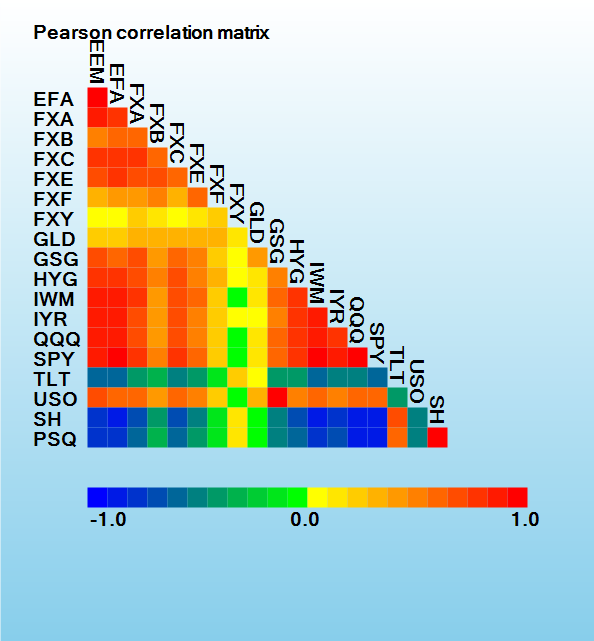

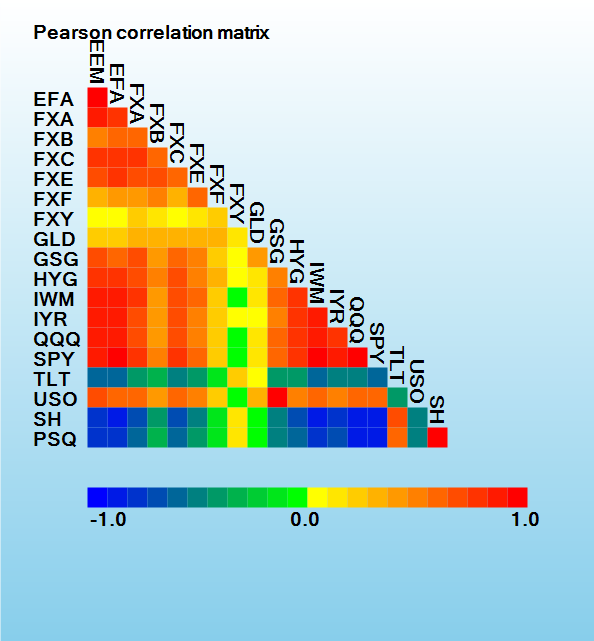

Color Scale

| -1.00000 |

-0.90476 |

-0.80952 |

-0.71429 |

-0.61905 |

-0.52381 |

-0.42857 |

-0.33333 |

-0.23810 |

-0.14286 |

-0.04762 |

0.04762 |

0.14286 |

0.23810 |

0.33333 |

0.42857 |

0.52381 |

0.61905 |

0.71429 |

0.80952 |

0.90476 |

1.00000 |

Pearson Correlation Matrix

|

EEM |

EFA |

FXA |

FXB |

FXC |

FXE |

FXF |

FXY |

GLD |

GSG |

HYG |

IWM |

IYR |

QQQ |

SPY |

TLT |

USO |

SH |

| EFA |

0.91233 |

| FXA |

0.82927 |

0.80591 |

| FXB |

0.52322 |

0.57749 |

0.60862 |

| FXC |

0.78338 |

0.76211 |

0.77673 |

0.53159 |

| FXE |

0.62389 |

0.72354 |

0.63595 |

0.65568 |

0.59305 |

| FXF |

0.31464 |

0.38732 |

0.37595 |

0.47458 |

0.32011 |

0.61897 |

| FXY |

-0.04125 |

0.00347 |

0.15024 |

0.13564 |

-0.00679 |

0.07236 |

0.16155 |

| GLD |

0.20169 |

0.15038 |

0.32980 |

0.25818 |

0.25387 |

0.25988 |

0.27095 |

0.08813 |

| GSG |

0.64537 |

0.61265 |

0.63048 |

0.38079 |

0.60084 |

0.48337 |

0.22687 |

-0.04108 |

0.34328 |

| HYG |

0.78178 |

0.76895 |

0.69788 |

0.43707 |

0.69680 |

0.48900 |

0.26809 |

-0.02120 |

0.12769 |

0.49902 |

| IWM |

0.87299 |

0.87651 |

0.72213 |

0.42387 |

0.71371 |

0.54486 |

0.21602 |

-0.06608 |

0.08521 |

0.59478 |

0.74427 |

| IYR |

0.81110 |

0.81180 |

0.66833 |

0.40235 |

0.64902 |

0.50619 |

0.22263 |

-0.02613 |

0.03744 |

0.51141 |

0.73609 |

0.88700 |

| QQQ |

0.84292 |

0.84308 |

0.69625 |

0.41501 |

0.70885 |

0.51699 |

0.17656 |

-0.06453 |

0.08743 |

0.57684 |

0.73275 |

0.89465 |

0.77558 |

| SPY |

0.90399 |

0.92200 |

0.76011 |

0.46613 |

0.76618 |

0.58139 |

0.22574 |

-0.06717 |

0.09111 |

0.61370 |

0.78163 |

0.94826 |

0.86866 |

0.93614 |

| TLT |

-0.64361 |

-0.67401 |

-0.50631 |

-0.33623 |

-0.55872 |

-0.46727 |

-0.15636 |

0.18577 |

0.04402 |

-0.46131 |

-0.51479 |

-0.63468 |

-0.55620 |

-0.60617 |

-0.69517 |

| USO |

0.64428 |

0.61020 |

0.59432 |

0.36206 |

0.58093 |

0.46642 |

0.19721 |

-0.06077 |

0.29479 |

0.93982 |

0.52019 |

0.59217 |

0.51243 |

0.58251 |

0.61707 |

-0.46211 |

| SH |

-0.89266 |

-0.91338 |

-0.74634 |

-0.45327 |

-0.75479 |

-0.57587 |

-0.21976 |

0.06610 |

-0.08769 |

-0.60497 |

-0.74415 |

-0.94433 |

-0.86452 |

-0.92810 |

-0.98817 |

0.70375 |

-0.59698 |

| PSQ |

-0.82807 |

-0.83005 |

-0.67986 |

-0.40173 |

-0.69153 |

-0.51084 |

-0.17165 |

0.06772 |

-0.08274 |

-0.56955 |

-0.68053 |

-0.88849 |

-0.76895 |

-0.98407 |

-0.92312 |

0.61625 |

-0.55743 |

0.93940 |