MMR

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.13 |

-0.11 |

-0.06 |

-0.04 |

-0.02 |

0.00 |

0.02 |

0.06 |

0.12 |

0.13 |

0.47 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.658 |

0.062 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.865 |

0.037 |

-23.359 |

0.0000 |

|log-return| |

-31.335 |

0.918 |

-34.118 |

0.0000 |

I(right-tail) |

-0.153 |

0.052 |

-2.931 |

0.0034 |

|log-return|*I(right-tail) |

5.611 |

1.236 |

4.539 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.428 |

0.836 |

0.844 |

0.782 |

ABX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.09 |

-0.07 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.07 |

0.09 |

0.75 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.452 |

0.099 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.739 |

0.040 |

-18.513 |

0.0000 |

|log-return| |

-52.061 |

1.514 |

-34.394 |

0.0000 |

I(right-tail) |

0.002 |

0.056 |

0.034 |

0.9730 |

|log-return|*I(right-tail) |

1.112 |

2.136 |

0.521 |

0.6025 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.748 |

0.841 |

0.912 |

0.777 |

IP

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.10 |

-0.08 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.08 |

0.10 |

0.87 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.036 |

0.086 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.905 |

0.038 |

-23.725 |

0.0000 |

|log-return| |

-48.466 |

1.450 |

-33.428 |

0.0000 |

I(right-tail) |

0.078 |

0.053 |

1.466 |

0.1428 |

|log-return|*I(right-tail) |

-2.237 |

2.068 |

-1.081 |

0.2796 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.155 |

0.299 |

0.774 |

0.758 |

NEM

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.06 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.07 |

0.08 |

0.26 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.333 |

0.108 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.699 |

0.040 |

-17.321 |

0.0000 |

|log-return| |

-58.402 |

1.688 |

-34.599 |

0.0000 |

I(right-tail) |

-0.046 |

0.057 |

-0.809 |

0.4183 |

|log-return|*I(right-tail) |

3.773 |

2.337 |

1.614 |

0.1066 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.521 |

0.671 |

0.644 |

0.725 |

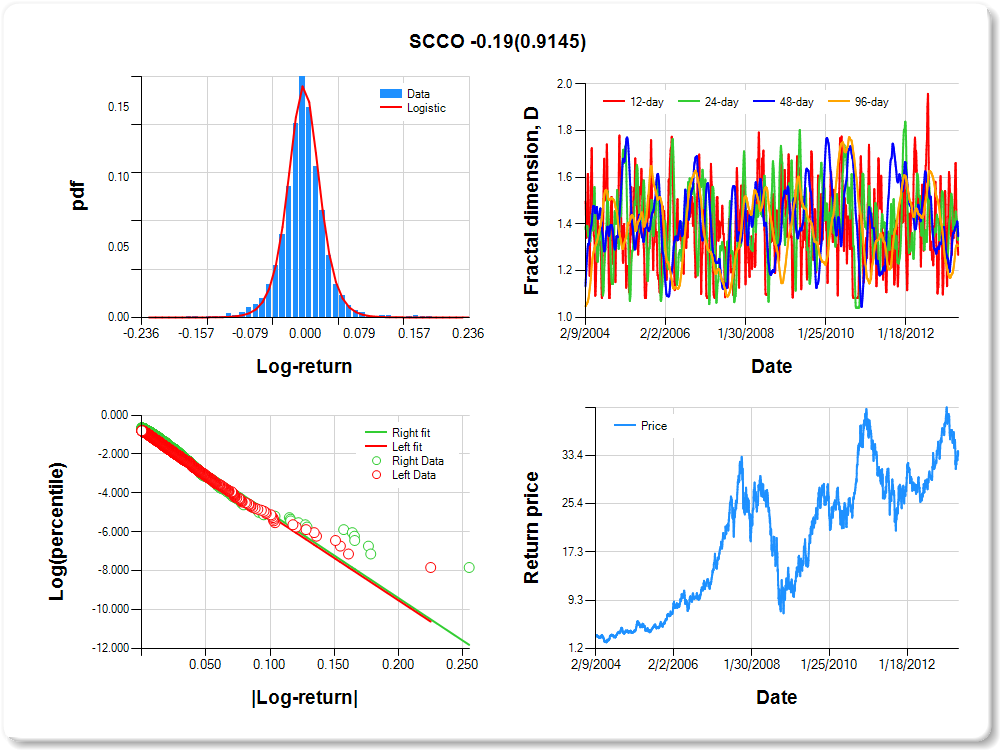

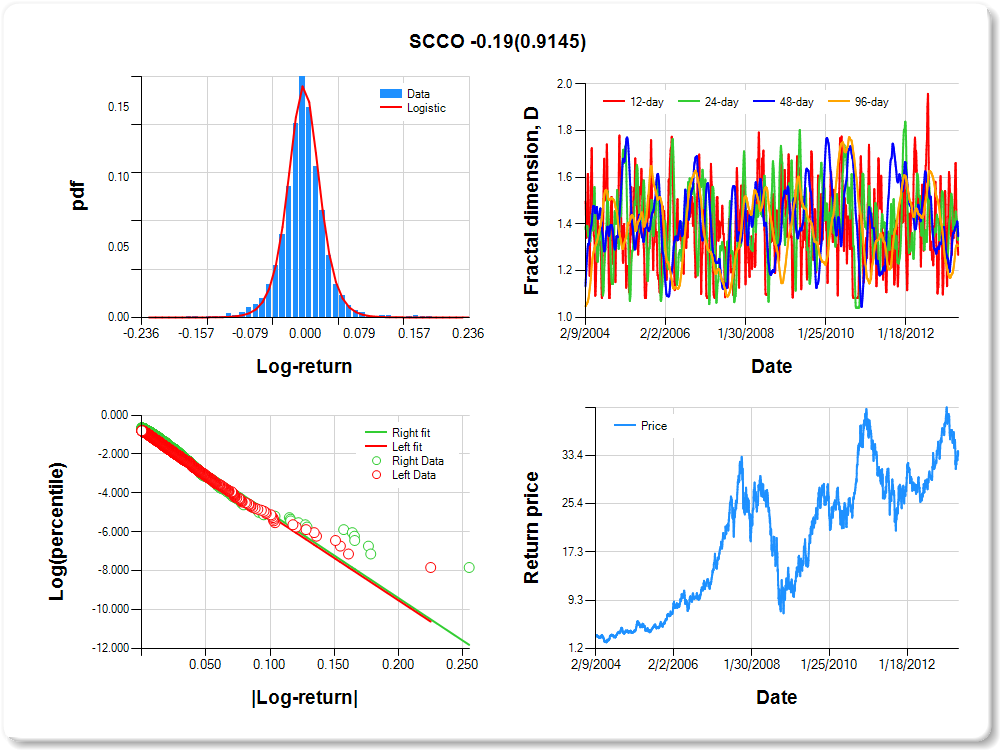

SCCO

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.10 |

-0.08 |

-0.05 |

-0.03 |

-0.01 |

0.00 |

0.02 |

0.05 |

0.08 |

0.11 |

0.27 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.091 |

0.104 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.811 |

0.042 |

-19.256 |

0.0000 |

|log-return| |

-43.486 |

1.319 |

-32.977 |

0.0000 |

I(right-tail) |

0.156 |

0.058 |

2.707 |

0.0068 |

|log-return|*I(right-tail) |

-0.195 |

1.814 |

-0.107 |

0.9145 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.732 |

0.635 |

0.652 |

0.695 |

APC

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.10 |

-0.07 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.07 |

0.08 |

0.08 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.038 |

0.098 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.918 |

0.038 |

-23.886 |

0.0000 |

|log-return| |

-44.849 |

1.377 |

-32.573 |

0.0000 |

I(right-tail) |

0.288 |

0.055 |

5.188 |

0.0000 |

|log-return|*I(right-tail) |

-12.097 |

2.127 |

-5.688 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.602 |

0.509 |

0.468 |

0.685 |

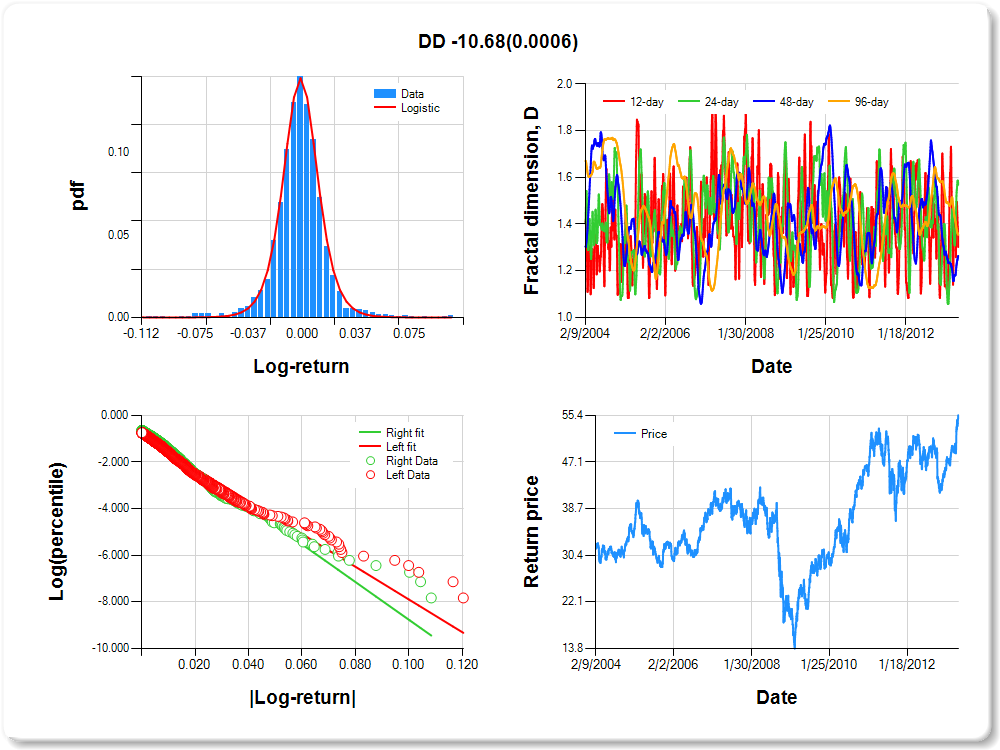

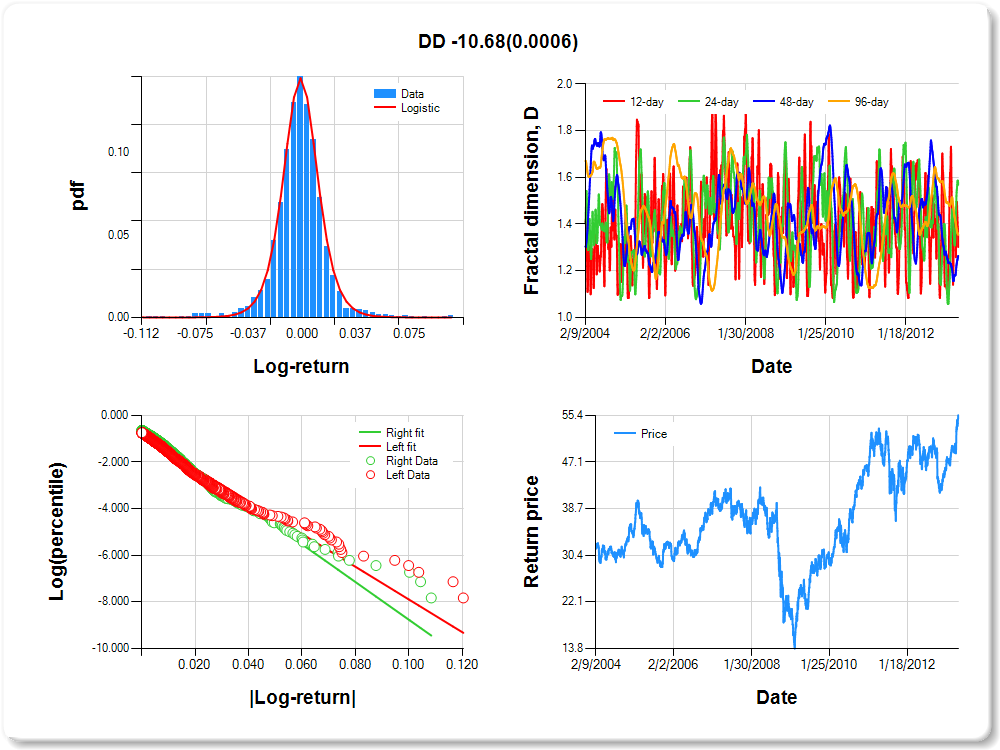

DD

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

0.58 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.103 |

0.118 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.873 |

0.039 |

-22.368 |

0.0000 |

|log-return| |

-70.126 |

2.101 |

-33.385 |

0.0000 |

I(right-tail) |

0.202 |

0.055 |

3.648 |

0.0003 |

|log-return|*I(right-tail) |

-10.677 |

3.107 |

-3.437 |

0.0006 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.698 |

0.432 |

0.736 |

0.646 |

MRO

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.07 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.06 |

0.08 |

0.63 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.049 |

0.088 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.908 |

0.040 |

-22.637 |

0.0000 |

|log-return| |

-49.952 |

1.540 |

-32.436 |

0.0000 |

I(right-tail) |

0.274 |

0.056 |

4.870 |

0.0000 |

|log-return|*I(right-tail) |

-9.523 |

2.289 |

-4.161 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.640 |

0.511 |

0.417 |

0.634 |

PXD

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.10 |

-0.08 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.02 |

0.04 |

0.08 |

0.10 |

1.55 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.321 |

0.104 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.860 |

0.039 |

-22.269 |

0.0000 |

|log-return| |

-44.180 |

1.321 |

-33.439 |

0.0000 |

I(right-tail) |

0.217 |

0.056 |

3.890 |

0.0001 |

|log-return|*I(right-tail) |

-7.298 |

1.969 |

-3.706 |

0.0002 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.621 |

0.574 |

0.679 |

0.620 |

HAL

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.10 |

-0.08 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.07 |

0.08 |

0.75 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.094 |

0.105 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.838 |

0.040 |

-21.176 |

0.0000 |

|log-return| |

-47.878 |

1.431 |

-33.447 |

0.0000 |

I(right-tail) |

0.235 |

0.057 |

4.149 |

0.0000 |

|log-return|*I(right-tail) |

-8.917 |

2.156 |

-4.136 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.440 |

0.467 |

0.589 |

0.613 |

XEC

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.09 |

-0.07 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.06 |

0.08 |

1.39 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.094 |

0.110 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.802 |

0.041 |

-19.568 |

0.0000 |

|log-return| |

-50.853 |

1.522 |

-33.410 |

0.0000 |

I(right-tail) |

0.167 |

0.057 |

2.933 |

0.0034 |

|log-return|*I(right-tail) |

-5.722 |

2.210 |

-2.589 |

0.0097 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.528 |

0.401 |

0.693 |

0.487 |

DHI

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.11 |

-0.09 |

-0.05 |

-0.03 |

-0.02 |

0.00 |

0.02 |

0.05 |

0.10 |

0.12 |

1.05 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.267 |

0.095 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.741 |

0.039 |

-18.887 |

0.0000 |

|log-return| |

-41.141 |

1.187 |

-34.652 |

0.0000 |

I(right-tail) |

0.001 |

0.056 |

0.021 |

0.9836 |

|log-return|*I(right-tail) |

1.520 |

1.664 |

0.914 |

0.3610 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.686 |

0.523 |

0.428 |

0.486 |

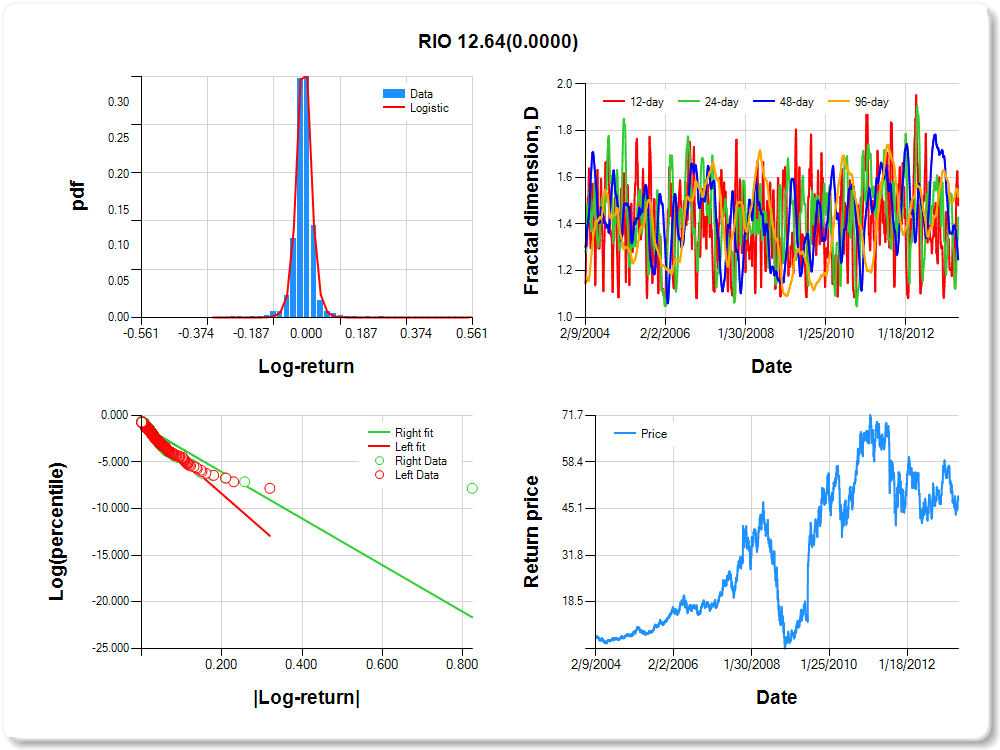

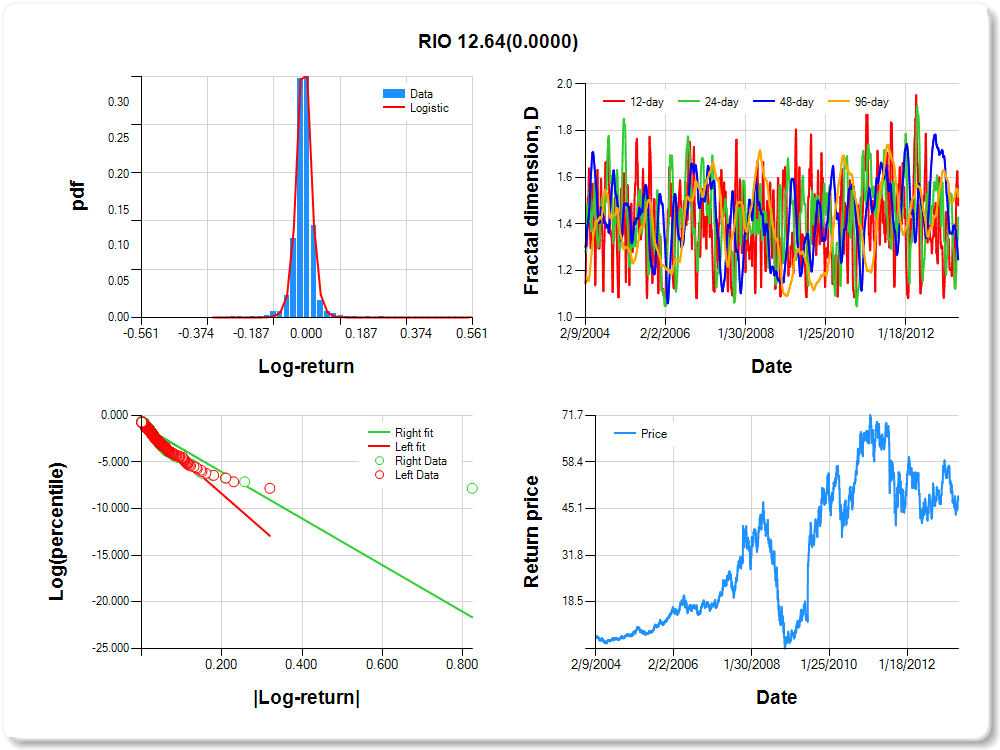

RIO

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.11 |

-0.10 |

-0.04 |

-0.03 |

-0.01 |

0.00 |

0.02 |

0.04 |

0.10 |

0.12 |

0.67 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.754 |

0.044 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.926 |

0.038 |

-24.222 |

0.0000 |

|log-return| |

-37.566 |

1.141 |

-32.919 |

0.0000 |

I(right-tail) |

-0.184 |

0.051 |

-3.599 |

0.0003 |

|log-return|*I(right-tail) |

12.642 |

1.440 |

8.777 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.519 |

0.571 |

0.752 |

0.483 |

FCX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.11 |

-0.10 |

-0.05 |

-0.03 |

-0.01 |

0.00 |

0.02 |

0.05 |

0.08 |

0.10 |

0.72 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.020 |

0.121 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.837 |

0.041 |

-20.632 |

0.0000 |

|log-return| |

-38.630 |

1.161 |

-33.274 |

0.0000 |

I(right-tail) |

0.266 |

0.057 |

4.661 |

0.0000 |

|log-return|*I(right-tail) |

-8.631 |

1.758 |

-4.908 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.682 |

0.460 |

0.546 |

0.475 |

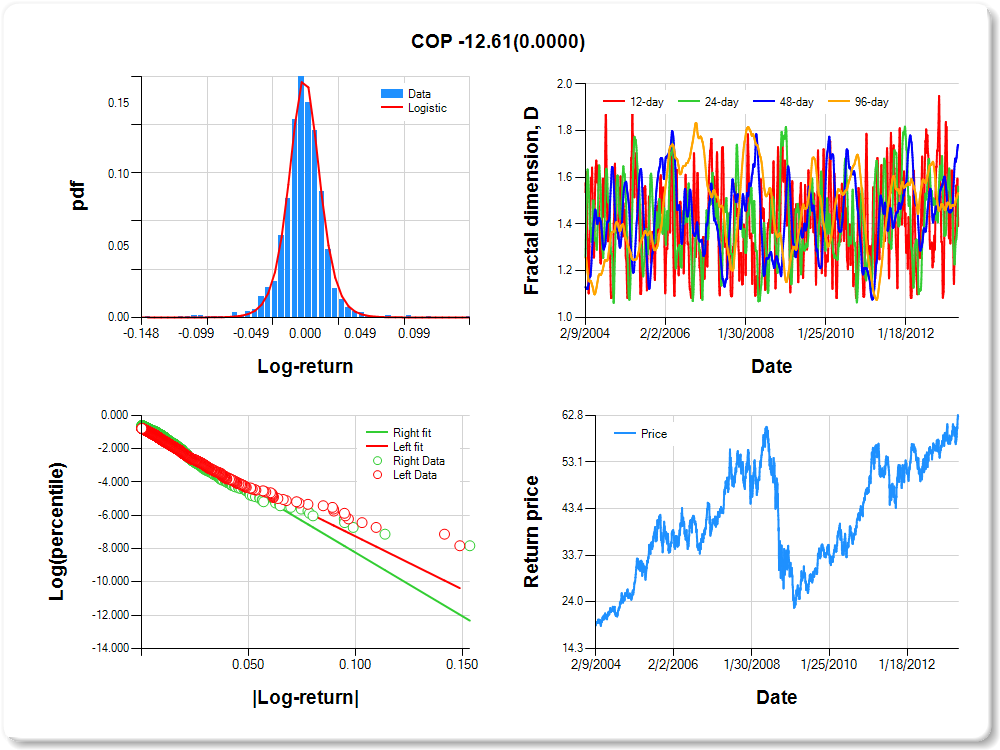

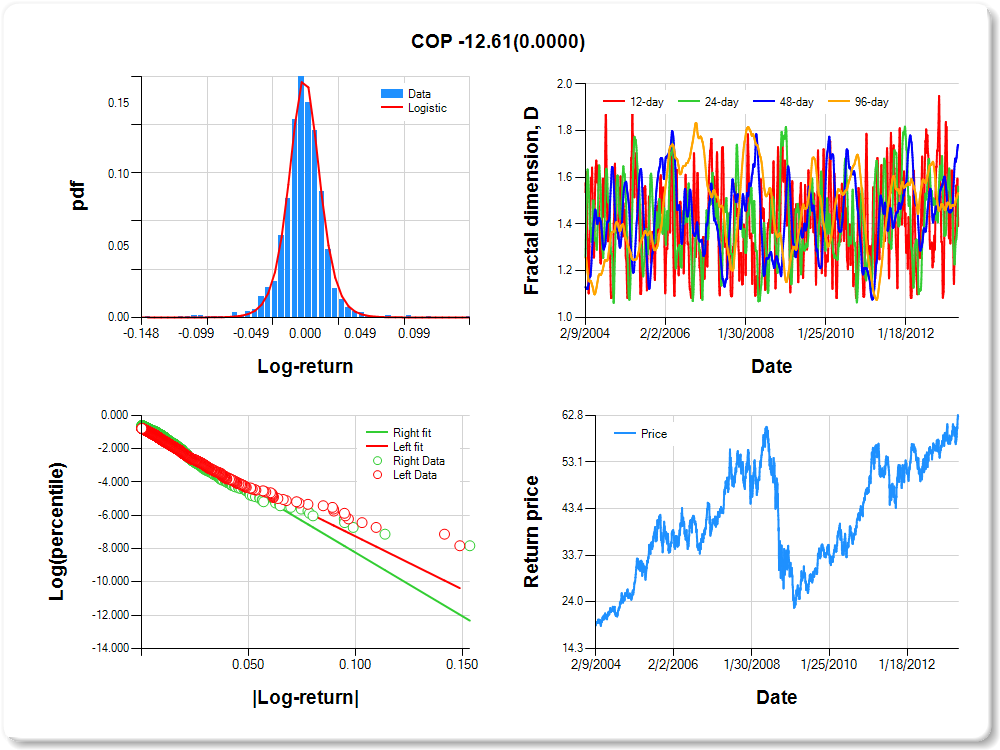

COP

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.06 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.007 |

0.102 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.891 |

0.040 |

-22.059 |

0.0000 |

|log-return| |

-63.712 |

1.951 |

-32.651 |

0.0000 |

I(right-tail) |

0.288 |

0.056 |

5.094 |

0.0000 |

|log-return|*I(right-tail) |

-12.608 |

2.903 |

-4.343 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.608 |

0.439 |

0.261 |

0.469 |

SLB

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.06 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.04 |

0.06 |

0.08 |

0.59 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.331 |

0.114 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.826 |

0.040 |

-20.598 |

0.0000 |

|log-return| |

-53.135 |

1.605 |

-33.101 |

0.0000 |

I(right-tail) |

0.222 |

0.057 |

3.897 |

0.0001 |

|log-return|*I(right-tail) |

-8.872 |

2.370 |

-3.743 |

0.0002 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.622 |

0.484 |

0.574 |

0.462 |

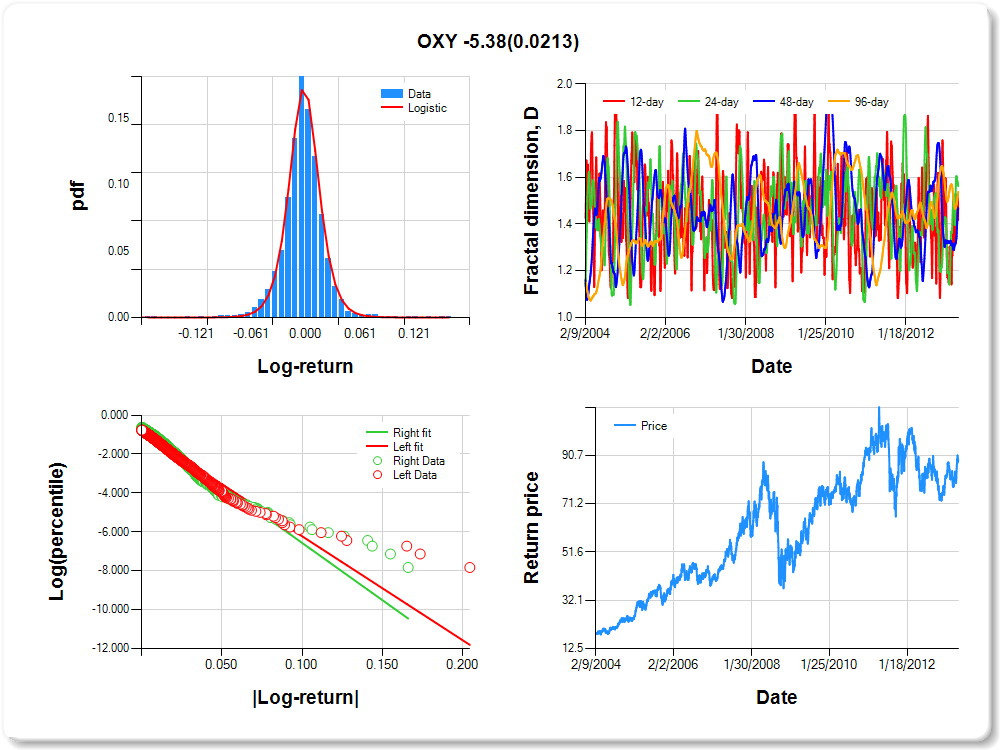

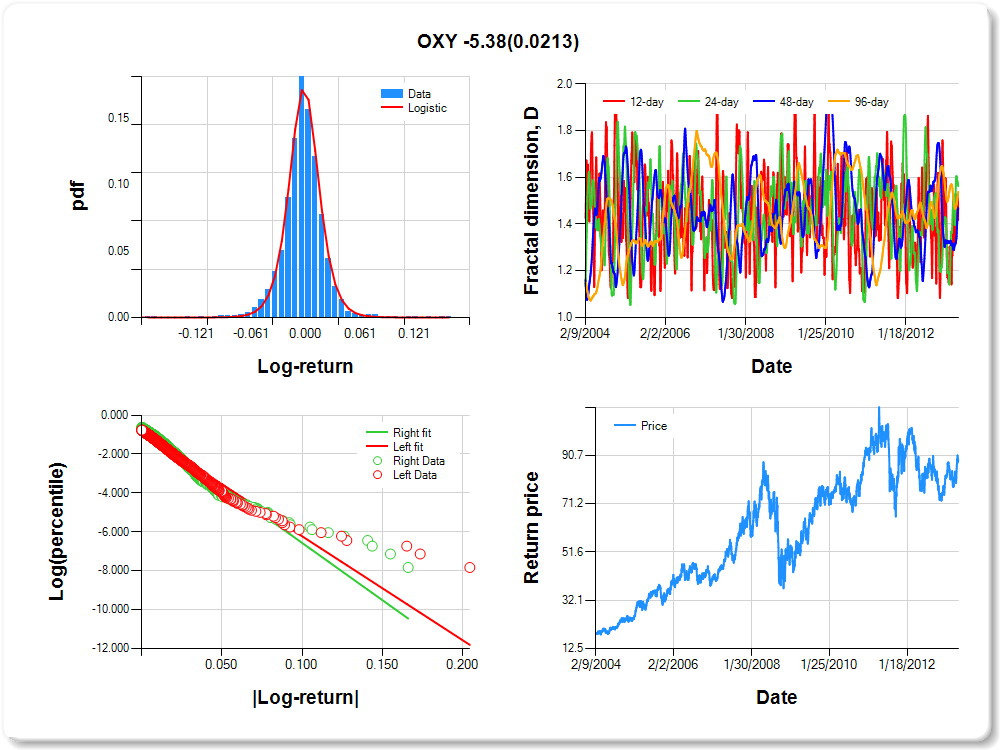

OXY

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.08 |

-0.06 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.07 |

0.08 |

-0.41 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.193 |

0.099 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.880 |

0.040 |

-22.162 |

0.0000 |

|log-return| |

-53.426 |

1.626 |

-32.852 |

0.0000 |

I(right-tail) |

0.196 |

0.055 |

3.543 |

0.0004 |

|log-return|*I(right-tail) |

-5.384 |

2.338 |

-2.303 |

0.0213 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.582 |

0.437 |

0.531 |

0.461 |

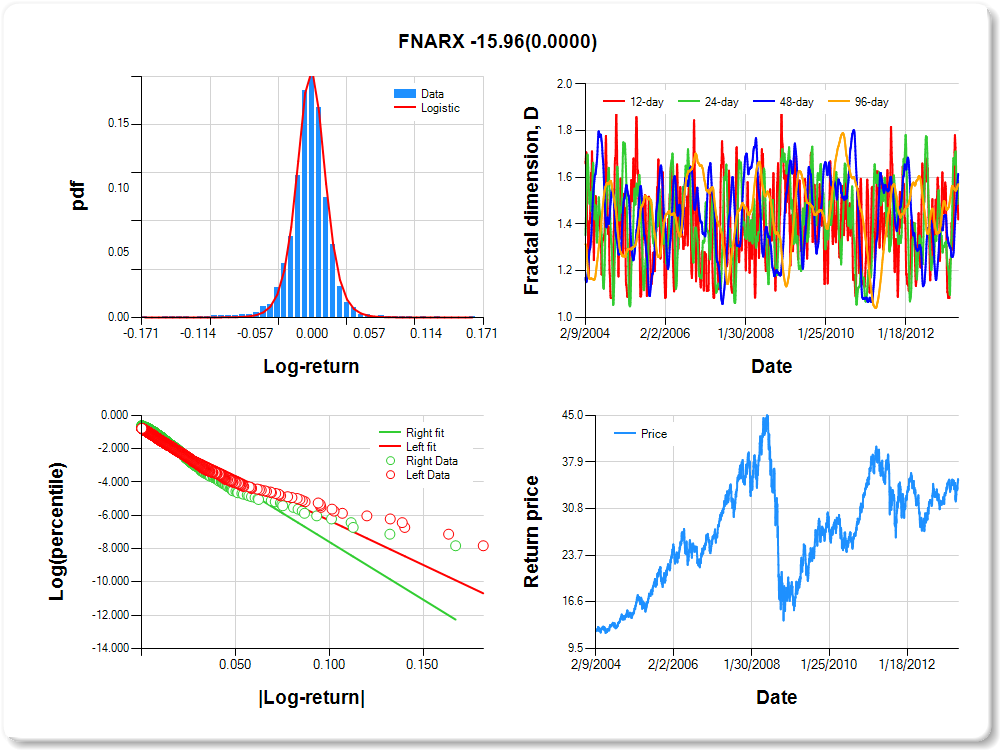

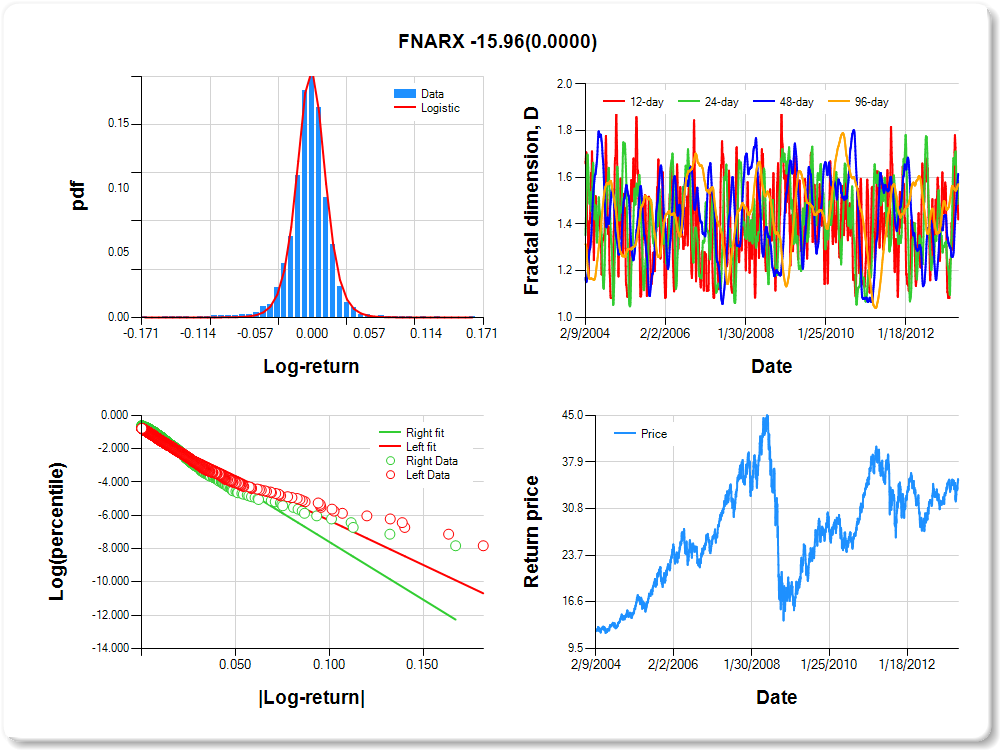

FNARX

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.09 |

-0.07 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.07 |

0.64 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.092 |

0.089 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.979 |

0.039 |

-25.258 |

0.0000 |

|log-return| |

-53.270 |

1.650 |

-32.290 |

0.0000 |

I(right-tail) |

0.314 |

0.055 |

5.724 |

0.0000 |

|log-return|*I(right-tail) |

-15.958 |

2.574 |

-6.201 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.580 |

0.414 |

0.384 |

0.429 |

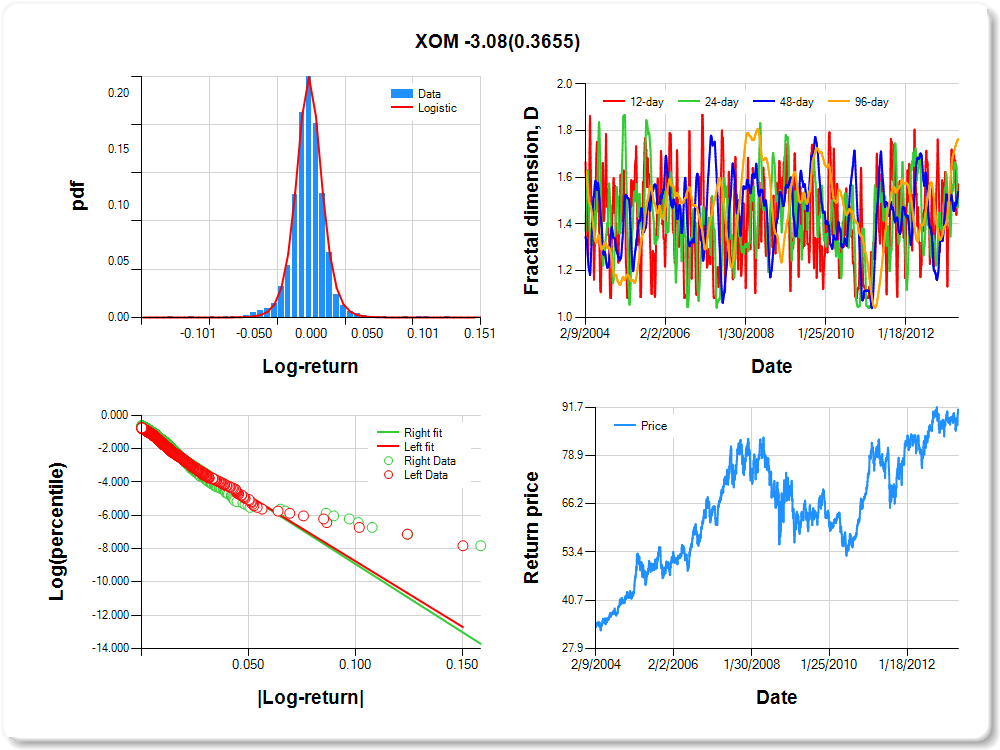

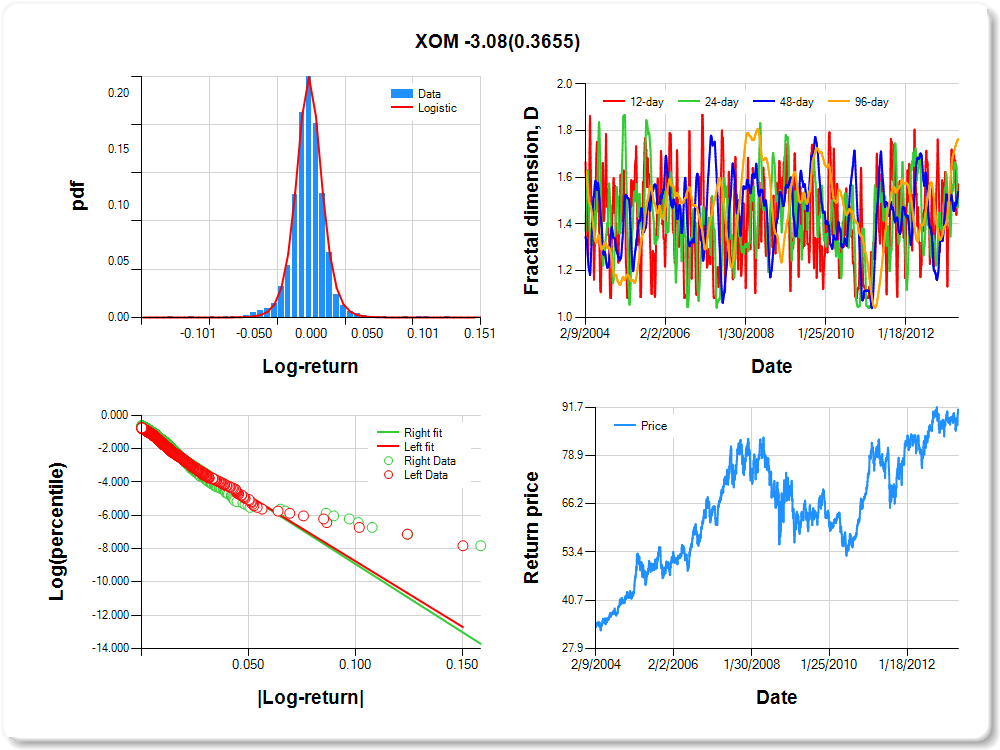

XOM

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

1.07 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.034 |

0.080 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.896 |

0.039 |

-22.722 |

0.0000 |

|log-return| |

-78.607 |

2.408 |

-32.646 |

0.0000 |

I(right-tail) |

0.141 |

0.055 |

2.580 |

0.0099 |

|log-return|*I(right-tail) |

-3.084 |

3.407 |

-0.905 |

0.3655 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.429 |

0.491 |

0.462 |

0.236 |