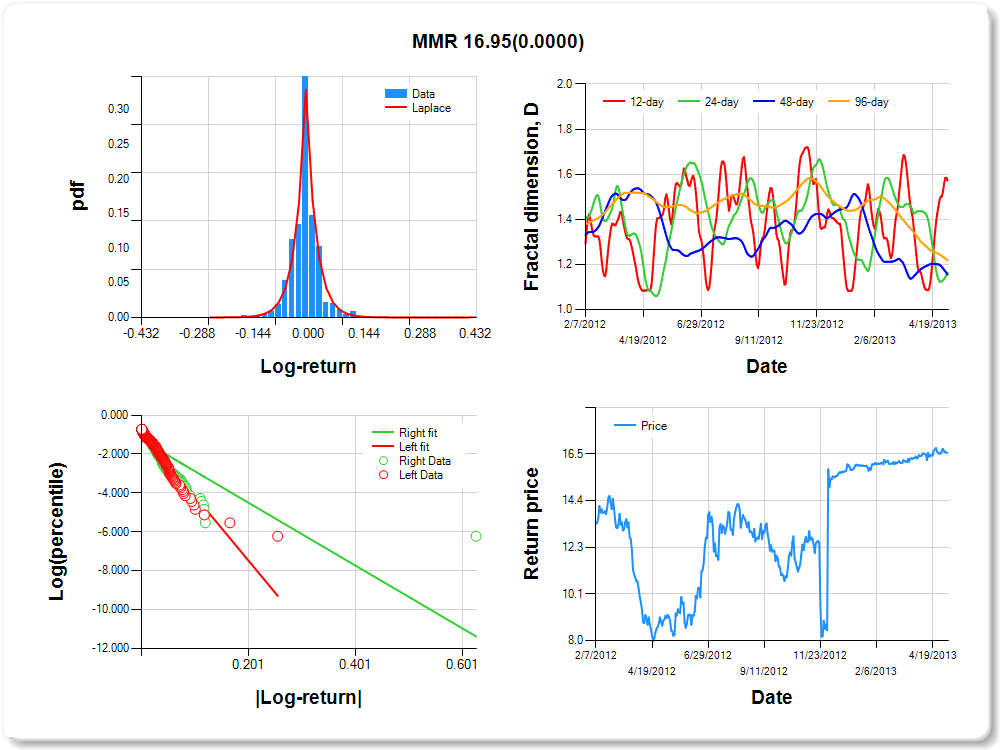

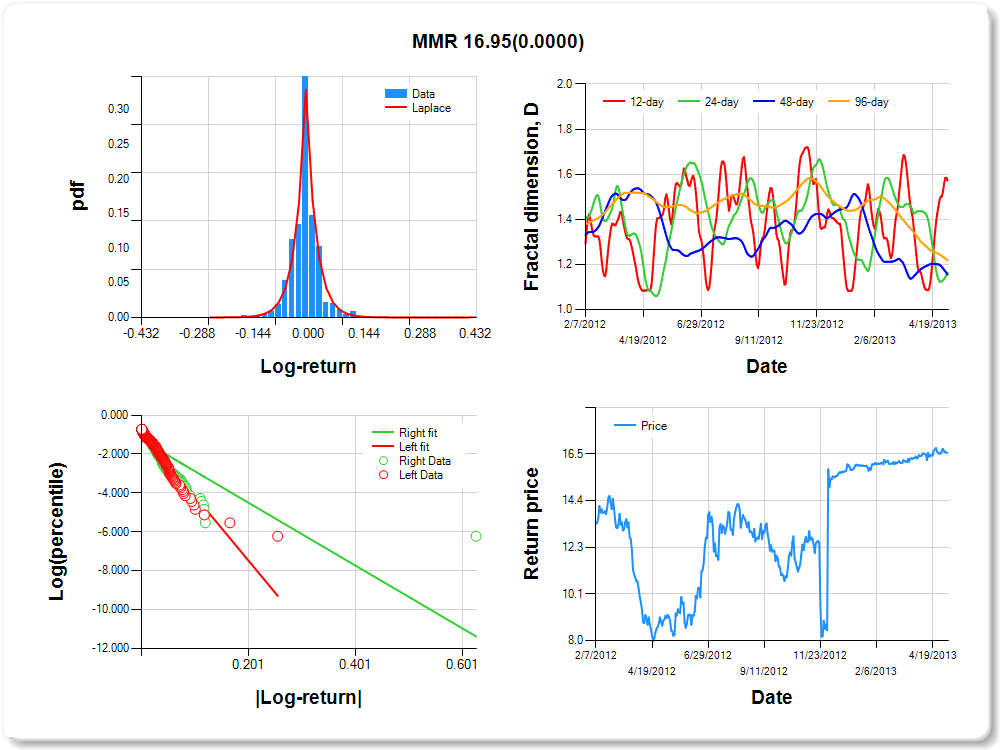

MMR

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.11 |

-0.09 |

-0.05 |

-0.04 |

-0.02 |

0.00 |

0.02 |

0.06 |

0.12 |

0.12 |

2.25 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.719 |

0.100 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.857 |

0.087 |

-9.876 |

0.0000 |

|log-return| |

-33.104 |

2.291 |

-14.448 |

0.0000 |

I(right-tail) |

-0.414 |

0.114 |

-3.638 |

0.0003 |

|log-return|*I(right-tail) |

16.953 |

2.686 |

6.311 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.428 |

0.836 |

0.844 |

0.782 |

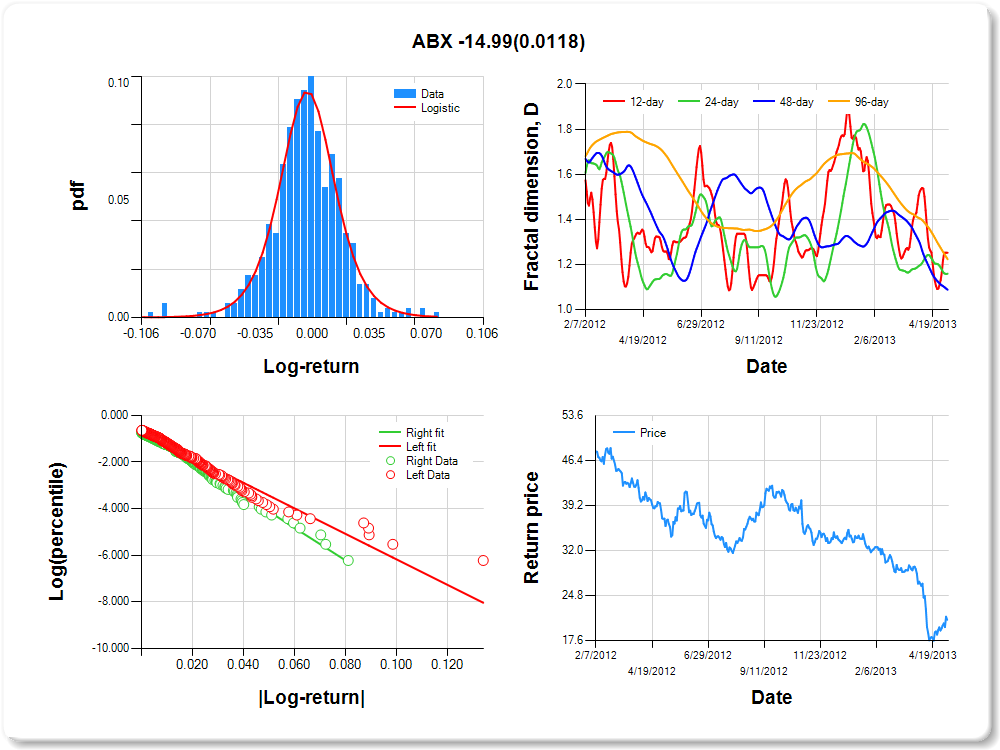

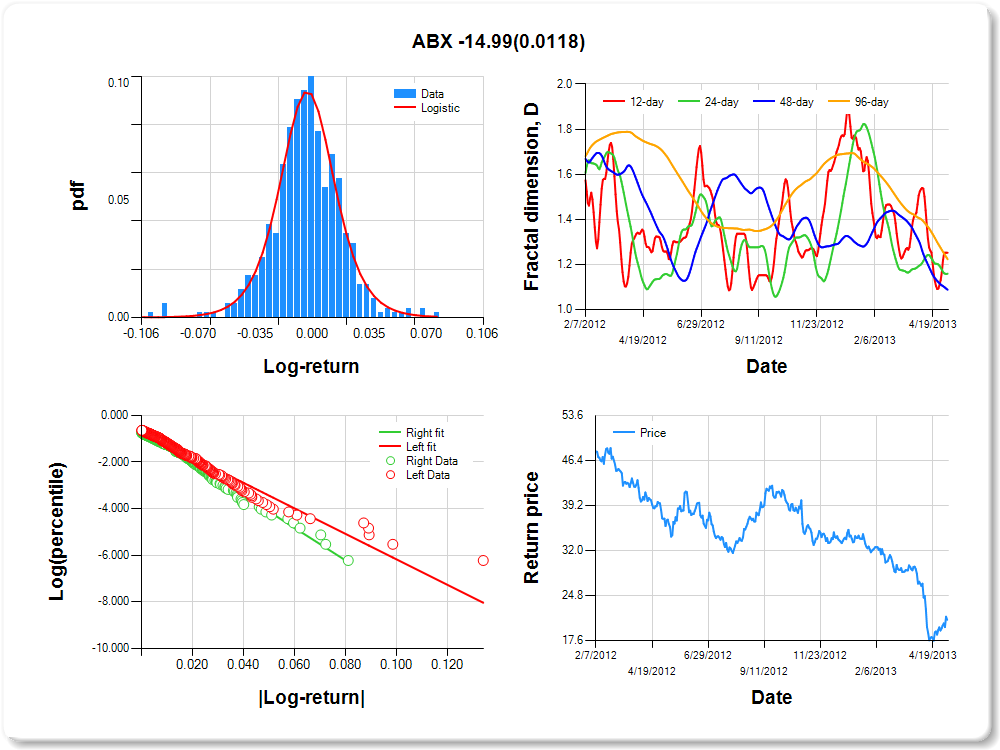

ABX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.09 |

-0.08 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.06 |

2.88 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.405 |

0.178 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.707 |

0.086 |

-8.211 |

0.0000 |

|log-return| |

-54.646 |

3.567 |

-15.318 |

0.0000 |

I(right-tail) |

0.065 |

0.131 |

0.492 |

0.6229 |

|log-return|*I(right-tail) |

-14.990 |

5.930 |

-2.528 |

0.0118 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.748 |

0.841 |

0.912 |

0.777 |

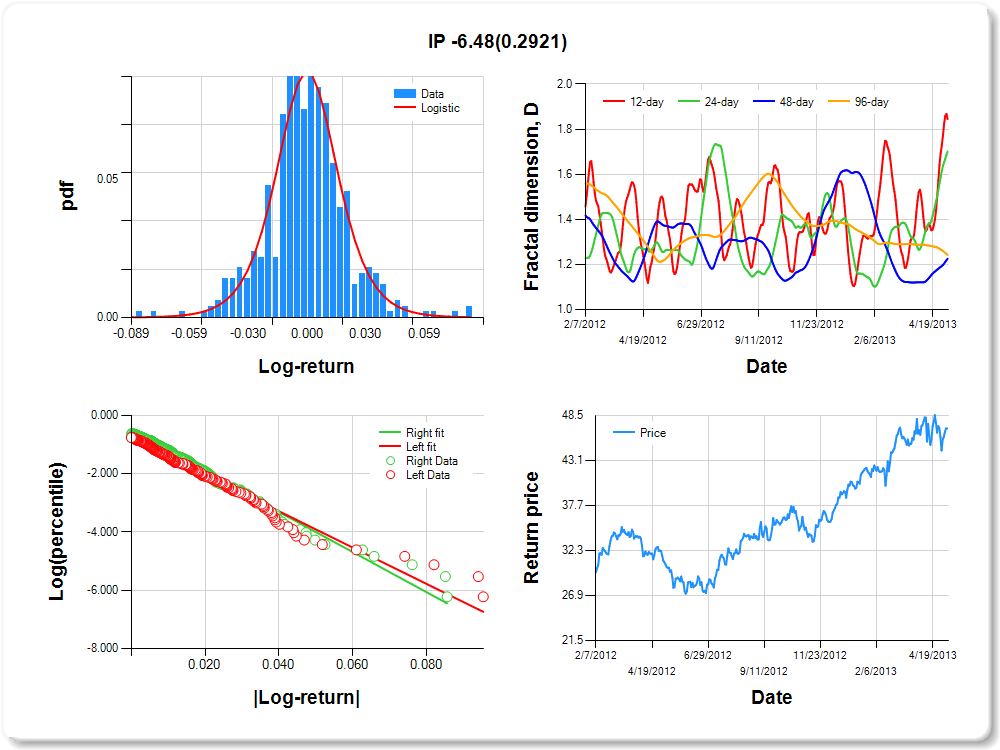

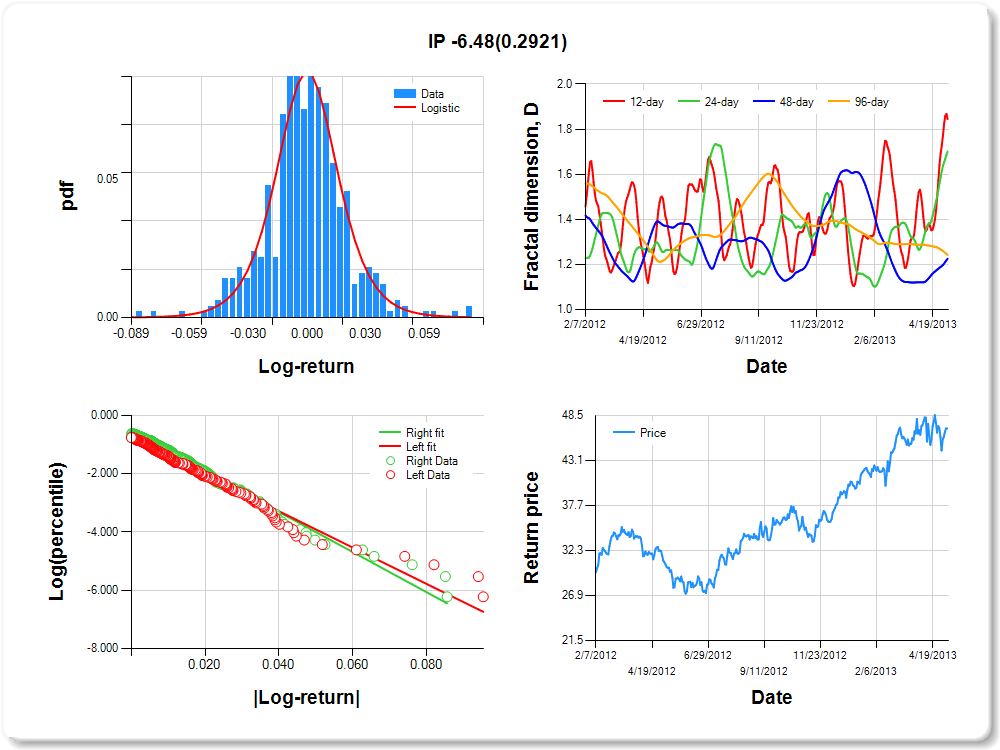

IP

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.05 |

0.07 |

3.07 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.125 |

0.193 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.788 |

0.093 |

-8.468 |

0.0000 |

|log-return| |

-62.319 |

4.298 |

-14.501 |

0.0000 |

I(right-tail) |

0.235 |

0.130 |

1.805 |

0.0717 |

|log-return|*I(right-tail) |

-6.478 |

6.143 |

-1.055 |

0.2921 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.155 |

0.299 |

0.774 |

0.758 |

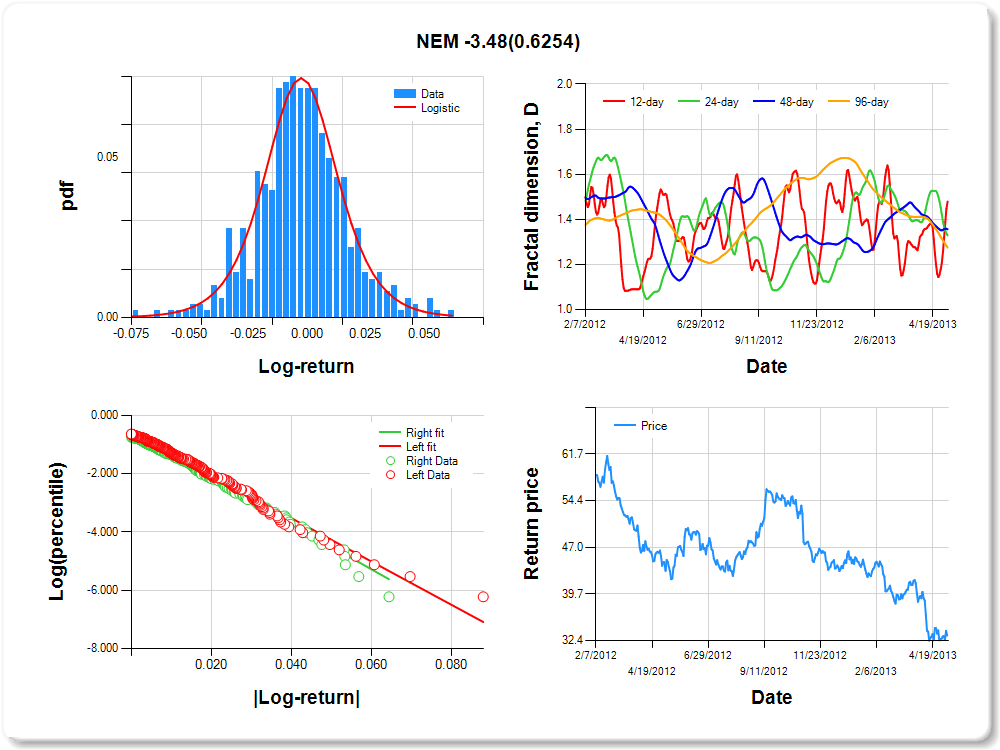

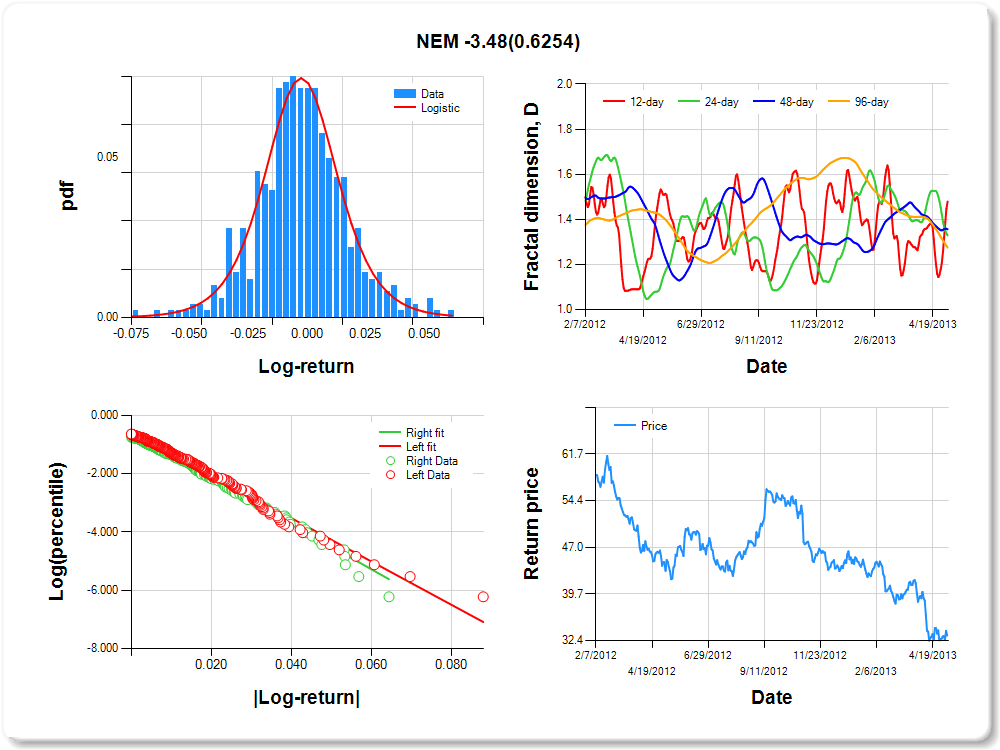

NEM

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.05 |

1.77 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.240 |

0.230 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.549 |

0.093 |

-5.918 |

0.0000 |

|log-return| |

-74.352 |

4.778 |

-15.562 |

0.0000 |

I(right-tail) |

-0.058 |

0.137 |

-0.421 |

0.6736 |

|log-return|*I(right-tail) |

-3.485 |

7.134 |

-0.488 |

0.6254 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.521 |

0.671 |

0.644 |

0.725 |

SCCO

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.07 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.06 |

0.07 |

3.25 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.228 |

0.270 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.783 |

0.092 |

-8.499 |

0.0000 |

|log-return| |

-57.196 |

3.917 |

-14.603 |

0.0000 |

I(right-tail) |

0.148 |

0.128 |

1.161 |

0.2463 |

|log-return|*I(right-tail) |

-6.723 |

5.667 |

-1.186 |

0.2360 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.732 |

0.635 |

0.652 |

0.695 |

APC

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.07 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.06 |

0.06 |

2.85 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.016 |

0.181 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.714 |

0.091 |

-7.860 |

0.0000 |

|log-return| |

-58.628 |

3.915 |

-14.975 |

0.0000 |

I(right-tail) |

0.143 |

0.132 |

1.078 |

0.2817 |

|log-return|*I(right-tail) |

-6.175 |

5.803 |

-1.064 |

0.2879 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.602 |

0.509 |

0.468 |

0.685 |

DD

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.05 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.06 |

3.54 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.358 |

0.171 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.849 |

0.090 |

-9.410 |

0.0000 |

|log-return| |

-74.588 |

5.194 |

-14.360 |

0.0000 |

I(right-tail) |

0.295 |

0.129 |

2.287 |

0.0226 |

|log-return|*I(right-tail) |

-21.239 |

8.071 |

-2.632 |

0.0088 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.698 |

0.432 |

0.736 |

0.646 |

MRO

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.07 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.05 |

0.06 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.235 |

0.198 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.736 |

0.092 |

-8.026 |

0.0000 |

|log-return| |

-58.035 |

3.900 |

-14.881 |

0.0000 |

I(right-tail) |

0.223 |

0.134 |

1.669 |

0.0957 |

|log-return|*I(right-tail) |

-10.526 |

5.930 |

-1.775 |

0.0765 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.640 |

0.511 |

0.417 |

0.634 |

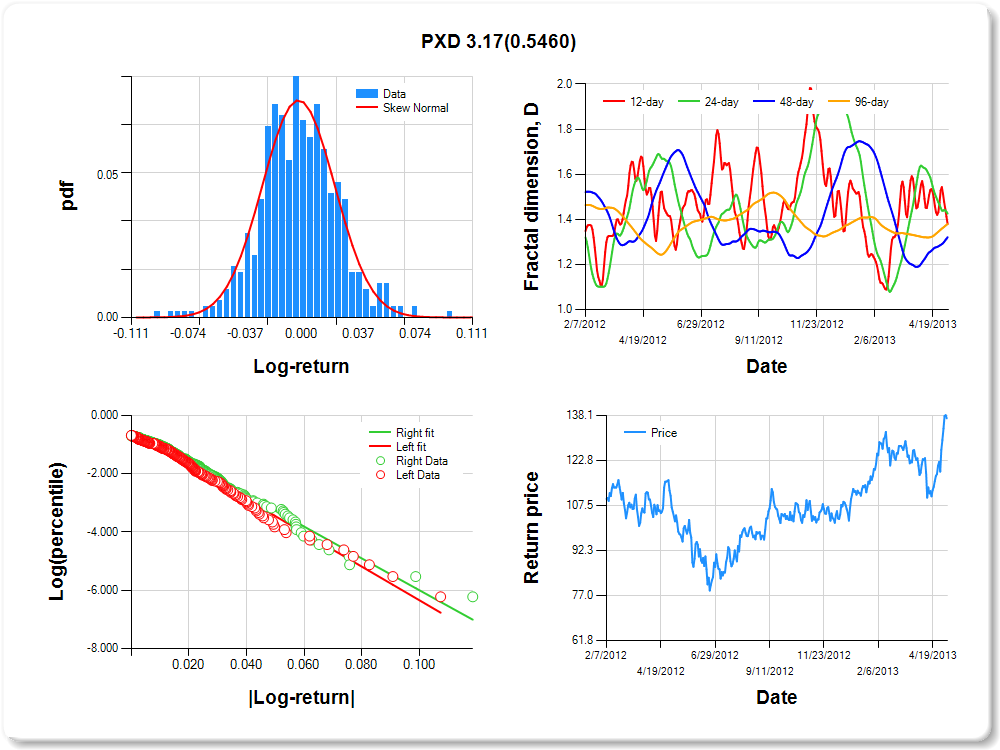

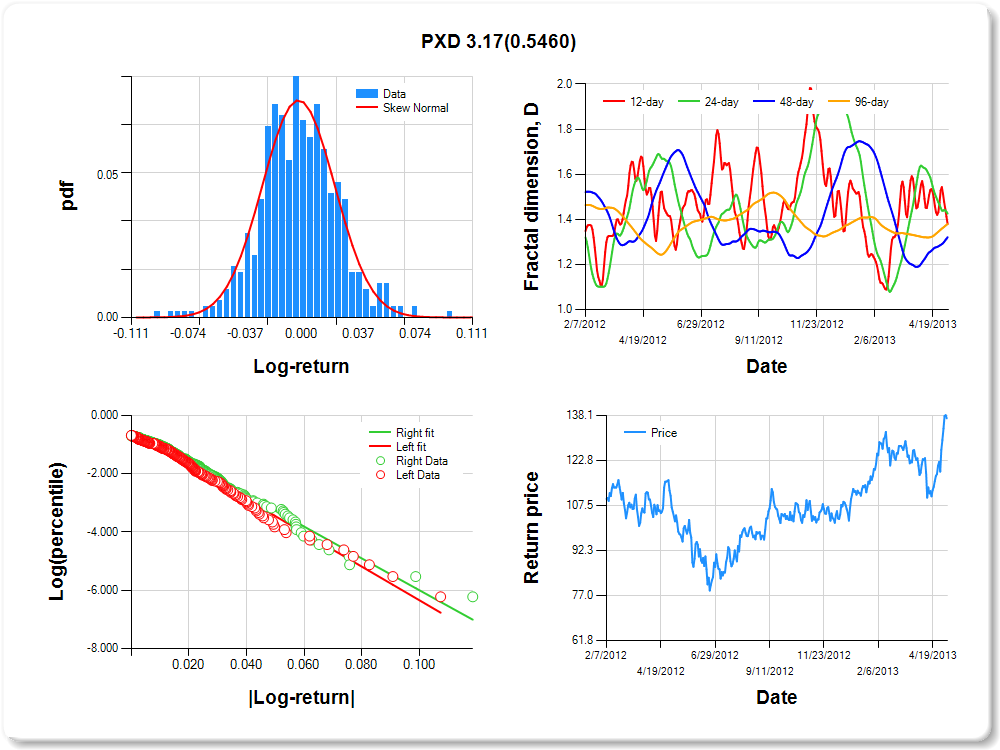

PXD

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.07 |

-0.04 |

-0.03 |

-0.02 |

0.00 |

0.02 |

0.04 |

0.07 |

0.08 |

2.42 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Skew Normal |

-0.044 |

0.359 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.574 |

0.096 |

-5.963 |

0.0000 |

|log-return| |

-57.701 |

3.804 |

-15.168 |

0.0000 |

I(right-tail) |

0.028 |

0.138 |

0.203 |

0.8392 |

|log-return|*I(right-tail) |

3.169 |

5.245 |

0.604 |

0.5460 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.621 |

0.574 |

0.679 |

0.620 |

HAL

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.09 |

-0.08 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.07 |

0.08 |

1.53 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.099 |

0.208 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.715 |

0.090 |

-7.935 |

0.0000 |

|log-return| |

-52.249 |

3.454 |

-15.125 |

0.0000 |

I(right-tail) |

0.118 |

0.132 |

0.899 |

0.3688 |

|log-return|*I(right-tail) |

-6.837 |

5.212 |

-1.312 |

0.1902 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.440 |

0.467 |

0.589 |

0.613 |

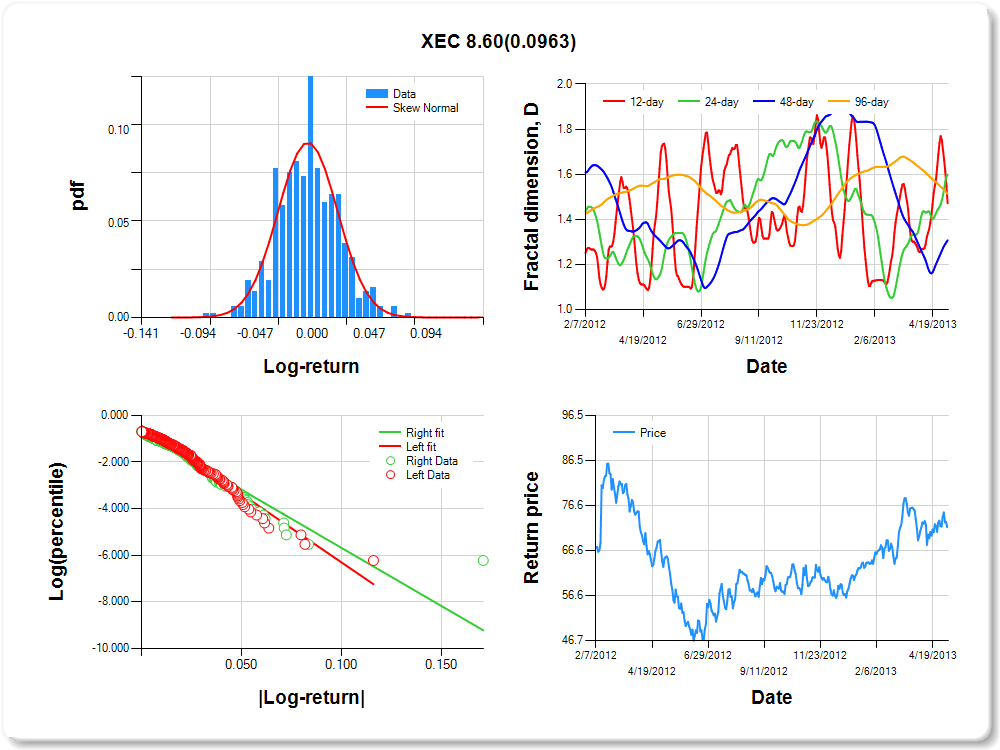

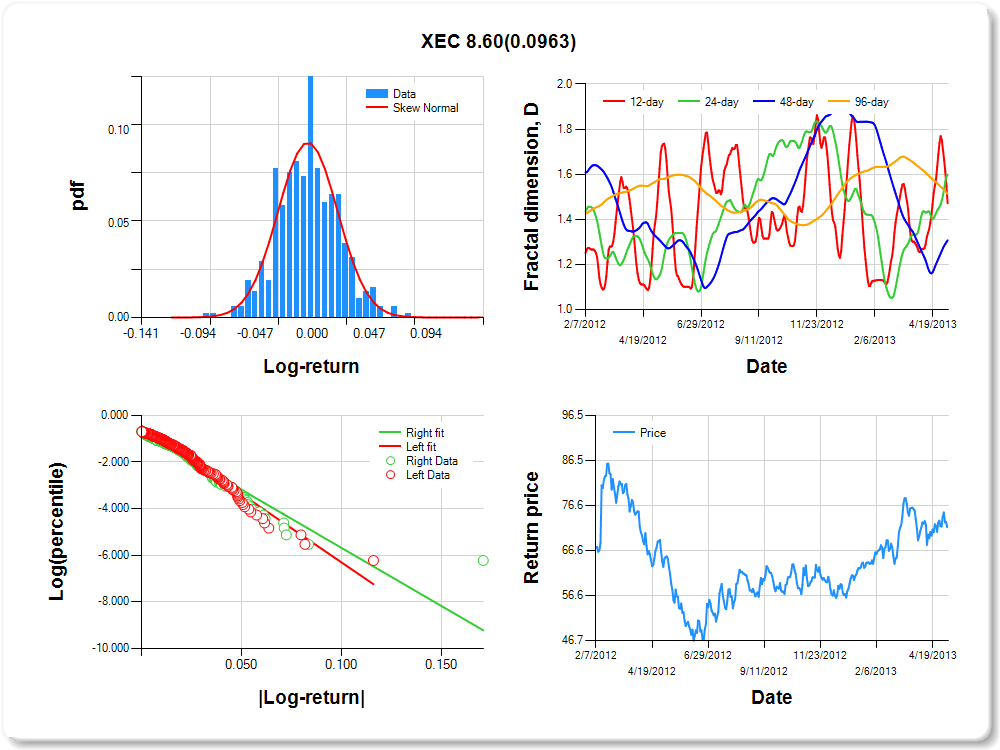

XEC

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.06 |

-0.04 |

-0.03 |

-0.02 |

0.00 |

0.02 |

0.04 |

0.06 |

0.07 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Skew Normal |

-0.268 |

0.302 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.467 |

0.103 |

-4.518 |

0.0000 |

|log-return| |

-58.427 |

3.903 |

-14.968 |

0.0000 |

I(right-tail) |

-0.238 |

0.138 |

-1.730 |

0.0843 |

|log-return|*I(right-tail) |

8.601 |

5.163 |

1.666 |

0.0963 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.528 |

0.401 |

0.693 |

0.487 |

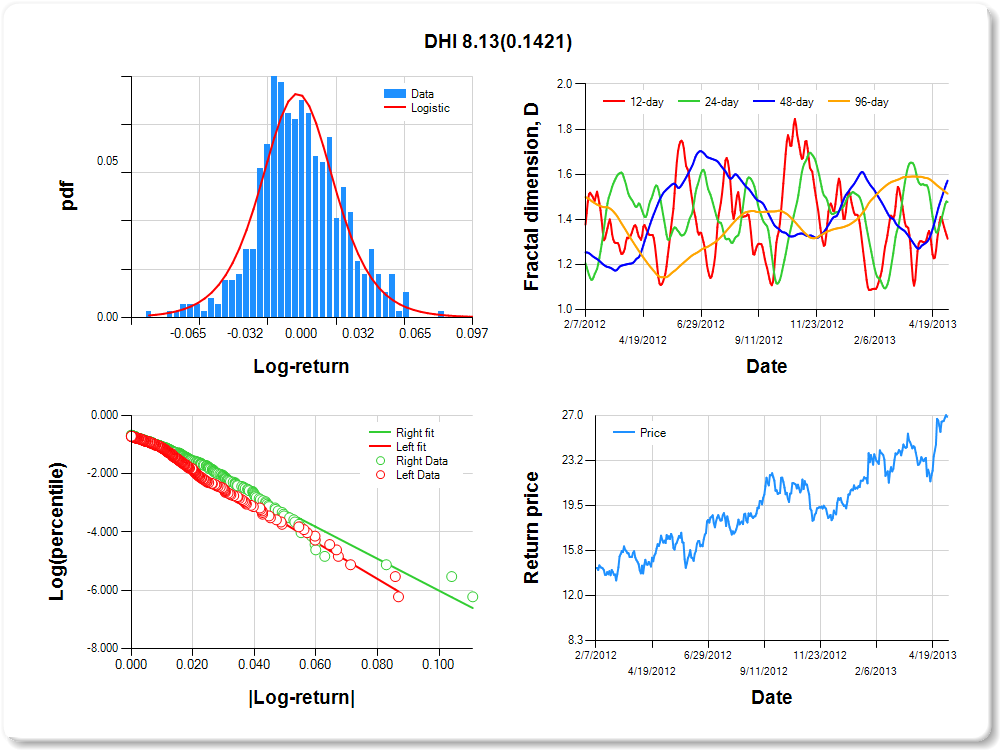

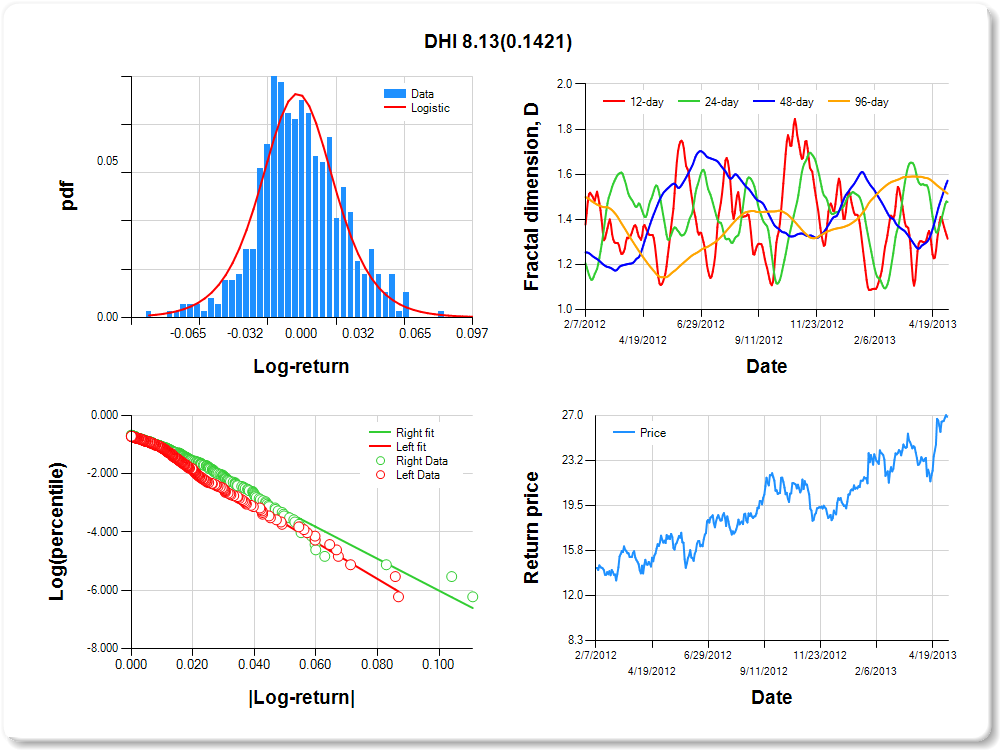

DHI

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.02 |

0.05 |

0.06 |

0.07 |

1.71 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.218 |

0.240 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.568 |

0.099 |

-5.728 |

0.0000 |

|log-return| |

-62.764 |

4.191 |

-14.976 |

0.0000 |

I(right-tail) |

0.038 |

0.139 |

0.276 |

0.7829 |

|log-return|*I(right-tail) |

8.128 |

5.528 |

1.470 |

0.1421 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.686 |

0.523 |

0.428 |

0.486 |

RIO

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.10 |

-0.07 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.07 |

0.08 |

2.71 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.074 |

0.174 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.662 |

0.092 |

-7.204 |

0.0000 |

|log-return| |

-52.559 |

3.470 |

-15.145 |

0.0000 |

I(right-tail) |

-0.016 |

0.131 |

-0.120 |

0.9045 |

|log-return|*I(right-tail) |

-1.753 |

5.017 |

-0.349 |

0.7269 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.519 |

0.571 |

0.752 |

0.483 |

FCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.09 |

-0.08 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.08 |

0.08 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.582 |

0.157 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.785 |

0.085 |

-9.265 |

0.0000 |

|log-return| |

-46.692 |

3.111 |

-15.010 |

0.0000 |

I(right-tail) |

0.107 |

0.127 |

0.841 |

0.4007 |

|log-return|*I(right-tail) |

-9.300 |

4.883 |

-1.905 |

0.0574 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.682 |

0.460 |

0.546 |

0.475 |

COP

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.04 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Skew Normal |

0.709 |

0.332 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.802 |

0.093 |

-8.632 |

0.0000 |

|log-return| |

-88.396 |

6.169 |

-14.328 |

0.0000 |

I(right-tail) |

0.394 |

0.136 |

2.894 |

0.0040 |

|log-return|*I(right-tail) |

-26.556 |

9.642 |

-2.754 |

0.0061 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.608 |

0.439 |

0.261 |

0.469 |

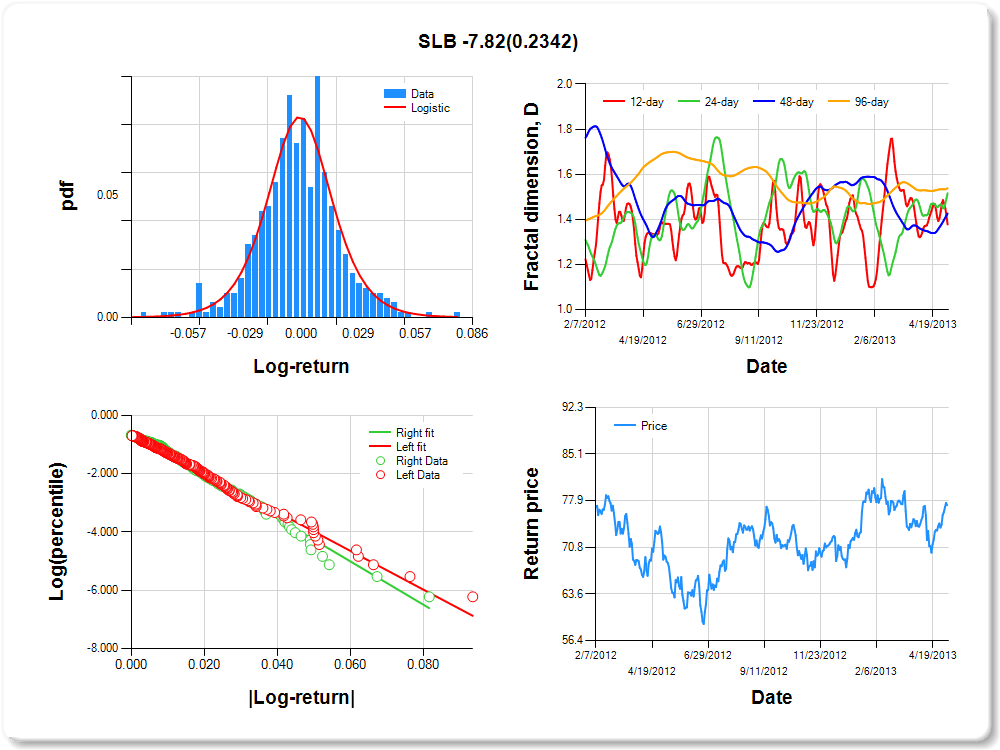

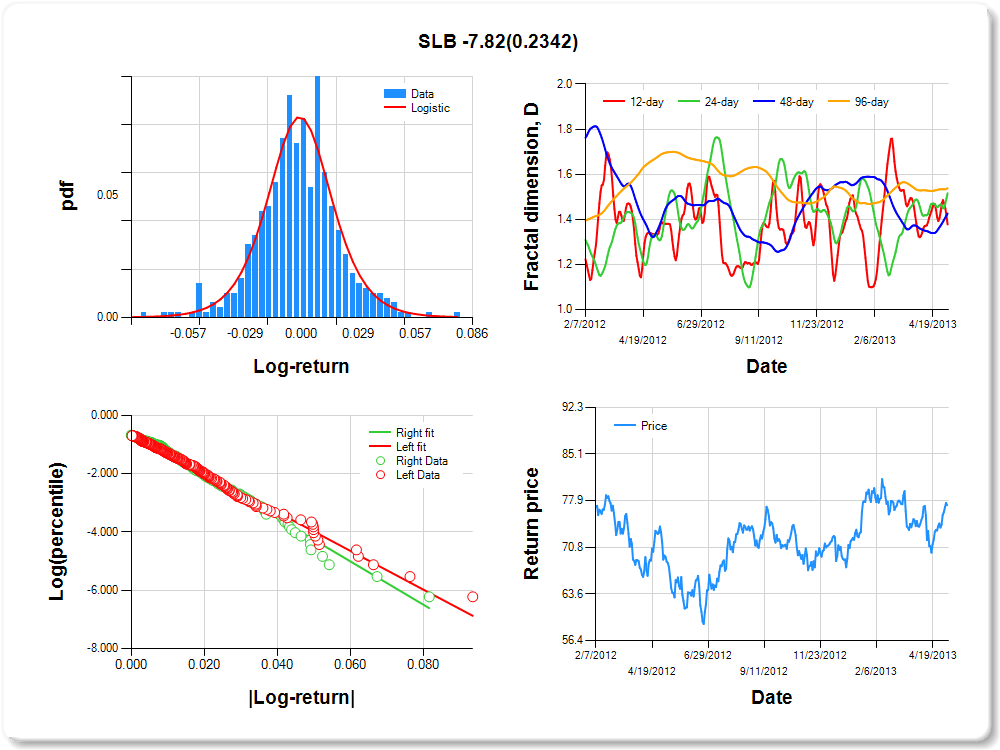

SLB

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.05 |

2.33 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.128 |

0.208 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.658 |

0.093 |

-7.073 |

0.0000 |

|log-return| |

-66.580 |

4.406 |

-15.113 |

0.0000 |

I(right-tail) |

0.109 |

0.134 |

0.815 |

0.4153 |

|log-return|*I(right-tail) |

-7.824 |

6.569 |

-1.191 |

0.2342 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.622 |

0.484 |

0.574 |

0.462 |

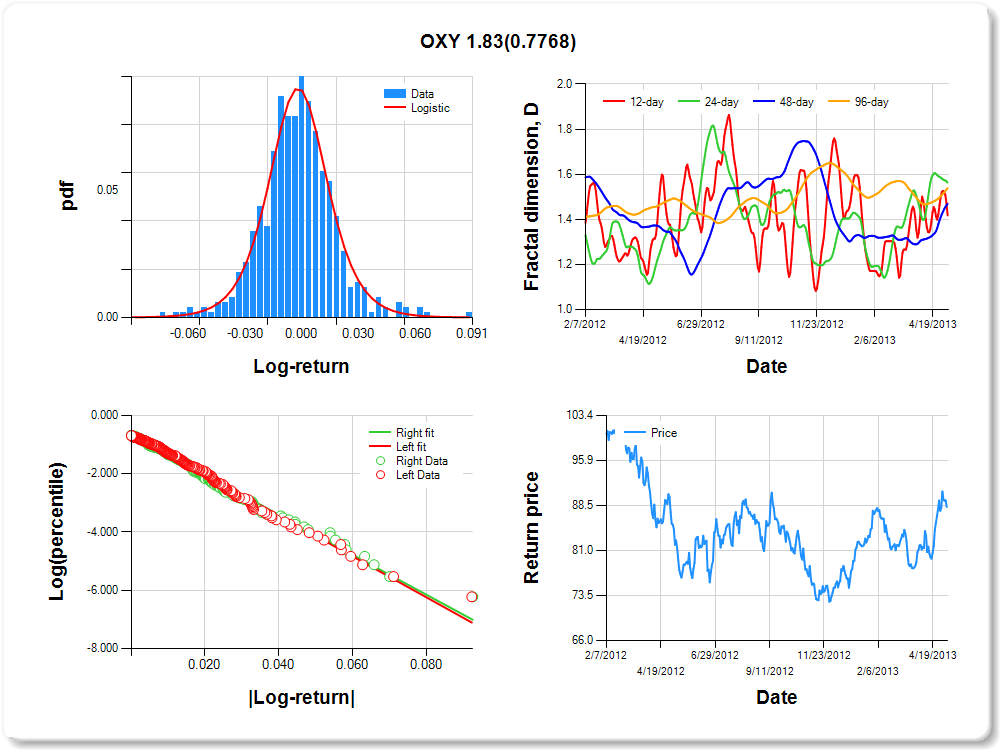

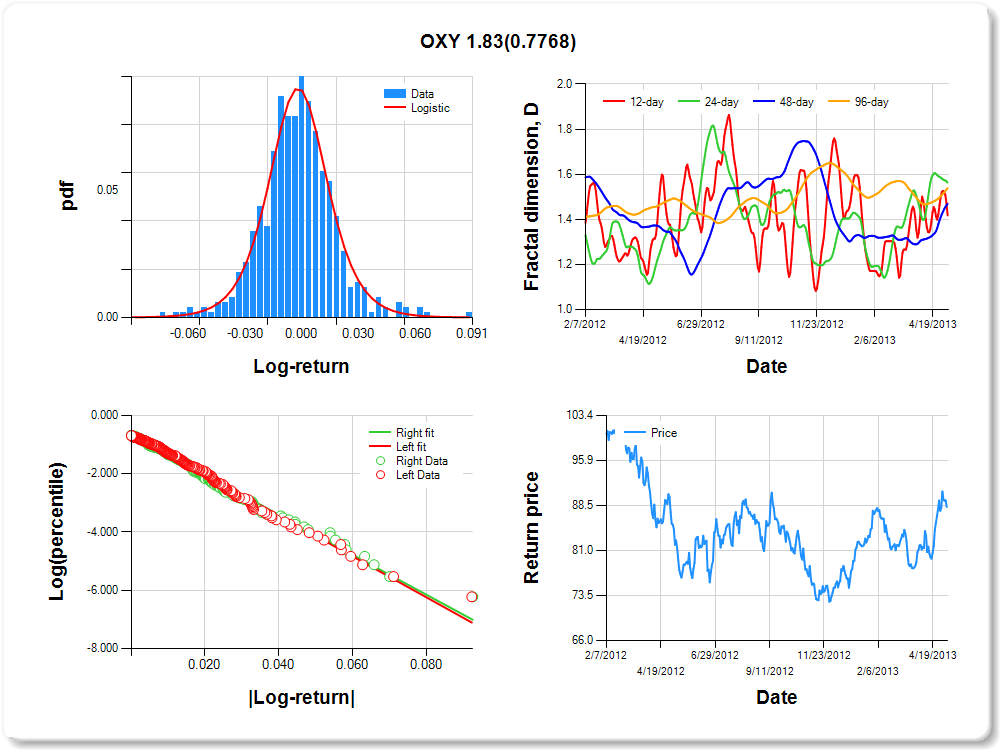

OXY

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.07 |

1.32 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.006 |

0.190 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.622 |

0.095 |

-6.577 |

0.0000 |

|log-return| |

-70.183 |

4.638 |

-15.132 |

0.0000 |

I(right-tail) |

-0.056 |

0.131 |

-0.424 |

0.6719 |

|log-return|*I(right-tail) |

1.831 |

6.456 |

0.284 |

0.7768 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.582 |

0.437 |

0.531 |

0.461 |

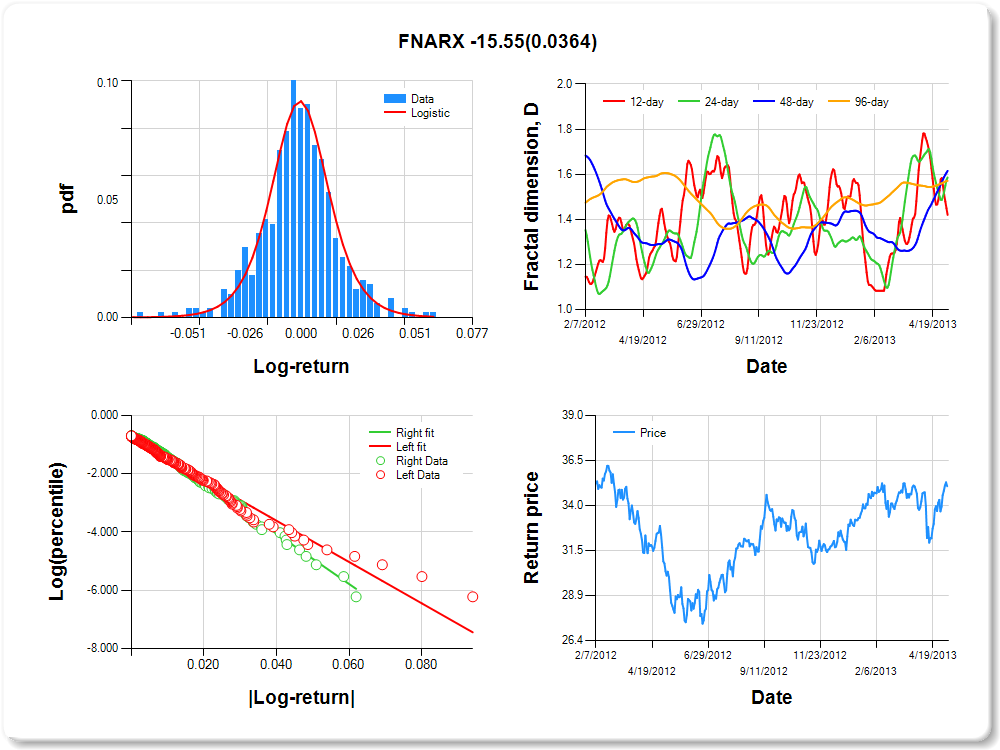

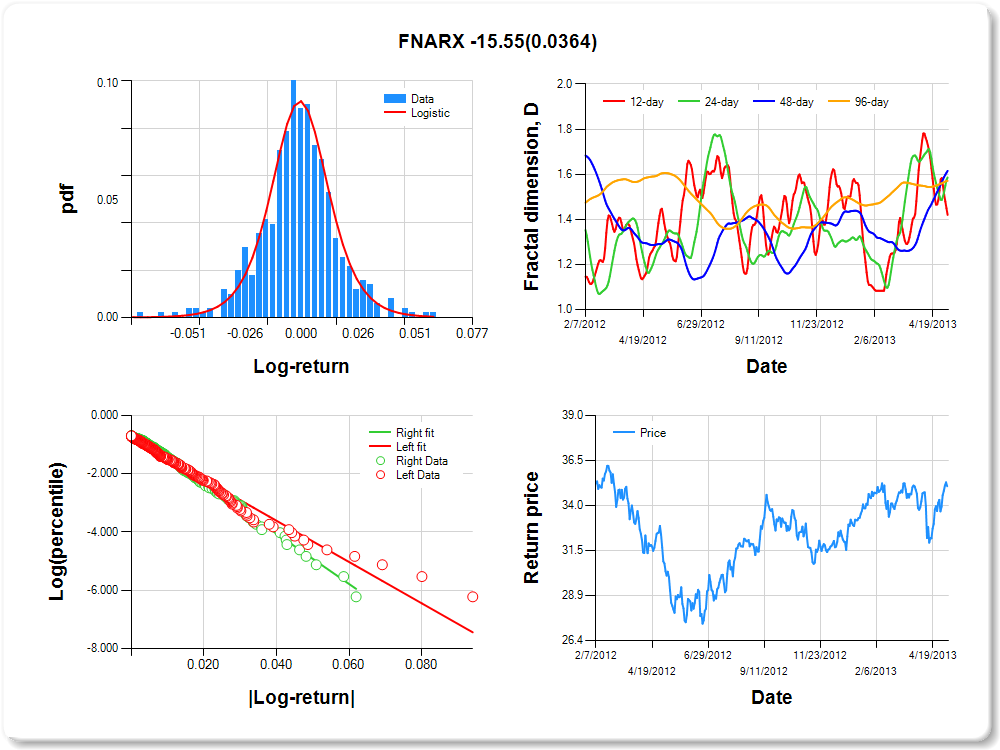

FNARX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.04 |

0.05 |

2.18 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.366 |

0.186 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.770 |

0.089 |

-8.705 |

0.0000 |

|log-return| |

-70.778 |

4.733 |

-14.954 |

0.0000 |

I(right-tail) |

0.183 |

0.131 |

1.397 |

0.1630 |

|log-return|*I(right-tail) |

-15.548 |

7.411 |

-2.098 |

0.0364 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.580 |

0.414 |

0.384 |

0.429 |

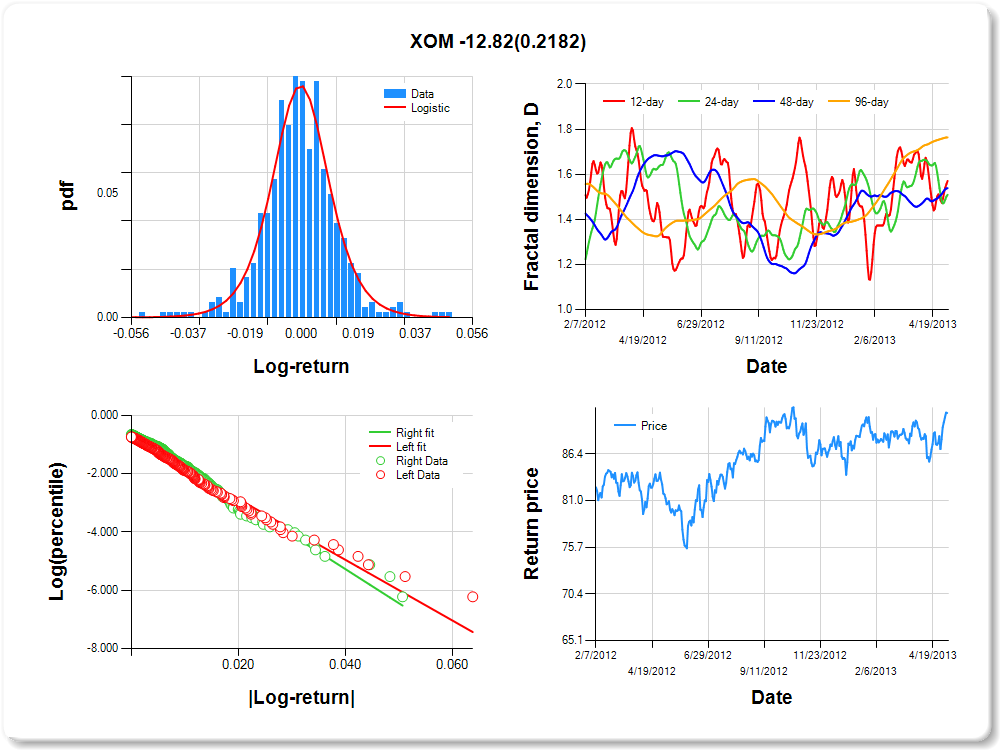

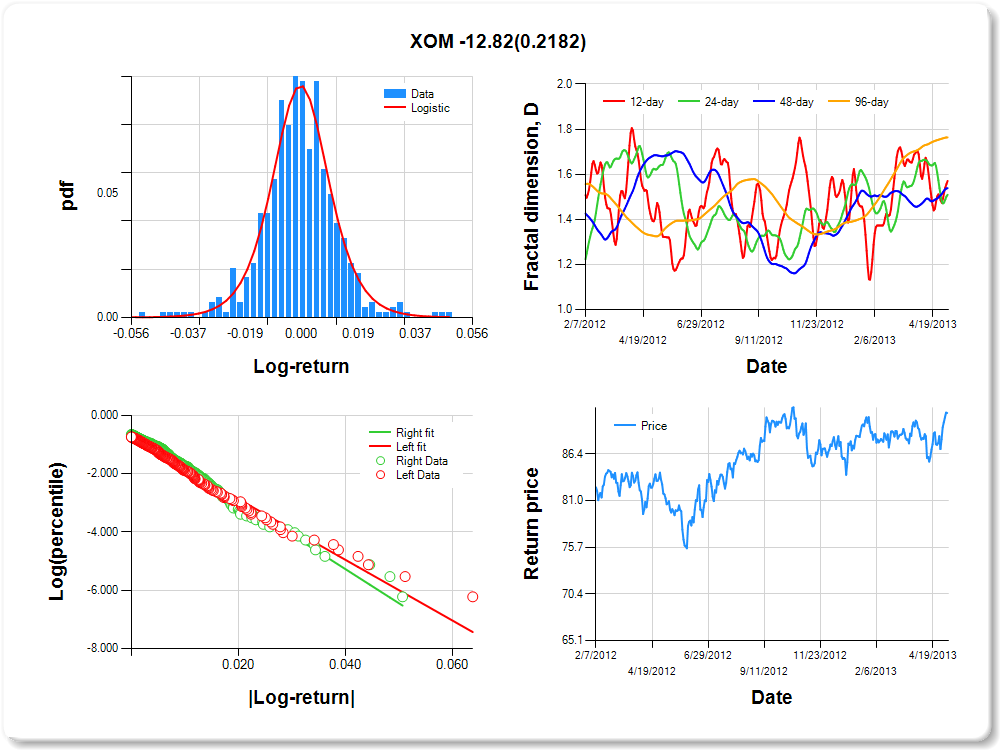

XOM

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.03 |

0.04 |

2.52 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.215 |

0.184 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.781 |

0.091 |

-8.543 |

0.0000 |

|log-return| |

-104.207 |

7.093 |

-14.692 |

0.0000 |

I(right-tail) |

0.194 |

0.130 |

1.493 |

0.1361 |

|log-return|*I(right-tail) |

-12.816 |

10.394 |

-1.233 |

0.2182 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.429 |

0.491 |

0.462 |

0.236 |