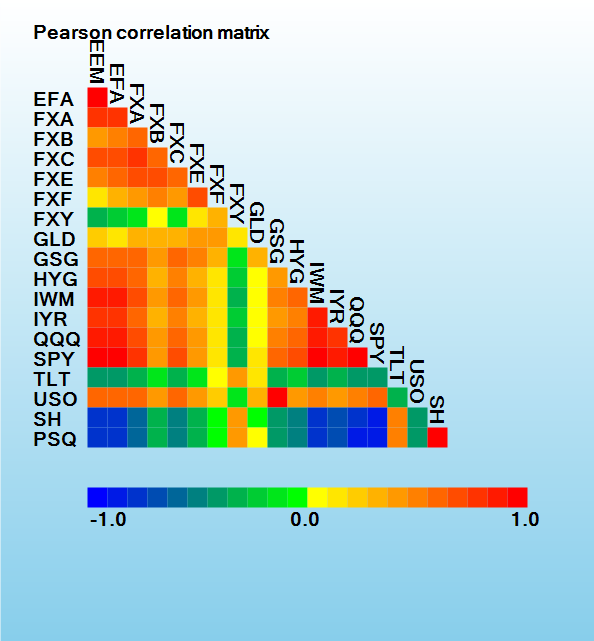

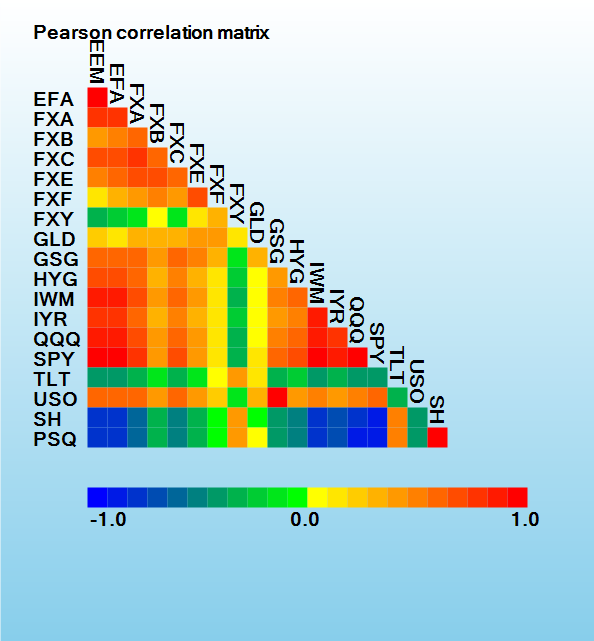

Color Scale

| -1.00000 |

-0.90476 |

-0.80952 |

-0.71429 |

-0.61905 |

-0.52381 |

-0.42857 |

-0.33333 |

-0.23810 |

-0.14286 |

-0.04762 |

0.04762 |

0.14286 |

0.23810 |

0.33333 |

0.42857 |

0.52381 |

0.61905 |

0.71429 |

0.80952 |

0.90476 |

1.00000 |

Pearson Correlation Matrix

|

EEM |

EFA |

FXA |

FXB |

FXC |

FXE |

FXF |

FXY |

GLD |

GSG |

HYG |

IWM |

IYR |

QQQ |

SPY |

TLT |

USO |

SH |

| EFA |

0.91300 |

| FXA |

0.74496 |

0.78148 |

| FXB |

0.42470 |

0.52248 |

0.59910 |

| FXC |

0.63898 |

0.68344 |

0.75398 |

0.54884 |

| FXE |

0.45747 |

0.59762 |

0.63497 |

0.63511 |

0.58468 |

| FXF |

0.14153 |

0.26439 |

0.37516 |

0.44664 |

0.35783 |

0.70889 |

| FXY |

-0.40192 |

-0.31828 |

-0.20332 |

-0.02092 |

-0.17699 |

0.07862 |

0.29267 |

| GLD |

0.14646 |

0.14067 |

0.28495 |

0.30299 |

0.30441 |

0.34463 |

0.35760 |

0.13870 |

| GSG |

0.56777 |

0.56524 |

0.59305 |

0.41860 |

0.59199 |

0.44921 |

0.25357 |

-0.20998 |

0.32205 |

| HYG |

0.62907 |

0.65019 |

0.57315 |

0.28750 |

0.51560 |

0.30314 |

0.09897 |

-0.26729 |

-0.01170 |

0.41101 |

| IWM |

0.84442 |

0.85745 |

0.63317 |

0.35696 |

0.58685 |

0.38347 |

0.09193 |

-0.36409 |

0.04426 |

0.49823 |

0.59027 |

| IYR |

0.75750 |

0.74720 |

0.53317 |

0.32000 |

0.47880 |

0.32587 |

0.08493 |

-0.33141 |

0.03328 |

0.39301 |

0.48488 |

0.85133 |

| QQQ |

0.86390 |

0.86813 |

0.65669 |

0.35597 |

0.58160 |

0.37797 |

0.05803 |

-0.37685 |

0.02963 |

0.47036 |

0.59662 |

0.90203 |

0.77905 |

| SPY |

0.90994 |

0.93222 |

0.71901 |

0.39534 |

0.64063 |

0.42712 |

0.09866 |

-0.39924 |

0.06085 |

0.53493 |

0.66239 |

0.92558 |

0.81631 |

0.93312 |

| TLT |

-0.45084 |

-0.46718 |

-0.34252 |

-0.21203 |

-0.39411 |

-0.21413 |

0.01954 |

0.40780 |

0.05115 |

-0.37130 |

-0.31809 |

-0.48608 |

-0.36072 |

-0.47599 |

-0.49073 |

| USO |

0.56317 |

0.55368 |

0.56591 |

0.37353 |

0.56953 |

0.42359 |

0.21538 |

-0.22021 |

0.29328 |

0.92398 |

0.39229 |

0.48853 |

0.38233 |

0.46740 |

0.52951 |

-0.38153 |

| SH |

-0.88203 |

-0.89537 |

-0.68155 |

-0.38172 |

-0.60525 |

-0.40906 |

-0.08468 |

0.37611 |

-0.06598 |

-0.50778 |

-0.60475 |

-0.89987 |

-0.79409 |

-0.90420 |

-0.95893 |

0.47467 |

-0.51075 |

| PSQ |

-0.86161 |

-0.86538 |

-0.65348 |

-0.35717 |

-0.57455 |

-0.38193 |

-0.06089 |

0.37190 |

-0.03713 |

-0.47952 |

-0.59122 |

-0.89565 |

-0.76879 |

-0.98889 |

-0.93113 |

0.47219 |

-0.47444 |

0.92893 |