MMR

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.20 |

-0.13 |

-0.07 |

-0.05 |

-0.02 |

0.00 |

0.02 |

0.08 |

0.13 |

0.17 |

0.46 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.659 |

0.129 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.856 |

0.054 |

-15.938 |

0.0000 |

|log-return| |

-24.861 |

1.041 |

-23.888 |

0.0000 |

I(right-tail) |

-0.158 |

0.074 |

-2.125 |

0.0337 |

|log-return|*I(right-tail) |

4.773 |

1.387 |

3.441 |

0.0006 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.428 |

0.836 |

0.844 |

0.782 |

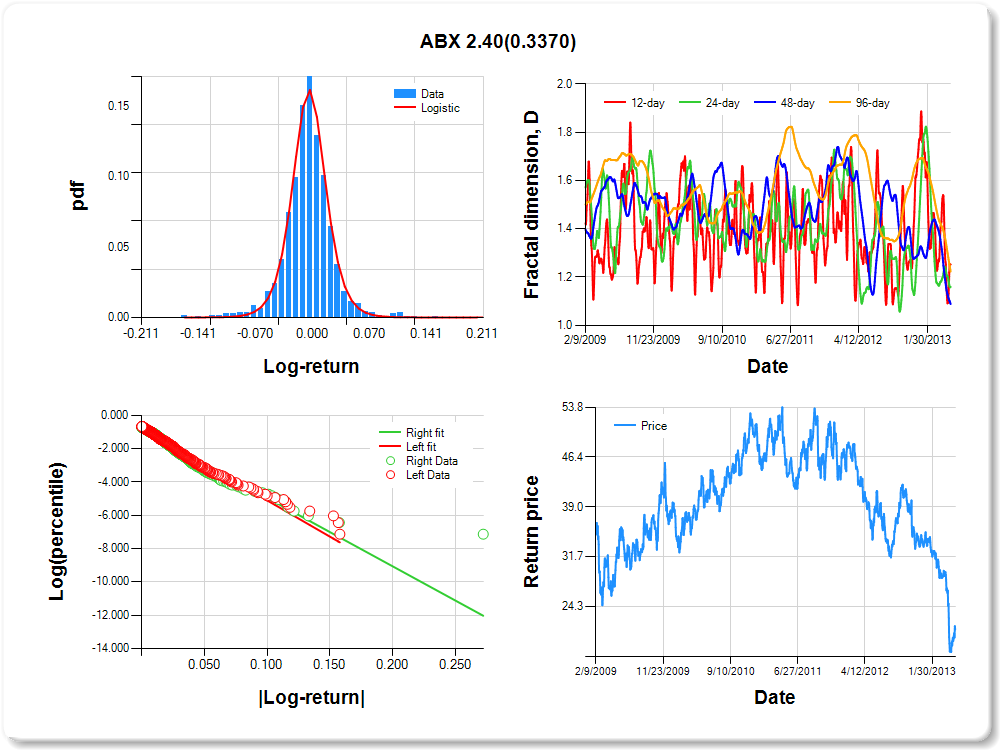

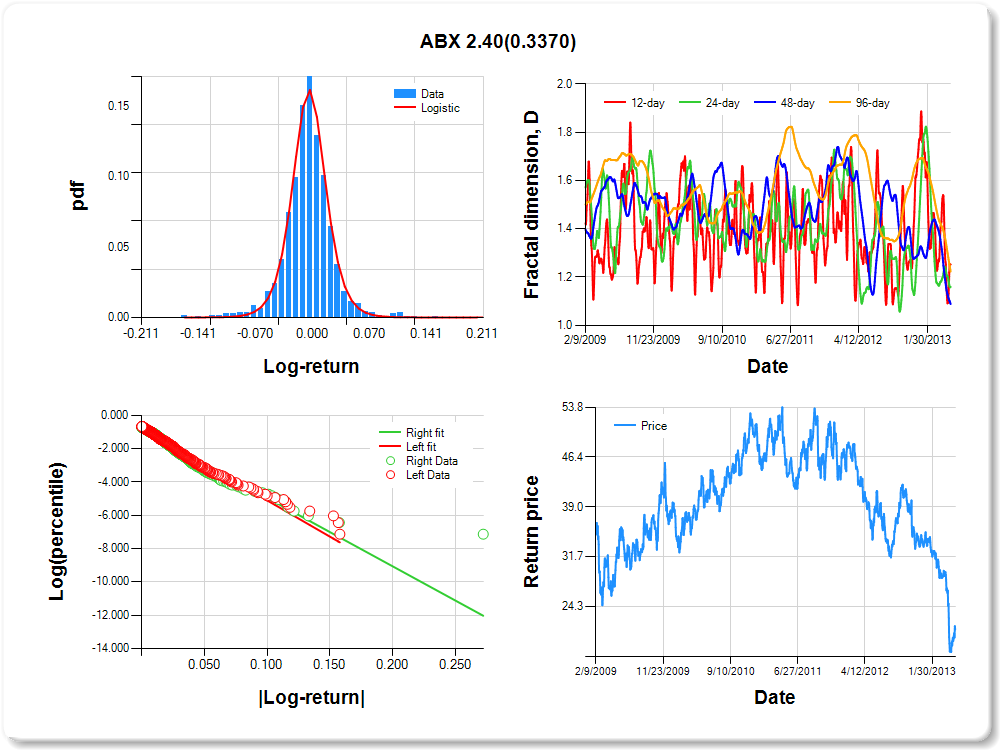

ABX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.11 |

-0.09 |

-0.05 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.09 |

0.12 |

1.29 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.454 |

0.106 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.761 |

0.054 |

-14.028 |

0.0000 |

|log-return| |

-43.447 |

1.771 |

-24.527 |

0.0000 |

I(right-tail) |

-0.086 |

0.077 |

-1.116 |

0.2644 |

|log-return|*I(right-tail) |

2.400 |

2.499 |

0.960 |

0.3370 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.748 |

0.841 |

0.912 |

0.777 |

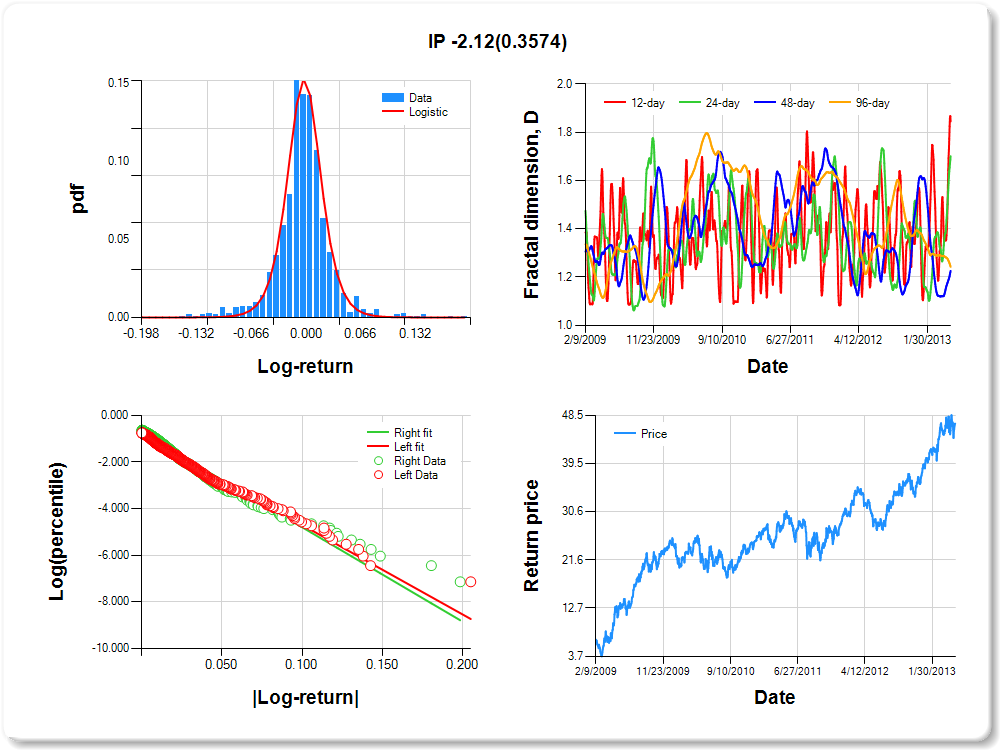

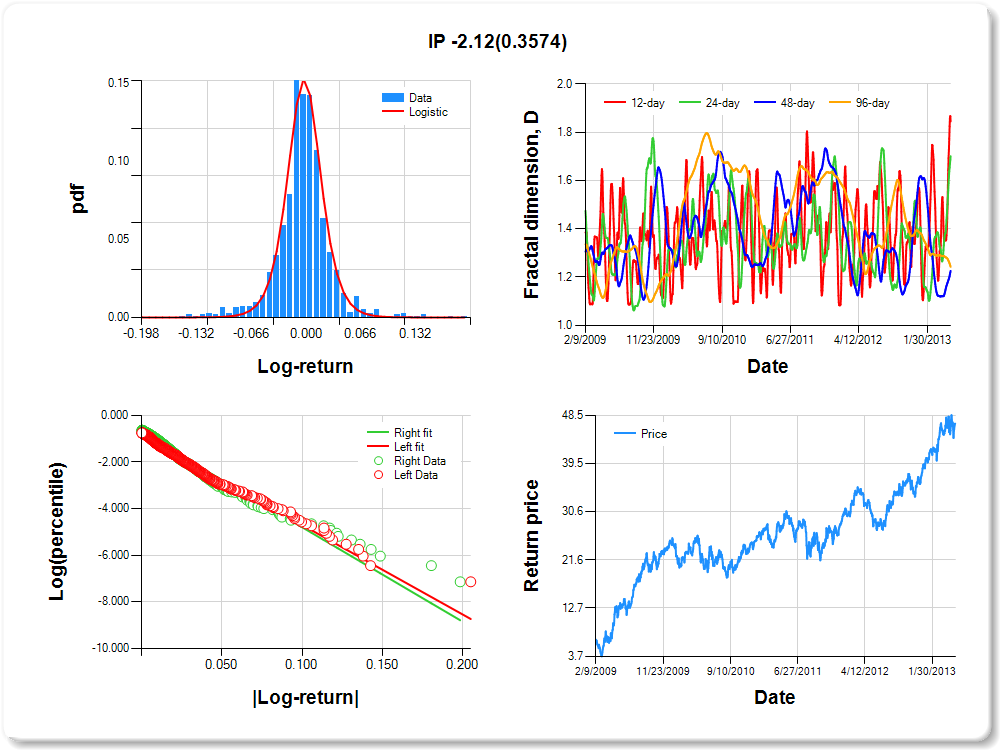

IP

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.11 |

-0.10 |

-0.05 |

-0.03 |

-0.01 |

0.00 |

0.02 |

0.05 |

0.10 |

0.13 |

0.85 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.042 |

0.112 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.865 |

0.056 |

-15.537 |

0.0000 |

|log-return| |

-38.325 |

1.625 |

-23.582 |

0.0000 |

I(right-tail) |

0.114 |

0.077 |

1.487 |

0.1374 |

|log-return|*I(right-tail) |

-2.121 |

2.304 |

-0.921 |

0.3574 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.155 |

0.299 |

0.774 |

0.758 |

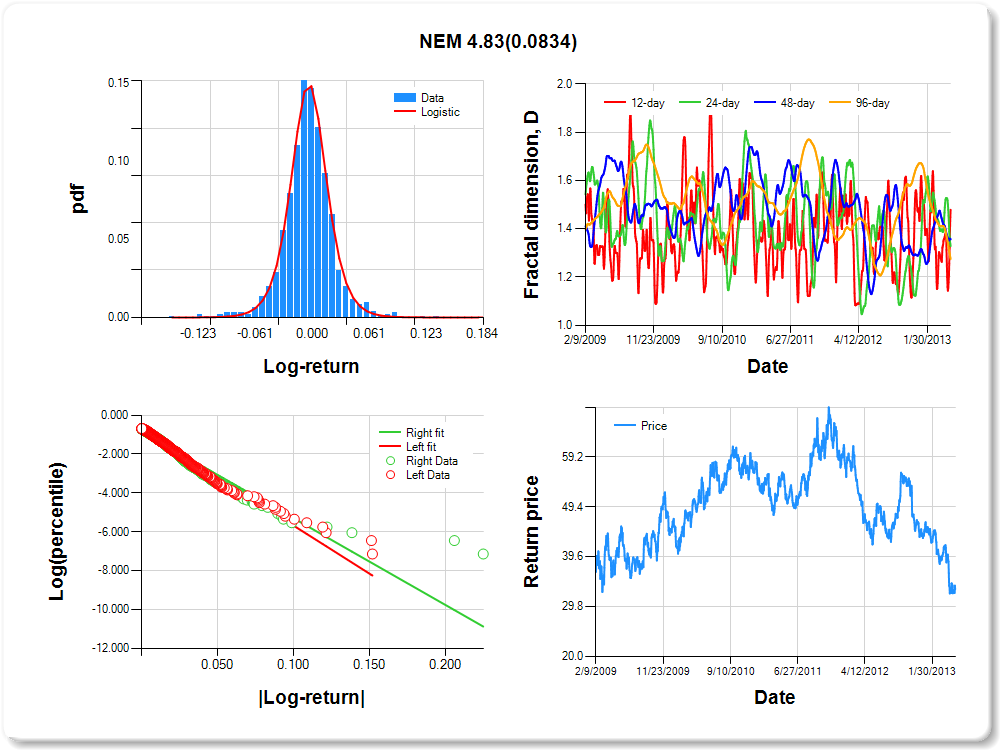

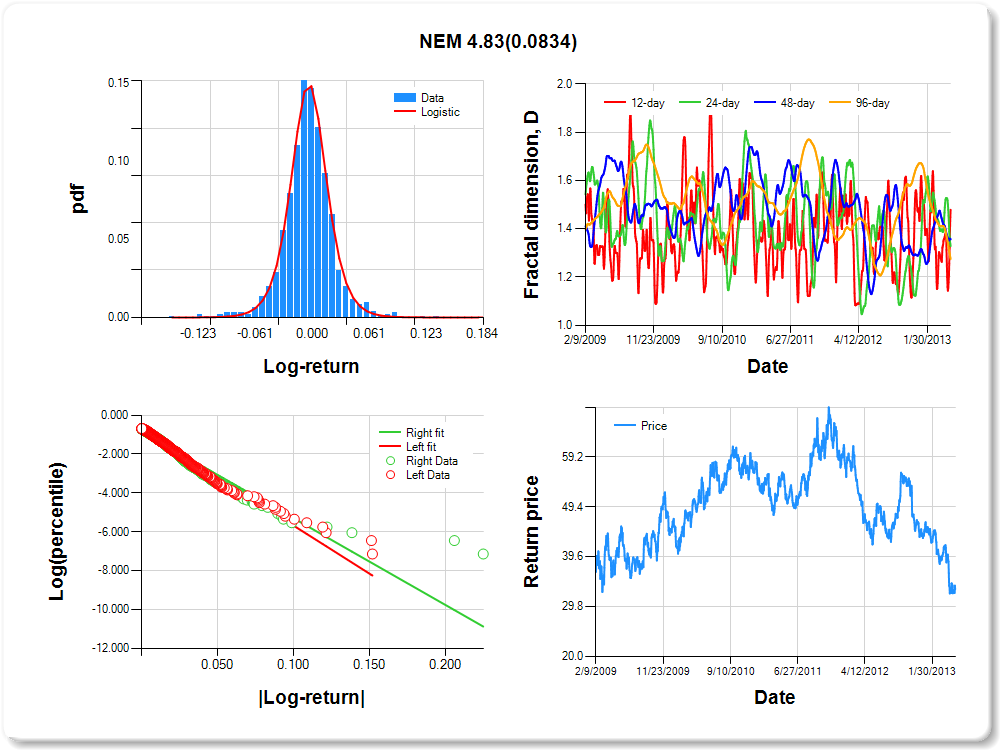

NEM

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.10 |

-0.08 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.08 |

0.10 |

0.32 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.334 |

0.114 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.736 |

0.055 |

-13.278 |

0.0000 |

|log-return| |

-49.472 |

2.028 |

-24.392 |

0.0000 |

I(right-tail) |

-0.106 |

0.078 |

-1.357 |

0.1750 |

|log-return|*I(right-tail) |

4.830 |

2.787 |

1.733 |

0.0834 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.521 |

0.671 |

0.644 |

0.725 |

SCCO

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.13 |

-0.09 |

-0.05 |

-0.04 |

-0.02 |

0.00 |

0.02 |

0.05 |

0.10 |

0.17 |

0.31 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.101 |

0.104 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.810 |

0.056 |

-14.554 |

0.0000 |

|log-return| |

-38.284 |

1.605 |

-23.849 |

0.0000 |

I(right-tail) |

-0.014 |

0.077 |

-0.181 |

0.8561 |

|log-return|*I(right-tail) |

2.026 |

2.199 |

0.921 |

0.3571 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.732 |

0.635 |

0.652 |

0.695 |

APC

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.15 |

-0.10 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.02 |

0.05 |

0.08 |

0.12 |

0.12 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.036 |

0.113 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.919 |

0.053 |

-17.375 |

0.0000 |

|log-return| |

-35.686 |

1.531 |

-23.303 |

0.0000 |

I(right-tail) |

0.247 |

0.077 |

3.186 |

0.0015 |

|log-return|*I(right-tail) |

-10.359 |

2.425 |

-4.271 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.602 |

0.509 |

0.468 |

0.685 |

DD

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.07 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.08 |

0.58 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.119 |

0.143 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.871 |

0.057 |

-15.328 |

0.0000 |

|log-return| |

-56.166 |

2.414 |

-23.265 |

0.0000 |

I(right-tail) |

0.226 |

0.079 |

2.867 |

0.0042 |

|log-return|*I(right-tail) |

-10.798 |

3.588 |

-3.009 |

0.0027 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.698 |

0.432 |

0.736 |

0.646 |

MRO

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.11 |

-0.08 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.08 |

0.10 |

0.89 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.042 |

0.158 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.920 |

0.054 |

-17.075 |

0.0000 |

|log-return| |

-41.338 |

1.782 |

-23.198 |

0.0000 |

I(right-tail) |

0.163 |

0.076 |

2.130 |

0.0334 |

|log-return|*I(right-tail) |

-6.336 |

2.652 |

-2.389 |

0.0170 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.640 |

0.511 |

0.417 |

0.634 |

PXD

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.13 |

-0.10 |

-0.05 |

-0.03 |

-0.02 |

0.00 |

0.02 |

0.06 |

0.10 |

0.12 |

1.72 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.321 |

0.127 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.854 |

0.054 |

-15.740 |

0.0000 |

|log-return| |

-35.305 |

1.487 |

-23.745 |

0.0000 |

I(right-tail) |

0.229 |

0.079 |

2.894 |

0.0039 |

|log-return|*I(right-tail) |

-7.261 |

2.272 |

-3.195 |

0.0014 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.621 |

0.574 |

0.679 |

0.620 |

HAL

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.12 |

-0.10 |

-0.05 |

-0.03 |

-0.01 |

0.00 |

0.02 |

0.05 |

0.08 |

0.10 |

0.88 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.097 |

0.122 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.833 |

0.054 |

-15.449 |

0.0000 |

|log-return| |

-38.682 |

1.606 |

-24.087 |

0.0000 |

I(right-tail) |

0.177 |

0.079 |

2.232 |

0.0258 |

|log-return|*I(right-tail) |

-7.734 |

2.497 |

-3.097 |

0.0020 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.440 |

0.467 |

0.589 |

0.613 |

XEC

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.11 |

-0.09 |

-0.05 |

-0.03 |

-0.02 |

0.00 |

0.02 |

0.05 |

0.08 |

0.11 |

1.71 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.096 |

0.139 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.737 |

0.058 |

-12.612 |

0.0000 |

|log-return| |

-42.006 |

1.761 |

-23.857 |

0.0000 |

I(right-tail) |

0.097 |

0.081 |

1.189 |

0.2347 |

|log-return|*I(right-tail) |

-3.874 |

2.565 |

-1.510 |

0.1313 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.528 |

0.401 |

0.693 |

0.487 |

DHI

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.14 |

-0.11 |

-0.06 |

-0.04 |

-0.02 |

0.00 |

0.02 |

0.06 |

0.11 |

0.15 |

1.12 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.267 |

0.103 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.789 |

0.054 |

-14.543 |

0.0000 |

|log-return| |

-34.100 |

1.403 |

-24.300 |

0.0000 |

I(right-tail) |

0.009 |

0.078 |

0.117 |

0.9065 |

|log-return|*I(right-tail) |

0.835 |

1.983 |

0.421 |

0.6738 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.686 |

0.523 |

0.428 |

0.486 |

RIO

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.14 |

-0.11 |

-0.06 |

-0.04 |

-0.02 |

0.00 |

0.02 |

0.06 |

0.12 |

0.15 |

1.18 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.756 |

0.075 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.888 |

0.053 |

-16.917 |

0.0000 |

|log-return| |

-30.418 |

1.278 |

-23.803 |

0.0000 |

I(right-tail) |

-0.306 |

0.071 |

-4.321 |

0.0000 |

|log-return|*I(right-tail) |

11.994 |

1.595 |

7.521 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.519 |

0.571 |

0.752 |

0.483 |

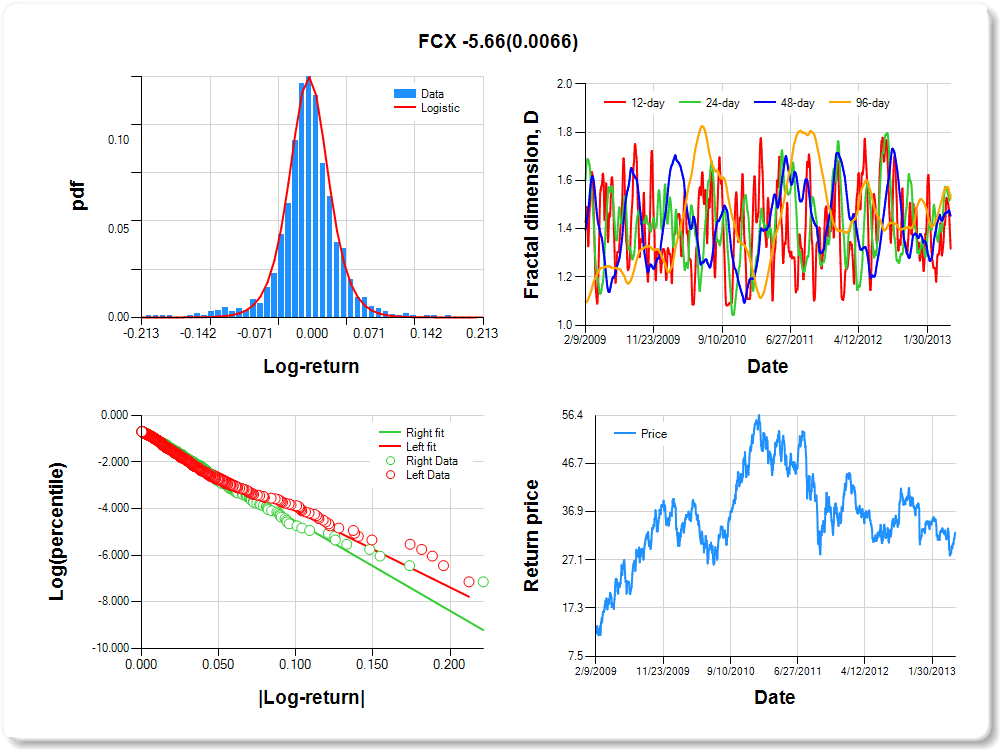

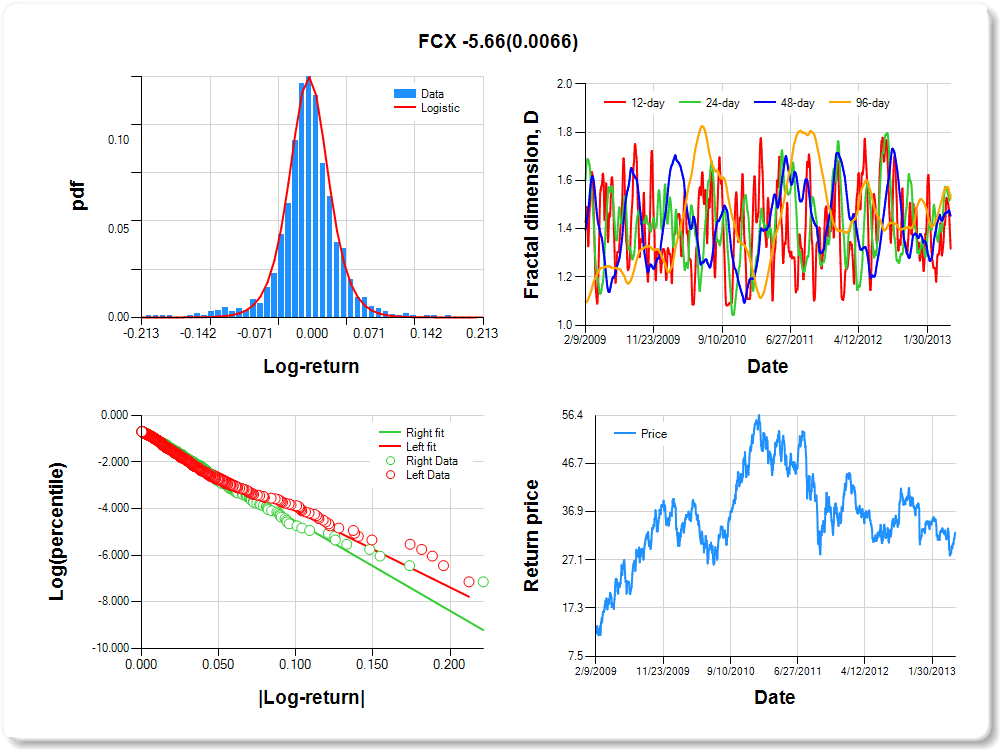

FCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.14 |

-0.11 |

-0.06 |

-0.04 |

-0.02 |

0.00 |

0.02 |

0.06 |

0.10 |

0.13 |

0.69 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.038 |

0.126 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.841 |

0.054 |

-15.717 |

0.0000 |

|log-return| |

-32.671 |

1.357 |

-24.083 |

0.0000 |

I(right-tail) |

0.126 |

0.078 |

1.624 |

0.1047 |

|log-return|*I(right-tail) |

-5.655 |

2.078 |

-2.722 |

0.0066 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.682 |

0.460 |

0.546 |

0.475 |

COP

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.09 |

-0.07 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.08 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.015 |

0.101 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.937 |

0.054 |

-17.423 |

0.0000 |

|log-return| |

-52.632 |

2.267 |

-23.214 |

0.0000 |

I(right-tail) |

0.180 |

0.076 |

2.374 |

0.0177 |

|log-return|*I(right-tail) |

-8.687 |

3.376 |

-2.574 |

0.0102 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.608 |

0.439 |

0.261 |

0.469 |

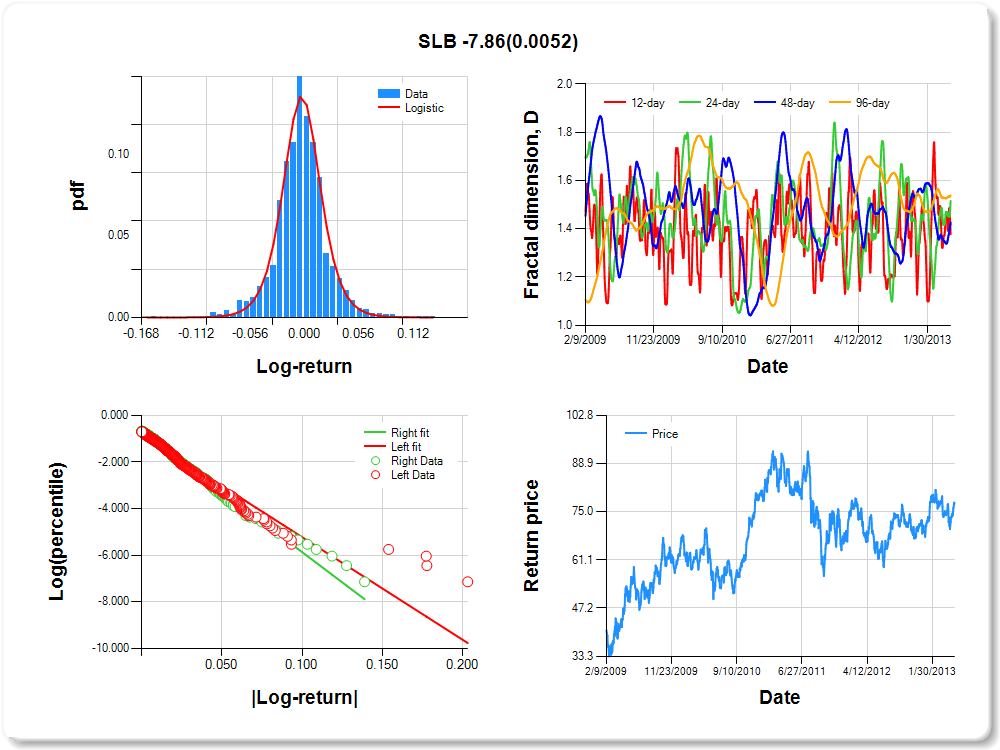

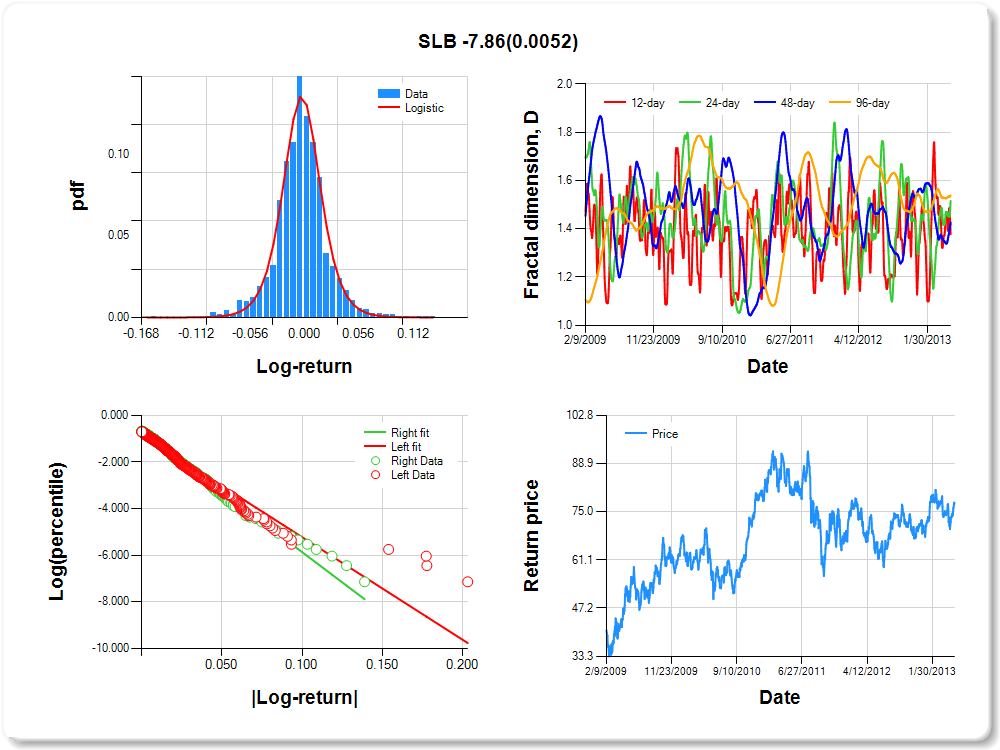

SLB

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.09 |

-0.08 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.08 |

0.10 |

0.73 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.325 |

0.127 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.829 |

0.055 |

-15.173 |

0.0000 |

|log-return| |

-43.939 |

1.860 |

-23.628 |

0.0000 |

I(right-tail) |

0.144 |

0.079 |

1.829 |

0.0676 |

|log-return|*I(right-tail) |

-7.856 |

2.809 |

-2.797 |

0.0052 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.622 |

0.484 |

0.574 |

0.462 |

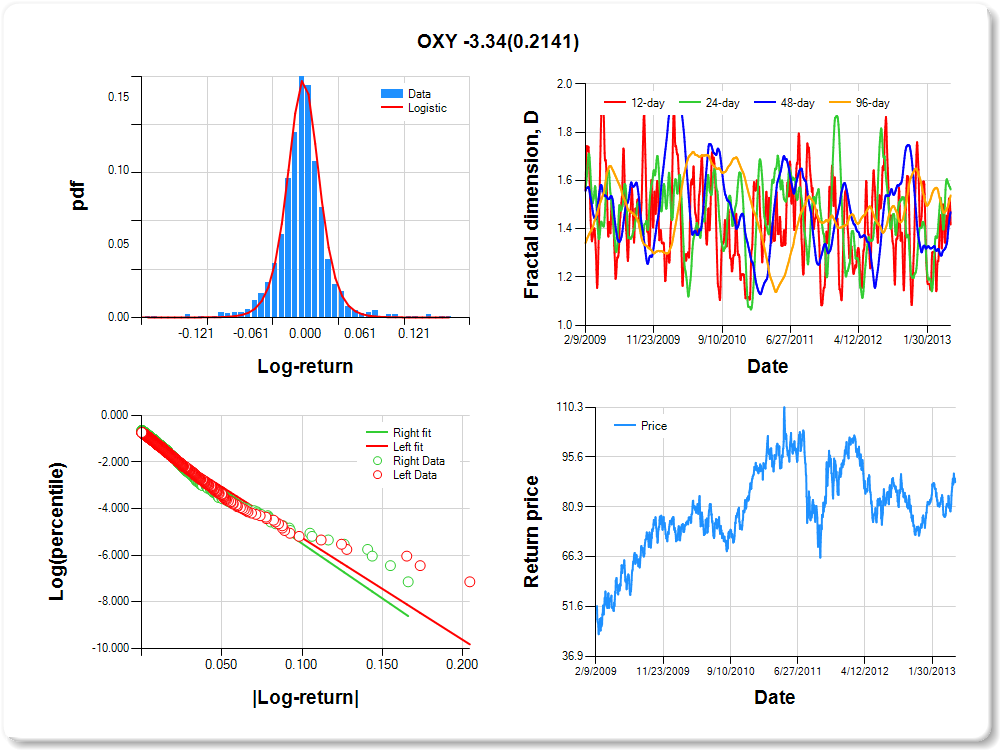

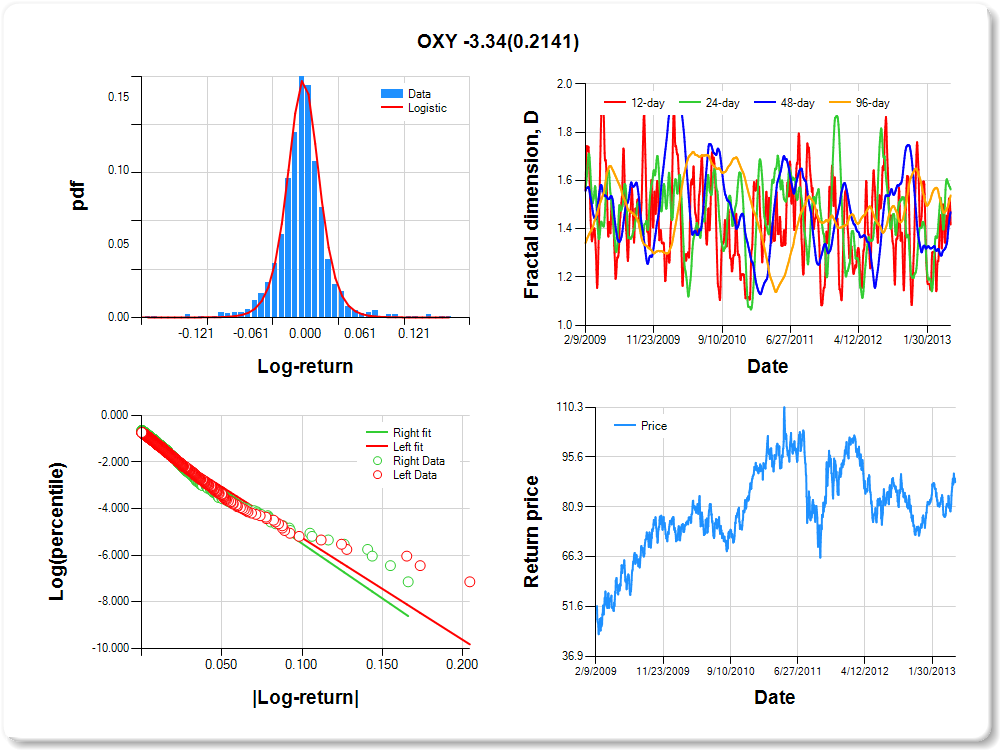

OXY

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.11 |

-0.08 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.08 |

0.11 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.187 |

0.106 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.891 |

0.054 |

-16.355 |

0.0000 |

|log-return| |

-43.651 |

1.871 |

-23.328 |

0.0000 |

I(right-tail) |

0.090 |

0.076 |

1.198 |

0.2313 |

|log-return|*I(right-tail) |

-3.338 |

2.685 |

-1.243 |

0.2141 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.582 |

0.437 |

0.531 |

0.461 |

FNARX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.11 |

-0.09 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.07 |

0.09 |

0.88 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.075 |

0.163 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.945 |

0.052 |

-18.045 |

0.0000 |

|log-return| |

-42.877 |

1.823 |

-23.520 |

0.0000 |

I(right-tail) |

0.196 |

0.076 |

2.584 |

0.0099 |

|log-return|*I(right-tail) |

-11.396 |

2.881 |

-3.955 |

0.0001 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.580 |

0.414 |

0.384 |

0.429 |

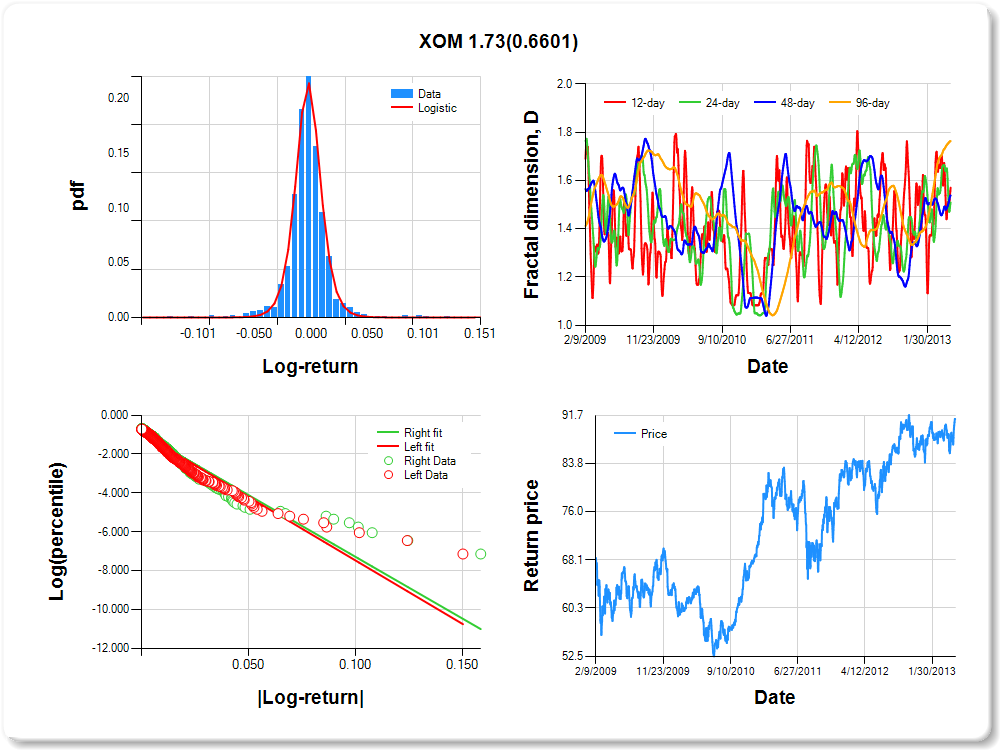

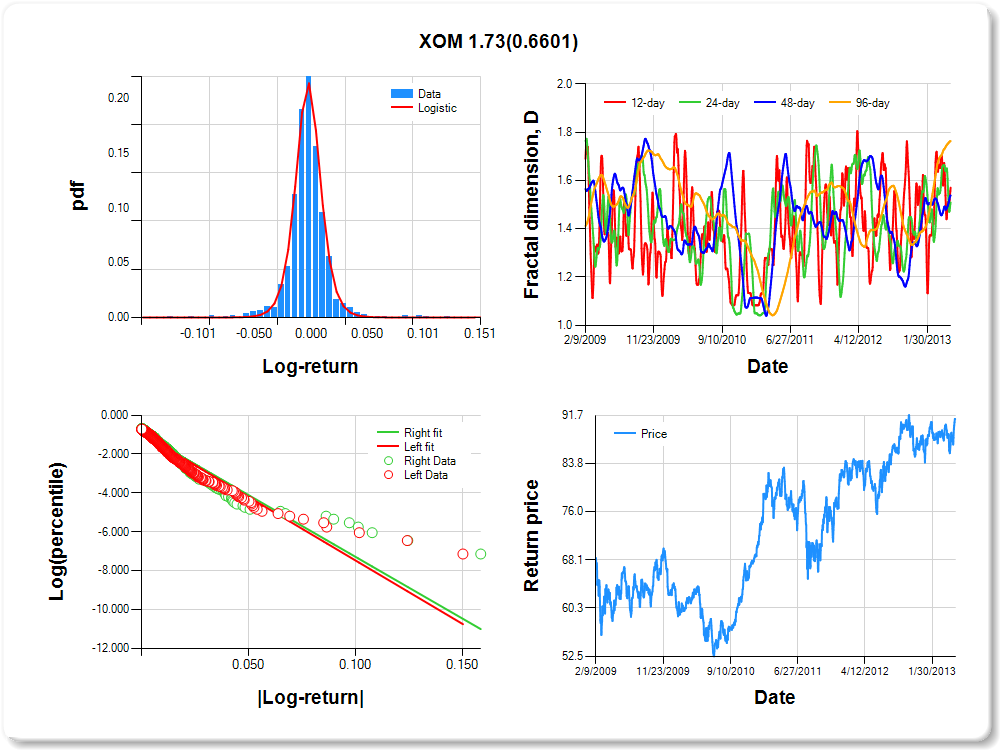

XOM

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.05 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.09 |

1.40 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.043 |

0.080 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.946 |

0.052 |

-18.208 |

0.0000 |

|log-return| |

-65.188 |

2.811 |

-23.188 |

0.0000 |

I(right-tail) |

0.014 |

0.073 |

0.190 |

0.8491 |

|log-return|*I(right-tail) |

1.731 |

3.934 |

0.440 |

0.6601 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.429 |

0.491 |

0.462 |

0.236 |