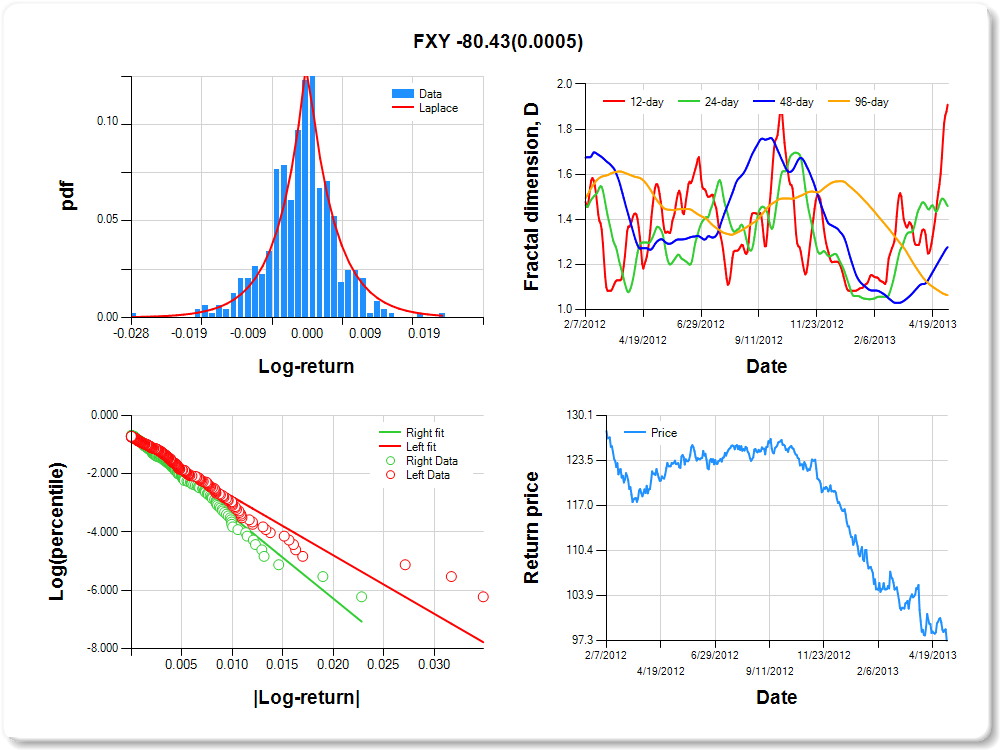

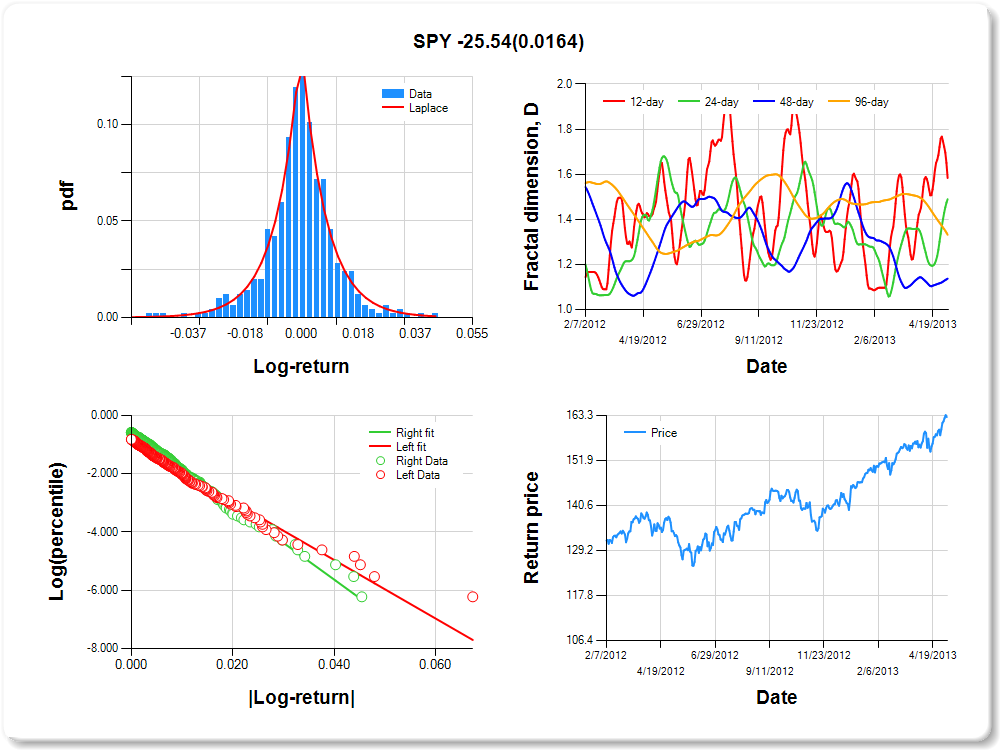

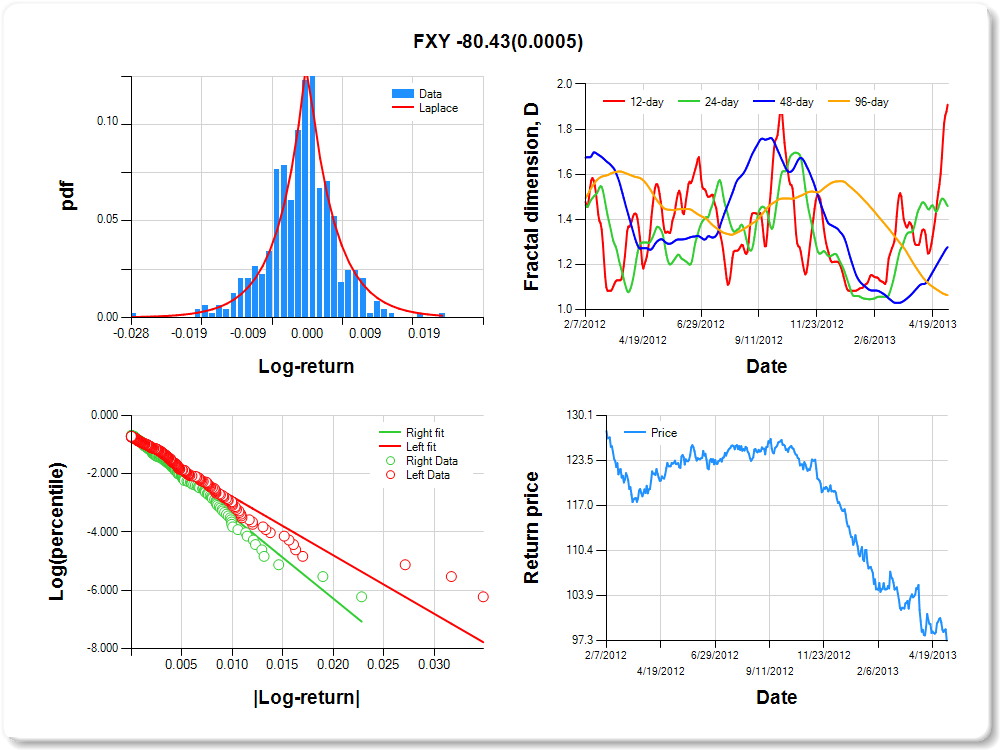

FXY

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.03 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.00 |

0.00 |

0.01 |

0.01 |

0.01 |

2.52 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.387 |

0.260 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.774 |

0.091 |

-8.544 |

0.0000 |

|log-return| |

-200.603 |

13.739 |

-14.601 |

0.0000 |

I(right-tail) |

0.130 |

0.130 |

1.006 |

0.3148 |

|log-return|*I(right-tail) |

-80.430 |

23.055 |

-3.489 |

0.0005 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.091 |

0.541 |

0.723 |

0.936 |

EFA

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

2.41 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.192 |

0.174 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.833 |

0.094 |

-8.880 |

0.0000 |

|log-return| |

-79.514 |

5.578 |

-14.255 |

0.0000 |

I(right-tail) |

0.290 |

0.129 |

2.236 |

0.0258 |

|log-return|*I(right-tail) |

-21.840 |

8.487 |

-2.573 |

0.0104 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.467 |

0.432 |

0.449 |

0.751 |

IYR

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.04 |

0.05 |

2.15 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.038 |

0.102 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.017 |

0.090 |

-11.333 |

0.0000 |

|log-return| |

-84.104 |

6.120 |

-13.743 |

0.0000 |

I(right-tail) |

0.301 |

0.121 |

2.487 |

0.0132 |

|log-return|*I(right-tail) |

-14.743 |

8.838 |

-1.668 |

0.0959 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.593 |

0.850 |

0.832 |

0.726 |

IWM

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.05 |

0.05 |

2.26 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.325 |

0.156 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.851 |

0.088 |

-9.703 |

0.0000 |

|log-return| |

-77.528 |

5.279 |

-14.687 |

0.0000 |

I(right-tail) |

0.218 |

0.125 |

1.735 |

0.0834 |

|log-return|*I(right-tail) |

-12.555 |

7.878 |

-1.594 |

0.1116 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.481 |

0.341 |

0.555 |

0.688 |

SH

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.03 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.03 |

0.04 |

2.10 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

-0.239 |

0.242 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.670 |

0.085 |

-7.844 |

0.0000 |

|log-return| |

-119.060 |

7.572 |

-15.723 |

0.0000 |

I(right-tail) |

-0.210 |

0.125 |

-1.672 |

0.0951 |

|log-return|*I(right-tail) |

16.038 |

10.451 |

1.535 |

0.1255 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.406 |

0.557 |

0.881 |

0.682 |

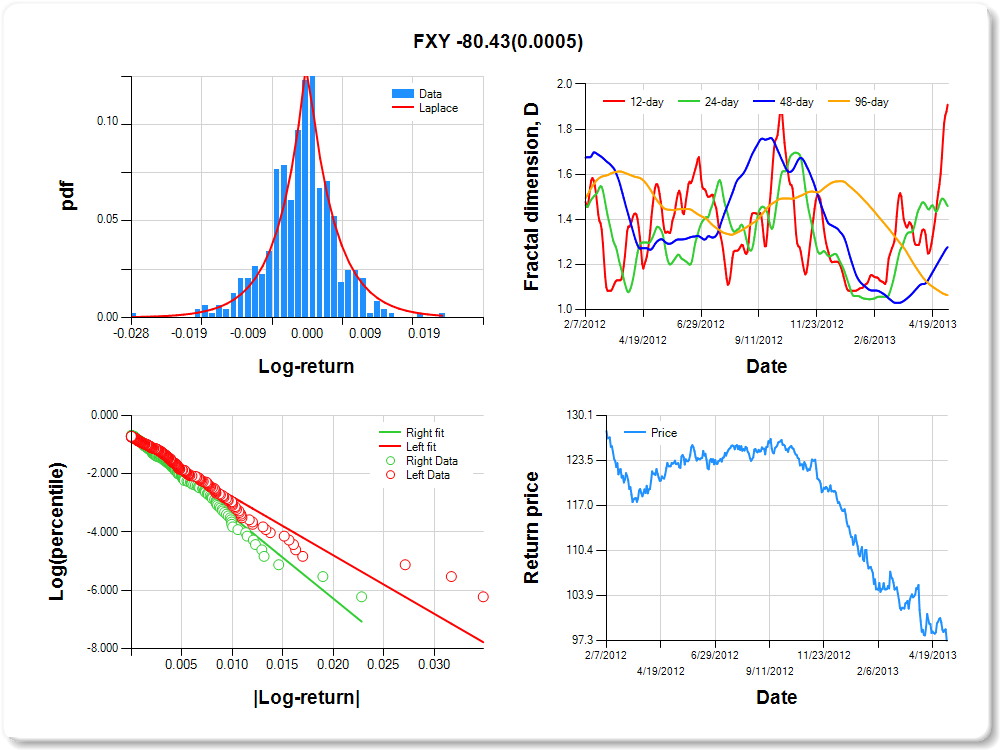

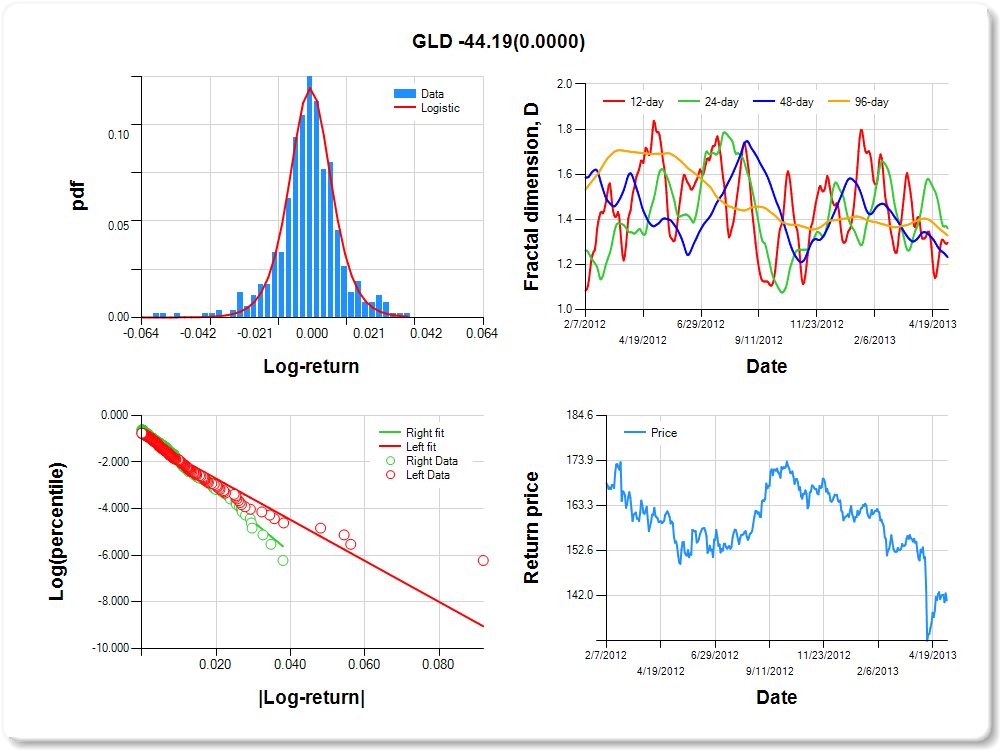

GLD

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.03 |

0.03 |

3.78 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.723 |

0.136 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.958 |

0.087 |

-11.070 |

0.0000 |

|log-return| |

-88.004 |

6.265 |

-14.047 |

0.0000 |

I(right-tail) |

0.365 |

0.124 |

2.945 |

0.0034 |

|log-return|*I(right-tail) |

-44.186 |

10.465 |

-4.222 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.703 |

0.640 |

0.767 |

0.672 |

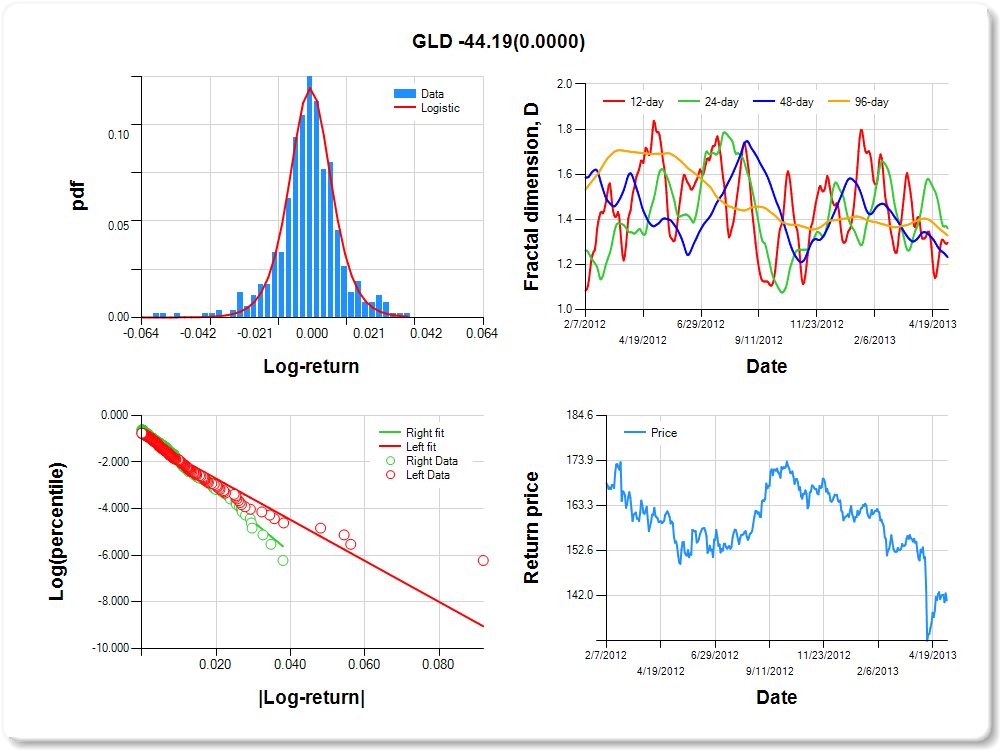

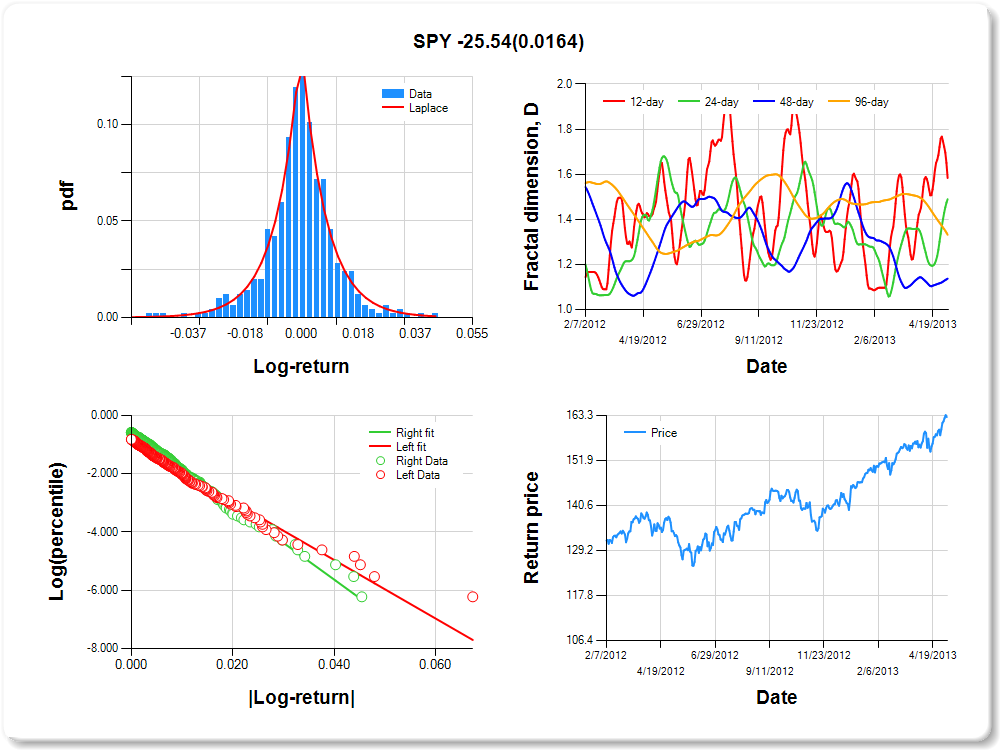

SPY

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.04 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.02 |

0.03 |

0.03 |

2.56 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.357 |

0.241 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.944 |

0.091 |

-10.324 |

0.0000 |

|log-return| |

-100.430 |

7.156 |

-14.034 |

0.0000 |

I(right-tail) |

0.350 |

0.125 |

2.800 |

0.0053 |

|log-return|*I(right-tail) |

-25.544 |

10.611 |

-2.407 |

0.0164 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.416 |

0.511 |

0.863 |

0.668 |

HYG

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.02 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.00 |

0.00 |

0.01 |

0.02 |

0.02 |

2.69 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.326 |

0.184 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.062 |

0.086 |

-12.336 |

0.0000 |

|log-return| |

-181.256 |

13.254 |

-13.676 |

0.0000 |

I(right-tail) |

0.407 |

0.122 |

3.346 |

0.0009 |

|log-return|*I(right-tail) |

-29.503 |

18.858 |

-1.565 |

0.1183 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.807 |

0.863 |

0.628 |

0.665 |

QQQ

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.03 |

0.04 |

0.78 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.266 |

0.191 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.790 |

0.093 |

-8.462 |

0.0000 |

|log-return| |

-104.568 |

7.208 |

-14.507 |

0.0000 |

I(right-tail) |

0.241 |

0.132 |

1.829 |

0.0679 |

|log-return|*I(right-tail) |

-14.074 |

10.475 |

-1.344 |

0.1797 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.409 |

0.502 |

0.648 |

0.634 |

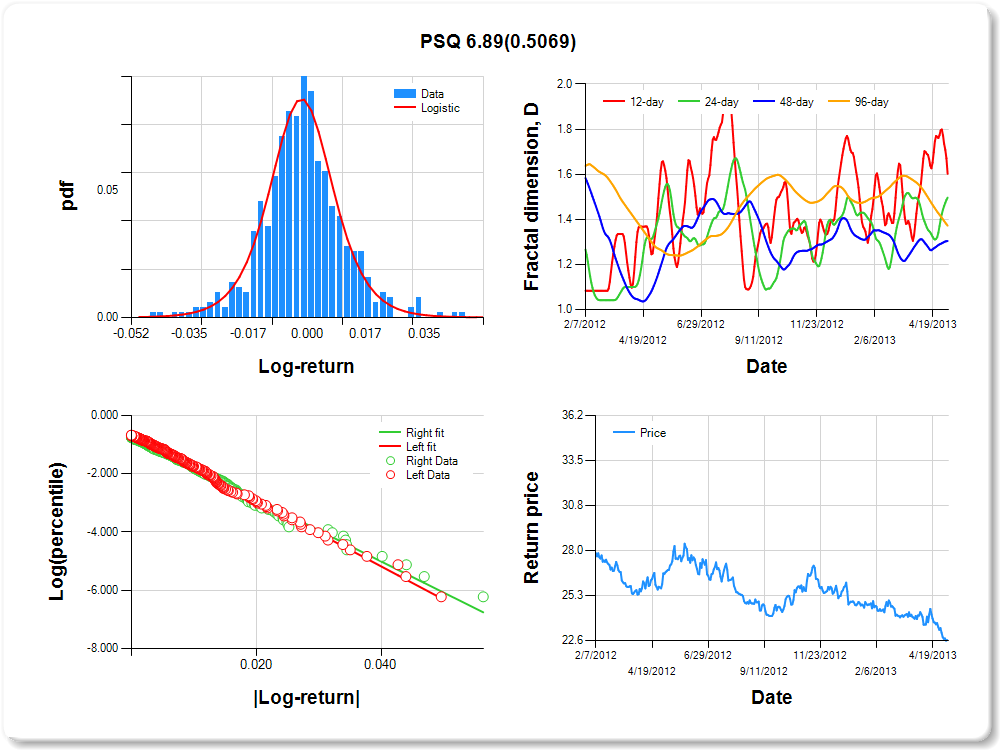

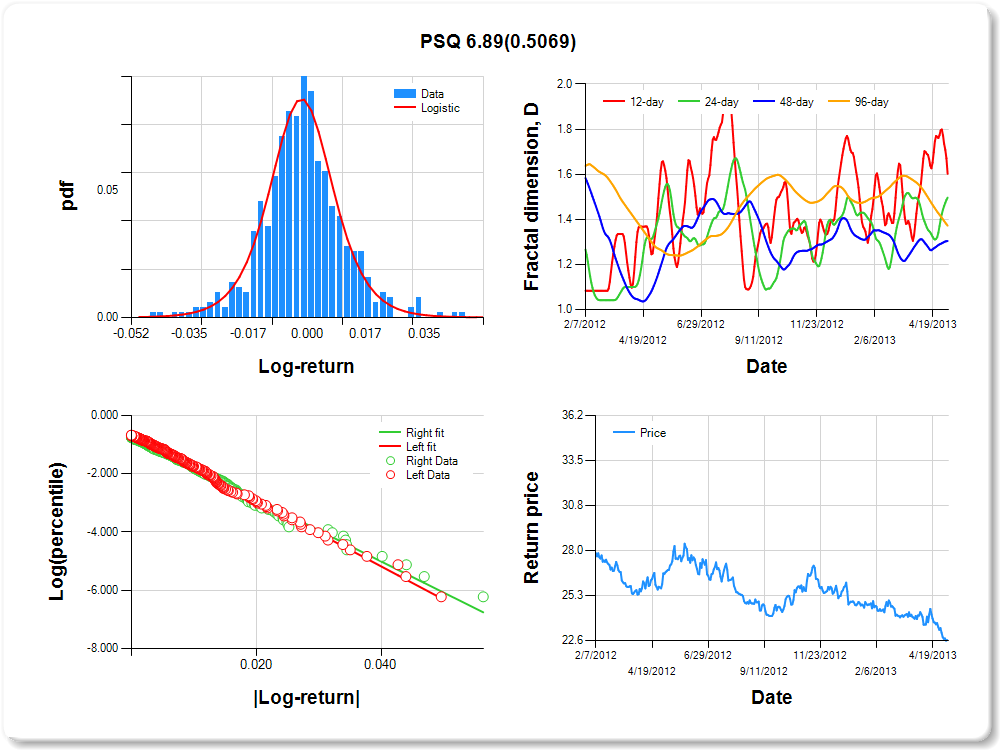

PSQ

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.04 |

-0.03 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.04 |

0.04 |

1.40 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.129 |

0.199 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.605 |

0.094 |

-6.455 |

0.0000 |

|log-return| |

-113.554 |

7.423 |

-15.297 |

0.0000 |

I(right-tail) |

-0.109 |

0.134 |

-0.816 |

0.4150 |

|log-return|*I(right-tail) |

6.891 |

10.376 |

0.664 |

0.5069 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.398 |

0.503 |

0.696 |

0.628 |

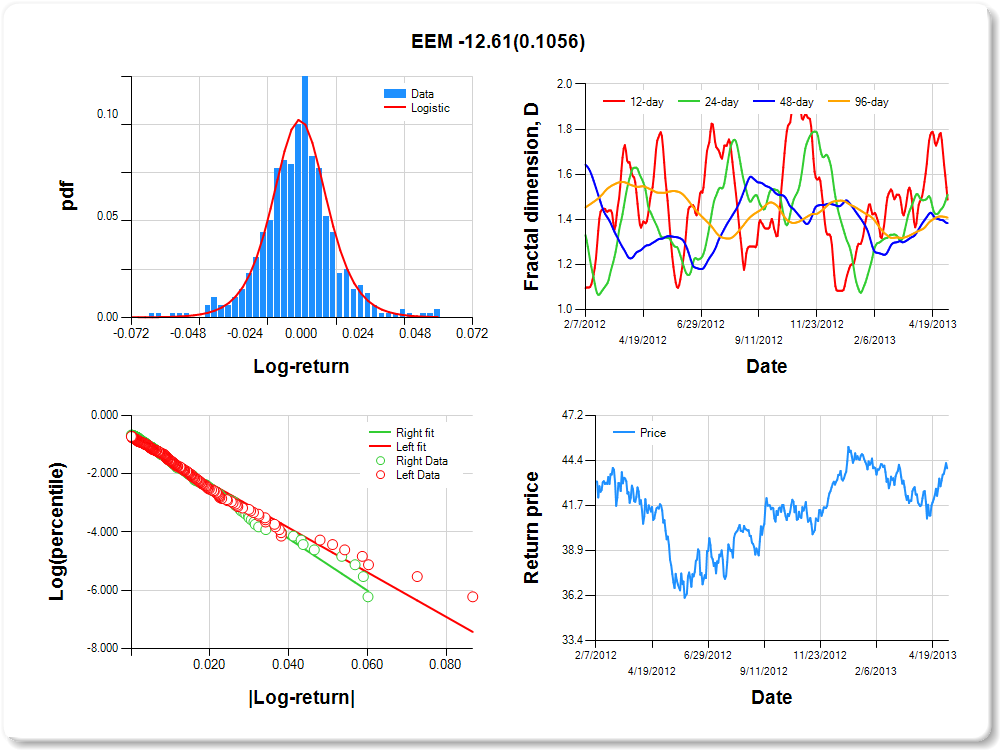

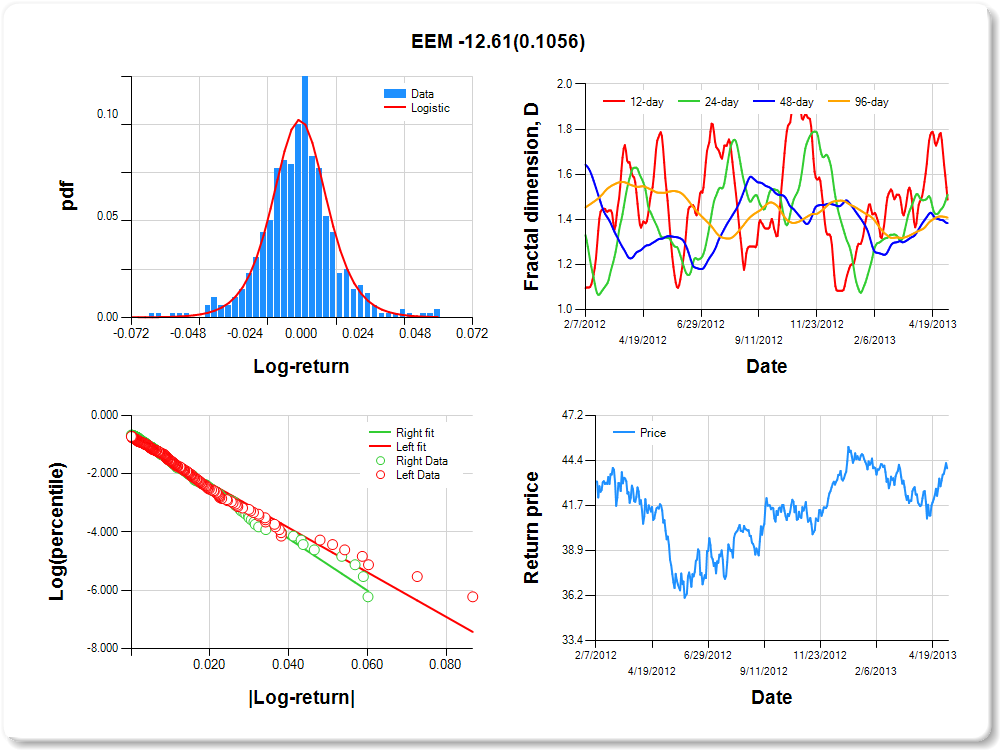

EEM

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.06 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.04 |

0.06 |

0.00 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.320 |

0.176 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.788 |

0.090 |

-8.798 |

0.0000 |

|log-return| |

-76.360 |

5.167 |

-14.779 |

0.0000 |

I(right-tail) |

0.134 |

0.128 |

1.052 |

0.2932 |

|log-return|*I(right-tail) |

-12.614 |

7.780 |

-1.621 |

0.1056 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.513 |

0.491 |

0.616 |

0.592 |

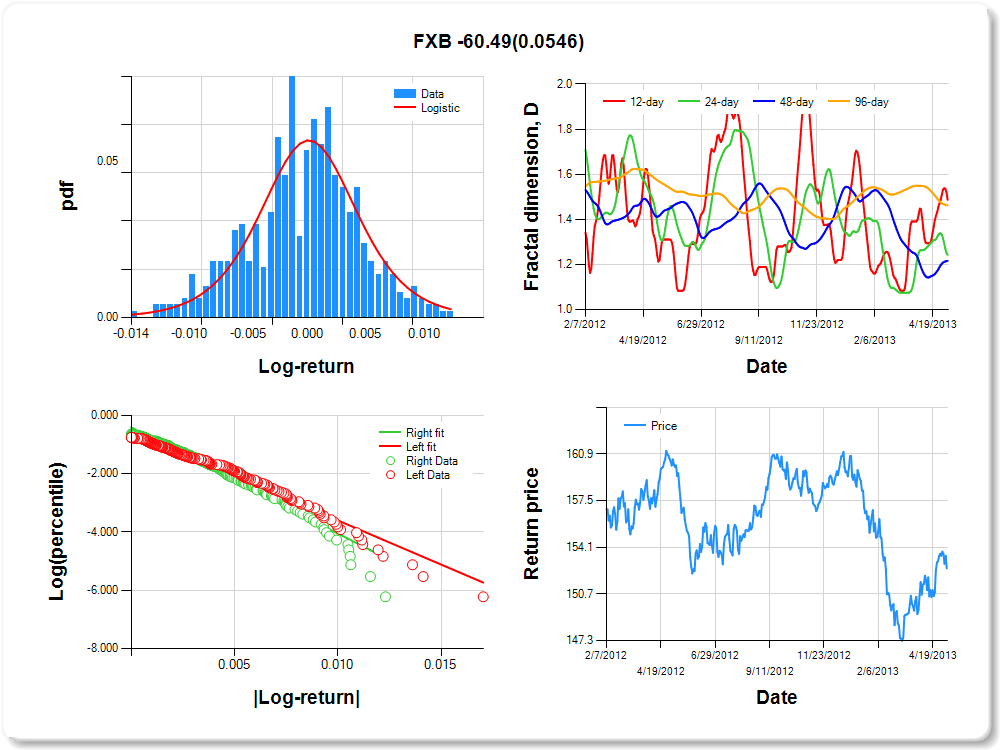

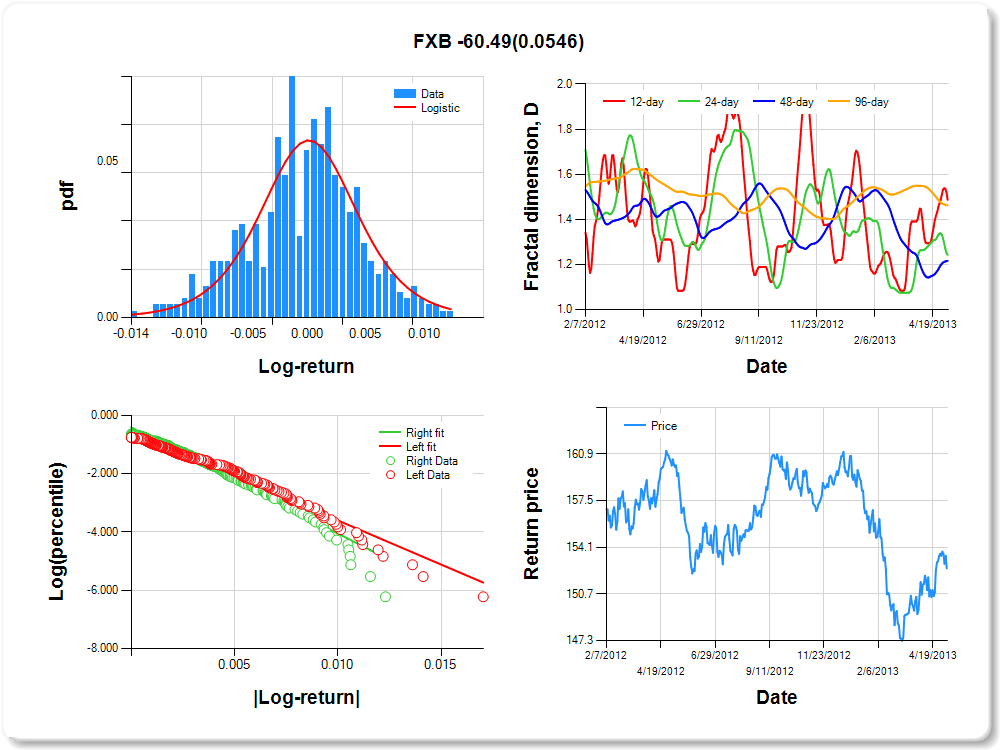

FXB

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.01 |

-0.01 |

-0.01 |

-0.01 |

0.00 |

0.00 |

0.00 |

0.01 |

0.01 |

0.01 |

2.11 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.324 |

0.306 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.565 |

0.104 |

-5.446 |

0.0000 |

|log-return| |

-302.609 |

20.742 |

-14.589 |

0.0000 |

I(right-tail) |

0.161 |

0.145 |

1.110 |

0.2677 |

|log-return|*I(right-tail) |

-60.493 |

31.404 |

-1.926 |

0.0546 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.513 |

0.757 |

0.784 |

0.538 |

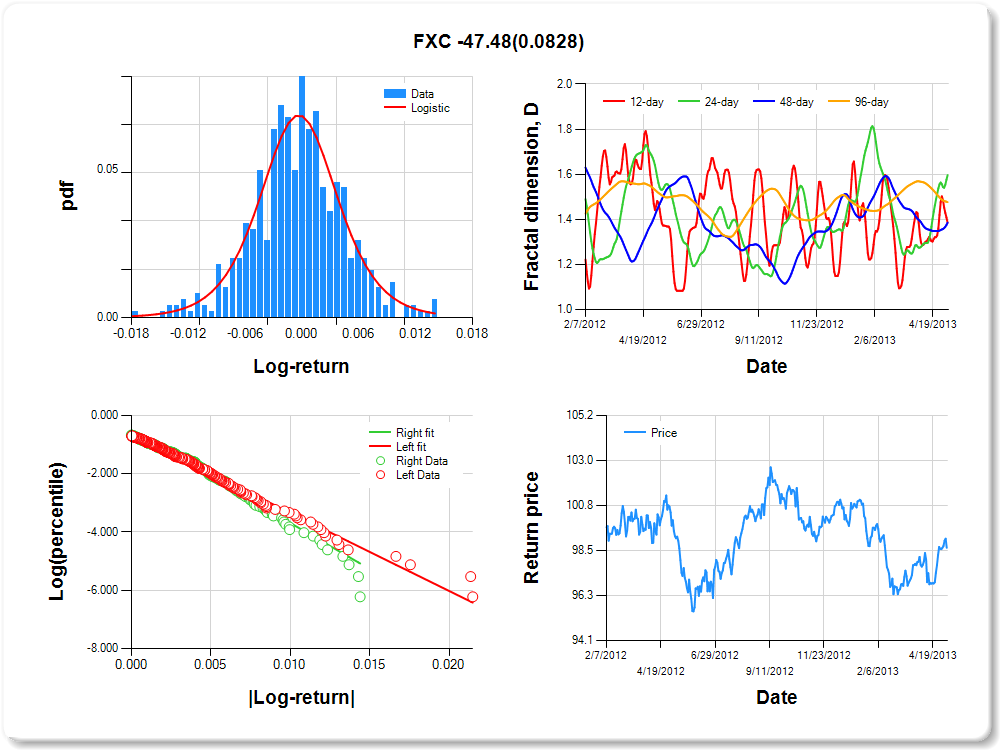

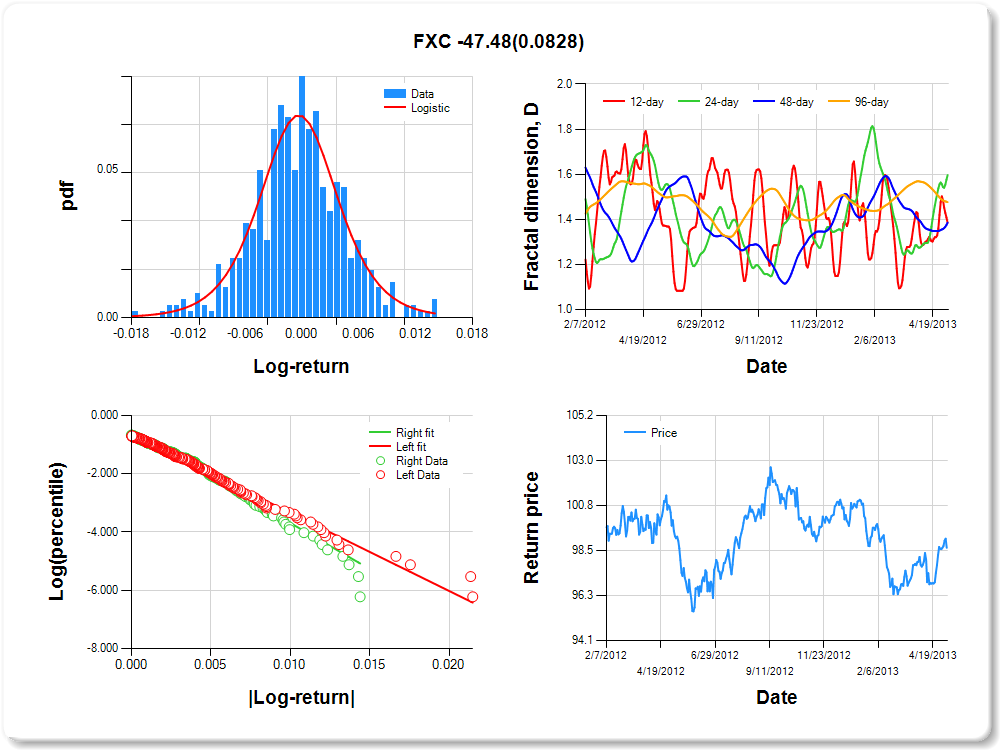

FXC

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.02 |

-0.01 |

-0.01 |

-0.01 |

0.00 |

0.00 |

0.00 |

0.01 |

0.01 |

0.01 |

5.88 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.340 |

0.253 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.649 |

0.094 |

-6.911 |

0.0000 |

|log-return| |

-268.174 |

17.793 |

-15.072 |

0.0000 |

I(right-tail) |

0.129 |

0.136 |

0.952 |

0.3417 |

|log-return|*I(right-tail) |

-47.485 |

27.319 |

-1.738 |

0.0828 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.615 |

0.404 |

0.614 |

0.524 |

FXE

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.02 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.00 |

0.00 |

0.01 |

0.01 |

0.02 |

4.38 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.129 |

0.275 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.589 |

0.097 |

-6.099 |

0.0000 |

|log-return| |

-219.984 |

14.582 |

-15.086 |

0.0000 |

I(right-tail) |

0.106 |

0.140 |

0.759 |

0.4483 |

|log-return|*I(right-tail) |

-47.599 |

22.919 |

-2.077 |

0.0383 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.450 |

0.531 |

0.557 |

0.518 |

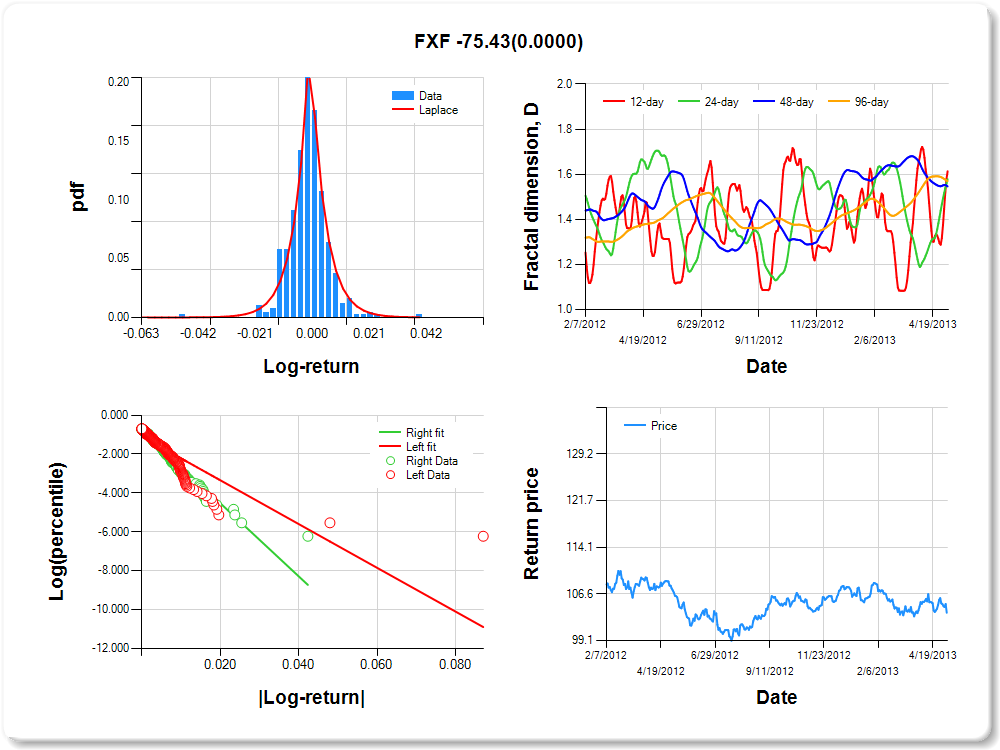

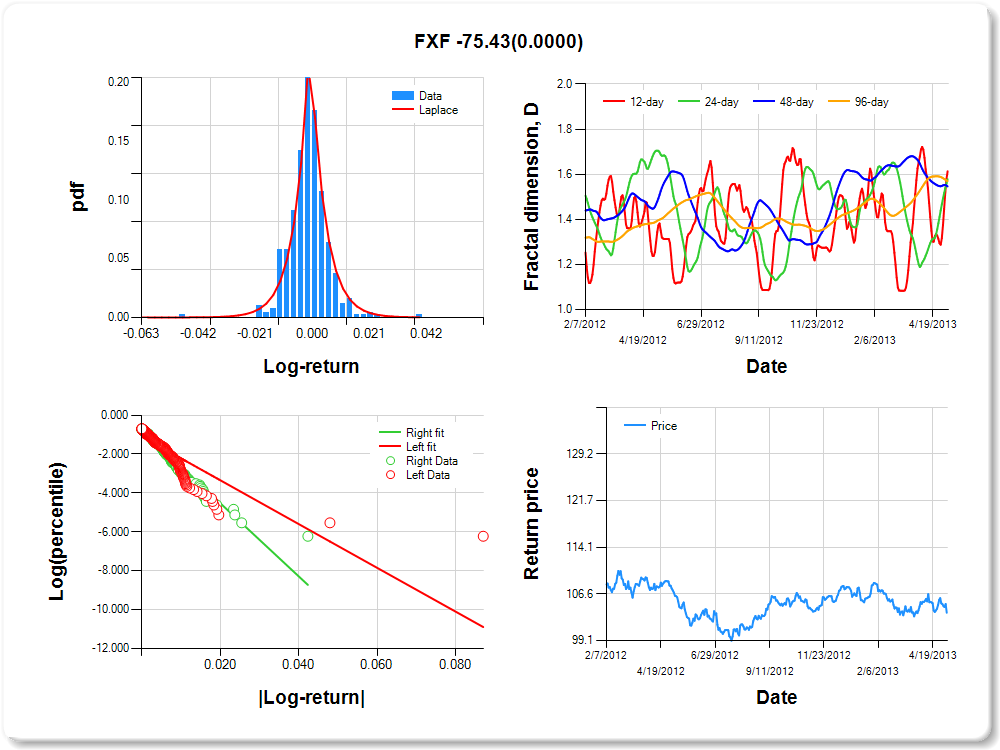

FXF

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.02 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.00 |

0.00 |

0.01 |

0.02 |

0.02 |

3.86 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Laplace |

0.601 |

0.142 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-1.085 |

0.079 |

-13.792 |

0.0000 |

|log-return| |

-112.626 |

8.883 |

-12.679 |

0.0000 |

I(right-tail) |

0.333 |

0.120 |

2.776 |

0.0057 |

|log-return|*I(right-tail) |

-75.427 |

15.560 |

-4.848 |

0.0000 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.386 |

0.422 |

0.454 |

0.430 |

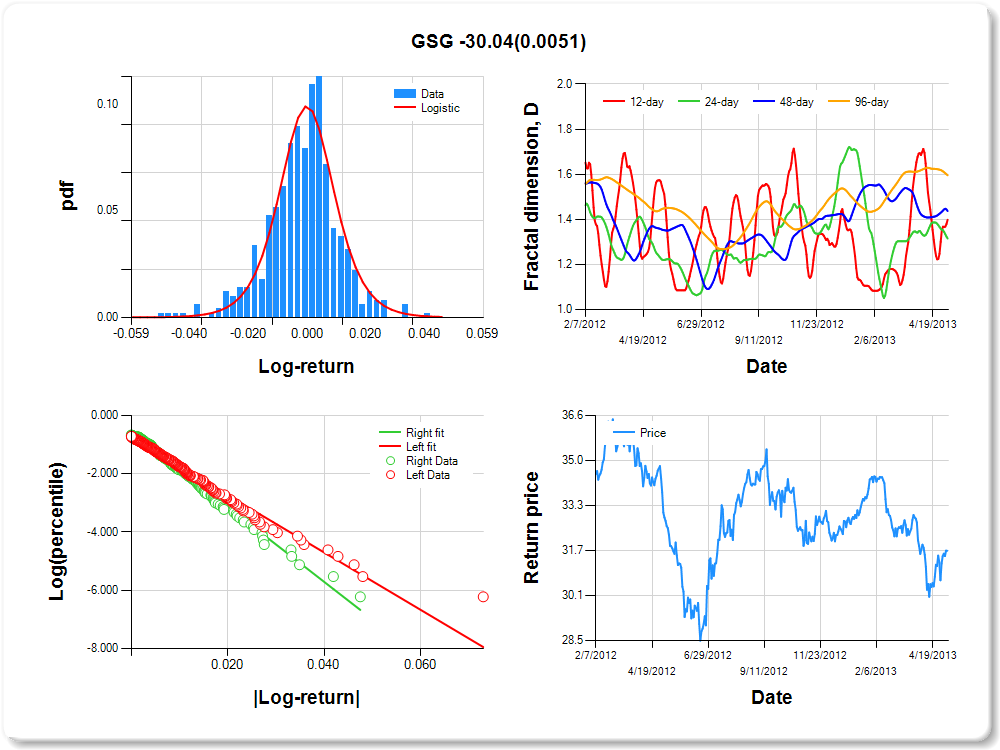

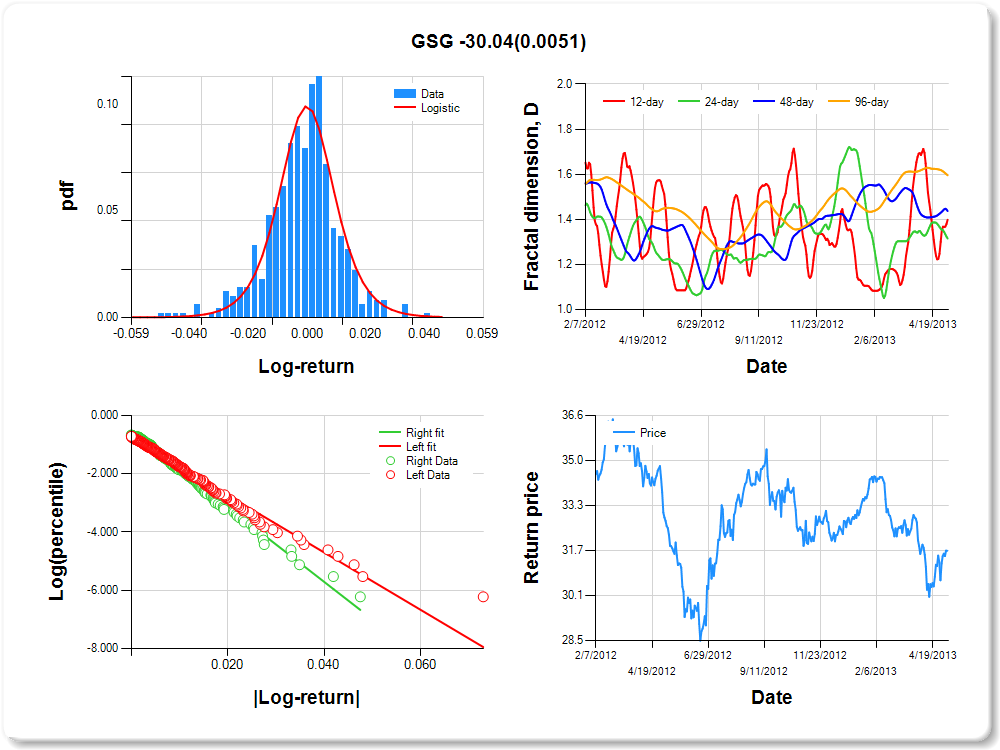

GSG

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.05 |

-0.04 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.03 |

0.03 |

3.26 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.391 |

0.173 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.749 |

0.091 |

-8.238 |

0.0000 |

|log-return| |

-98.289 |

6.621 |

-14.846 |

0.0000 |

I(right-tail) |

0.203 |

0.132 |

1.532 |

0.1261 |

|log-return|*I(right-tail) |

-30.043 |

10.678 |

-2.813 |

0.0051 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.602 |

0.685 |

0.563 |

0.404 |

TLT

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.03 |

-0.03 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.01 |

0.02 |

0.03 |

0.04 |

3.36 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.283 |

0.221 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.654 |

0.102 |

-6.395 |

0.0000 |

|log-return| |

-133.370 |

9.356 |

-14.255 |

0.0000 |

I(right-tail) |

0.134 |

0.137 |

0.980 |

0.3273 |

|log-return|*I(right-tail) |

3.957 |

12.427 |

0.318 |

0.7503 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.718 |

0.774 |

0.557 |

0.368 |

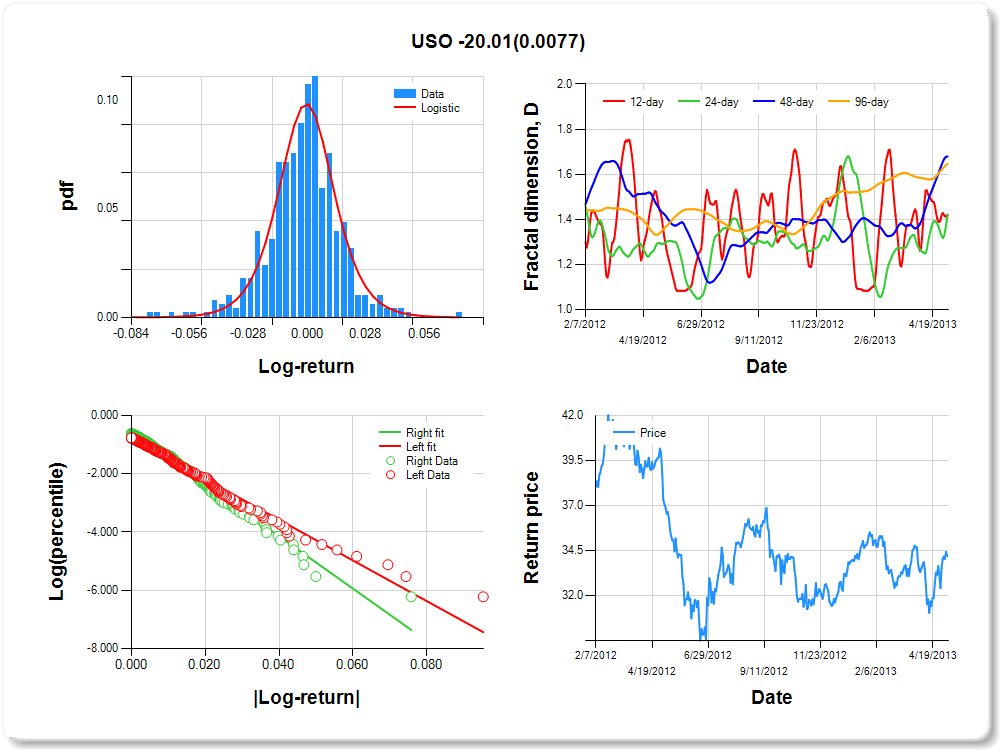

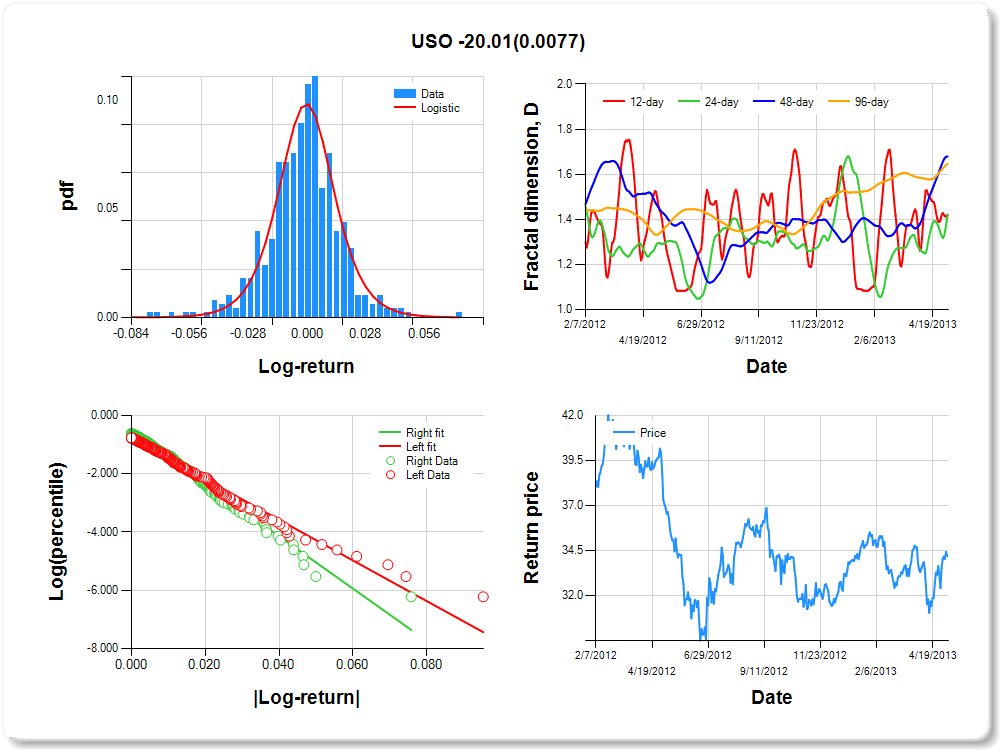

USO

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.07 |

-0.05 |

-0.03 |

-0.02 |

-0.01 |

0.00 |

0.01 |

0.03 |

0.05 |

0.05 |

3.21 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

0.220 |

0.174 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.779 |

0.094 |

-8.264 |

0.0000 |

|log-return| |

-69.761 |

4.818 |

-14.479 |

0.0000 |

I(right-tail) |

0.240 |

0.132 |

1.822 |

0.0691 |

|log-return|*I(right-tail) |

-20.012 |

7.483 |

-2.674 |

0.0077 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.578 |

0.580 |

0.321 |

0.353 |

FXA

Percentile values of daily loss(gain) in per cent

| 0.5 | 1 | 5 | 10 | 25 | 50 | 75 | 90 | 95 | 99 | 99.5 |

| -0.02 |

-0.02 |

-0.01 |

-0.01 |

0.00 |

0.00 |

0.00 |

0.01 |

0.02 |

0.02 |

2.05 |

Daily log-return distribution fitting results

| Distribution | Location, a | Scale, b |

| Logistic |

-0.015 |

0.215 |

Linear regression results [Model: y=log(percentile of log-return), x=|log-return|]

| Variable | Coef(b) | s.e.(b) | t-value | P-value |

| Constant |

-0.658 |

0.096 |

-6.841 |

0.0000 |

|log-return| |

-194.080 |

13.043 |

-14.880 |

0.0000 |

I(right-tail) |

0.097 |

0.135 |

0.717 |

0.4737 |

|log-return|*I(right-tail) |

-9.305 |

18.559 |

-0.501 |

0.6163 |

Hurst exponent (of daily return price)

| 12-day | 24-day | 48-day | 96-day |

| 0.529 |

0.698 |

0.494 |

0.332 |