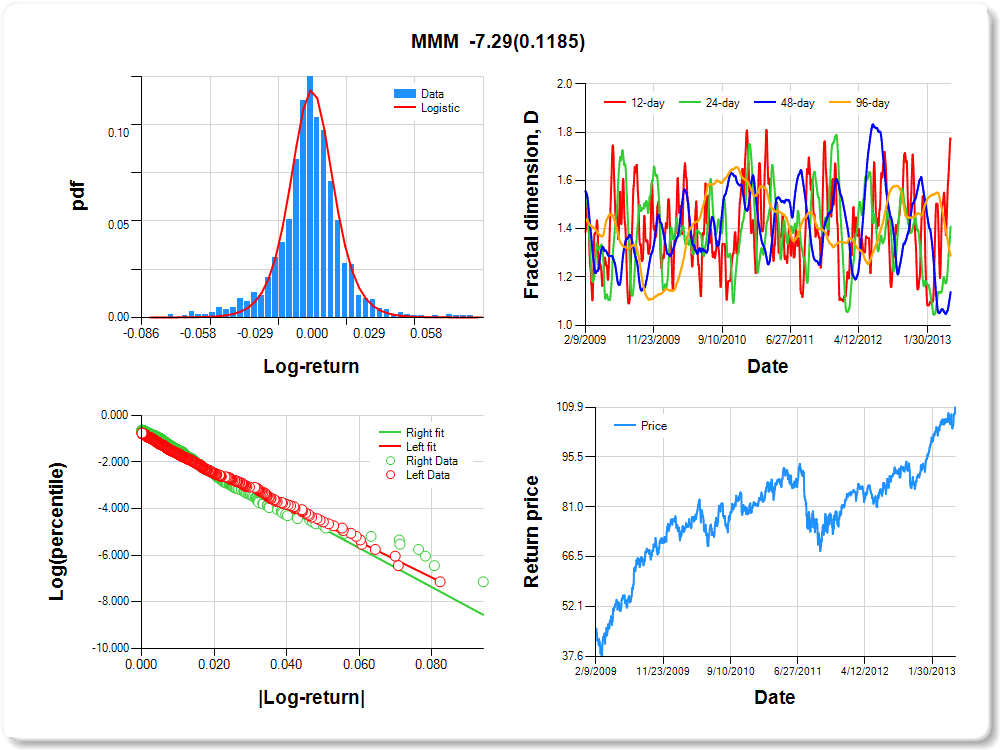

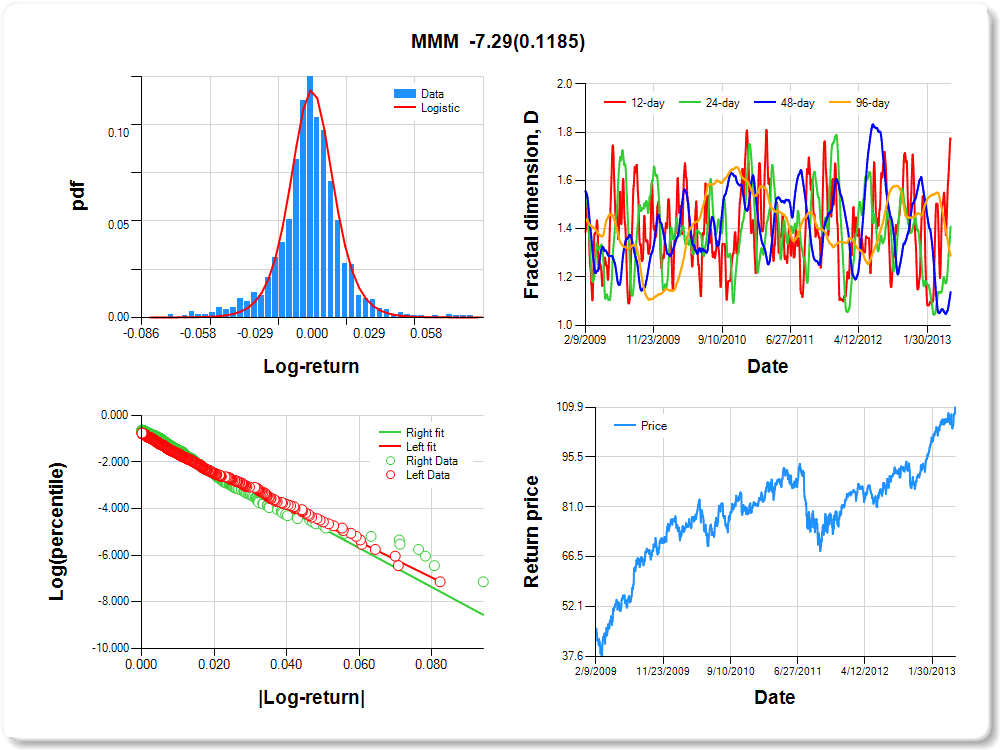

MMM

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.05 |

0.07 |

1.31 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.088 |

0.139 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.843 |

0.057 |

-14.853 |

0.0000 |

|log-return| |

-76.386 |

3.237 |

-23.597 |

0.0000 |

I(right-tail) |

0.172 |

0.079 |

2.178 |

0.0296 |

|log-return|*I(right-tail) |

-7.290 |

4.666 |

-1.562 |

0.1185 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.226 |

0.591 |

0.862 |

0.712 |

HD

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.08 |

0.58 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.349 |

0.214 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.785 |

0.057 |

-13.687 |

0.0000 |

|log-return| |

-70.117 |

2.941 |

-23.838 |

0.0000 |

I(right-tail) |

0.031 |

0.078 |

0.395 |

0.6929 |

|log-return|*I(right-tail) |

7.791 |

3.875 |

2.011 |

0.0446 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.717 |

0.693 |

0.694 |

0.706 |

BA

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.08 |

1.20 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.474 |

0.238 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.753 |

0.057 |

-13.104 |

0.0000 |

|log-return| |

-62.723 |

2.618 |

-23.957 |

0.0000 |

I(right-tail) |

0.055 |

0.080 |

0.685 |

0.4936 |

|log-return|*I(right-tail) |

-0.927 |

3.678 |

-0.252 |

0.8010 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.619 |

0.710 |

0.786 |

0.702 |

PG

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.04 |

0.04 |

1.14 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.137 |

0.159 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.911 |

0.055 |

-16.577 |

0.0000 |

|log-return| |

-95.424 |

4.084 |

-23.368 |

0.0000 |

I(right-tail) |

0.164 |

0.077 |

2.133 |

0.0331 |

|log-return|*I(right-tail) |

-8.284 |

5.866 |

-1.412 |

0.1581 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.634 |

0.677 |

0.890 |

0.687 |

PFE

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.04 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

0.56 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.099 |

0.126 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.812 |

0.055 |

-14.719 |

0.0000 |

|log-return| |

-78.979 |

3.300 |

-23.930 |

0.0000 |

I(right-tail) |

0.132 |

0.080 |

1.646 |

0.0999 |

|log-return|*I(right-tail) |

-1.787 |

4.694 |

-0.381 |

0.7035 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.728 |

0.727 |

0.866 |

0.674 |

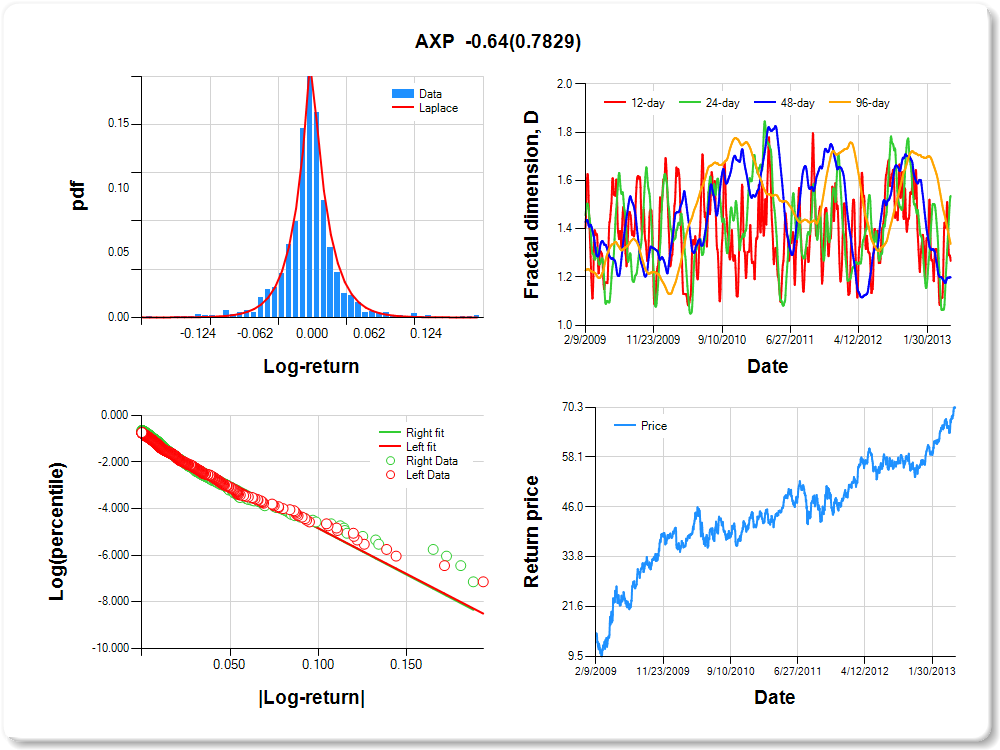

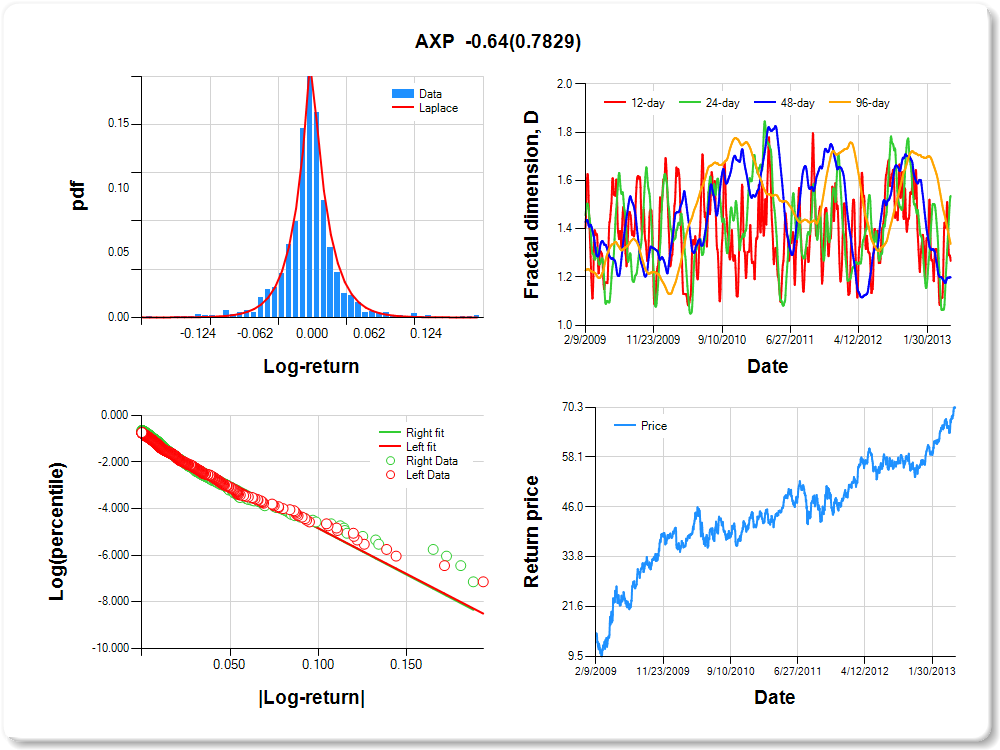

AXP

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.11 |

-0.09 |

-0.05 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.05 |

0.10 |

0.13 |

1.13 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.047 |

0.161 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.928 |

0.053 |

-17.428 |

0.0000 |

|log-return| |

-39.180 |

1.657 |

-23.648 |

0.0000 |

I(right-tail) |

0.063 |

0.073 |

0.861 |

0.3894 |

|log-return|*I(right-tail) |

-0.641 |

2.328 |

-0.276 |

0.7829 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.733 |

0.464 |

0.801 |

0.663 |

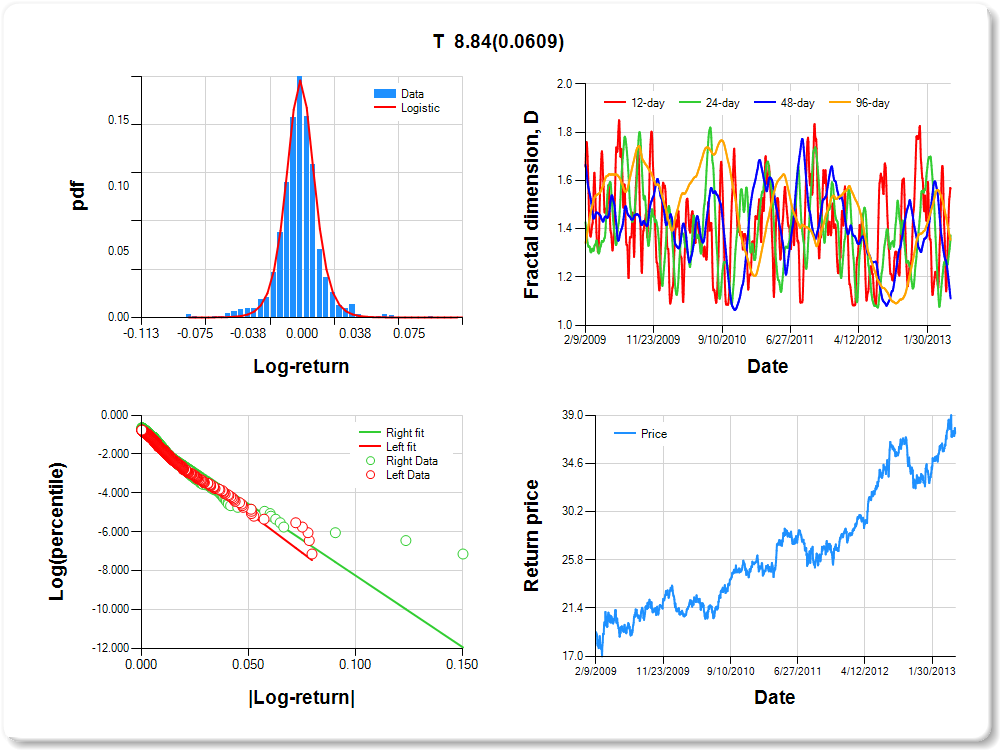

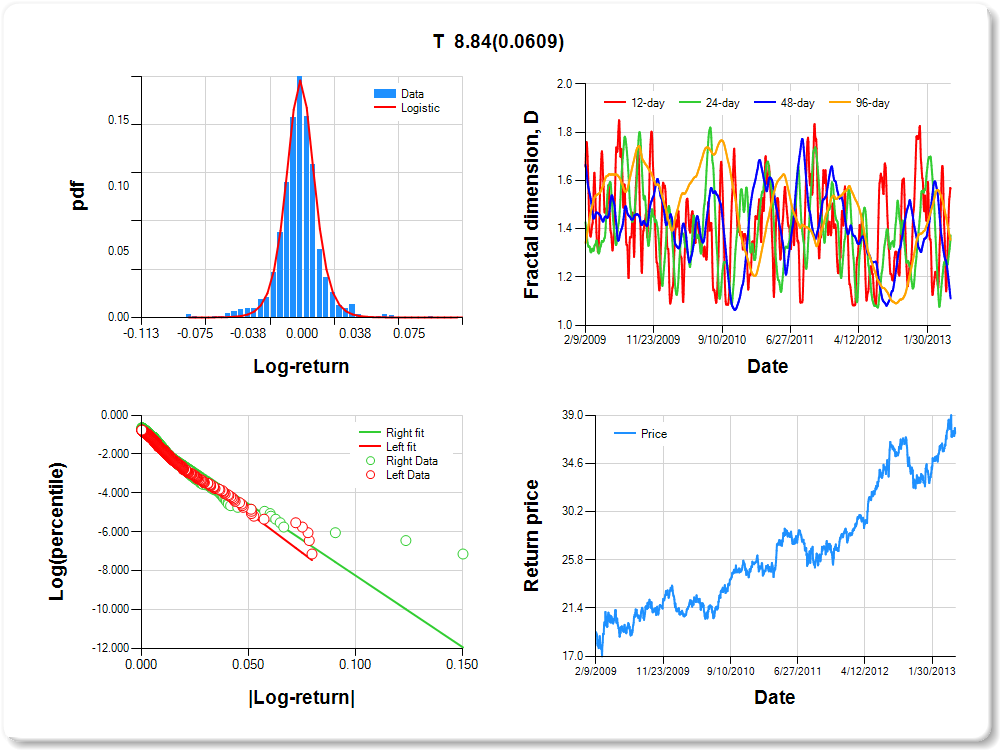

T

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.06 |

0.82 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.513 |

0.095 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.875 |

0.056 |

-15.636 |

0.0000 |

|log-return| |

-82.324 |

3.524 |

-23.359 |

0.0000 |

I(right-tail) |

-0.002 |

0.076 |

-0.030 |

0.9763 |

|log-return|*I(right-tail) |

8.836 |

4.710 |

1.876 |

0.0609 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.433 |

0.627 |

0.889 |

0.646 |

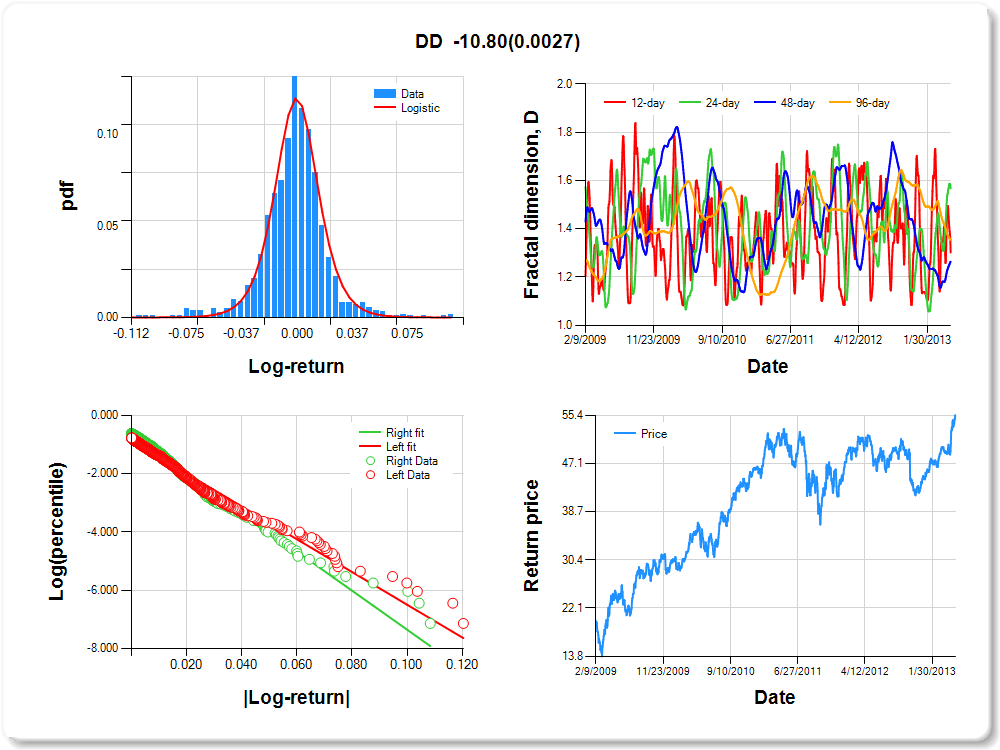

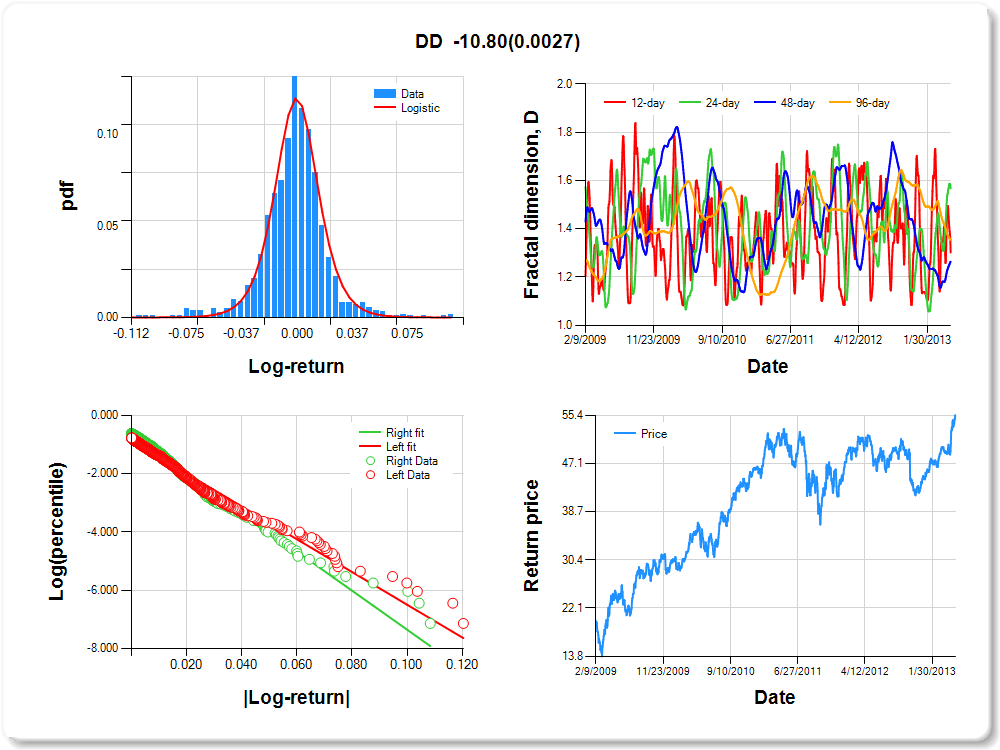

DD

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.07 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.08 |

0.40 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.116 |

0.143 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.871 |

0.057 |

-15.328 |

0.0000 |

|log-return| |

-56.166 |

2.414 |

-23.265 |

0.0000 |

I(right-tail) |

0.226 |

0.079 |

2.867 |

0.0042 |

|log-return|*I(right-tail) |

-10.798 |

3.588 |

-3.009 |

0.0027 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.698 |

0.432 |

0.736 |

0.646 |

DIS

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.08 |

0.44 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.301 |

0.194 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.842 |

0.056 |

-15.120 |

0.0000 |

|log-return| |

-62.480 |

2.637 |

-23.694 |

0.0000 |

I(right-tail) |

0.049 |

0.077 |

0.637 |

0.5243 |

|log-return|*I(right-tail) |

2.787 |

3.593 |

0.776 |

0.4382 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.890 |

0.785 |

0.833 |

0.638 |

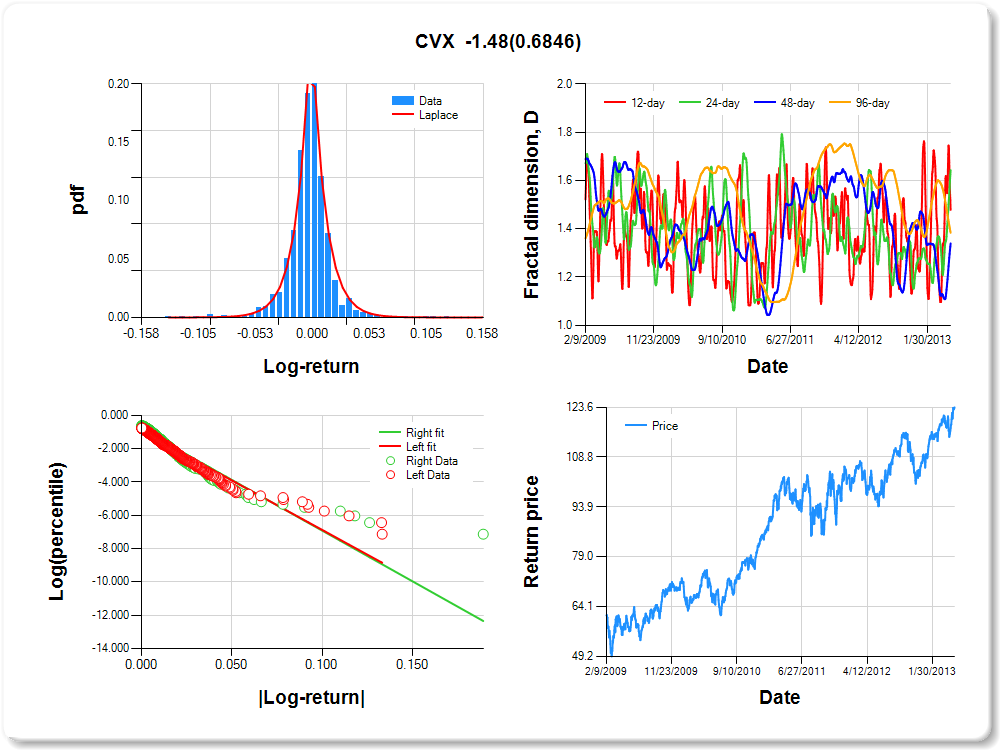

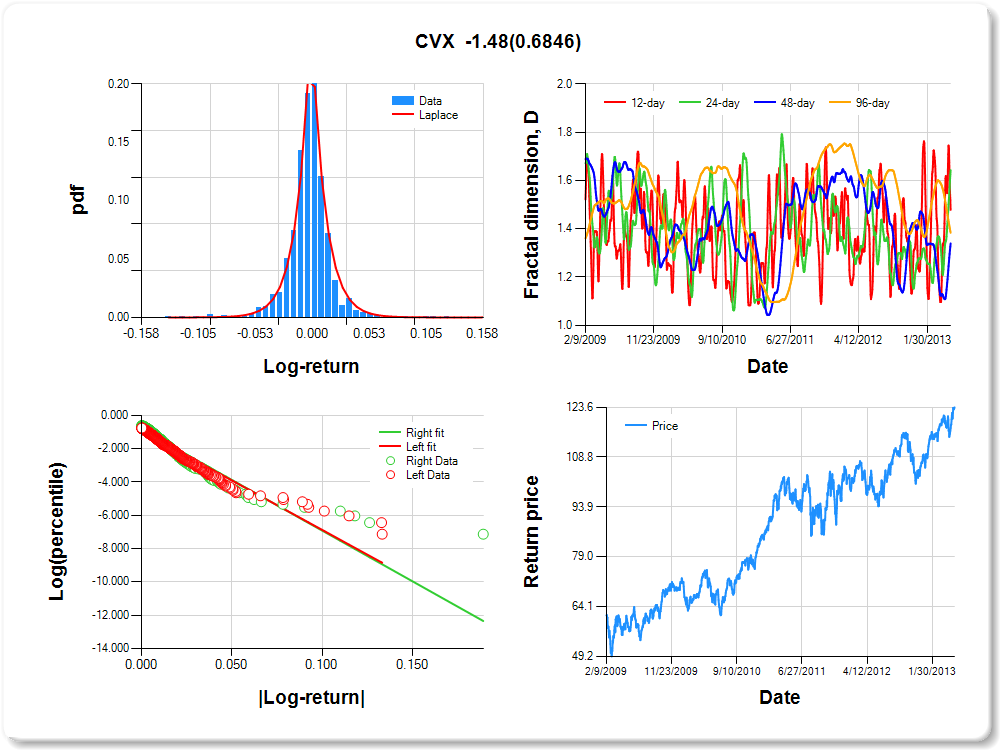

CVX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.09 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.07 |

1.30 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.276 |

0.134 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.954 |

0.054 |

-17.532 |

0.0000 |

|log-return| |

-59.236 |

2.590 |

-22.874 |

0.0000 |

I(right-tail) |

0.104 |

0.074 |

1.403 |

0.1608 |

|log-return|*I(right-tail) |

-1.479 |

3.641 |

-0.406 |

0.6846 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.521 |

0.357 |

0.660 |

0.616 |

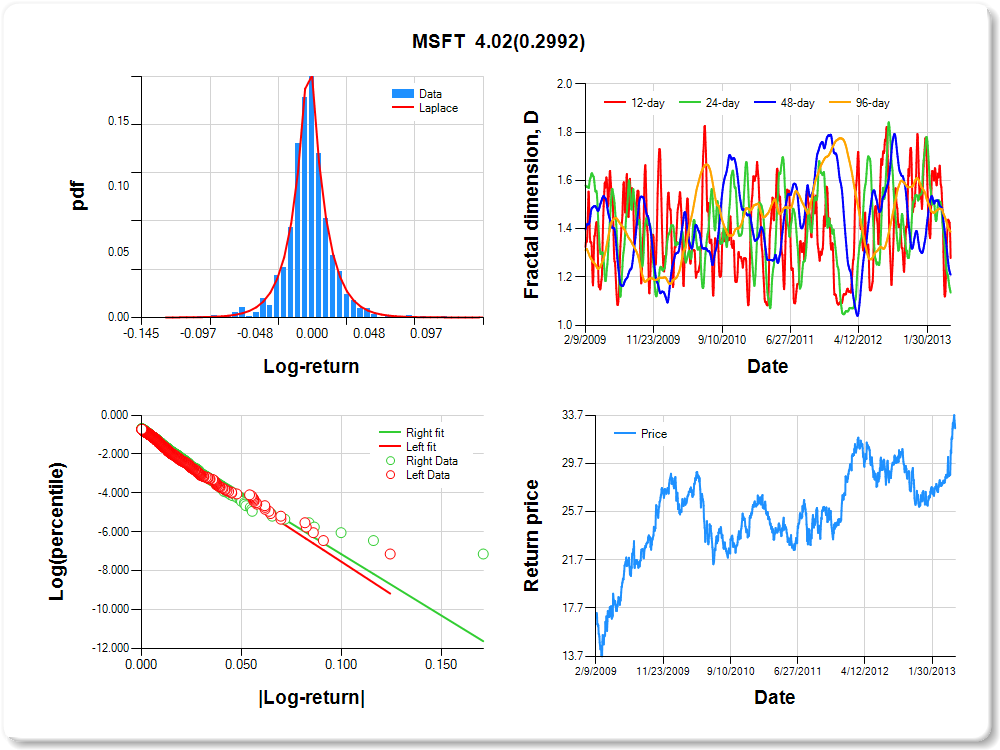

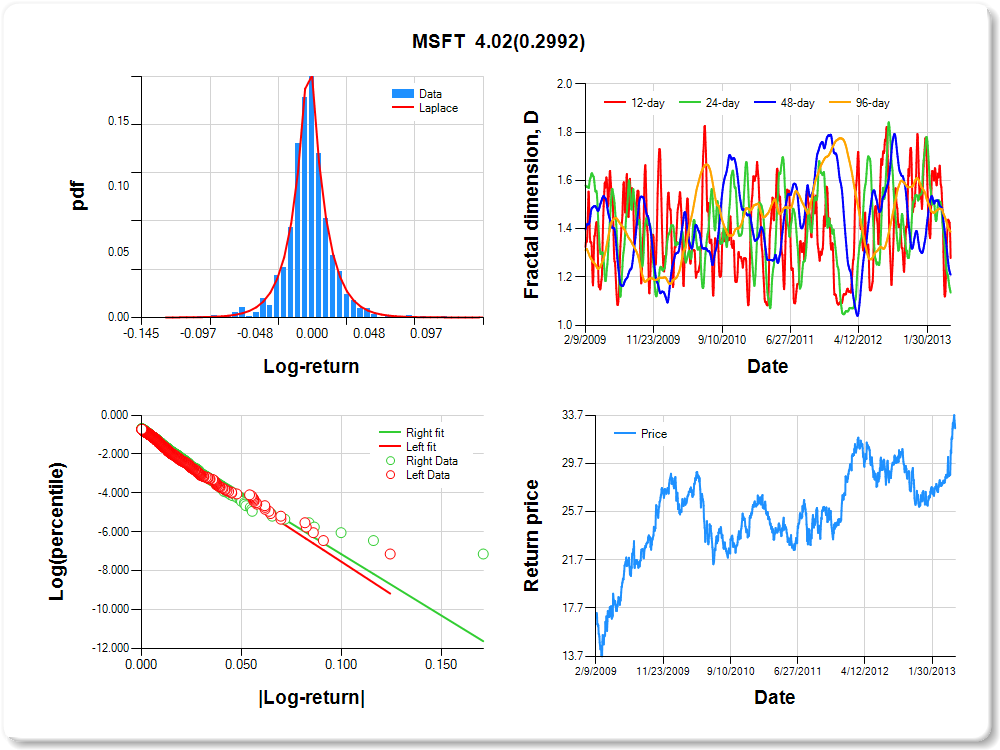

MSFT

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.07 |

0.86 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.270 |

0.154 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.818 |

0.055 |

-14.842 |

0.0000 |

|log-return| |

-67.143 |

2.807 |

-23.921 |

0.0000 |

I(right-tail) |

-0.014 |

0.077 |

-0.182 |

0.8558 |

|log-return|*I(right-tail) |

4.016 |

3.867 |

1.039 |

0.2992 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.721 |

0.864 |

0.790 |

0.612 |

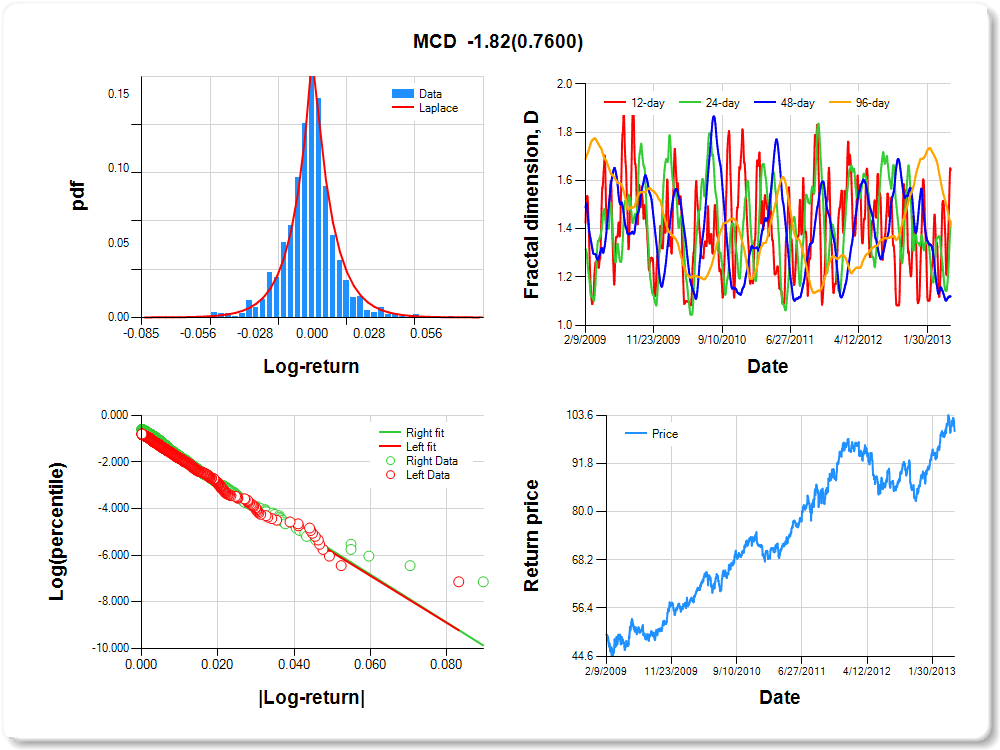

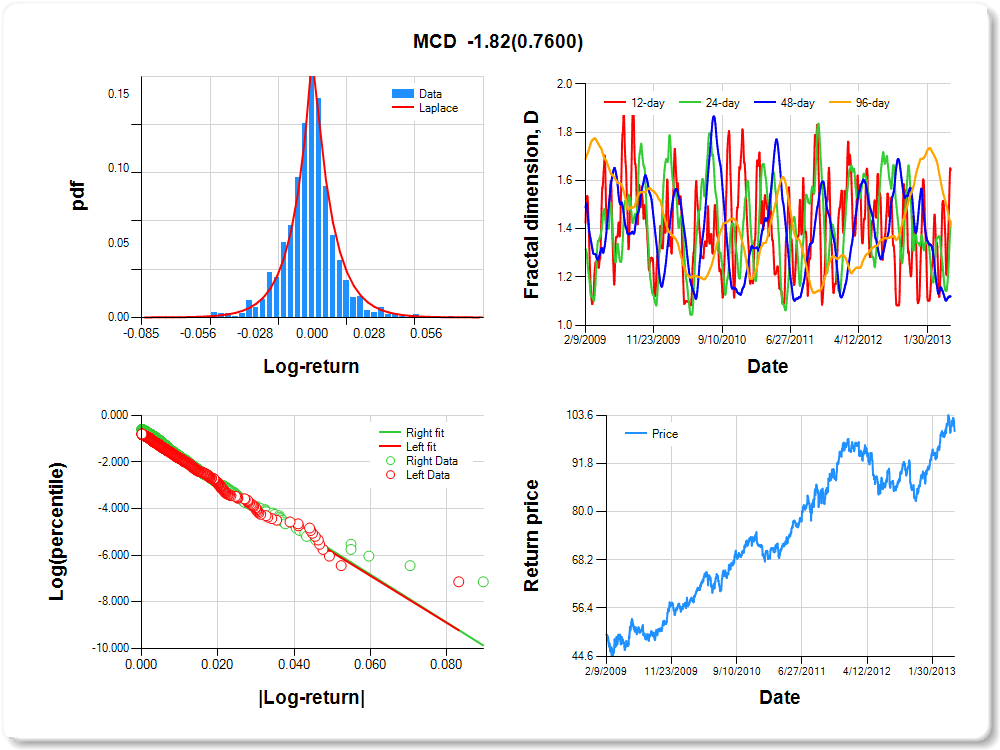

MCD

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.04 |

0.20 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.025 |

0.187 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.832 |

0.060 |

-13.979 |

0.0000 |

|log-return| |

-100.745 |

4.375 |

-23.026 |

0.0000 |

I(right-tail) |

0.163 |

0.080 |

2.046 |

0.0410 |

|log-return|*I(right-tail) |

-1.821 |

5.959 |

-0.305 |

0.7600 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.357 |

0.569 |

0.880 |

0.589 |

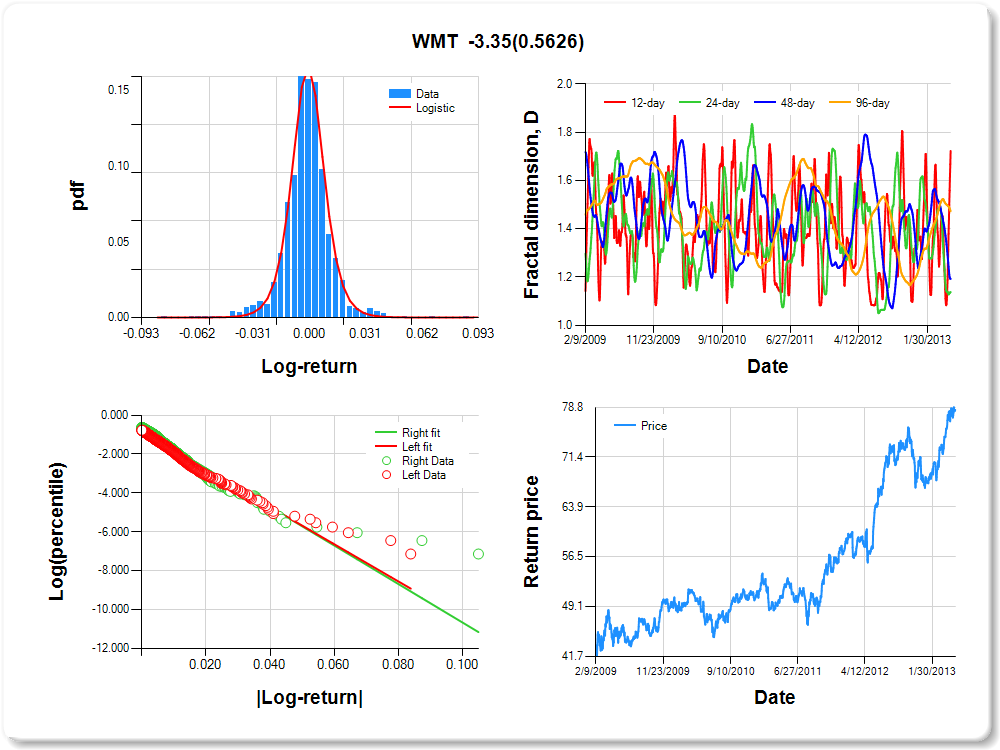

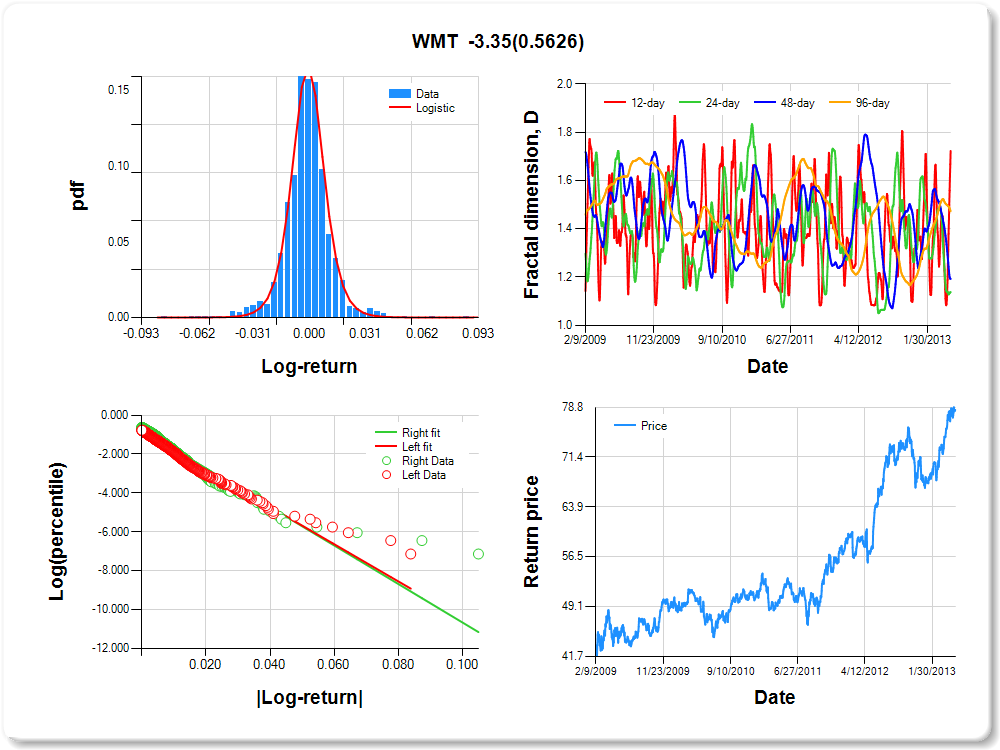

WMT

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.04 |

0.46 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.178 |

0.103 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.881 |

0.056 |

-15.636 |

0.0000 |

|log-return| |

-95.695 |

4.123 |

-23.209 |

0.0000 |

I(right-tail) |

0.136 |

0.077 |

1.756 |

0.0793 |

|log-return|*I(right-tail) |

-3.351 |

5.786 |

-0.579 |

0.5626 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.277 |

0.862 |

0.808 |

0.527 |

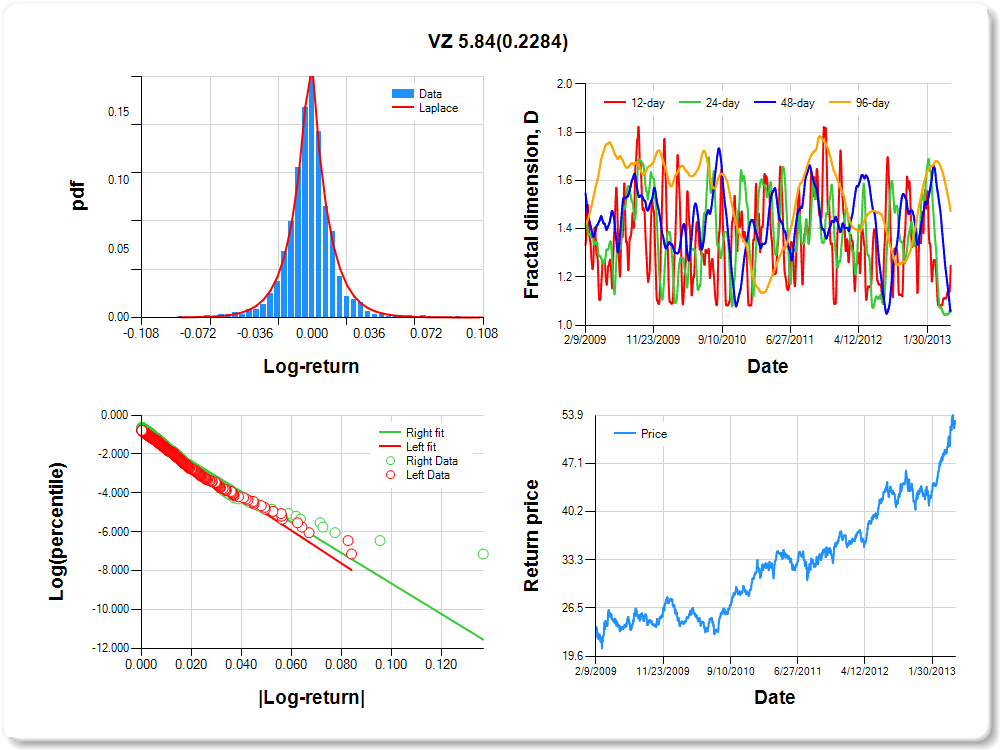

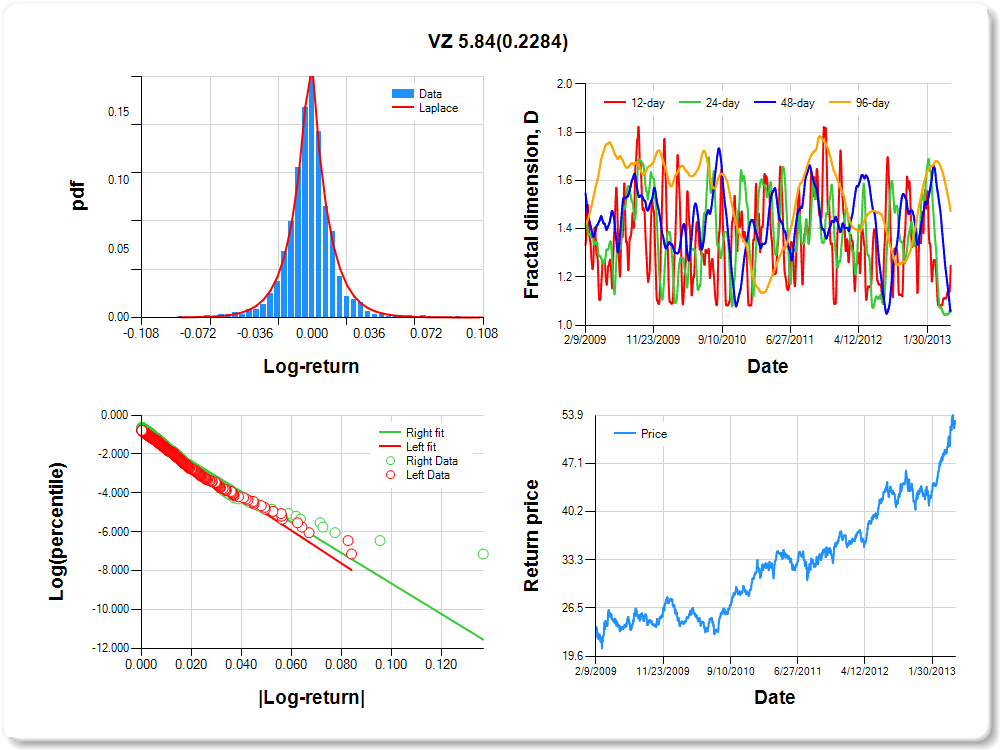

VZ

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.06 |

0.85 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.397 |

0.166 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.858 |

0.057 |

-15.009 |

0.0000 |

|log-return| |

-84.372 |

3.622 |

-23.296 |

0.0000 |

I(right-tail) |

0.072 |

0.077 |

0.935 |

0.3498 |

|log-return|*I(right-tail) |

5.835 |

4.842 |

1.205 |

0.2284 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.753 |

0.936 |

0.943 |

0.527 |

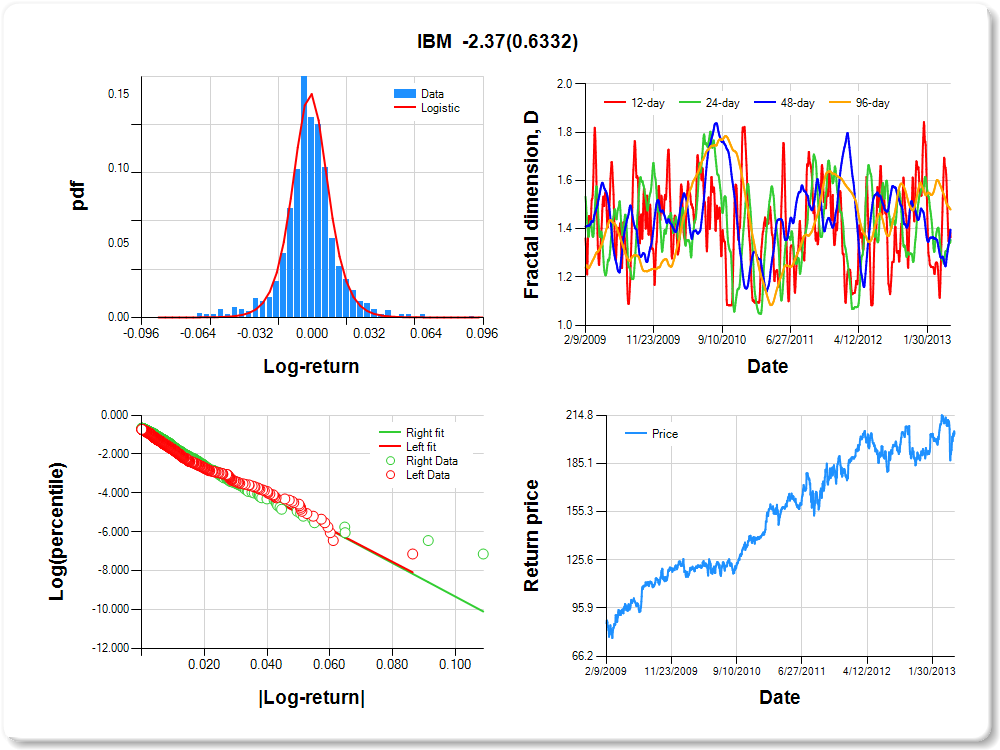

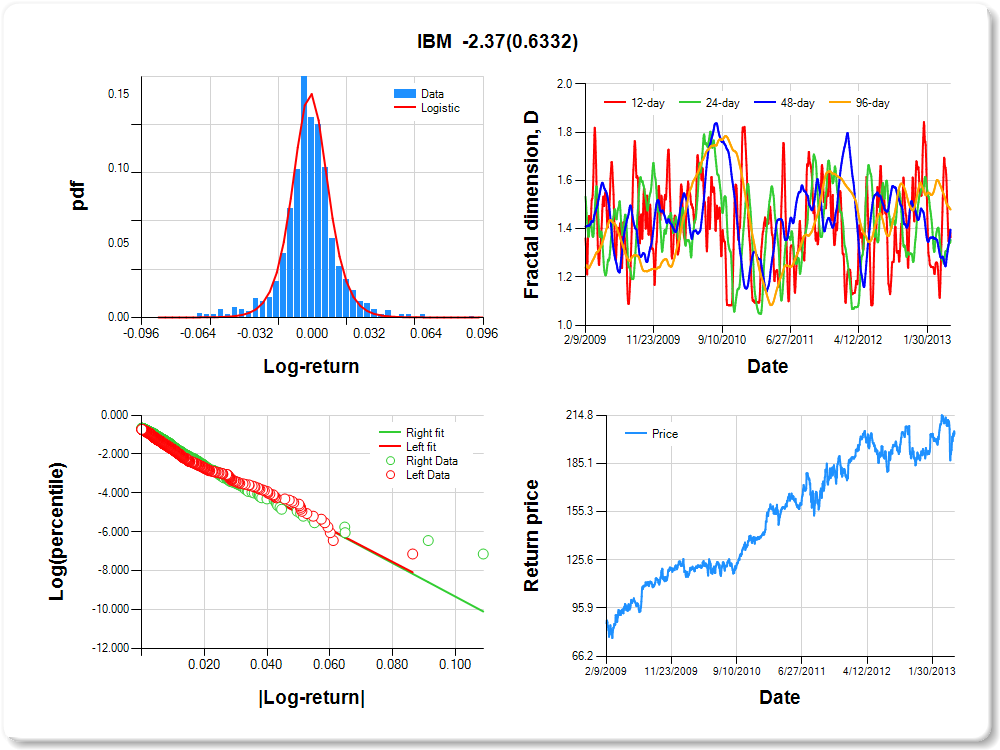

IBM

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

1.59 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.186 |

0.114 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.847 |

0.055 |

-15.526 |

0.0000 |

|log-return| |

-83.694 |

3.500 |

-23.910 |

0.0000 |

I(right-tail) |

0.126 |

0.077 |

1.629 |

0.1036 |

|log-return|*I(right-tail) |

-2.366 |

4.957 |

-0.477 |

0.6332 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.636 |

0.646 |

0.604 |

0.520 |

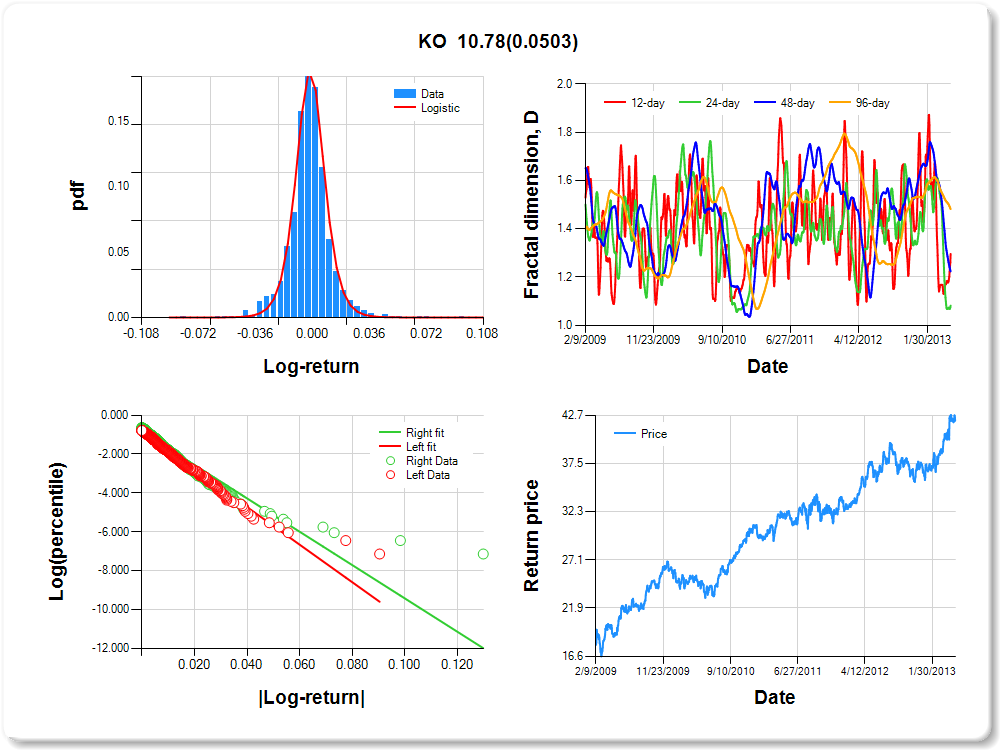

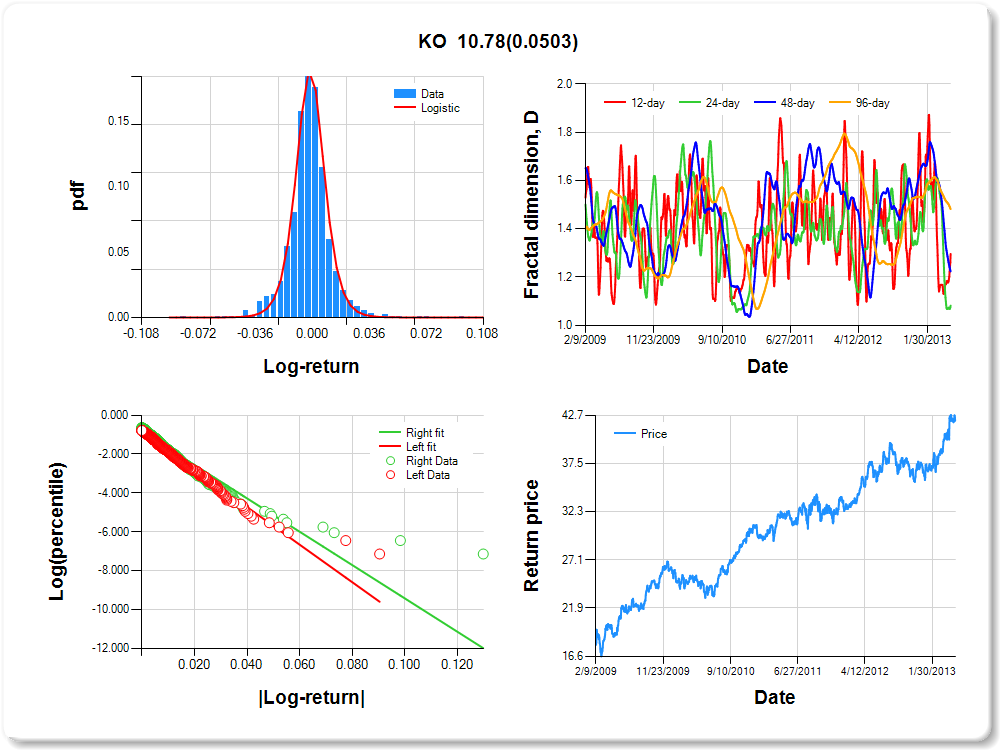

KO

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

1.15 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.295 |

0.090 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.841 |

0.058 |

-14.473 |

0.0000 |

|log-return| |

-96.633 |

4.176 |

-23.139 |

0.0000 |

I(right-tail) |

0.015 |

0.078 |

0.195 |

0.8456 |

|log-return|*I(right-tail) |

10.782 |

5.502 |

1.960 |

0.0503 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.704 |

0.918 |

0.776 |

0.519 |

GE

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.10 |

-0.08 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.07 |

0.10 |

1.38 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.344 |

0.172 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.881 |

0.055 |

-16.083 |

0.0000 |

|log-return| |

-49.458 |

2.088 |

-23.685 |

0.0000 |

I(right-tail) |

0.038 |

0.076 |

0.504 |

0.6145 |

|log-return|*I(right-tail) |

-1.644 |

2.979 |

-0.552 |

0.5811 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.665 |

0.650 |

0.756 |

0.479 |

INTC

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.07 |

0.51 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.036 |

0.149 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.732 |

0.059 |

-12.484 |

0.0000 |

|log-return| |

-66.298 |

2.774 |

-23.901 |

0.0000 |

I(right-tail) |

0.040 |

0.082 |

0.486 |

0.6269 |

|log-return|*I(right-tail) |

0.051 |

3.877 |

0.013 |

0.9895 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.855 |

0.482 |

0.428 |

0.478 |

MRK

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.07 |

0.91 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.012 |

0.114 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.881 |

0.054 |

-16.428 |

0.0000 |

|log-return| |

-67.379 |

2.848 |

-23.659 |

0.0000 |

I(right-tail) |

0.111 |

0.077 |

1.444 |

0.1489 |

|log-return|*I(right-tail) |

-2.874 |

4.080 |

-0.704 |

0.4813 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.601 |

0.762 |

0.606 |

0.421 |

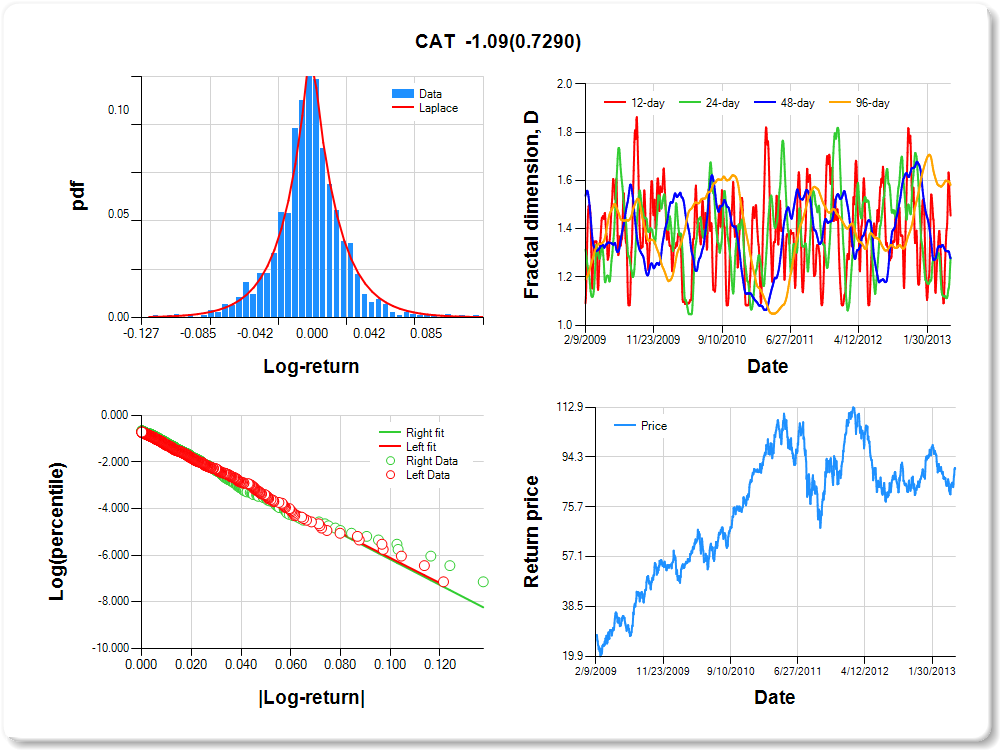

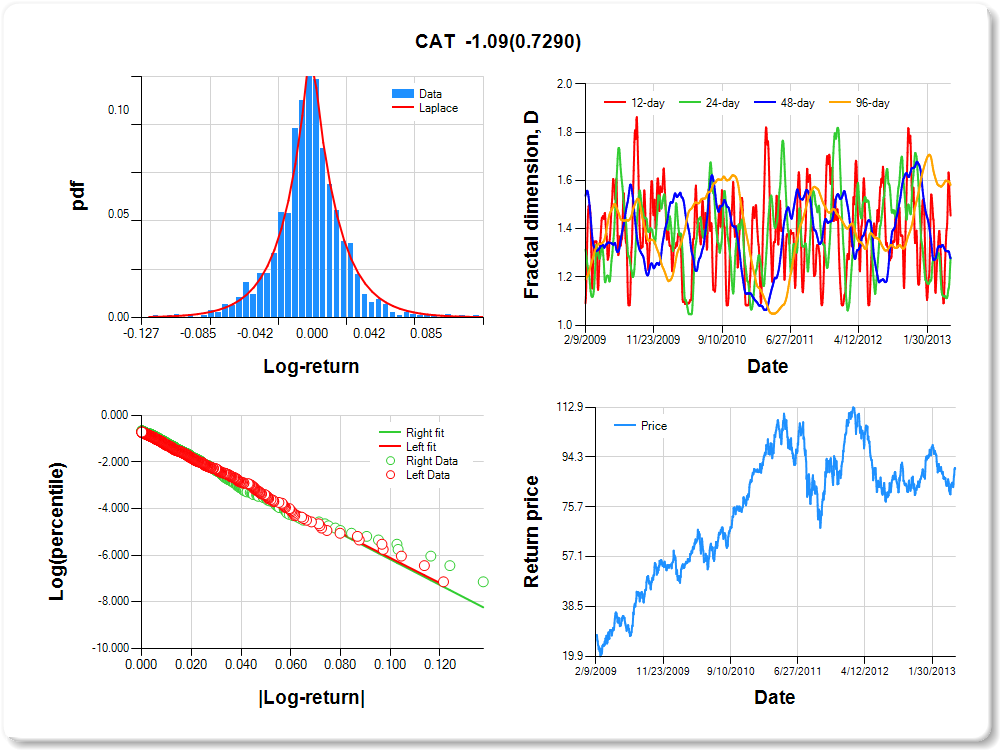

CAT

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.07 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.07 |

0.09 |

1.13 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.087 |

0.251 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.726 |

0.057 |

-12.625 |

0.0000 |

|log-return| |

-53.896 |

2.228 |

-24.195 |

0.0000 |

I(right-tail) |

0.051 |

0.080 |

0.640 |

0.5225 |

|log-return|*I(right-tail) |

-1.092 |

3.151 |

-0.347 |

0.7290 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.545 |

0.718 |

0.722 |

0.418 |

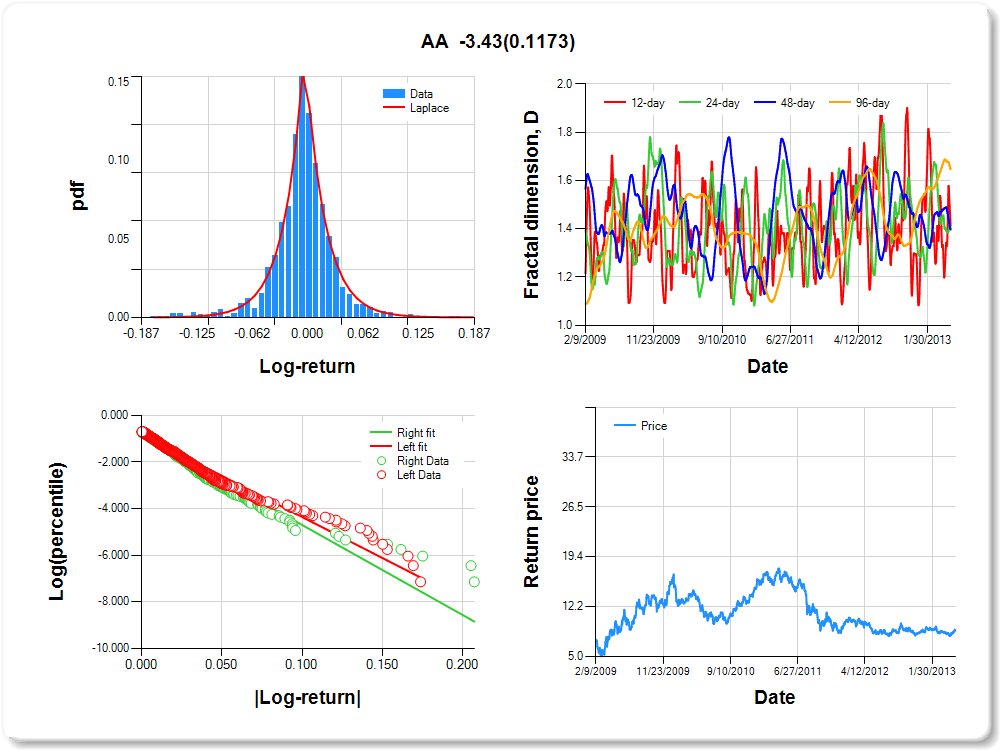

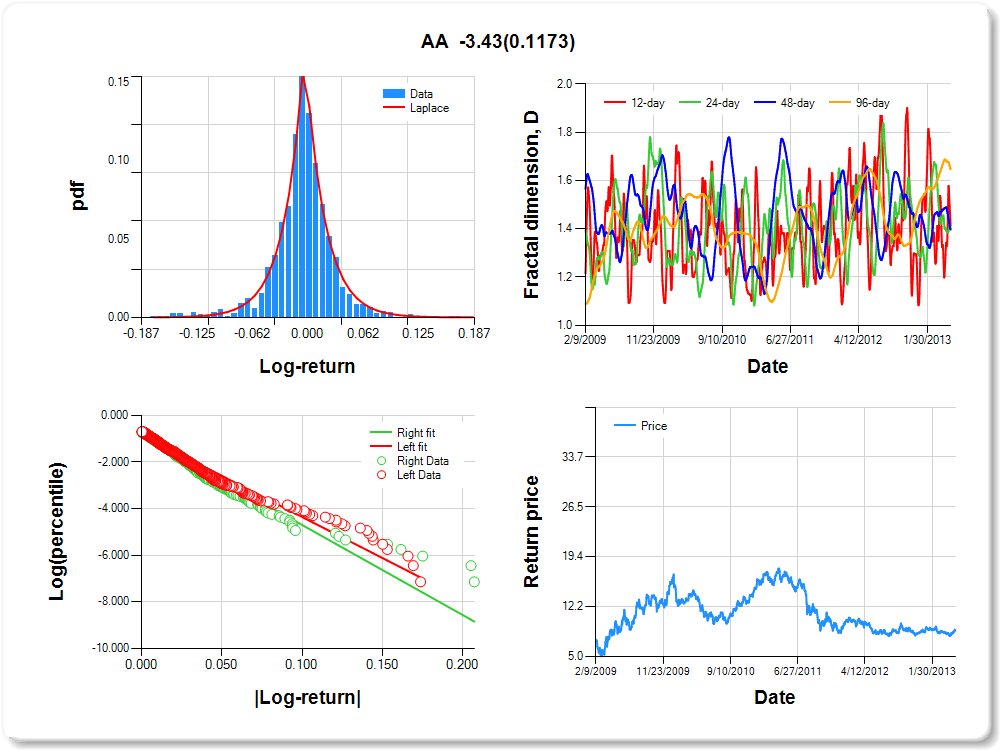

AA

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.13 |

-0.11 |

-0.05 |

-0.04 |

-0.02 |

0.00 |

0.02 |

0.05 |

0.10 |

0.13 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.152 |

0.200 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.837 |

0.054 |

-15.558 |

0.0000 |

|log-return| |

-35.128 |

1.461 |

-24.049 |

0.0000 |

I(right-tail) |

0.001 |

0.077 |

0.009 |

0.9928 |

|log-return|*I(right-tail) |

-3.428 |

2.187 |

-1.567 |

0.1173 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.586 |

0.598 |

0.603 |

0.354 |

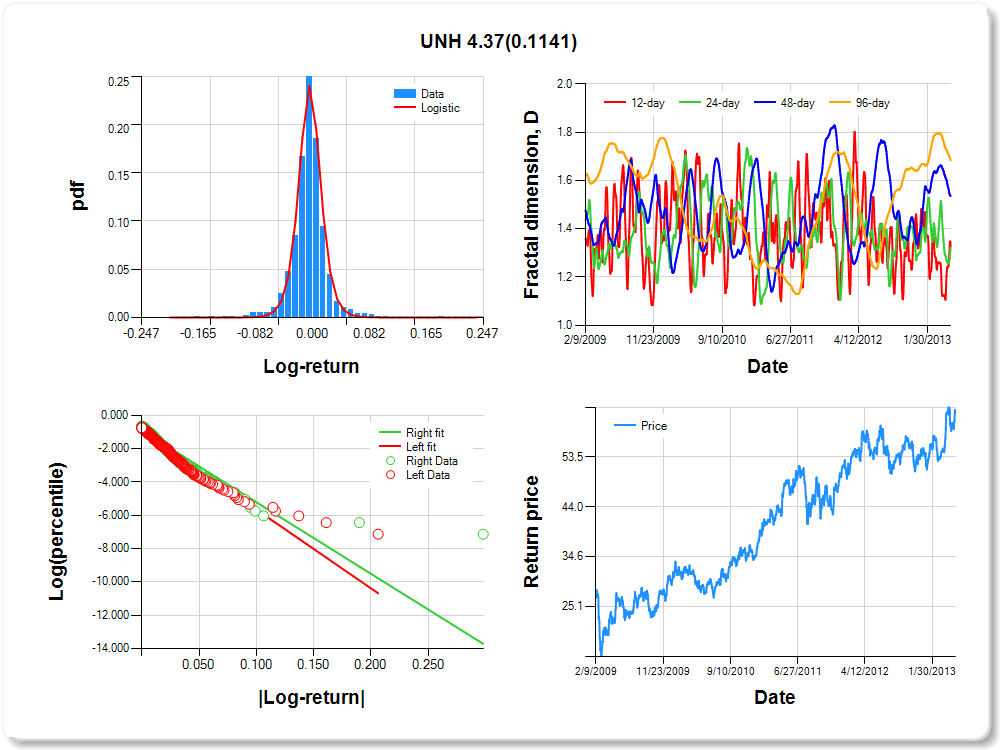

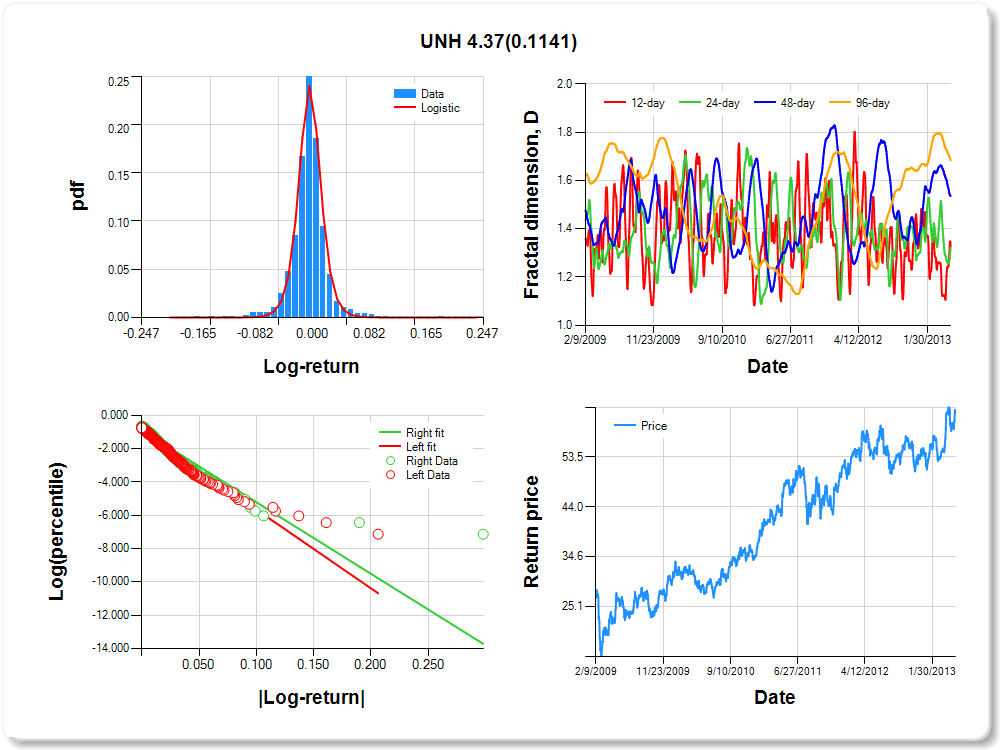

UNH

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.09 |

-0.07 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.08 |

0.10 |

0.49 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.305 |

0.070 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.926 |

0.054 |

-17.085 |

0.0000 |

|log-return| |

-47.303 |

2.052 |

-23.055 |

0.0000 |

I(right-tail) |

0.000 |

0.074 |

-0.004 |

0.9969 |

|log-return|*I(right-tail) |

4.373 |

2.766 |

1.581 |

0.1141 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.672 |

0.677 |

0.464 |

0.316 |

XOM

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.05 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.09 |

0.47 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.045 |

0.079 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.946 |

0.052 |

-18.208 |

0.0000 |

|log-return| |

-65.188 |

2.811 |

-23.188 |

0.0000 |

I(right-tail) |

0.014 |

0.073 |

0.190 |

0.8491 |

|log-return|*I(right-tail) |

1.731 |

3.934 |

0.440 |

0.6601 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.429 |

0.491 |

0.462 |

0.236 |