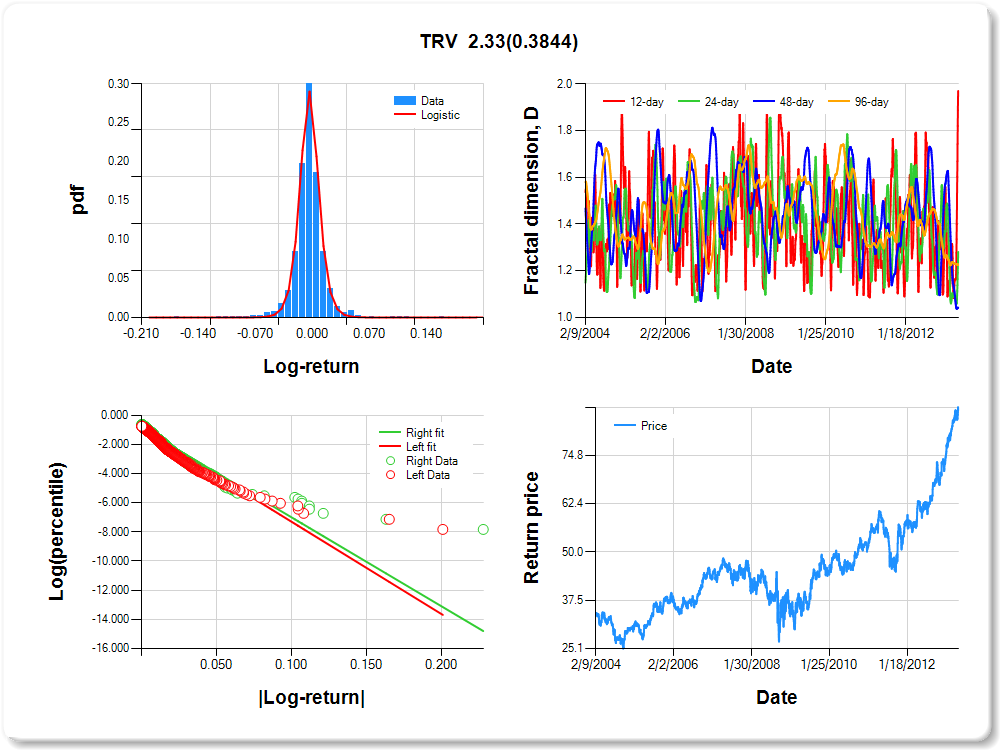

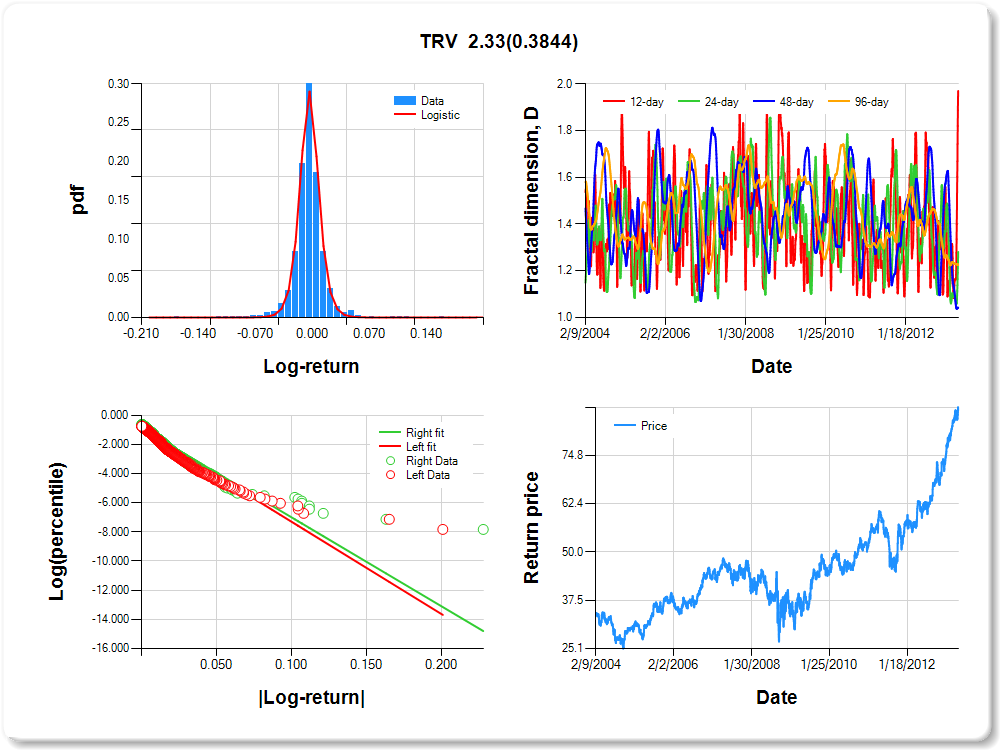

TRV

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.105 |

0.059 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.976 |

0.038 |

-25.906 |

0.0000 |

|log-return| |

-63.368 |

1.962 |

-32.296 |

0.0000 |

I(right-tail) |

0.070 |

0.052 |

1.349 |

0.1775 |

|log-return|*I(right-tail) |

2.326 |

2.674 |

0.870 |

0.3844 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.029 |

0.719 |

0.958 |

0.775 |

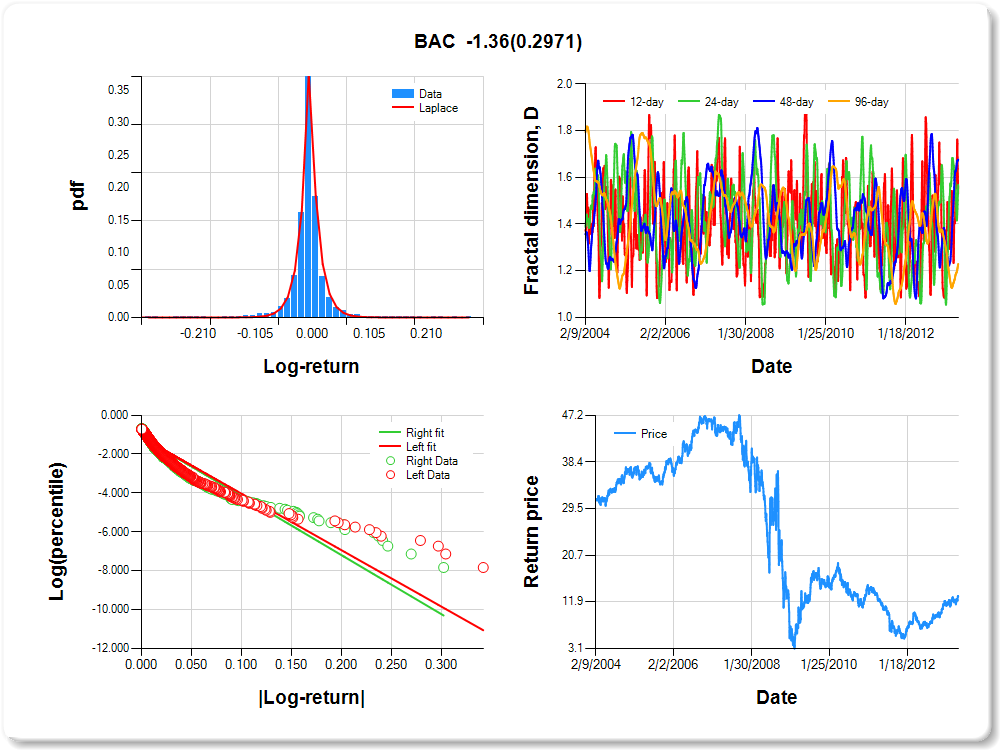

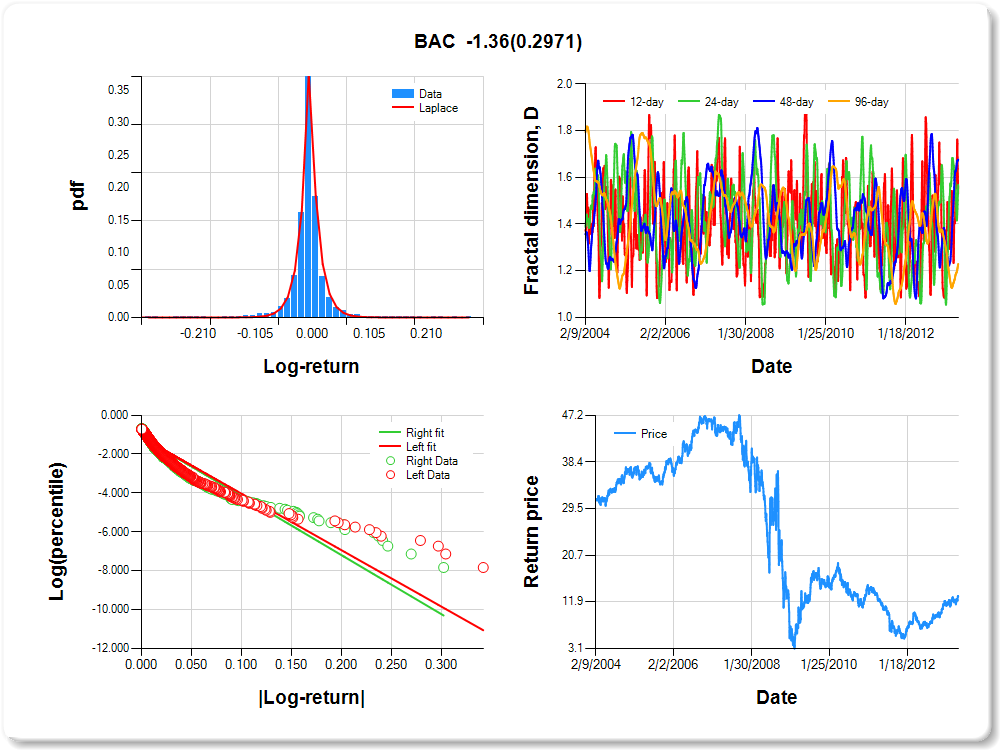

BAC

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.14 |

-0.11 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.12 |

0.17 |

0.26 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.108 |

0.083 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.136 |

0.034 |

-33.711 |

0.0000 |

|log-return| |

-29.051 |

0.908 |

-32.012 |

0.0000 |

I(right-tail) |

0.017 |

0.047 |

0.368 |

0.7130 |

|log-return|*I(right-tail) |

-1.360 |

1.304 |

-1.043 |

0.2971 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.469 |

0.432 |

0.323 |

0.770 |

JPM

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.10 |

-0.08 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.09 |

0.13 |

0.12 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.028 |

0.112 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.985 |

0.036 |

-27.548 |

0.0000 |

|log-return| |

-44.570 |

1.337 |

-33.346 |

0.0000 |

I(right-tail) |

-0.013 |

0.050 |

-0.270 |

0.7875 |

|log-return|*I(right-tail) |

3.057 |

1.827 |

1.673 |

0.0944 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.263 |

0.321 |

0.576 |

0.767 |

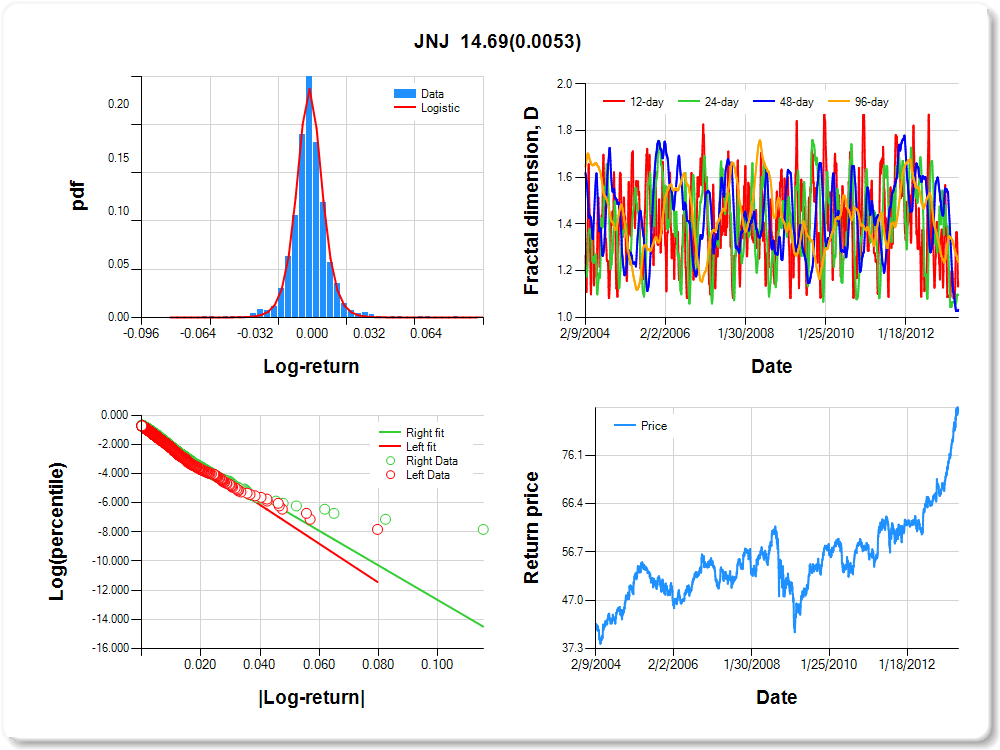

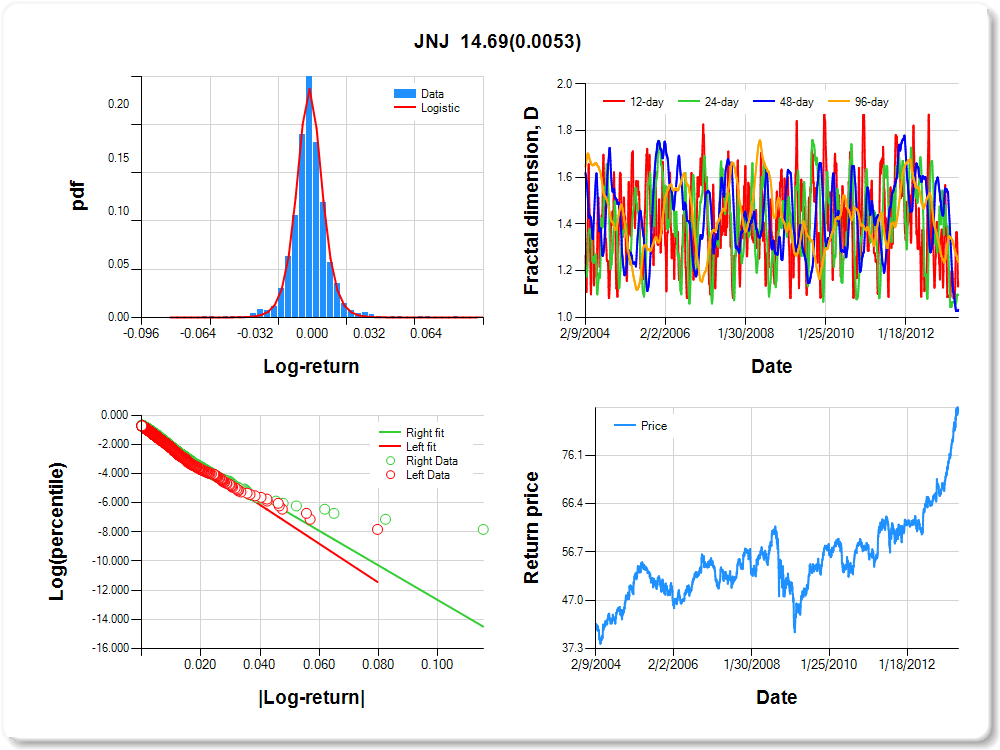

JNJ

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.03 |

-0.03 |

-0.01 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.03 |

0.04 |

1.35 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.310 |

0.080 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.811 |

0.039 |

-20.614 |

0.0000 |

|log-return| |

-133.203 |

3.928 |

-33.913 |

0.0000 |

I(right-tail) |

0.002 |

0.055 |

0.041 |

0.9677 |

|log-return|*I(right-tail) |

14.693 |

5.268 |

2.789 |

0.0053 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.847 |

0.903 |

0.967 |

0.764 |

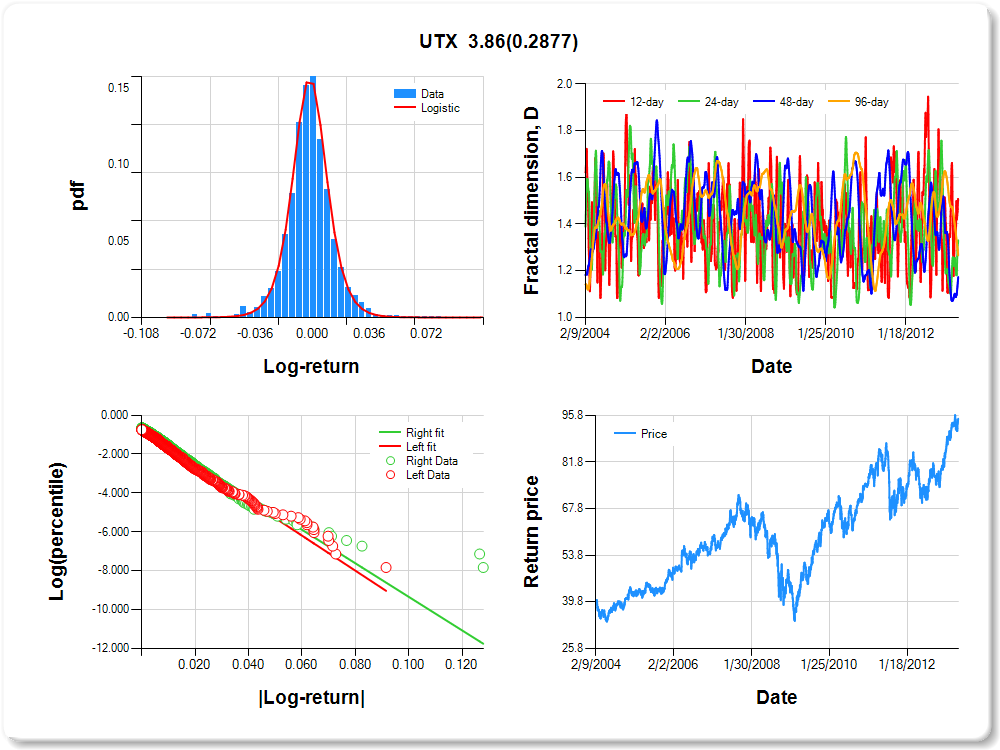

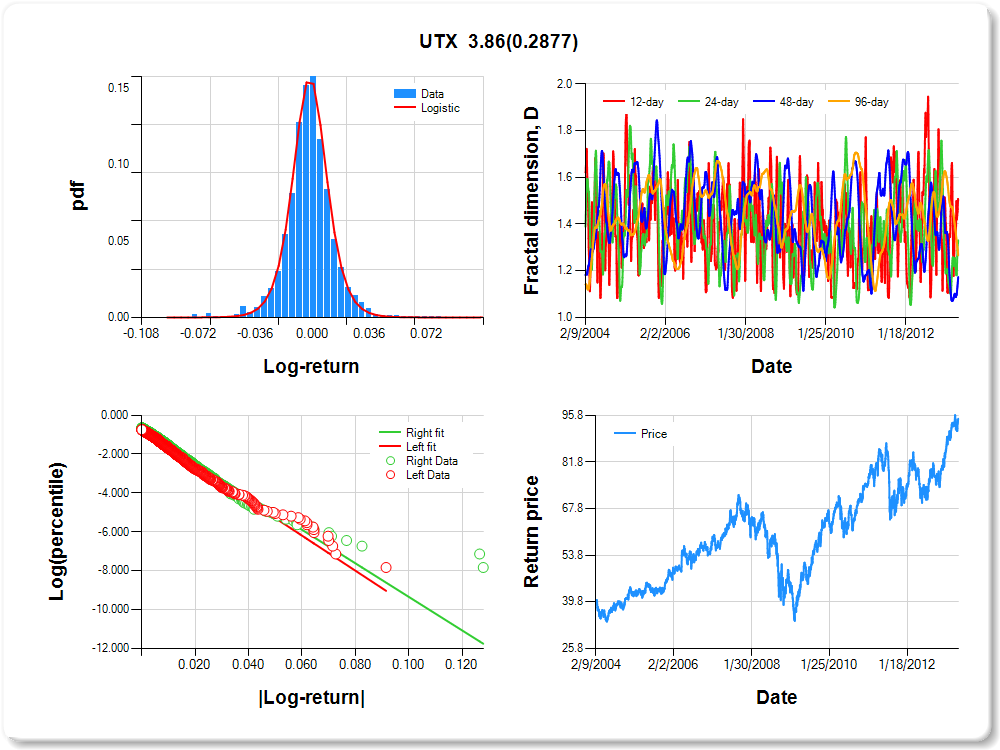

UTX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.04 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.02 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.276 |

0.109 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.775 |

0.041 |

-19.060 |

0.0000 |

|log-return| |

-90.161 |

2.661 |

-33.879 |

0.0000 |

I(right-tail) |

0.070 |

0.056 |

1.241 |

0.2146 |

|log-return|*I(right-tail) |

3.861 |

3.631 |

1.063 |

0.2877 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.501 |

0.669 |

0.827 |

0.733 |

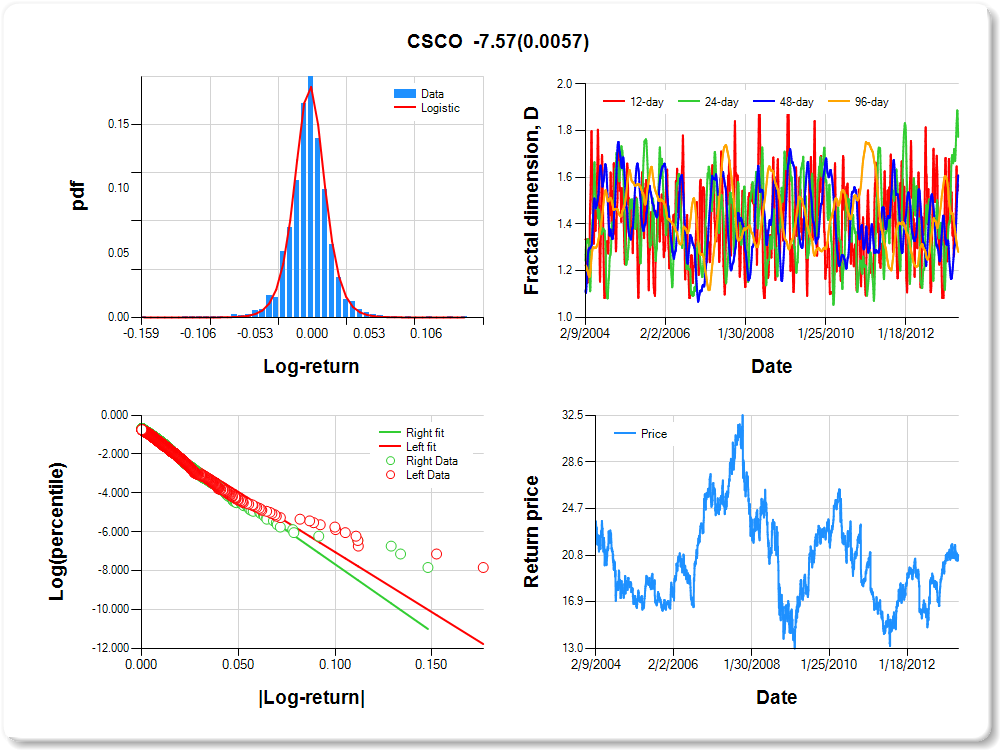

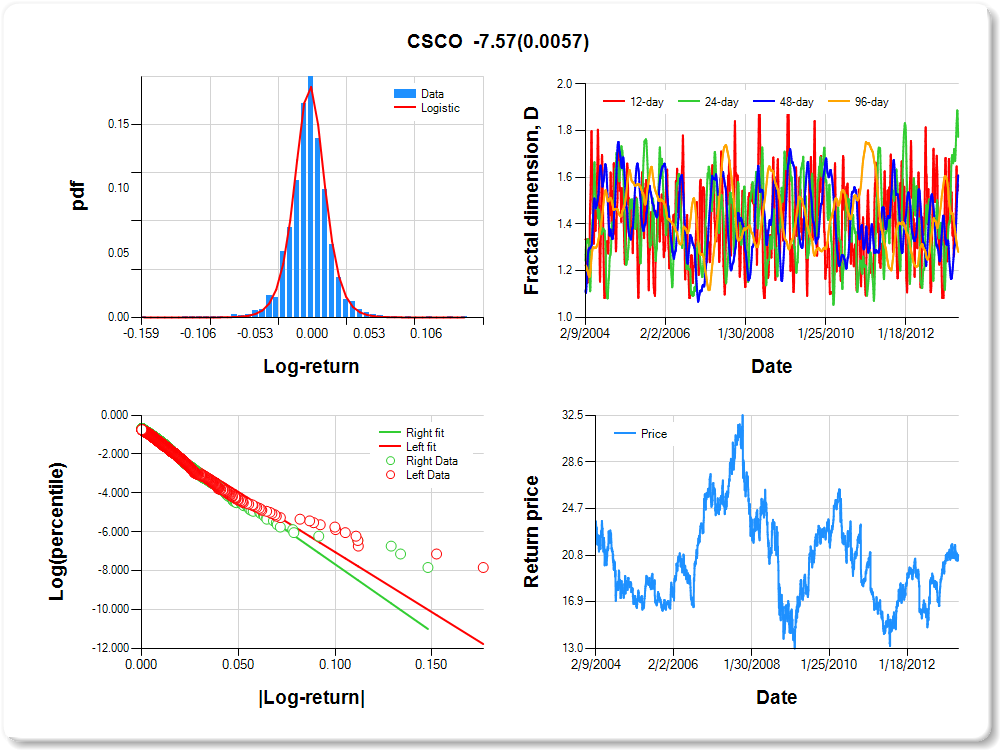

CSCO

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.07 |

1.08 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.157 |

0.095 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.849 |

0.039 |

-21.574 |

0.0000 |

|log-return| |

-61.772 |

1.861 |

-33.196 |

0.0000 |

I(right-tail) |

0.130 |

0.056 |

2.336 |

0.0196 |

|log-return|*I(right-tail) |

-7.573 |

2.735 |

-2.769 |

0.0057 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.435 |

0.226 |

0.391 |

0.719 |

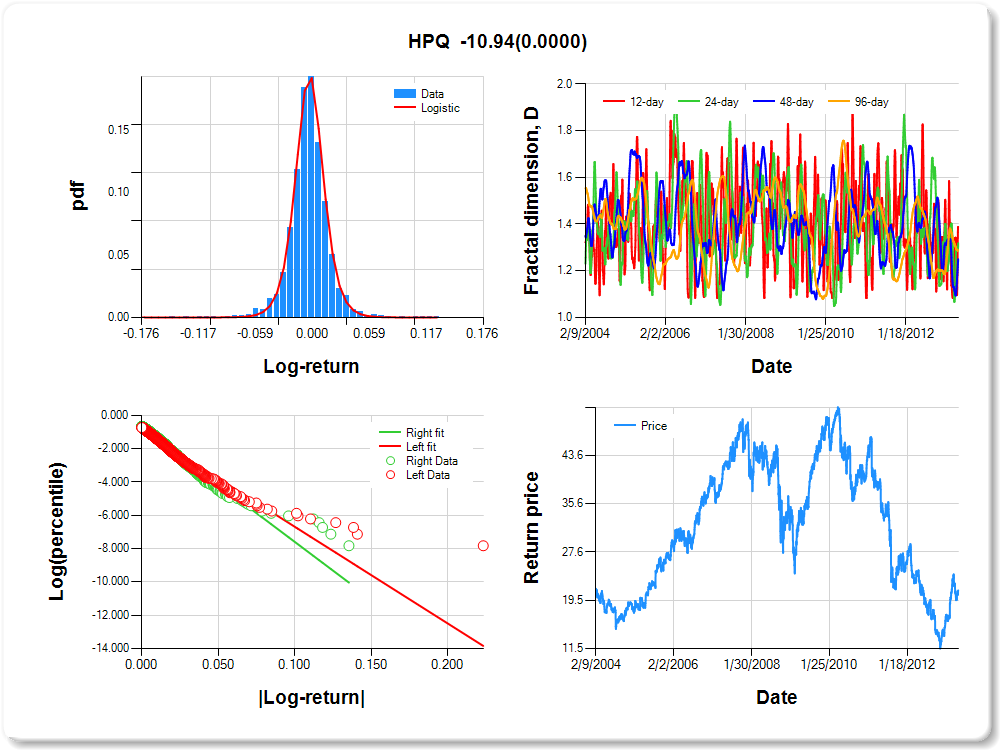

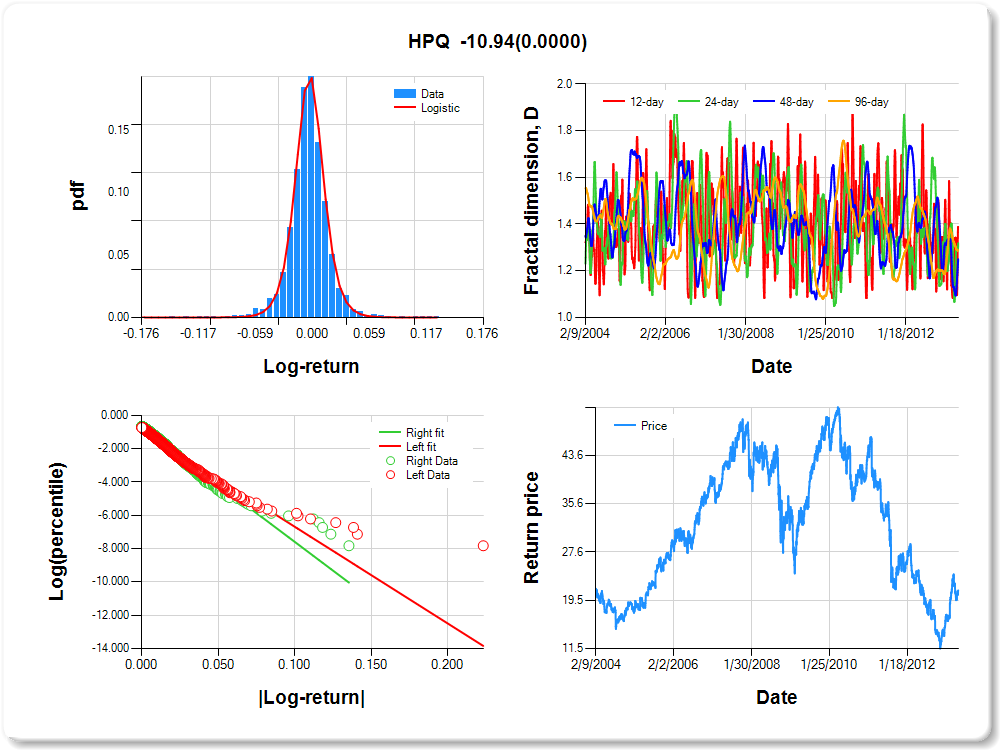

HPQ

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.07 |

0.36 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.424 |

0.088 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.880 |

0.039 |

-22.692 |

0.0000 |

|log-return| |

-58.070 |

1.759 |

-33.004 |

0.0000 |

I(right-tail) |

0.187 |

0.055 |

3.376 |

0.0007 |

|log-return|*I(right-tail) |

-10.935 |

2.649 |

-4.127 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.612 |

0.681 |

0.750 |

0.713 |

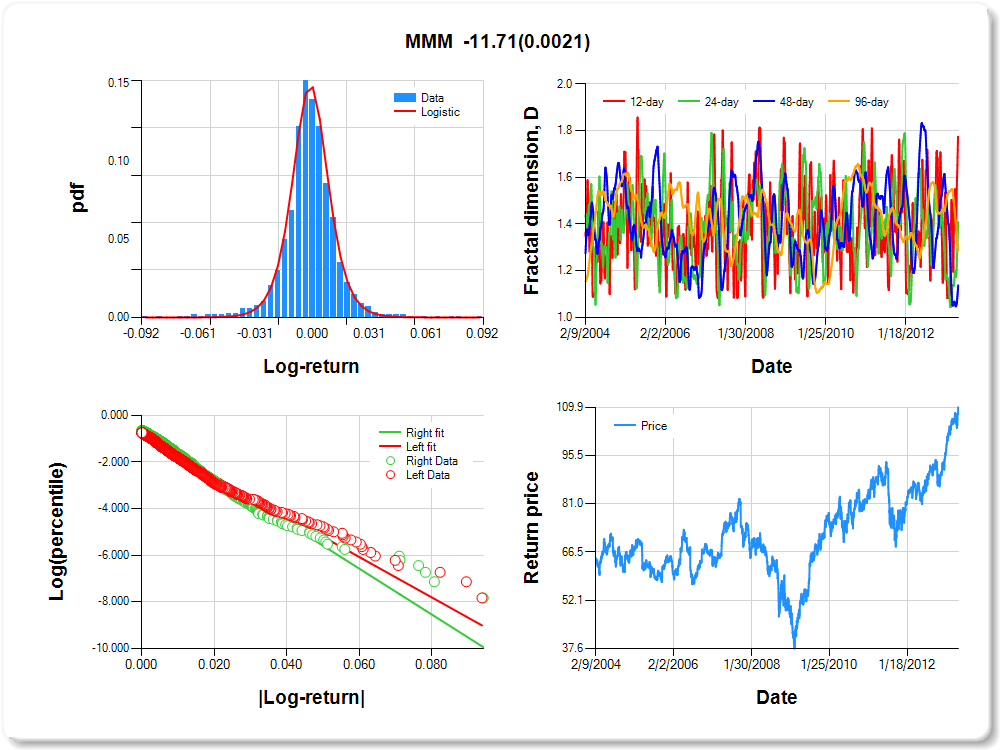

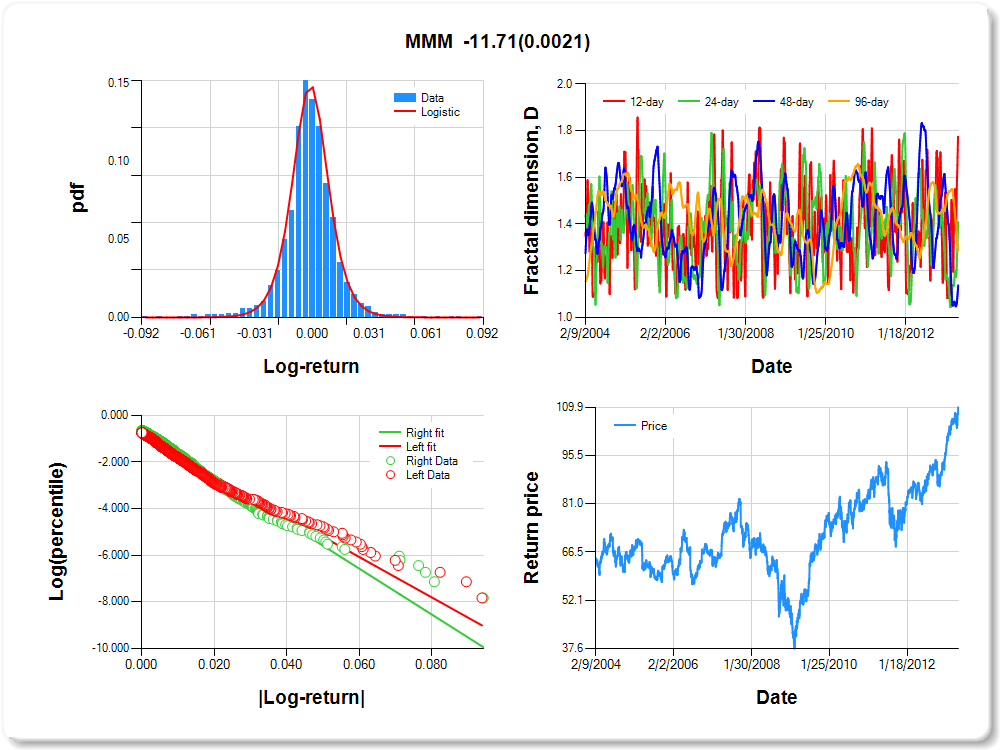

MMM

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.05 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.90 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.009 |

0.115 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.876 |

0.039 |

-22.540 |

0.0000 |

|log-return| |

-86.663 |

2.577 |

-33.632 |

0.0000 |

I(right-tail) |

0.204 |

0.055 |

3.695 |

0.0002 |

|log-return|*I(right-tail) |

-11.707 |

3.801 |

-3.080 |

0.0021 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.226 |

0.591 |

0.862 |

0.712 |

HD

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

0.20 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.355 |

0.126 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.705 |

0.041 |

-17.180 |

0.0000 |

|log-return| |

-82.695 |

2.399 |

-34.475 |

0.0000 |

I(right-tail) |

-0.043 |

0.057 |

-0.757 |

0.4491 |

|log-return|*I(right-tail) |

10.473 |

3.175 |

3.299 |

0.0010 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.717 |

0.693 |

0.694 |

0.706 |

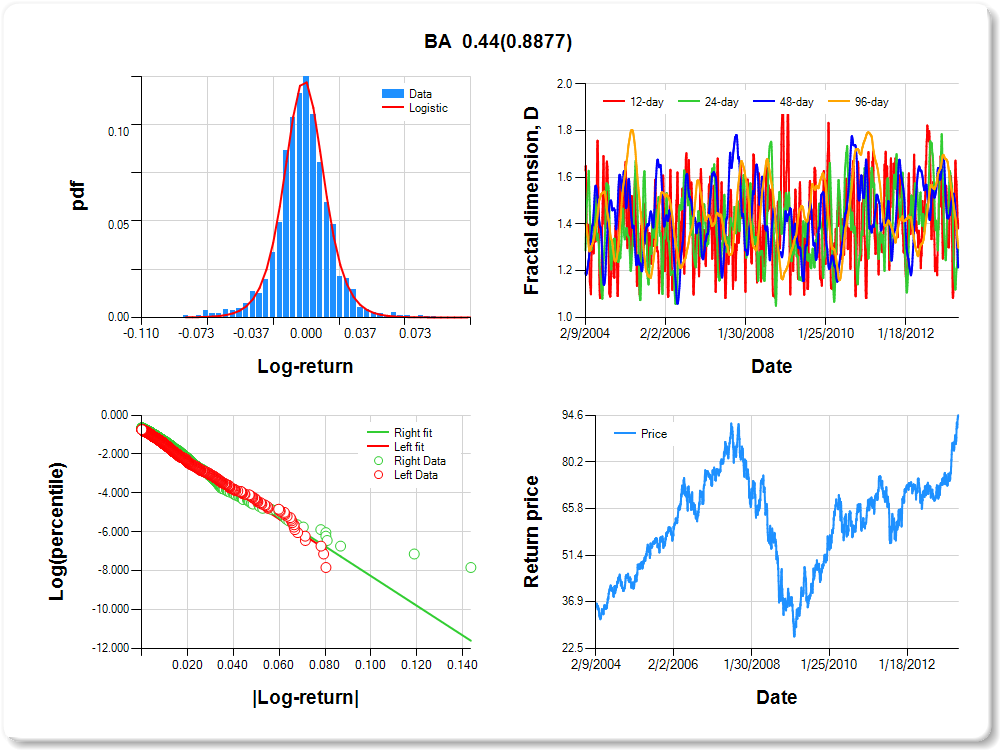

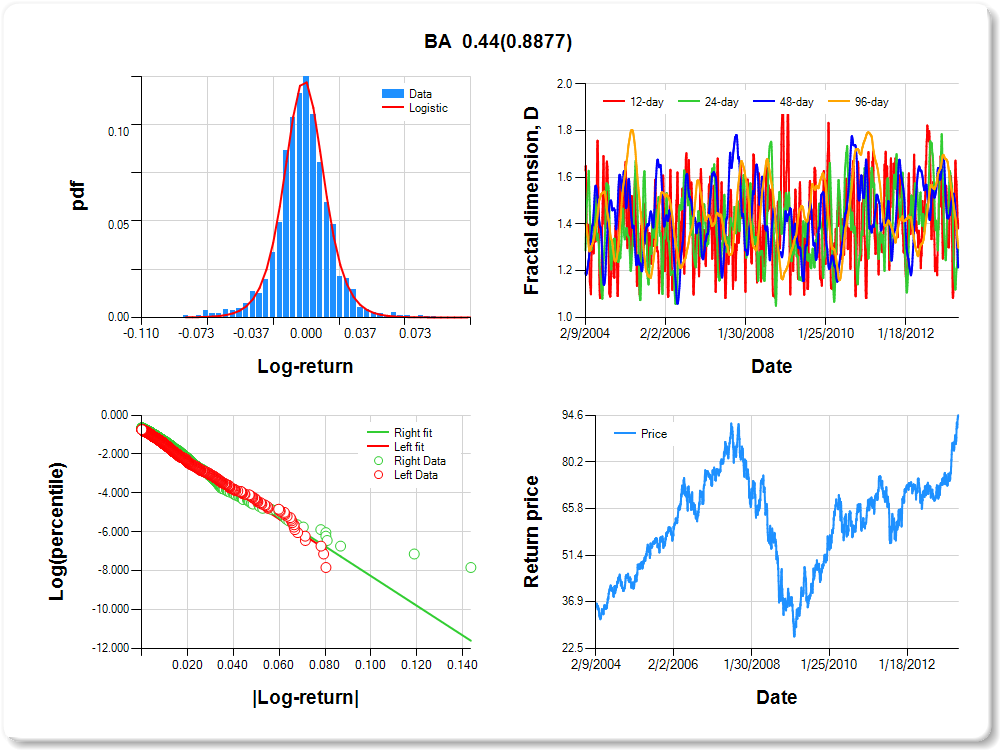

BA

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

0.79 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.473 |

0.133 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.734 |

0.041 |

-17.829 |

0.0000 |

|log-return| |

-76.696 |

2.249 |

-34.102 |

0.0000 |

I(right-tail) |

0.096 |

0.057 |

1.669 |

0.0952 |

|log-return|*I(right-tail) |

0.441 |

3.121 |

0.141 |

0.8877 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.619 |

0.710 |

0.786 |

0.702 |

PG

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.03 |

0.04 |

1.13 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.138 |

0.148 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.859 |

0.039 |

-21.759 |

0.0000 |

|log-return| |

-116.370 |

3.485 |

-33.396 |

0.0000 |

I(right-tail) |

0.168 |

0.056 |

3.026 |

0.0025 |

|log-return|*I(right-tail) |

-7.134 |

4.953 |

-1.441 |

0.1498 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.634 |

0.677 |

0.890 |

0.687 |

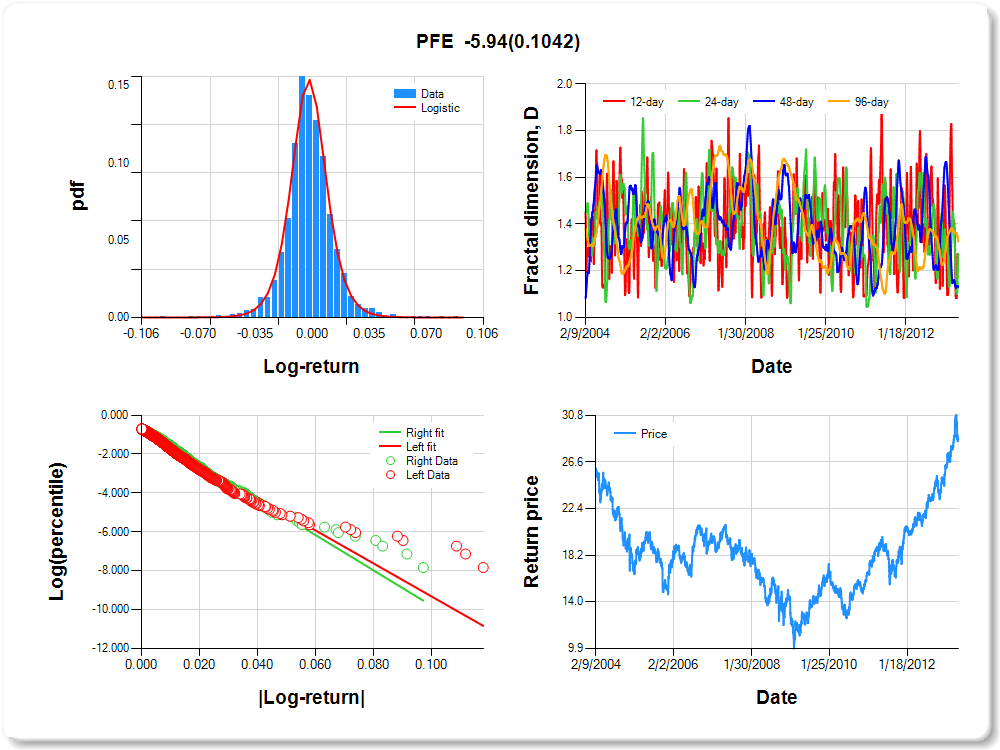

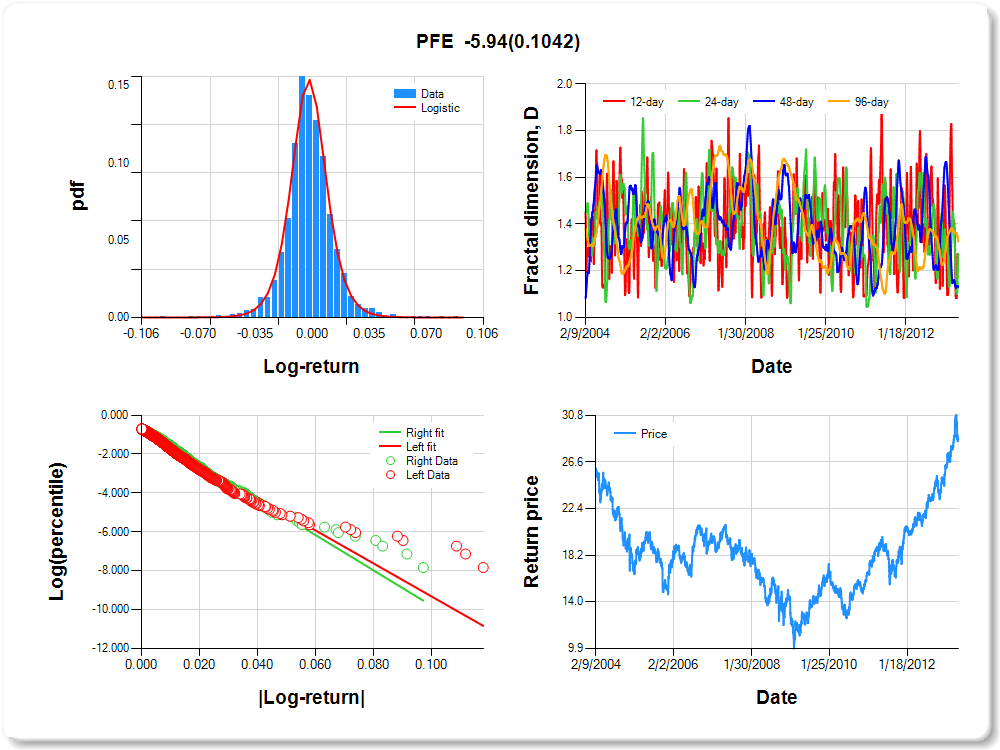

PFE

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.37 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.162 |

0.111 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.810 |

0.039 |

-20.892 |

0.0000 |

|log-return| |

-84.806 |

2.513 |

-33.746 |

0.0000 |

I(right-tail) |

0.120 |

0.057 |

2.116 |

0.0345 |

|log-return|*I(right-tail) |

-5.937 |

3.652 |

-1.626 |

0.1042 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.728 |

0.727 |

0.866 |

0.674 |

AXP

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.10 |

-0.07 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.08 |

0.10 |

0.87 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.026 |

0.121 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.982 |

0.036 |

-27.314 |

0.0000 |

|log-return| |

-48.972 |

1.457 |

-33.615 |

0.0000 |

I(right-tail) |

0.048 |

0.051 |

0.940 |

0.3471 |

|log-return|*I(right-tail) |

0.078 |

2.053 |

0.038 |

0.9697 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.733 |

0.464 |

0.801 |

0.663 |

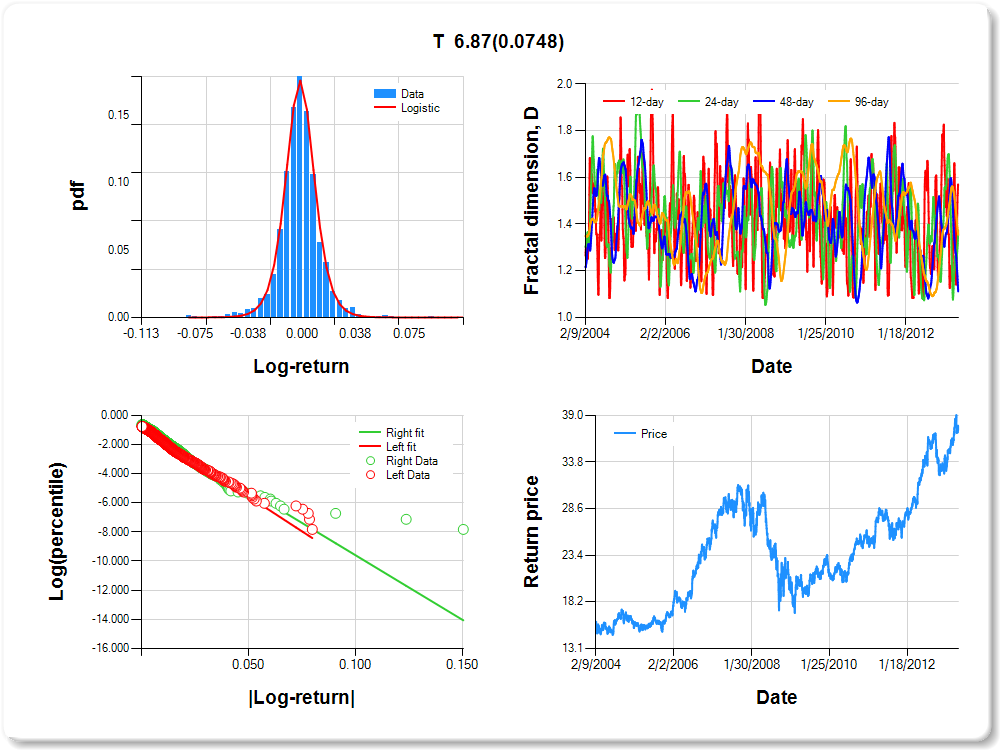

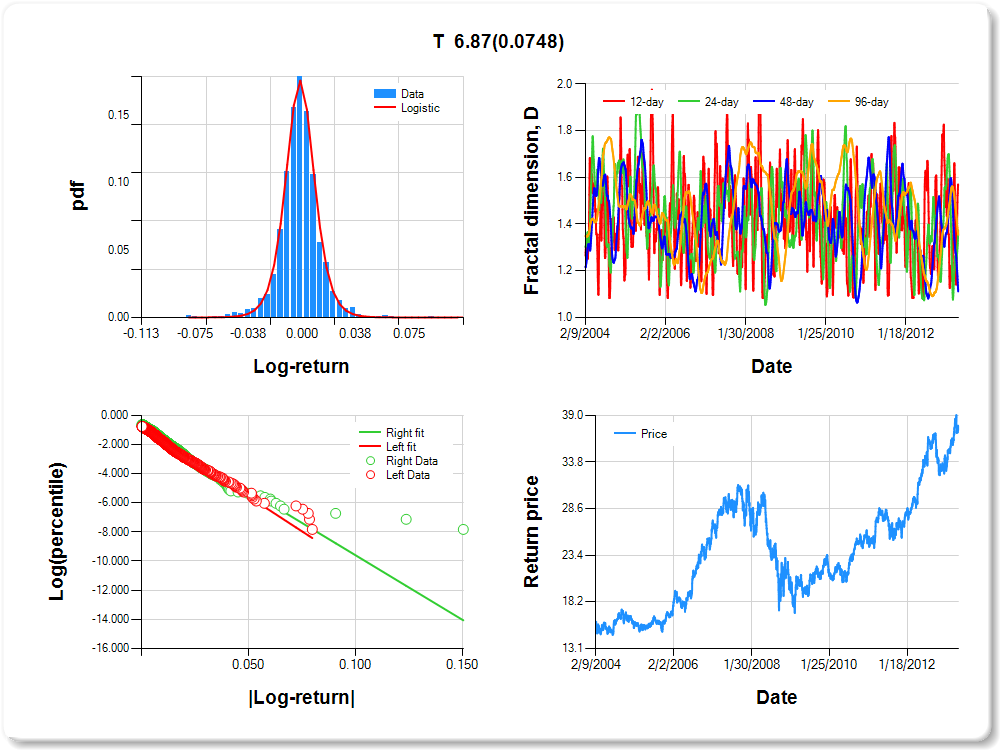

T

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.04 |

0.73 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.517 |

0.098 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.803 |

0.041 |

-19.443 |

0.0000 |

|log-return| |

-95.365 |

2.861 |

-33.335 |

0.0000 |

I(right-tail) |

0.062 |

0.056 |

1.095 |

0.2736 |

|log-return|*I(right-tail) |

6.867 |

3.852 |

1.783 |

0.0748 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.433 |

0.627 |

0.889 |

0.646 |

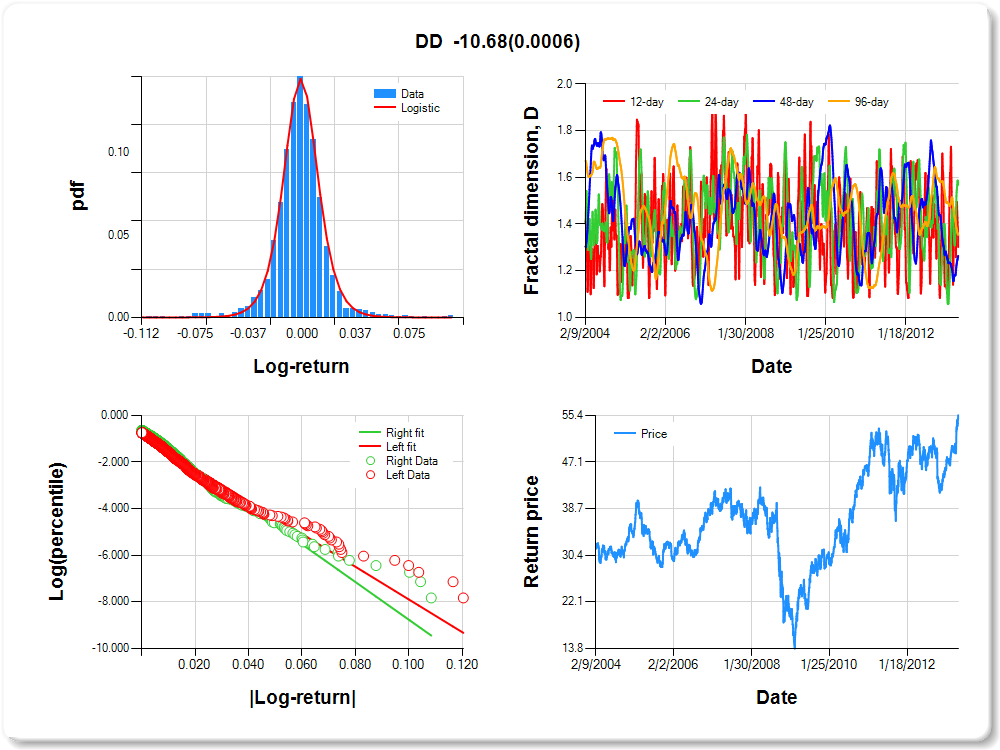

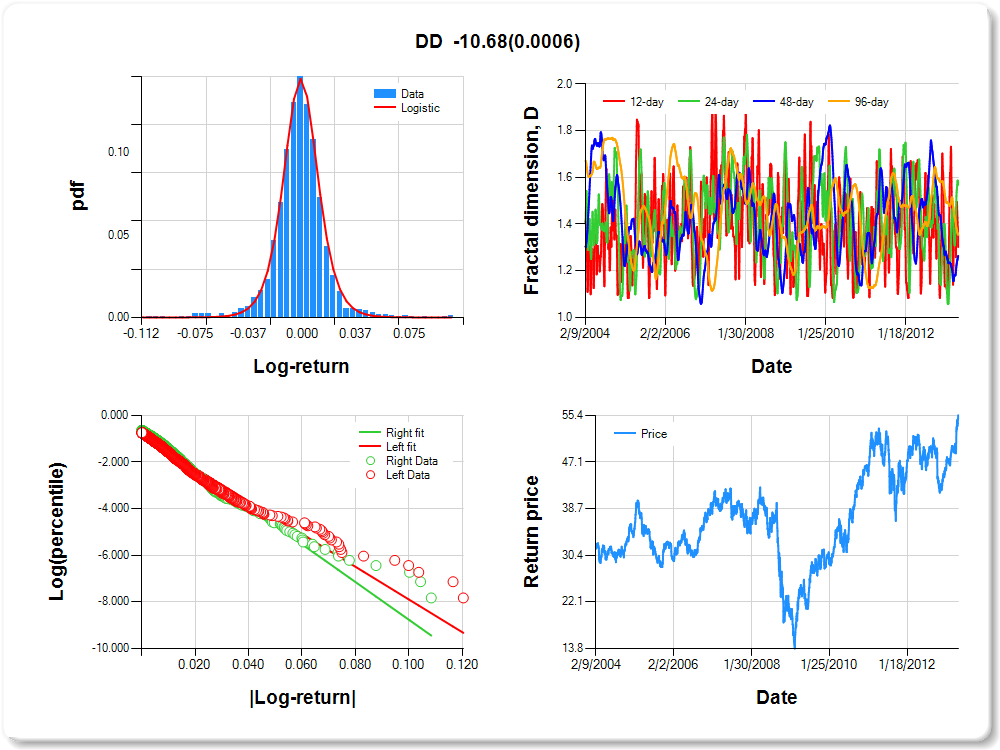

DD

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

0.18 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.105 |

0.118 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.873 |

0.039 |

-22.368 |

0.0000 |

|log-return| |

-70.126 |

2.101 |

-33.385 |

0.0000 |

I(right-tail) |

0.202 |

0.055 |

3.648 |

0.0003 |

|log-return|*I(right-tail) |

-10.677 |

3.107 |

-3.437 |

0.0006 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.698 |

0.432 |

0.736 |

0.646 |

DIS

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

0.48 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.305 |

0.108 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.800 |

0.040 |

-19.863 |

0.0000 |

|log-return| |

-77.099 |

2.290 |

-33.673 |

0.0000 |

I(right-tail) |

0.023 |

0.055 |

0.415 |

0.6780 |

|log-return|*I(right-tail) |

6.037 |

3.083 |

1.958 |

0.0503 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.890 |

0.785 |

0.833 |

0.638 |

CVX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.94 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.280 |

0.085 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.903 |

0.041 |

-22.201 |

0.0000 |

|log-return| |

-73.307 |

2.280 |

-32.149 |

0.0000 |

I(right-tail) |

0.198 |

0.055 |

3.573 |

0.0004 |

|log-return|*I(right-tail) |

-4.745 |

3.222 |

-1.473 |

0.1410 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.521 |

0.357 |

0.660 |

0.616 |

MSFT

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.04 |

0.05 |

1.90 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.272 |

0.127 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.843 |

0.039 |

-21.856 |

0.0000 |

|log-return| |

-77.212 |

2.286 |

-33.774 |

0.0000 |

I(right-tail) |

0.023 |

0.055 |

0.431 |

0.6667 |

|log-return|*I(right-tail) |

1.854 |

3.193 |

0.581 |

0.5615 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.721 |

0.864 |

0.790 |

0.612 |

MCD

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.03 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.14 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.038 |

0.128 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.750 |

0.044 |

-17.174 |

0.0000 |

|log-return| |

-106.055 |

3.222 |

-32.919 |

0.0000 |

I(right-tail) |

0.129 |

0.058 |

2.221 |

0.0264 |

|log-return|*I(right-tail) |

5.651 |

4.254 |

1.328 |

0.1841 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.357 |

0.569 |

0.880 |

0.589 |

WMT

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.03 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.04 |

0.47 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.185 |

0.108 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.728 |

0.041 |

-17.593 |

0.0000 |

|log-return| |

-113.126 |

3.337 |

-33.904 |

0.0000 |

I(right-tail) |

0.050 |

0.057 |

0.871 |

0.3838 |

|log-return|*I(right-tail) |

1.741 |

4.619 |

0.377 |

0.7062 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.277 |

0.862 |

0.808 |

0.527 |

VZ

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.36 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.399 |

0.102 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.781 |

0.041 |

-18.980 |

0.0000 |

|log-return| |

-98.502 |

2.934 |

-33.578 |

0.0000 |

I(right-tail) |

0.086 |

0.057 |

1.518 |

0.1291 |

|log-return|*I(right-tail) |

3.653 |

4.010 |

0.911 |

0.3624 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.753 |

0.936 |

0.943 |

0.527 |

IBM

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

1.44 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.187 |

0.108 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.814 |

0.039 |

-20.770 |

0.0000 |

|log-return| |

-96.943 |

2.845 |

-34.073 |

0.0000 |

I(right-tail) |

0.137 |

0.056 |

2.465 |

0.0138 |

|log-return|*I(right-tail) |

-4.500 |

4.062 |

-1.108 |

0.2681 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.636 |

0.646 |

0.604 |

0.520 |

KO

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.03 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.03 |

0.04 |

0.73 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.298 |

0.080 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.845 |

0.041 |

-20.658 |

0.0000 |

|log-return| |

-113.472 |

3.460 |

-32.800 |

0.0000 |

I(right-tail) |

0.063 |

0.056 |

1.128 |

0.2596 |

|log-return|*I(right-tail) |

8.040 |

4.634 |

1.735 |

0.0829 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.704 |

0.918 |

0.776 |

0.519 |

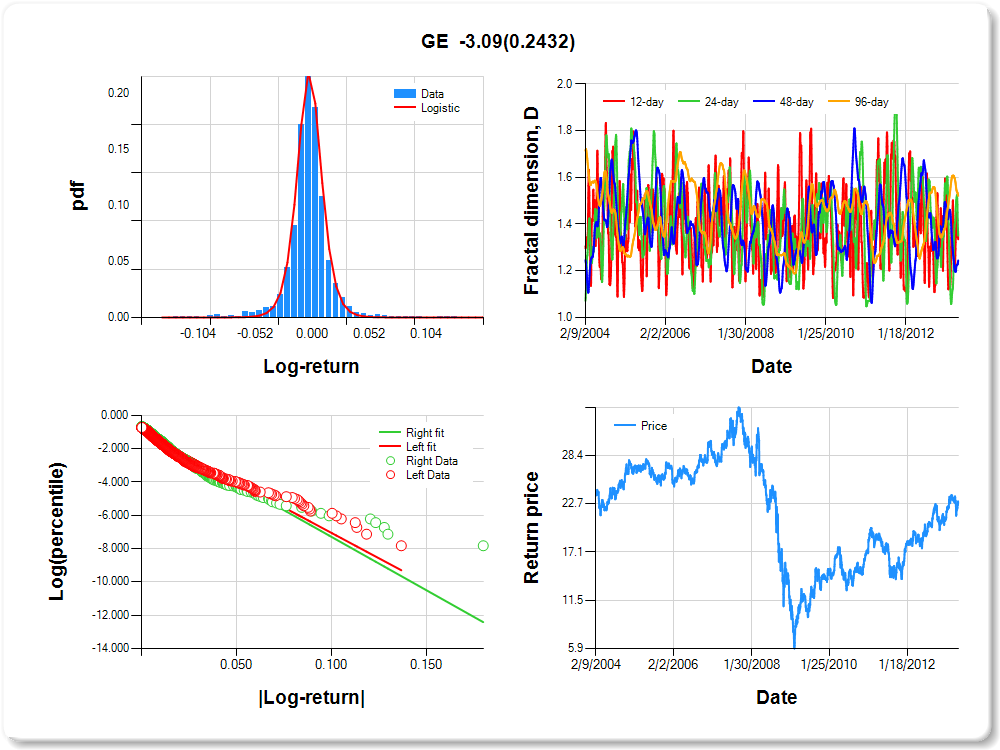

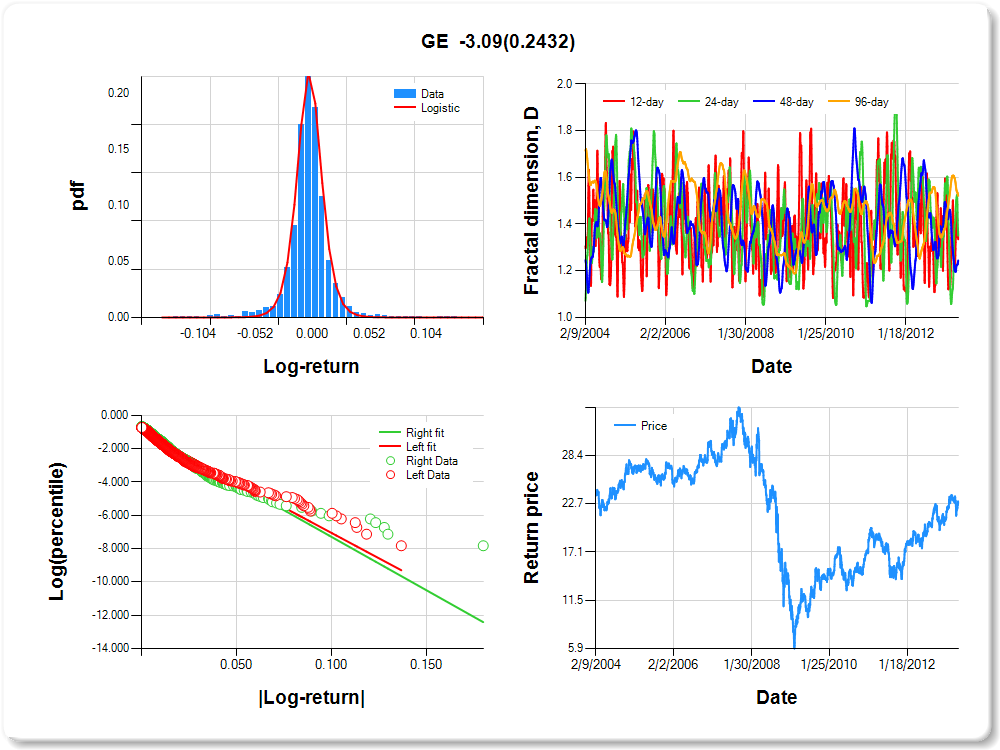

GE

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.07 |

1.09 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.230 |

0.078 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.959 |

0.037 |

-25.862 |

0.0000 |

|log-return| |

-60.958 |

1.832 |

-33.276 |

0.0000 |

I(right-tail) |

0.070 |

0.052 |

1.337 |

0.1814 |

|log-return|*I(right-tail) |

-3.086 |

2.644 |

-1.167 |

0.2432 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.665 |

0.650 |

0.756 |

0.479 |

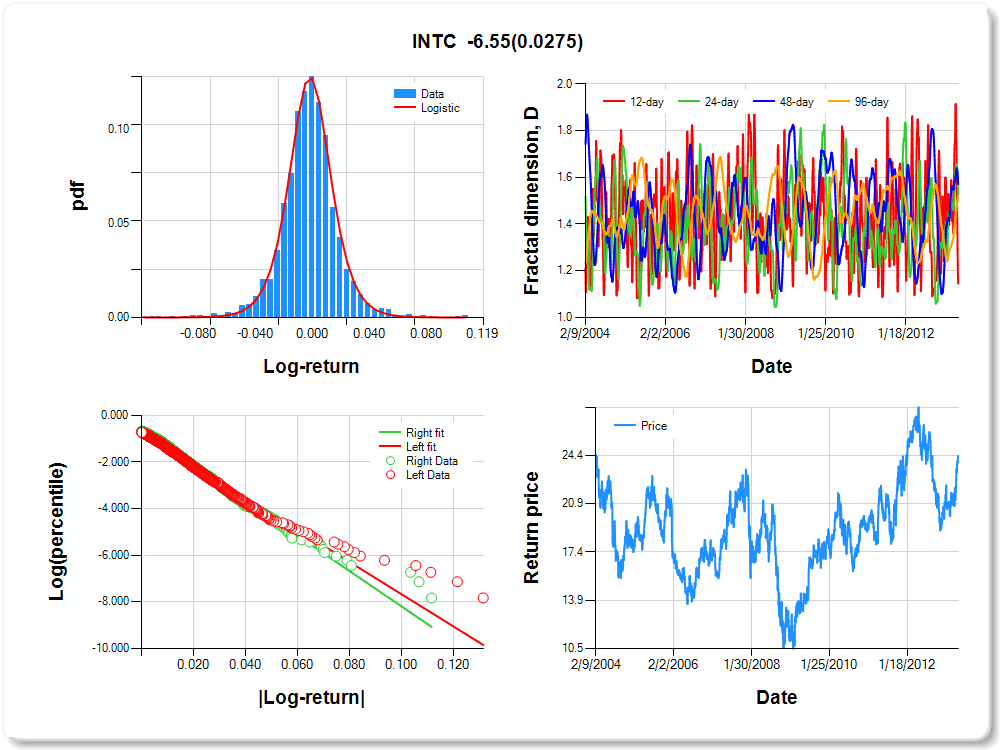

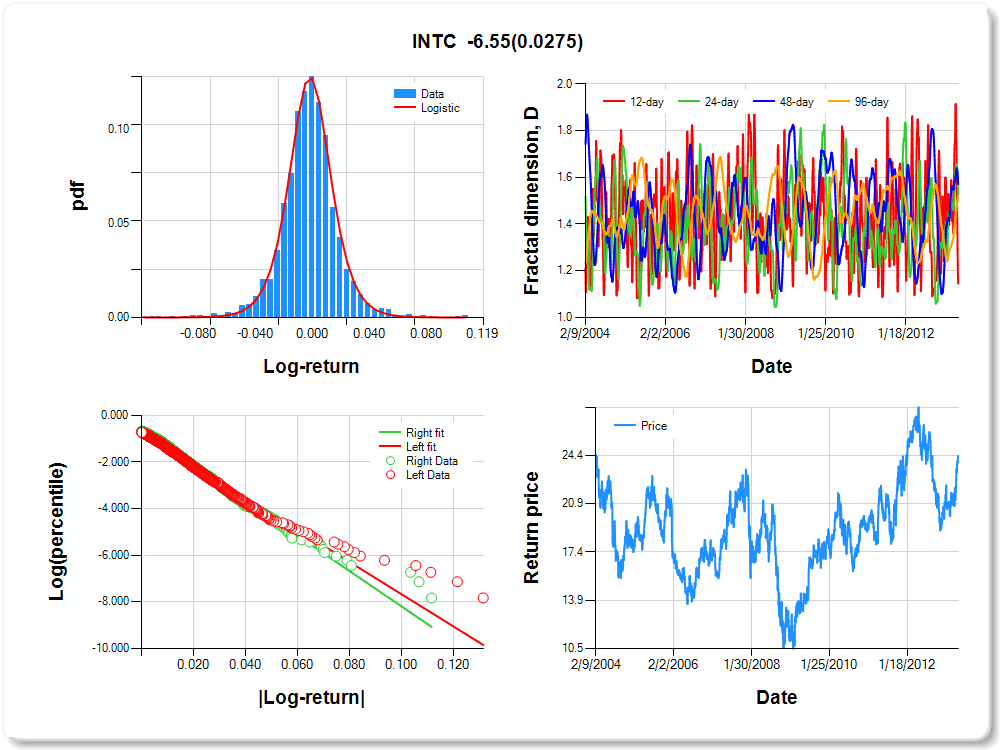

INTC

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

0.47 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.149 |

0.134 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.734 |

0.041 |

-17.806 |

0.0000 |

|log-return| |

-69.146 |

2.041 |

-33.881 |

0.0000 |

I(right-tail) |

0.134 |

0.059 |

2.292 |

0.0220 |

|log-return|*I(right-tail) |

-6.552 |

2.971 |

-2.205 |

0.0275 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.855 |

0.482 |

0.428 |

0.478 |

MRK

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.06 |

0.86 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.752 |

0.059 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.094 |

0.036 |

-30.667 |

0.0000 |

|log-return| |

-53.695 |

1.757 |

-30.561 |

0.0000 |

I(right-tail) |

0.354 |

0.053 |

6.731 |

0.0000 |

|log-return|*I(right-tail) |

-25.332 |

2.884 |

-8.783 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.601 |

0.762 |

0.606 |

0.421 |

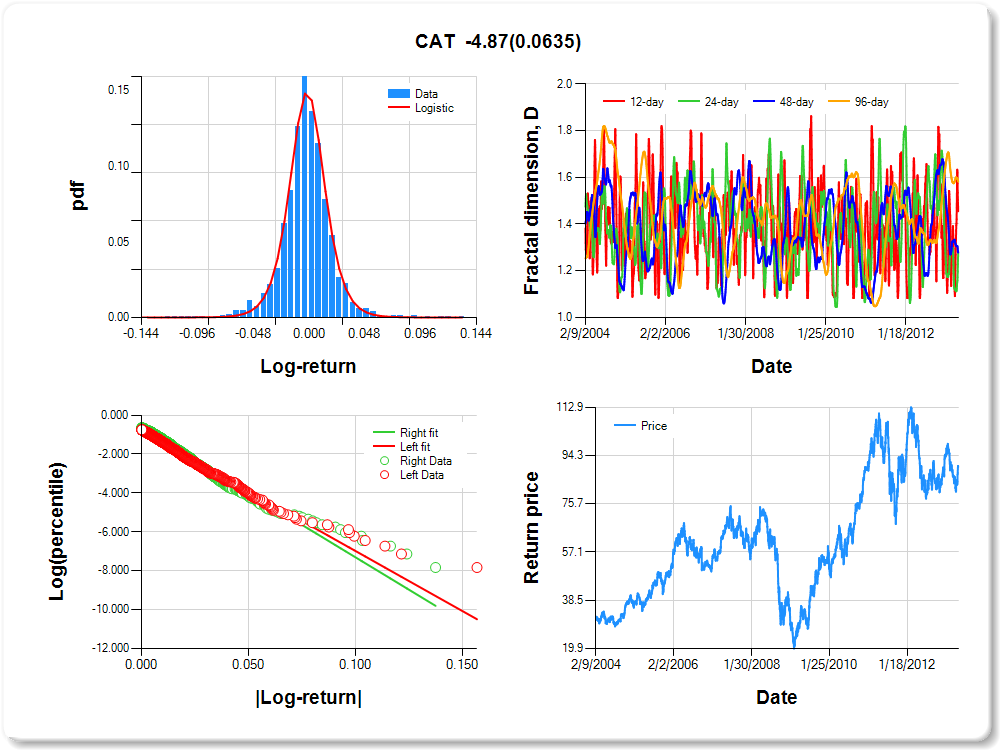

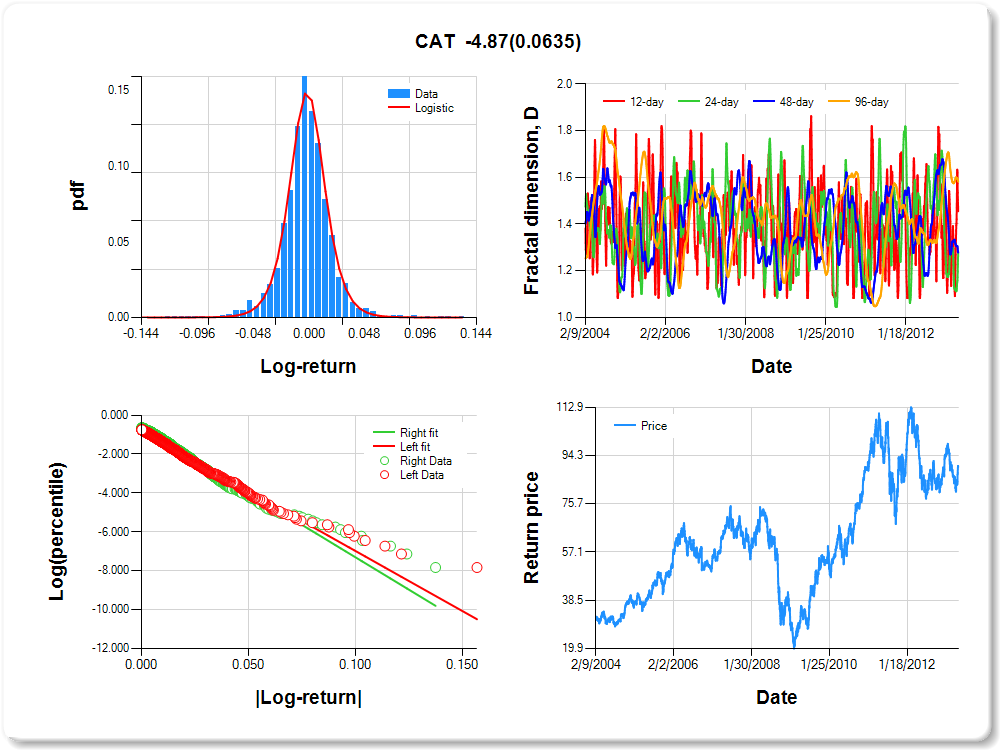

CAT

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.08 |

0.64 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.125 |

0.115 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.807 |

0.040 |

-20.089 |

0.0000 |

|log-return| |

-61.763 |

1.829 |

-33.769 |

0.0000 |

I(right-tail) |

0.163 |

0.056 |

2.894 |

0.0038 |

|log-return|*I(right-tail) |

-4.871 |

2.623 |

-1.857 |

0.0635 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.545 |

0.718 |

0.722 |

0.418 |

AA

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.11 |

-0.09 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.08 |

0.10 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.145 |

0.166 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.872 |

0.038 |

-22.890 |

0.0000 |

|log-return| |

-43.618 |

1.292 |

-33.757 |

0.0000 |

I(right-tail) |

0.071 |

0.054 |

1.308 |

0.1909 |

|log-return|*I(right-tail) |

-4.909 |

1.923 |

-2.553 |

0.0107 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.586 |

0.598 |

0.603 |

0.354 |

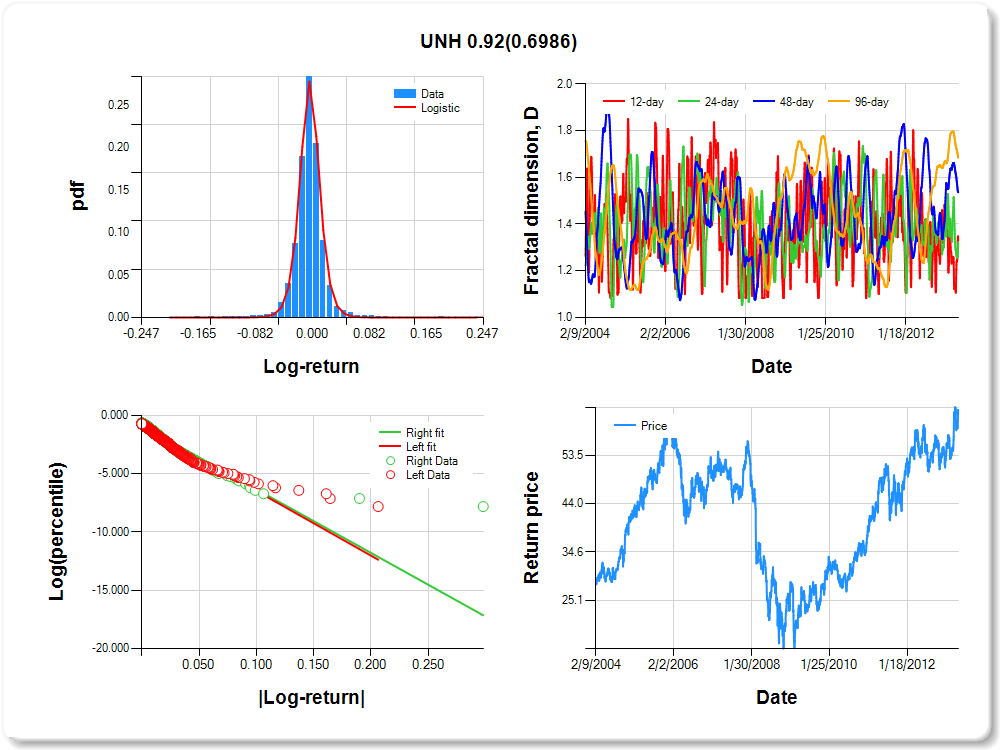

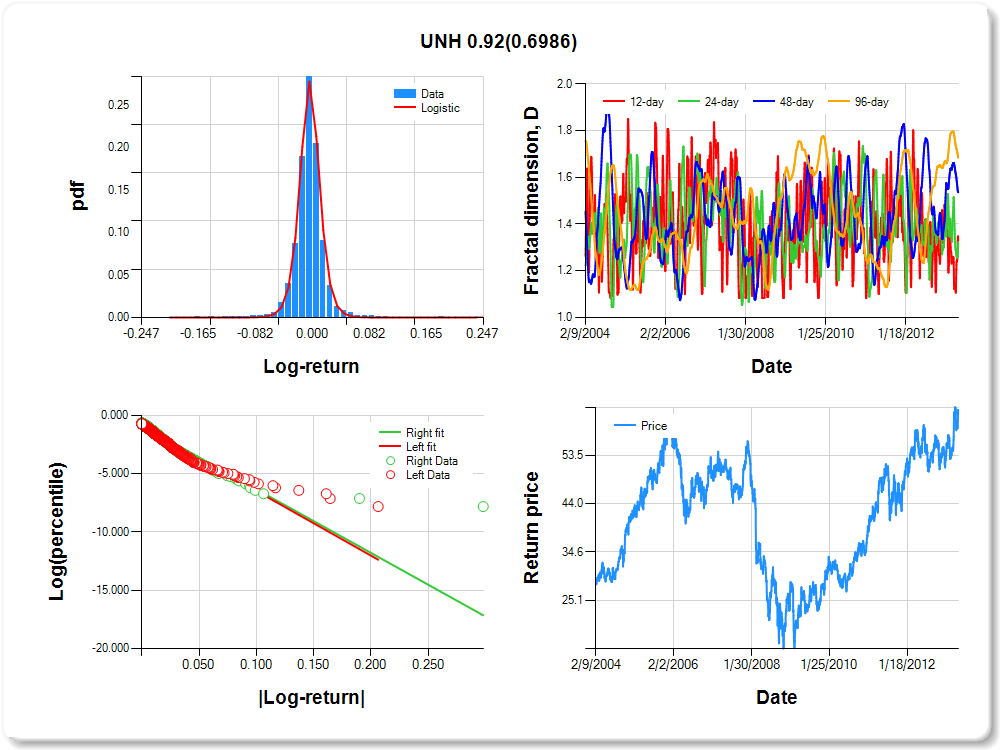

UNH

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.08 |

0.23 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.305 |

0.062 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.933 |

0.038 |

-24.784 |

0.0000 |

|log-return| |

-55.498 |

1.689 |

-32.861 |

0.0000 |

I(right-tail) |

0.048 |

0.053 |

0.907 |

0.3643 |

|log-return|*I(right-tail) |

0.917 |

2.367 |

0.387 |

0.6986 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.672 |

0.677 |

0.464 |

0.316 |

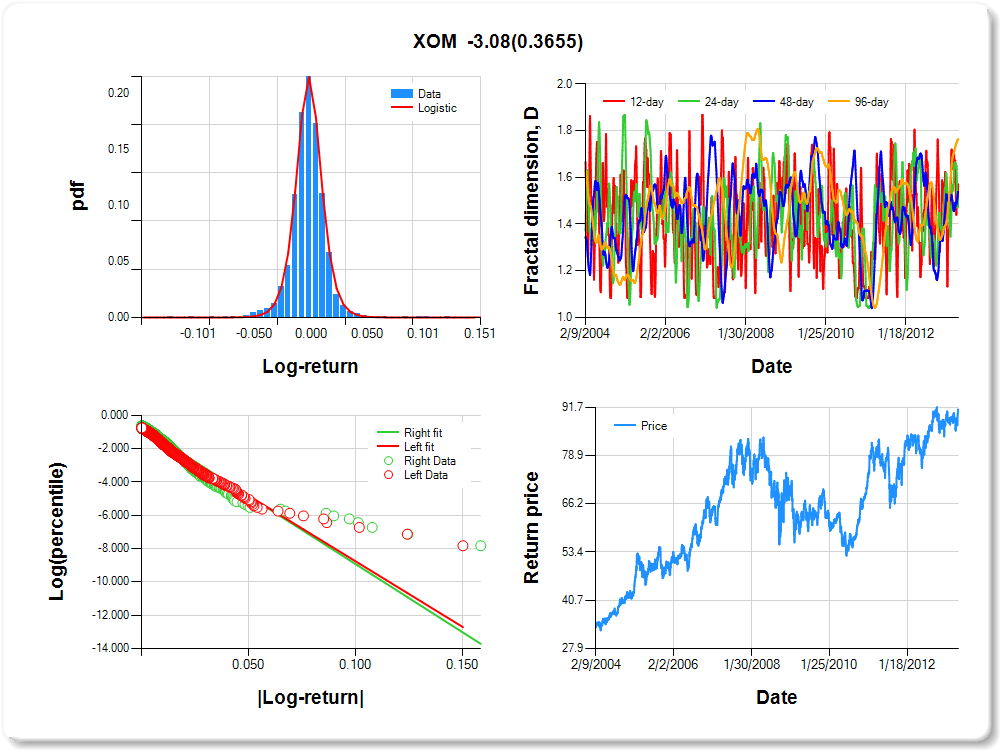

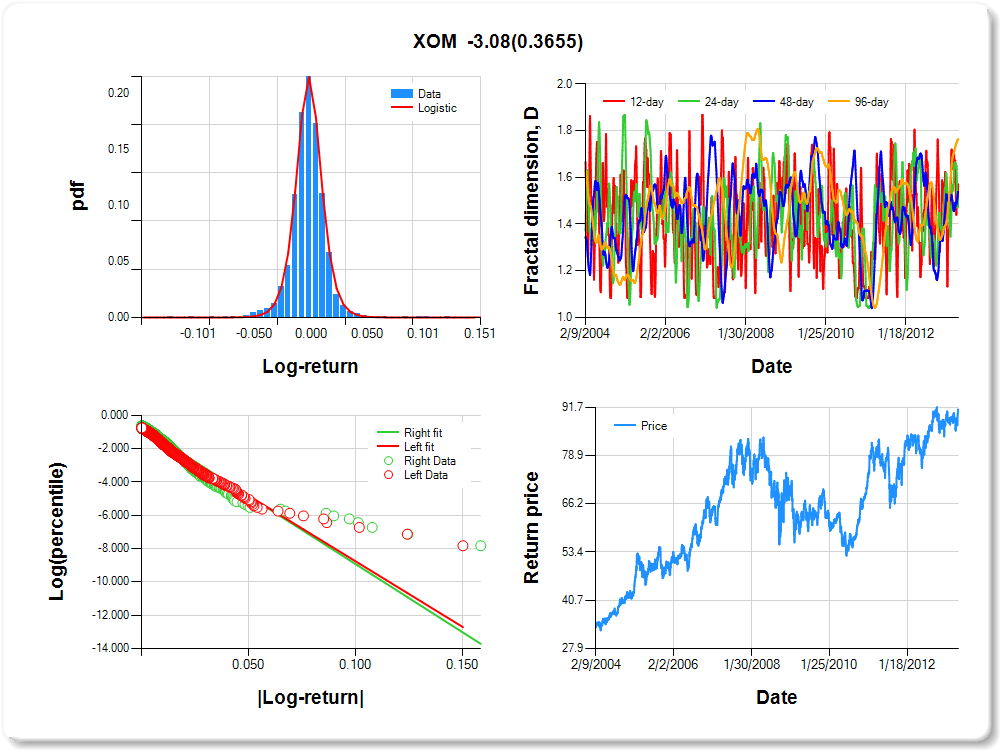

XOM

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

0.15 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.036 |

0.080 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.896 |

0.039 |

-22.722 |

0.0000 |

|log-return| |

-78.607 |

2.408 |

-32.646 |

0.0000 |

I(right-tail) |

0.141 |

0.055 |

2.580 |

0.0099 |

|log-return|*I(right-tail) |

-3.084 |

3.407 |

-0.905 |

0.3655 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.429 |

0.491 |

0.462 |

0.236 |